Form 8880 - Credit For Qualified Retirement Savings Contributions

Form 8880 - Credit For Qualified Retirement Savings Contributions - Depending on your adjusted gross income. You're not eligible for the credit if your adjusted gross income exceeds a certain amount. The maximum amount of the. Ad access irs tax forms. This credit can be claimed in addition to any. Ad access irs tax forms. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. Web • voluntary employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan). Web in order to claim the retirement savings credit, you must use irs form 8880. Get ready for tax season deadlines by completing any required tax forms today.

Get ready for tax season deadlines by completing any required tax forms today. Web how do i claim the credit? Web use form 8885 to elect and figure the amount, if any, of your hctc. Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. Eligible retirement plans contributions you make to any qualified retirement plan can. Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is the latest version of form 8880, fully updated for tax year 2022. Get ready for tax season deadlines by completing any required tax forms today. The maximum amount of the. You're not eligible for the credit if your adjusted gross income exceeds a certain amount.

Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is the latest version of form 8880, fully updated for tax year 2022. The maximum amount of the. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). • contributions to a 501(c)(18)(d). Ad access irs tax forms. Web these two factors will determine the maximum credit you can take. Web use form 8885 to elect and figure the amount, if any, of your hctc. Web • voluntary employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan). Web in order to claim the retirement savings credit, you must use irs form 8880.

Business Concept about Form 8880 Credit for Qualified Retirement

Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. Ad access irs tax forms. Web voluntary employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan). Web how do i claim the credit? You're not.

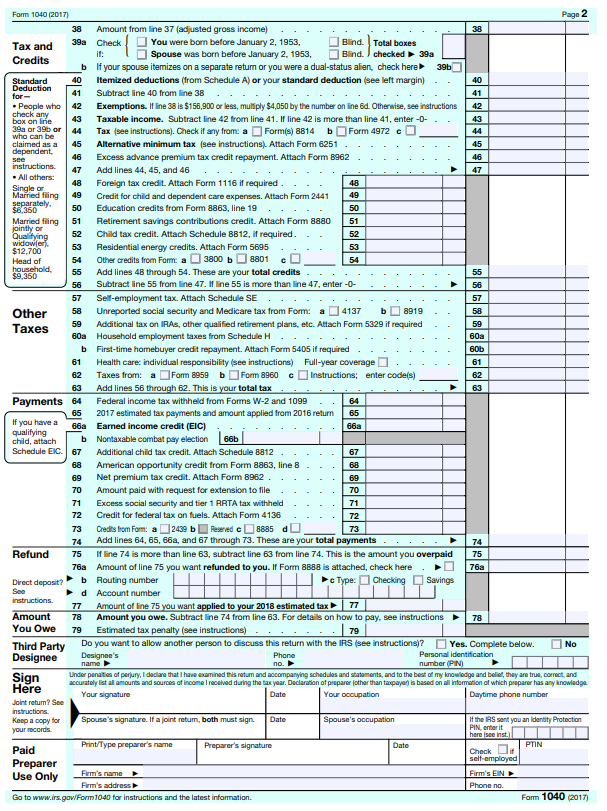

Solved Required information [The following information

Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Ad access irs tax forms. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). This credit can be claimed in addition to.

Retirement plan 8880 Early Retirement

Web use form 8885 to elect and figure the amount, if any, of your hctc. Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. Depending on your adjusted gross income. Web • voluntary employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings.

ABLE accounts A financial solution for people with disabilities

Web contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan), or (d) contributions to a 501(c)(18)(d) plan. Ad access irs tax forms. Eligible retirement plans contributions you make to any qualified retirement plan can. Ad access irs tax forms. Web credit for qualified retirement savings contributions 8880 you cannot take this credit.

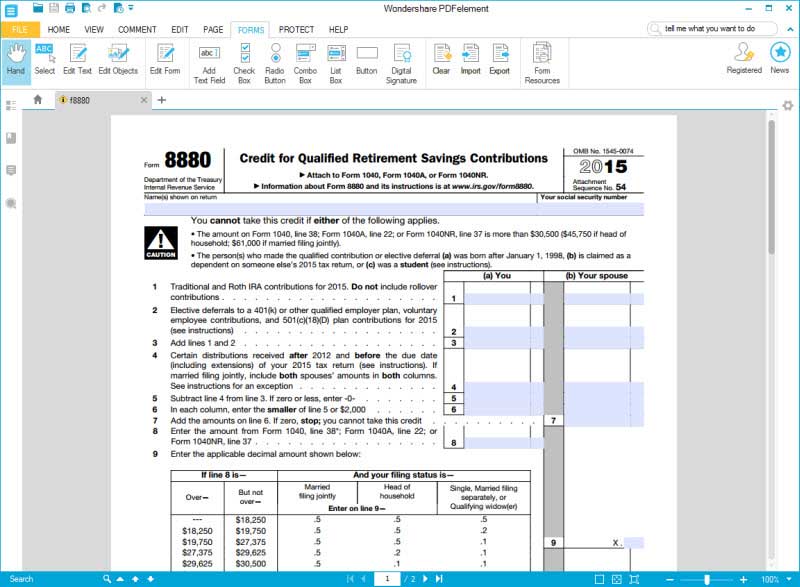

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

Web voluntary employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan). Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following.

