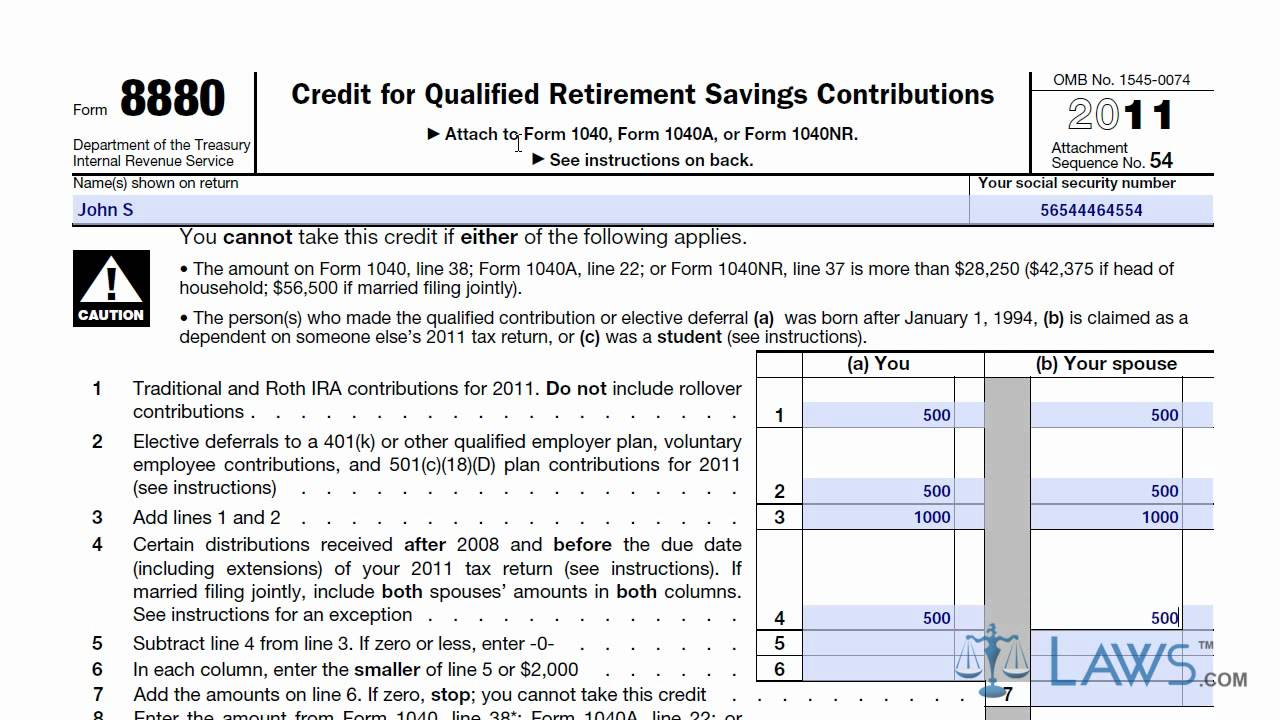

Form 8880 - Taxpayer Distributions

Form 8880 - Taxpayer Distributions - Eligible retirement plans contributions you make to any qualified retirement plan can be. The taxpayer(s) make a traditional ira or a roth ira contribution before the filing deadline. $65,000 if married filing jointly). • the person(s) who made the. Web you may also exclude one or all of these distributions from form 8880, line 4 by entering x in the not from ira or elective deferral plan (8880). Web this article explains what to do if form 8880, credit for qualified retirement savings contributions, isn't generating a credit due to a current year distribution. This credit can be claimed in addition to any ira. Web distributions not allowed on form 8880 according to the irs instructions the following types of retirement distributions should not be included when figuring certain. Report inappropriate content click here for contact information. Web see form 8880, credit for qualified retirement savings contributions, for more information.

