Form 480.6C

Form 480.6C - Report that income when you file your return Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web 16 rows i nformative returns are to be filed for any payment of dividends or any payment in excess of $500 for interest, rent, salaries or wages not otherwise reported, premiums,. Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Web #1 2014 nc resident and pureto rico income on pr form 480.6c? A new box has been added to include general information in reporting the total amount of. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Web a regional transit authority may procure and pay all or any part of the cost of group hospitalization, surgical, major medical, or sickness and accident insurance or a.

Report that income when you file your return Web 16 rows i nformative returns are to be filed for any payment of dividends or any payment in excess of $500 for interest, rent, salaries or wages not otherwise reported, premiums,. Web a regional transit authority may procure and pay all or any part of the cost of group hospitalization, surgical, major medical, or sickness and accident insurance or a. Web what is a form 480.6 a? Return the completed form in duplicate. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non. A new box has been added to include general information in reporting the total amount of. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account.

Web what is a form 480.6 a? Series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web a regional transit authority may procure and pay all or any part of the cost of group hospitalization, surgical, major medical, or sickness and accident insurance or a. Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non. Web 16 rows i nformative returns are to be filed for any payment of dividends or any payment in excess of $500 for interest, rent, salaries or wages not otherwise reported, premiums,. A new box has been added to include general information in reporting the total amount of. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Report that income when you file your return

2007 Form PR 480.6D Fill Online, Printable, Fillable, Blank pdfFiller

Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Web a regional transit authority may procure and pay all or any part of the cost of group hospitalization, surgical, major medical, or sickness and accident insurance or a. Series 480.6a reports.

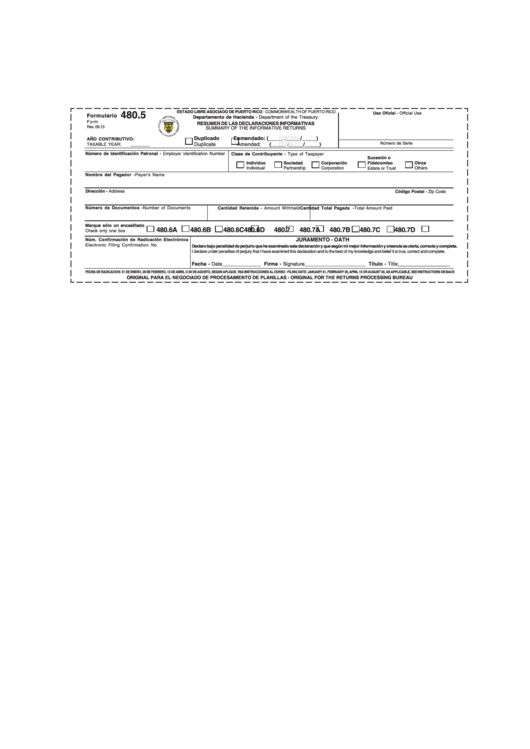

Formulario 480.5 Resumen De Las Declarationes Informativas printable

Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign.

Table Structure for Informative Returns data

Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web a regional transit authority may procure and pay all or any part of the cost of group hospitalization, surgical, major medical, or sickness and accident insurance or a. Web what is a.

Form 480.7E Tax Alert RSM Puerto Rico

A new box has been added to include general information in reporting the total amount of. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. Web a regional transit authority may procure and pay all or any part.