Credit Limit Worksheet 8880

Complete, edit or print tax forms instantly. • contributions to a 501(c)(18)(d). Web in order to claim the retirement savings credit, you must use irs form 8880. The maximum amount of the. Depending on your adjusted gross income.

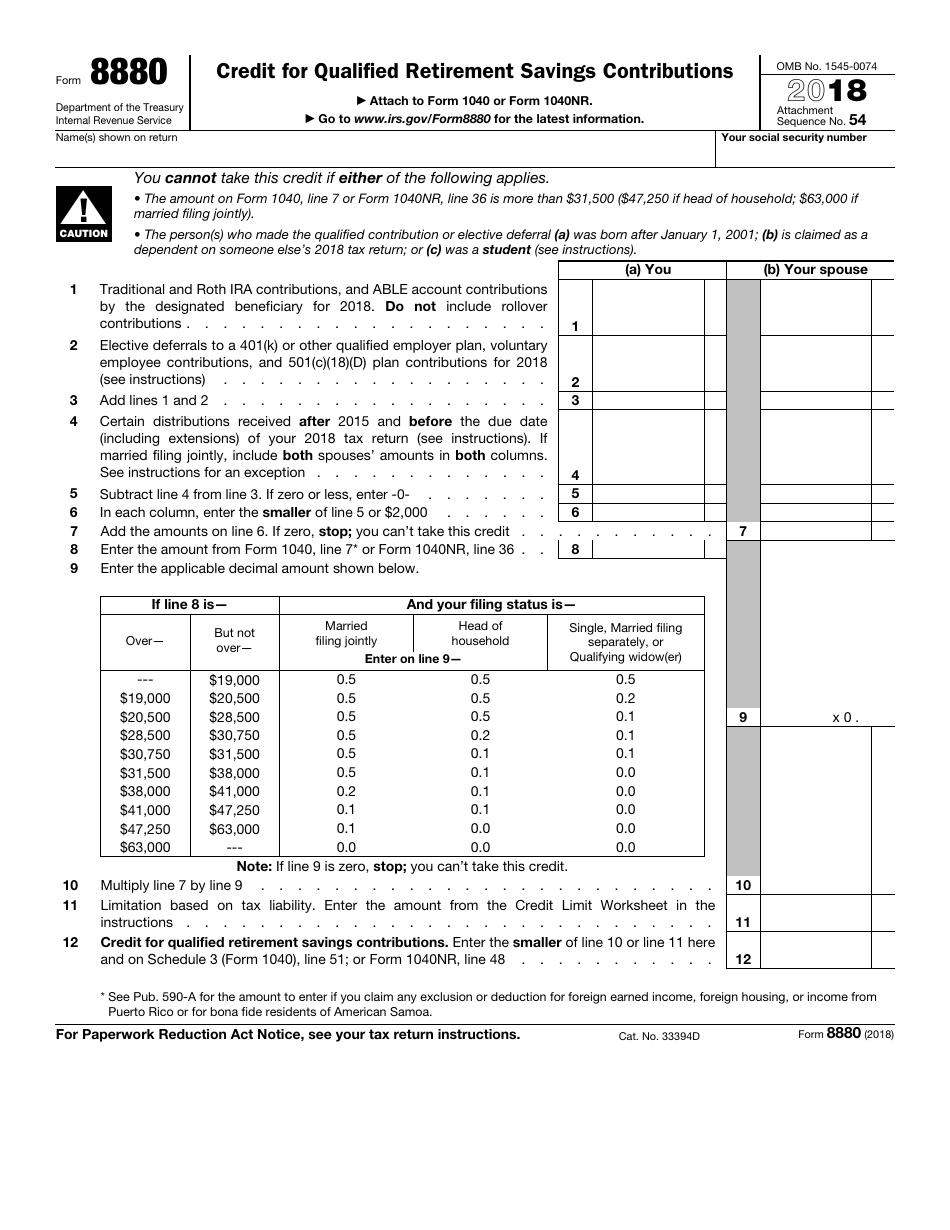

IRS Form 8880 Download Fillable PDF or Fill Online Credit for Qualified

Ad access irs tax forms. The maximum amount of the. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Web • voluntary employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan).

