Crypto.com 1099 Tax Form

Crypto.com 1099 Tax Form - Register your account in crypto.com tax step 2: Even if you don’t receive 1099s from. Web did you receive a form 1099 from your cryptocurrency exchange or platform? You may refer to this section on how to set up your tax. Web 1099 tax forms in the cryptoverse (misc and b) tyler perkes. Web jan 26, 2022 we’re excited to share that u.s. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web the recently passed infrastructure act put crypto in the crosshairs, where congress and the irs hope to scoop up enormous tax dollars. 1099 tax forms come in two flavors: Web definition of digital assets digital assets are broadly defined as any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar.

Web 1 hour agoan unusual alliance of liberal and conservative lawmakers, the irs, and a conservative advocacy group hope their alignment will boost efforts to tweak rules. Web the regulations for 1099 reporting for crypto are still under development. Register your account in crypto.com tax step 2: Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. Web the infrastructure investment and jobs act of 2021 indicates a 1099 reporting obligation for dispositions of crypto assets under section 6045 of the us internal revenue code. You may refer to this section on how to set up your tax. Web definition of digital assets digital assets are broadly defined as any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar. Select the tax settings you’d like to generate your tax reports. Web for the us taxpayers, the following tax forms/files will be generated for you as well:

Web did you receive a form 1099 from your cryptocurrency exchange or platform? Web the regulations for 1099 reporting for crypto are still under development. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. This form itemizes and reports all commodity. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. Web the recently passed infrastructure act put crypto in the crosshairs, where congress and the irs hope to scoop up enormous tax dollars. Web jan 26, 2022 we’re excited to share that u.s. Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. Select the tax settings you’d like to generate your tax reports. Web the infrastructure investment and jobs act of 2021 indicates a 1099 reporting obligation for dispositions of crypto assets under section 6045 of the us internal revenue code.