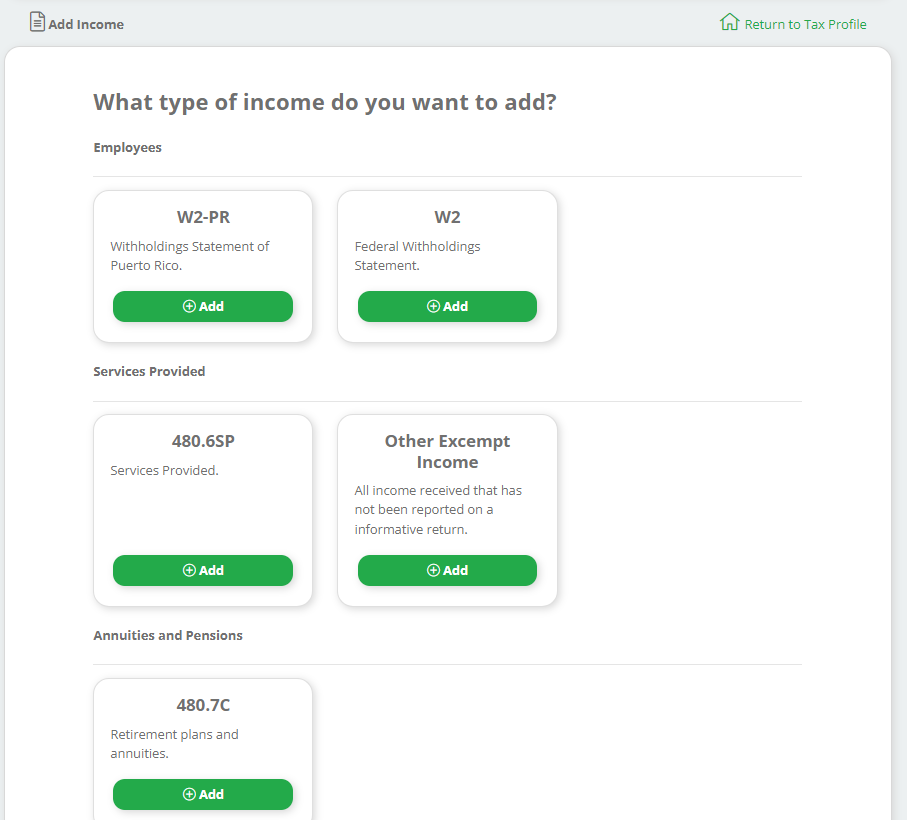

What is a withholding statement W2PR, 480? Taxmania

A new box has been added to include general information in reporting the total amount of. Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas.