Fill Free fillable IRS PDF forms

Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web voluntary employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan). Web how do i claim the credit? Web form 8880 is used to figure the amount, if any,.

Fill Free fillable IRS PDF forms

The maximum amount of the. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Complete, edit or print tax forms instantly. Web these two factors will determine the maximum credit you can take. Web use form 8880 to figure the amount, if any, of your retirement savings.

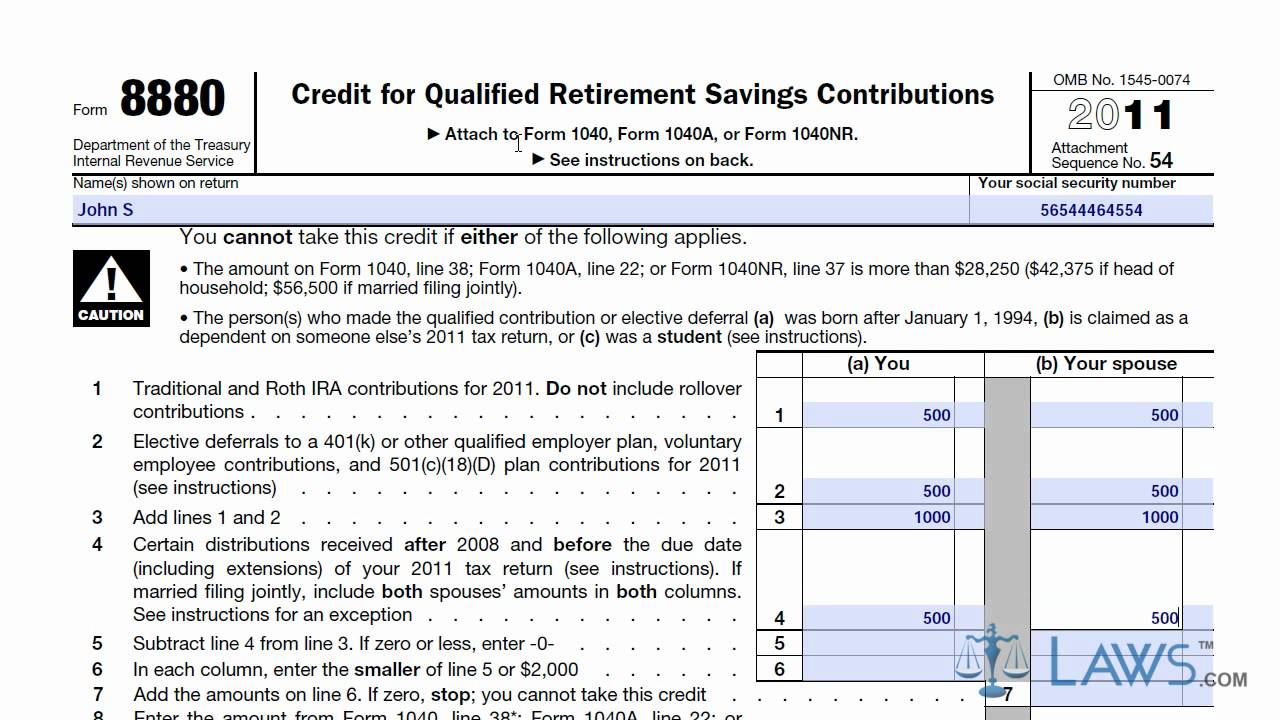

Learn How to Fill the Form 8880 Credit for Qualified Retirement Savings

Web use form 8885 to elect and figure the amount, if any, of your hctc. Web how do i claim the credit? Complete, edit or print tax forms instantly. Web voluntary employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan). Web see form 8880, credit for qualified retirement savings contributions, for.

• Contributions To A 501(C)(18)(D).

Ad access irs tax forms. Complete, edit or print tax forms instantly. Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. Web contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan), or (d) contributions to a 501(c)(18)(d) plan.

Depending On Your Adjusted Gross Income.

Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Web in order to claim the retirement savings credit, you must use irs form 8880. Web • voluntary employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan). Web use form 8885 to elect and figure the amount, if any, of your hctc.

Eligible Retirement Plans Contributions You Make To Any Qualified Retirement Plan Can.

Web voluntary employee contributions to a qualified retirement plan as defined in section 4974(c) (including the federal thrift savings plan). Complete, edit or print tax forms instantly. The maximum amount of the. Ad access irs tax forms.

Web These Two Factors Will Determine The Maximum Credit You Can Take.

Get ready for tax season deadlines by completing any required tax forms today. Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. Web • form 8880, credit for qualified retirement savings contributions, is used to claim this credit. This credit can be claimed in addition to any.