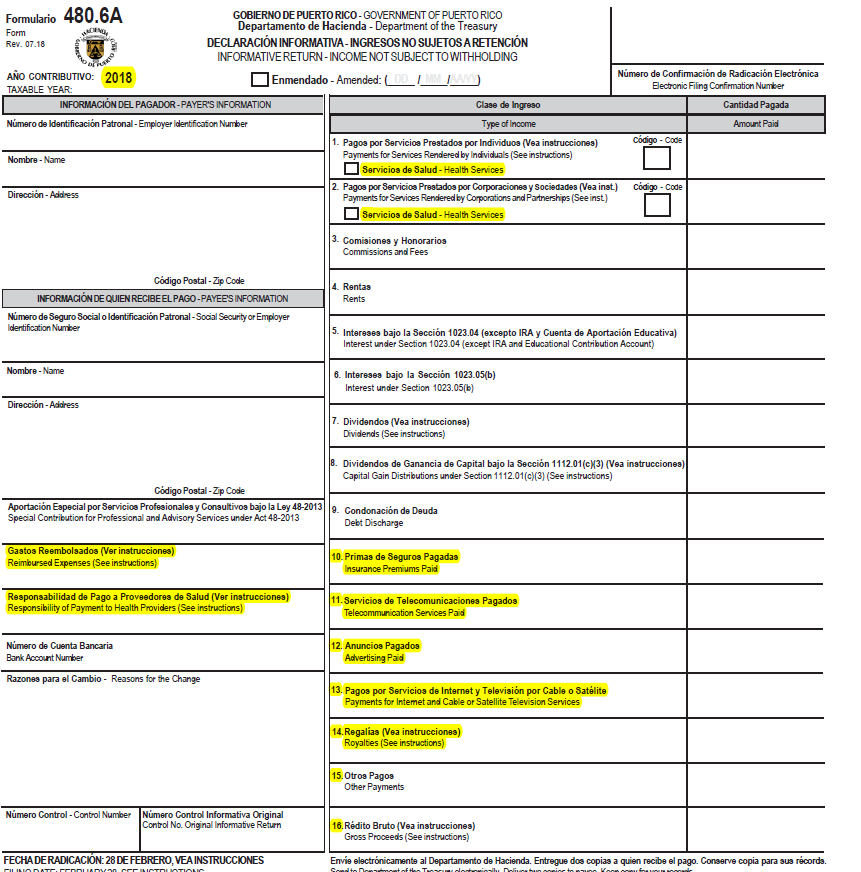

480.6A Form

480.6A Form - Form 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. If you receive these forms, it is. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web 1 best answer ds30 new member yes, you will need to report this puerto rican bank interest as income on your income tax returns. Save or instantly send your ready documents. What is the puerto rico withholding tax?. Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web click on new document and choose the form importing option: An heir files this form to report the.

Save or instantly send your ready documents. Web 16 rows tax form (click on the link) form name. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web what is tax form 480.6a? Web en el ca so de intereses, se requerirá un formulario 480.6a cuando la cantidad pagada en el año sea de $50 o más. Upload 480 6a from your device, the cloud, or a protected link. An heir files this form to report the. When would you need to file a 480.6a? Web click on new document and choose the form importing option: Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the.

Easily fill out pdf blank, edit, and sign them. Web 1 best answer ds30 new member yes, you will need to report this puerto rican bank interest as income on your income tax returns. Form 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. You can include this pr. Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. If you receive these forms, it is. Make adjustments to the template. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. When would you need to file a 480.6a?

480.6SP 2019 Public Documents 1099 Pro Wiki

Make adjustments to the template. When would you need to file a 480.6a? If you receive these forms, it is. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. Web 16 rows tax form (click on the link) form name.

2016 Form PR 480.30(II) Fill Online, Printable, Fillable, Blank pdfFiller

Web what is tax form 480.6a? Web complete 480 6a 2020 online with us legal forms. Web click on new document and choose the form importing option: Easily fill out pdf blank, edit, and sign them. You can include this pr.

2015 Form PR 480.2 Fill Online, Printable, Fillable, Blank pdfFiller

Web en el ca so de intereses, se requerirá un formulario 480.6a cuando la cantidad pagada en el año sea de $50 o más. The forms (480.6a, 480.6b, 480.6d, & 480.7f) must be file by february 28, 2022. Make adjustments to the template. What is the puerto rico withholding tax?. Upload 480 6a from your device, the cloud, or a.