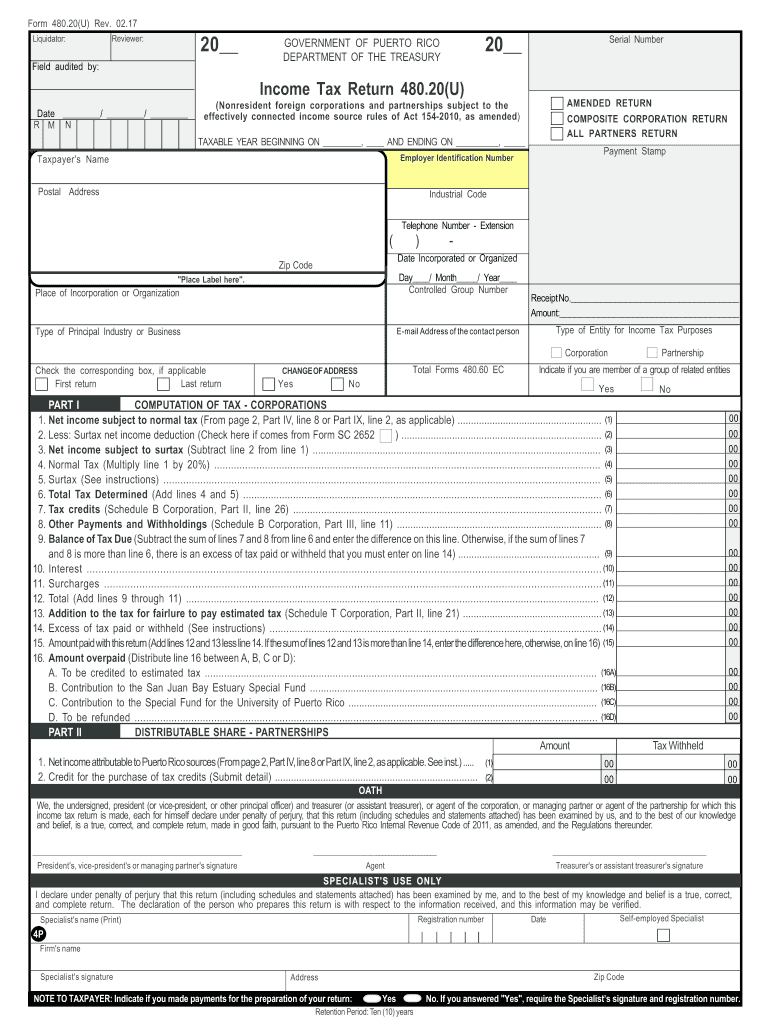

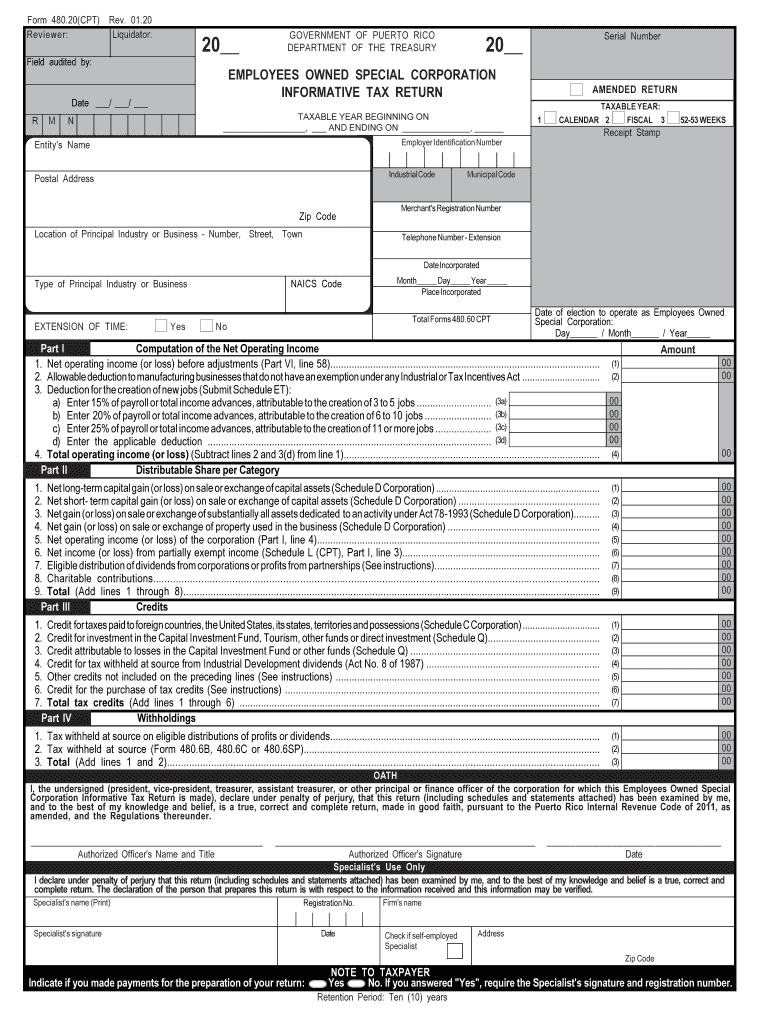

Form 480 20 Fill Online, Printable, Fillable, Blank pdfFiller

Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web a regional transit authority may procure and pay all or any part of the cost of group hospitalization, surgical, major medical, or sickness and accident insurance or a. Web what is a.

W2 Puerto Rico Form Fill Out and Sign Printable PDF Template signNow

Return the completed form in duplicate. Web 16 rows i nformative returns are to be filed for any payment of dividends or any payment in excess of $500 for interest, rent, salaries or wages not otherwise reported, premiums,. Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when.