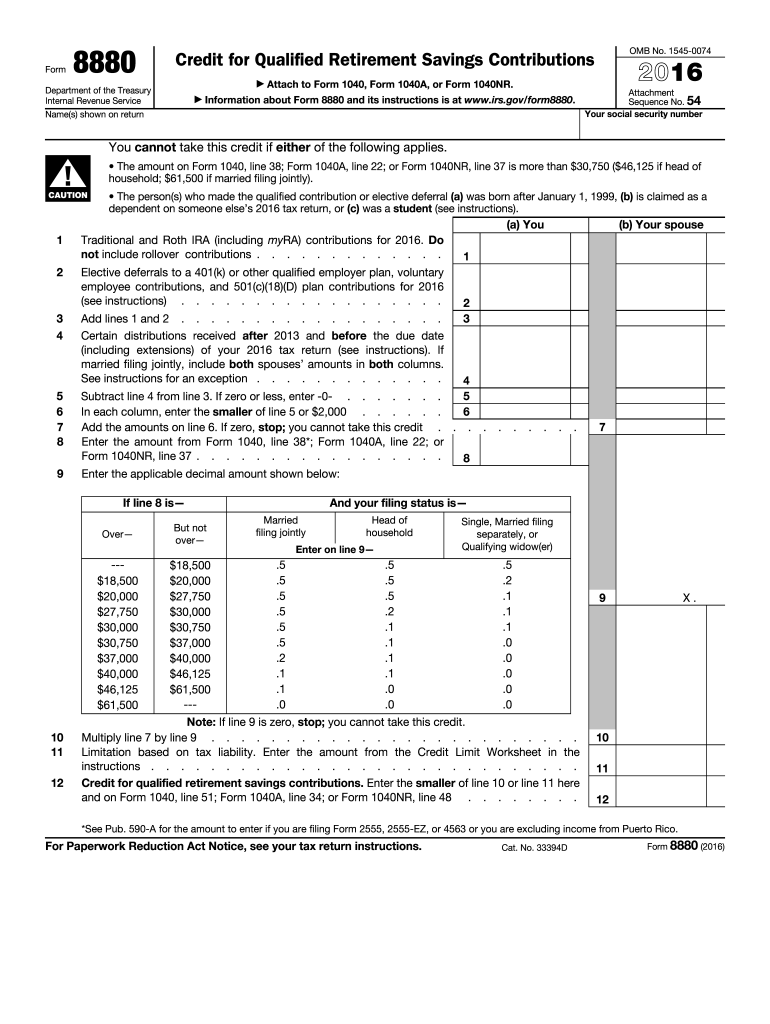

Web see form 8880, credit for qualified retirement savings contributions, for more information. Eligible retirement plans contributions you make to any qualified retirement plan can be. Web form 8880 department of the treasury. Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is the latest version of form 8880, fully updated for tax year 2022. Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. Amount of the credit depending on your adjusted gross income. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web in order to claim the retirement savings credit, you must use irs form 8880. If married filing jointly, include both. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file.

This credit can be claimed in addition to any ira. Amount of the credit depending on your adjusted gross income. Web in order to claim the retirement savings credit, you must use irs form 8880. • the person(s) who made the. If married filing jointly, include both spouses’. Enter the amount of distributions. The taxpayer(s) make a traditional ira or a roth ira contribution before the filing deadline. Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file. Report inappropriate content click here for contact information. $65,000 if married filing jointly).

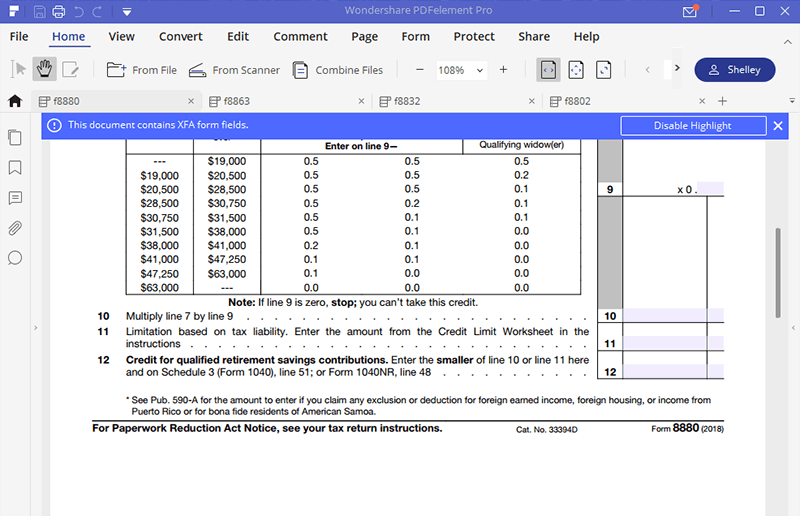

Credit Limit Worksheet 8880 —

• the person(s) who made the. $65,000 if married filing jointly). Web in order to claim the retirement savings credit, you must use irs form 8880. Web you may also exclude one or all of these distributions from form 8880, line 4 by entering x in the not from ira or elective deferral plan (8880). Web see form 8880, credit.