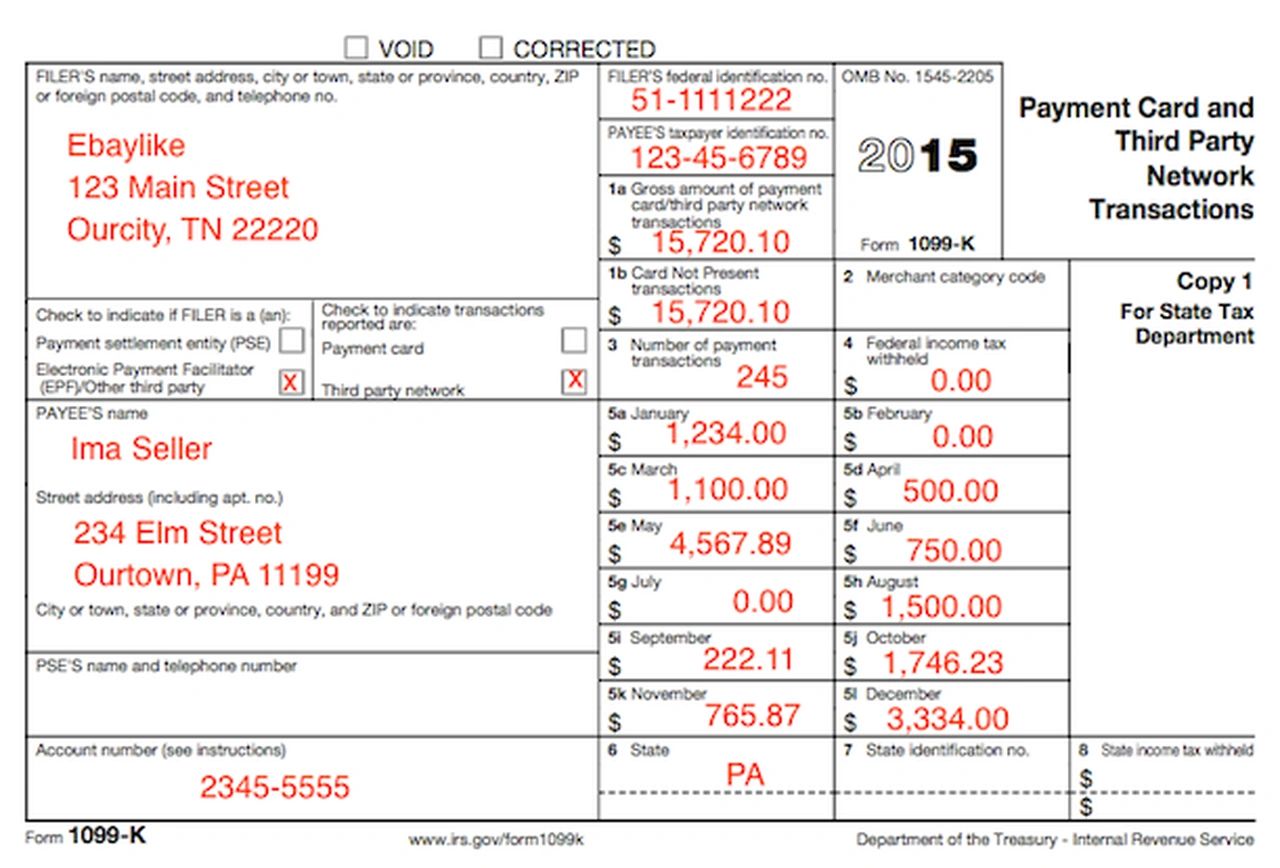

Don’t Follow 1099Ks To Prepare Your Crypto Taxes

Web 1099 tax forms in the cryptoverse (misc and b) tyler perkes. Web jan 26, 2022 we’re excited to share that u.s. Web the recently passed infrastructure act put crypto in the crosshairs, where congress and the irs hope to scoop up enormous tax dollars. However, many crypto exchanges don’t provide a 1099, leaving you with work to do. Web.

Formulario 1099B Producto de la Definición de Broker y Swap Exchange

You may refer to this section on how to set up your tax. Web the regulations for 1099 reporting for crypto are still under development. Web for the us taxpayers, the following tax forms/files will be generated for you as well: Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. Web 1 hour.

Coinbase 1099 K / What To Do With Your 1099 K For Cryptotaxes Each

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web did you receive a form 1099 from your cryptocurrency exchange or platform? Register your account in crypto.com tax step 2: Web jan 26, 2022 we’re excited to share that u.s. And.

What's Form 1099MISC Used For? Tax attorney, 1099 tax form, Tax forms

Even if you don’t receive 1099s from. Web the recently passed infrastructure act put crypto in the crosshairs, where congress and the irs hope to scoop up enormous tax dollars. Web the regulations for 1099 reporting for crypto are still under development. Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs. Web definition.

1099 Int Form Bank Of America Universal Network

Web 1099 tax forms in the cryptoverse (misc and b) tyler perkes. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web the regulations for 1099 reporting for crypto are still under development. The form has details pertaining to gross proceeds,.

How Not To Deal With A Bad 1099

Select the tax settings you’d like to generate your tax reports. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. Web jan 26, 2022 we’re excited to share that u.s. Web the regulations for 1099 reporting for crypto are still under development. Web for the us taxpayers, the following tax forms/files will be generated.

How To Pick The Best Crypto Tax Software

1099 tax forms come in two flavors: Web the tax form typically provides all the information you need to fill out form 8949. The form has details pertaining to gross proceeds, cost basis, and capital gains and losses. Web 1099 tax forms in the cryptoverse (misc and b) tyler perkes. Form 1099 is designed to report taxable income to you,.

Crypto Tax Advice for Uphold 1099K with Heleum 3/10/18 YouTube

You may refer to this section on how to set up your tax. 1099 tax forms come in two flavors: Web the recently passed infrastructure act put crypto in the crosshairs, where congress and the irs hope to scoop up enormous tax dollars. Select the tax settings you’d like to generate your tax reports. The form has details pertaining to.

Understanding your 1099 Robinhood

Web jan 26, 2022 we’re excited to share that u.s. 1099 tax forms come in two flavors: Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web did you receive a form 1099 from your cryptocurrency exchange or platform? You may.

form 1099 Gary M. Kaplan, C.P.A., P.A.

This form itemizes and reports all commodity. However, many crypto exchanges don’t provide a 1099, leaving you with work to do. Web the regulations for 1099 reporting for crypto are still under development. Web the recently passed infrastructure act put crypto in the crosshairs, where congress and the irs hope to scoop up enormous tax dollars. 1099 tax forms come.

However, Many Crypto Exchanges Don’t Provide A 1099, Leaving You With Work To Do.

Select the tax settings you’d like to generate your tax reports. Web the tax form typically provides all the information you need to fill out form 8949. Register your account in crypto.com tax step 2: Web the recently passed infrastructure act put crypto in the crosshairs, where congress and the irs hope to scoop up enormous tax dollars.

1099 Tax Forms Come In Two Flavors:

Web did you receive a form 1099 from your cryptocurrency exchange or platform? Web for the us taxpayers, the following tax forms/files will be generated for you as well: Web definition of digital assets digital assets are broadly defined as any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar. Even if you don’t receive 1099s from.

You May Refer To This Section On How To Set Up Your Tax.

Web 1 hour agoan unusual alliance of liberal and conservative lawmakers, the irs, and a conservative advocacy group hope their alignment will boost efforts to tweak rules. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web the infrastructure investment and jobs act of 2021 indicates a 1099 reporting obligation for dispositions of crypto assets under section 6045 of the us internal revenue code. Form 1099 is designed to report taxable income to you, the taxpayer, and to the irs.

The Form Has Details Pertaining To Gross Proceeds, Cost Basis, And Capital Gains And Losses.

Web 1099 tax forms in the cryptoverse (misc and b) tyler perkes. And canada users can now generate their 2021 crypto tax reports on crypto.com tax, which is also available to. This form itemizes and reports all commodity. Web jan 26, 2022 we’re excited to share that u.s.