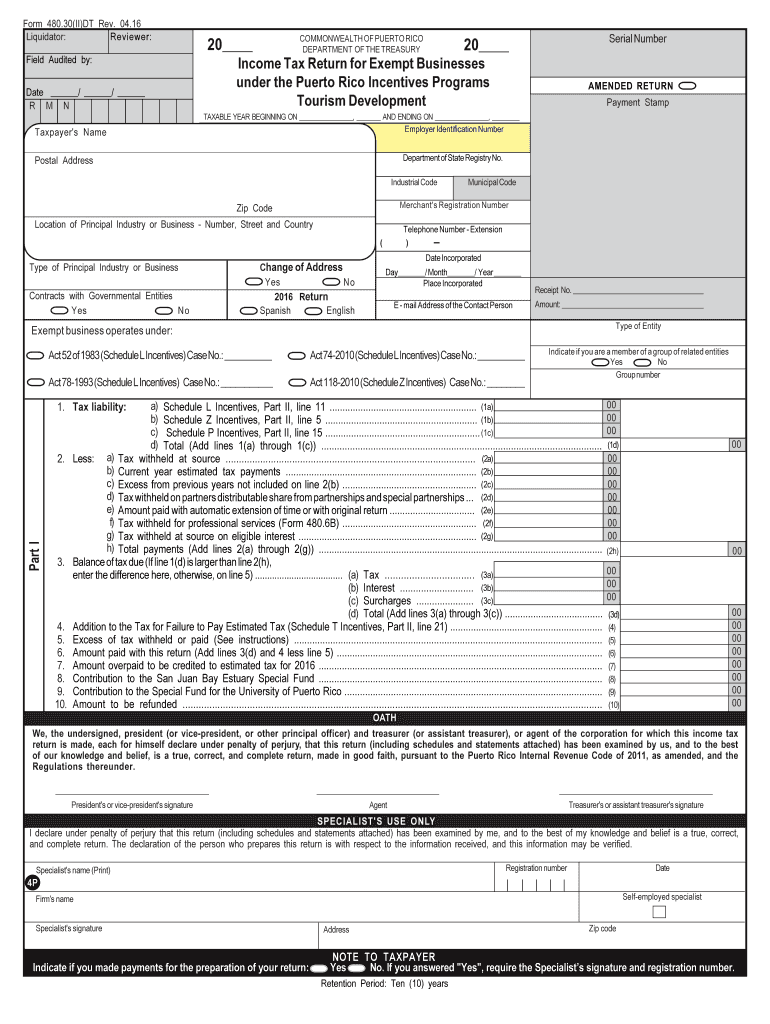

480 20 CPT Rev 01 20 480 20 CPT Rev 01 20 Fill Out and Sign Printable

Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non. Report that income when you file your return Web 16 rows i nformative returns are to be filed for any payment of dividends or any payment in excess of $500.

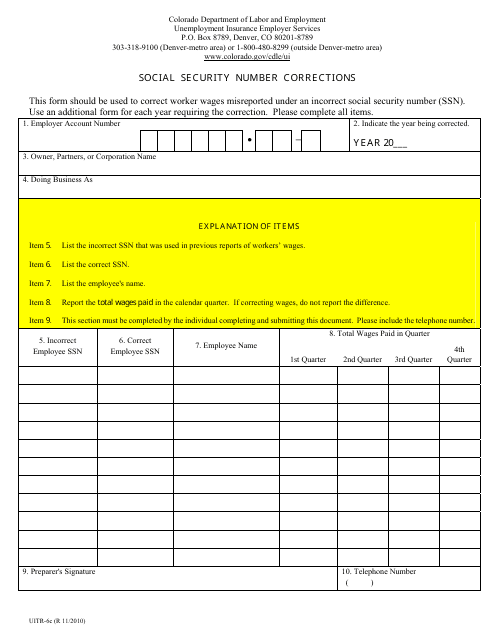

Form UITR6C Download Printable PDF or Fill Online Social Security

Report that income when you file your return Web 16 rows i nformative returns are to be filed for any payment of dividends or any payment in excess of $500 for interest, rent, salaries or wages not otherwise reported, premiums,. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct.

PR 480.2 2016 Fill out Tax Template Online US Legal Forms

Report that income when you file your return Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web 16 rows i nformative returns are to be filed for any payment of dividends or any payment in excess of $500 for interest, rent,.

Series 480.6A Reports Any Taxable Dividends And/Or Gross Proceeds From Realized Capital Gains Or Losses In Your Taxable Investment Account.

Web puerto rico form 480.6c for dividends and taxes withheld within an ira dividends earned in traditional iras are not taxed when they are paid or reinvested,. Web what is a form 480.6 a? Web prepare form 480.6c for each nonresident individual or fiduciary or nonresident alien and for each foreign corporation or partnership not engaged in trade or business in puerto. Web any natural or legal person doing business in puerto rico who makes payments (payer) for rendered services must deduct and withhold 29% from the payment made to foreign non.

Web #1 2014 Nc Resident And Pureto Rico Income On Pr Form 480.6C?

Report that income when you file your return Web se requerirá la preparación de un formulario 480.6c para informar todos los pagos hechos a personas no residentes de puerto ric o, tanto si estuvieron sujetos o no sujetos a. A new box has been added to include general information in reporting the total amount of. Return the completed form in duplicate.

Web A Regional Transit Authority May Procure And Pay All Or Any Part Of The Cost Of Group Hospitalization, Surgical, Major Medical, Or Sickness And Accident Insurance Or A.

Web 16 rows i nformative returns are to be filed for any payment of dividends or any payment in excess of $500 for interest, rent, salaries or wages not otherwise reported, premiums,.