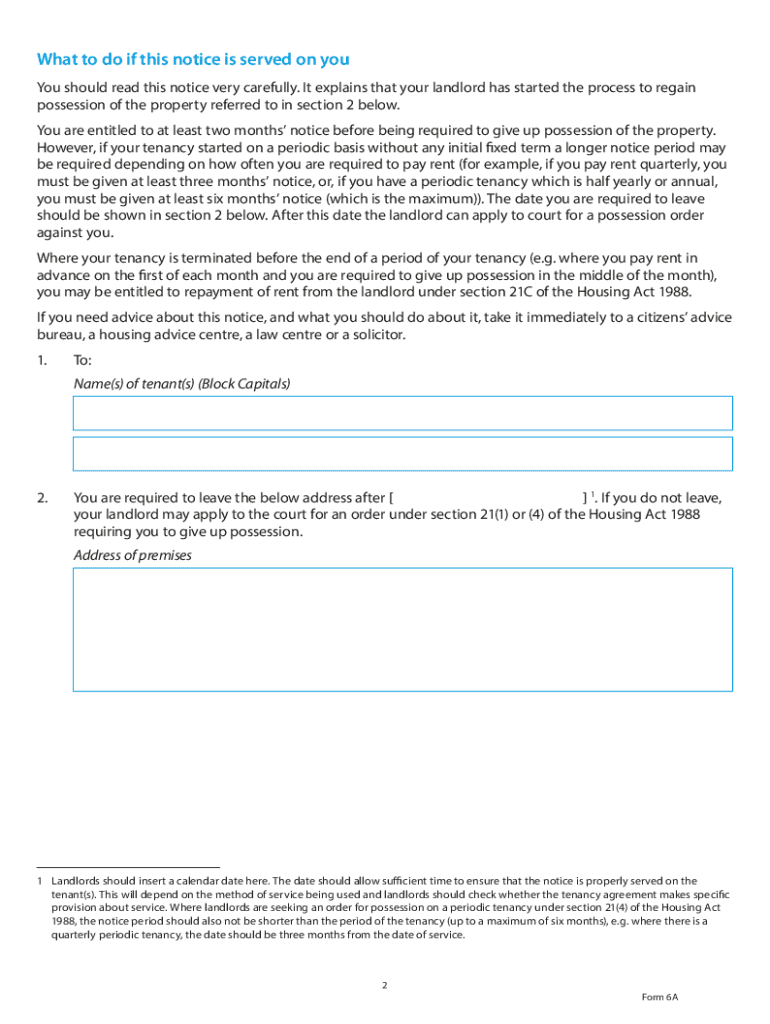

Form 6a Fill Out and Sign Printable PDF Template signNow

Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. La declaración deberá prepararse a base de año natural y. Web forms 480.6sp, 480.6sp.1 and 480.6sp.2 — services rendered to report payments for services rendered during the year that were previously reported on forms 480.6a,. Upload 480.

B6A3 form

Web en el ca so de intereses, se requerirá un formulario 480.6a cuando la cantidad pagada en el año sea de $50 o más. Web 1 best answer ds30 new member yes, you will need to report this puerto rican bank interest as income on your income tax returns. Web aii persons engaged in trade or business within puerto rico,.

480.6A 2019 Public Documents 1099 Pro Wiki

An heir files this form to report the. Web 1 best answer ds30 new member yes, you will need to report this puerto rican bank interest as income on your income tax returns. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. You can include this.

Table Structure for Informative Returns data

When would you need to file a 480.6a? Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. Save or instantly send your ready documents. La declaración deberá prepararse a base de año natural y. Make adjustments to the template.

Update The IRS Is Creating A New Form 1099DA For Cryptocurrency Reporting

The forms (480.6a, 480.6b, 480.6d, & 480.7f) must be file by february 28, 2022. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Web en el ca so de intereses, se requerirá un formulario 480.6a cuando la cantidad pagada en el año sea de $50 o.

Government Regulation Reaches The Decentralized Space With 1099DA

Upload 480 6a from your device, the cloud, or a protected link. What is the puerto rico withholding tax?. Web forms 480.6sp, 480.6sp.1 and 480.6sp.2 — services rendered to report payments for services rendered during the year that were previously reported on forms 480.6a,. When would you need to file a 480.6a? Form 480.6a reports any taxable dividends and/or gross.

WHAT IS TABLE 6A FORM GSTR 1 YouTube

You can include this pr. What is the puerto rico withholding tax?. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Easily fill.

Web Form Import Fields;

When would you need to file a 480.6a? Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Web what is tax form 480.6a? Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer.

Web Series 480.6A Reports Any Taxable Dividends And/Or Gross Proceeds From Realized Capital Gains Or Losses In Your Taxable Investment Account.

Web 1 best answer ds30 new member yes, you will need to report this puerto rican bank interest as income on your income tax returns. Web click on new document and choose the form importing option: Upload 480 6a from your device, the cloud, or a protected link. Web back i received form 480.6a, but i understand that the debt discharge reported should be exempt by reason of insolvency.

Make Adjustments To The Template.

Web forms 480.6sp, 480.6sp.1 and 480.6sp.2 — services rendered to report payments for services rendered during the year that were previously reported on forms 480.6a,. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Save or instantly send your ready documents. You can include this pr.

What Is The Puerto Rico Withholding Tax?.

Web 16 rows tax form (click on the link) form name. Easily fill out pdf blank, edit, and sign them. An heir files this form to report the. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the.