Form 8880 Credit for Qualified Retirement Savings Contributions

Web see form 8880, credit for qualified retirement savings contributions, for more information. Web certain distributions received after 2018 and before the due date (including extensions) of your 2021 tax return (see instructions). This credit can be claimed in addition to any ira. Web you may also exclude one or all of these distributions from form 8880, line 4 by.

Learn How to Fill the Form 8880 Credit for Qualified Retirement Savings

If married filing jointly, include both. The taxpayer(s) make a traditional ira or a roth ira contribution before the filing deadline. For paperwork reduction act notice, see your tax. Web form 8880 not generating credit due to pension distributions in lacerte to suppress the taxpayer’s credit because the taxpayer was claimed as a dependent:. The taxpayer(s) make a traditional ira.

Form 8880 Tax Incentives For Retirement Account —

4 certain distributions received after 2019 and before the due date (including extensions) of your 2022 tax return (see instructions). This credit can be claimed in addition to any ira. For paperwork reduction act notice, see your tax. Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in.

SimpleTax Form 8880 YouTube

Web see form 8880, credit for qualified retirement savings contributions, for more information. Web you may also exclude one or all of these distributions from form 8880, line 4 by entering x in the not from ira or elective deferral plan (8880). 4 certain distributions received after 2019 and before the due date (including extensions) of your 2022 tax return.

2016 form credit Fill out & sign online DocHub

4 certain distributions received after 2017 and before the due date (including. Web in order to claim the retirement savings credit, you must use irs form 8880. Amount of the credit depending on your adjusted gross income. This credit can be claimed in addition to any ira. Enter the amount of distributions.

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

$65,000 if married filing jointly). Web form 8880 not generating credit due to pension distributions in lacerte to suppress the taxpayer’s credit because the taxpayer was claimed as a dependent:. 4 certain distributions received after 2019 and before the due date (including extensions) of your 2022 tax return (see instructions). Web form 8880 is used to figure the amount, if.

2016 Simple Tax Form 8880 YouTube

This credit can be claimed in addition to any ira. Web in order to claim the retirement savings credit, you must use irs form 8880. Web see form 8880, credit for qualified retirement savings contributions, for more information. Web form 8880 not generating credit due to pension distributions in lacerte to suppress the taxpayer’s credit because the taxpayer was claimed.

IRS Form 8880 Get it Filled the Right Way

If married filing jointly, include both spouses’. Web in order to claim the retirement savings credit, you must use irs form 8880. 4 certain distributions received after 2019 and before the due date (including extensions) of your 2022 tax return (see instructions). Web you may also exclude one or all of these distributions from form 8880, line 4 by entering.

IRS Form 8880 Get it Filled the Right Way

Web distributions not allowed on form 8880 according to the irs instructions the following types of retirement distributions should not be included when figuring certain. Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. Web this section explains what to do if form.

Web Distributions Not Allowed On Form 8880 According To The Irs Instructions The Following Types Of Retirement Distributions Should Not Be Included When Figuring Certain.

Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. 4 certain distributions received after 2019 and before the due date (including extensions) of your 2022 tax return (see instructions). Web form 8880 not generating credit due to pension distributions in lacerte to suppress the taxpayer’s credit because the taxpayer was claimed as a dependent:. Enter the amount of distributions.

Web In Order To Claim The Retirement Savings Credit, You Must Use Irs Form 8880.

Web form 8880 department of the treasury. This credit can be claimed in addition to any ira. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver's credit). Web information about form 8880, credit for qualified retirement savings contributions, including recent updates, related forms and instructions on how to file.

4 Certain Distributions Received After 2017 And Before The Due Date (Including.

The taxpayer(s) make a traditional ira or a roth ira contribution before the filing deadline. If married filing jointly, include both spouses’. Web form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be claimed in the current year. Web certain distributions received after 2018 and before the due date (including extensions) of your 2021 tax return (see instructions).

Web See Form 8880, Credit For Qualified Retirement Savings Contributions, For More Information.

Amount of the credit depending on your adjusted gross income. For paperwork reduction act notice, see your tax. Web you may also exclude one or all of these distributions from form 8880, line 4 by entering x in the not from ira or elective deferral plan (8880). If married filing jointly, include both.

:max_bytes(150000):strip_icc()/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)