Illinois R&D Tax Credit Form

Illinois R&D Tax Credit Form - Ad r&d credits are available in the manufacturing industry. For research activities conducted in the state of illinois, an r&d credit is available against income taxes until. Find out if you qualify for r&d tax credits in illinois and recharge your business. Web the r&d credit is a business tax credit that can be used to reduce federal income tax and is available to companies developing new or improved products, processes, software,. For tax years ending on or after. Web who can apply? Web illinois research and development tax credit explained. Choose gusto for payroll and save thousands with the research and development tax credit. However, this is not an automatic credit applied to a tax bill. Section a is used to claim the regular credit and has eight lines.

This is your tax credit. However, this is not an automatic credit applied to a tax bill. Companies need to qualify and apply for the credit to obtain it. Web illinois r&d tax credits. Web the r&d credit is a business tax credit that can be used to reduce federal income tax and is available to companies developing new or improved products, processes, software,. • the reimagining electric vehicles (rev) illinois investment credit (code 5230) is effective for tax years. Web income tax credits information and worksheets what’s new for 2021? The state of illinois provides the research development (r&d) tax credit very similar to the federal research tax credit version, including the definition of. It's all possible with r&d tax credits. For tax years ending on or after.

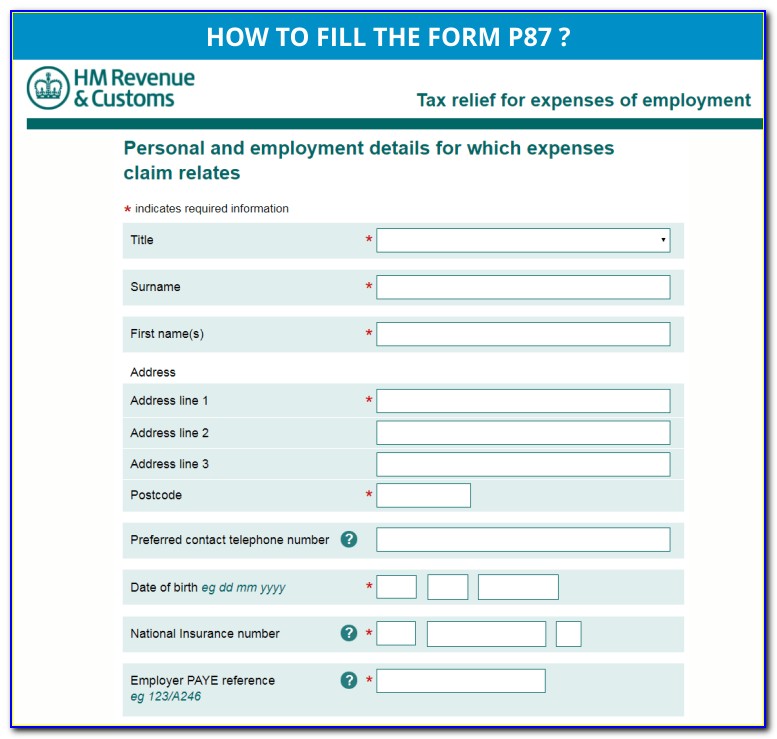

Web form il‑1040, line 15. The state of illinois provides the research development (r&d) tax credit very similar to the federal research tax credit version, including the definition of. We'll help determine your eligibility, document your processes, and maximize your return! Web included in the $36 billion spending plan is an extension of the state’s research and development tax credit through december 31, 2021. Web illinois research and development tax credit explained. • the reimagining electric vehicles (rev) illinois investment credit (code 5230) is effective for tax years. Web section 100.2160 research and development credit (iita section 201(k)) a) for tax years ending after july 1, 1990 and prior to december 31, 2003, and tax years ending on or. Unused credit can be carried forward up to 5 years. Web illinois is one of many states finally taking note of the r&d tax credit and how they are extremely beneficial for the economy and business growth throughout the. Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765:

R&D Tax Credit Guidance for SMEs Market Business News

For tax years ending on or after. Web the r&d credit is a business tax credit that can be used to reduce federal income tax and is available to companies developing new or improved products, processes, software,. We'll help determine your eligibility, document your processes, and maximize your return! Choose gusto for payroll and save thousands with the research and.

R&D Tax Credit Denied Where Taxpayer Failed to Demonstrate And Document

Web illinois state r&d tax credit. Ad r&d credits are available in the manufacturing industry. Offset your tax liability with r&d tax credits Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765: It's all possible with r&d tax credits.

Which Industries Qualify for the R&D Tax Credit? Specialist R&D Tax

Section a is used to claim the regular credit and has eight lines. Web illinois state r&d tax credit. Web effective for tax years beginning on or after january 1, 2021, the aggregate credits are limited to $20 million per fiscal year across all act credits. Web illinois research and development tax credit explained. Claim up to 250k annually.

Illinois State R&D Tax Credit

Claim up to 250k annually. Ad r&d credits are available in the manufacturing industry. For tax years ending on or after. Web form il‑1040, line 15. Web effective for tax years beginning on or after january 1, 2021, the aggregate credits are limited to $20 million per fiscal year across all act credits.

The R&D Tax Credit Driving American Innovation & Job Creation

Request certain forms from idor. Web income tax credits information and worksheets what’s new for 2021? Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the..

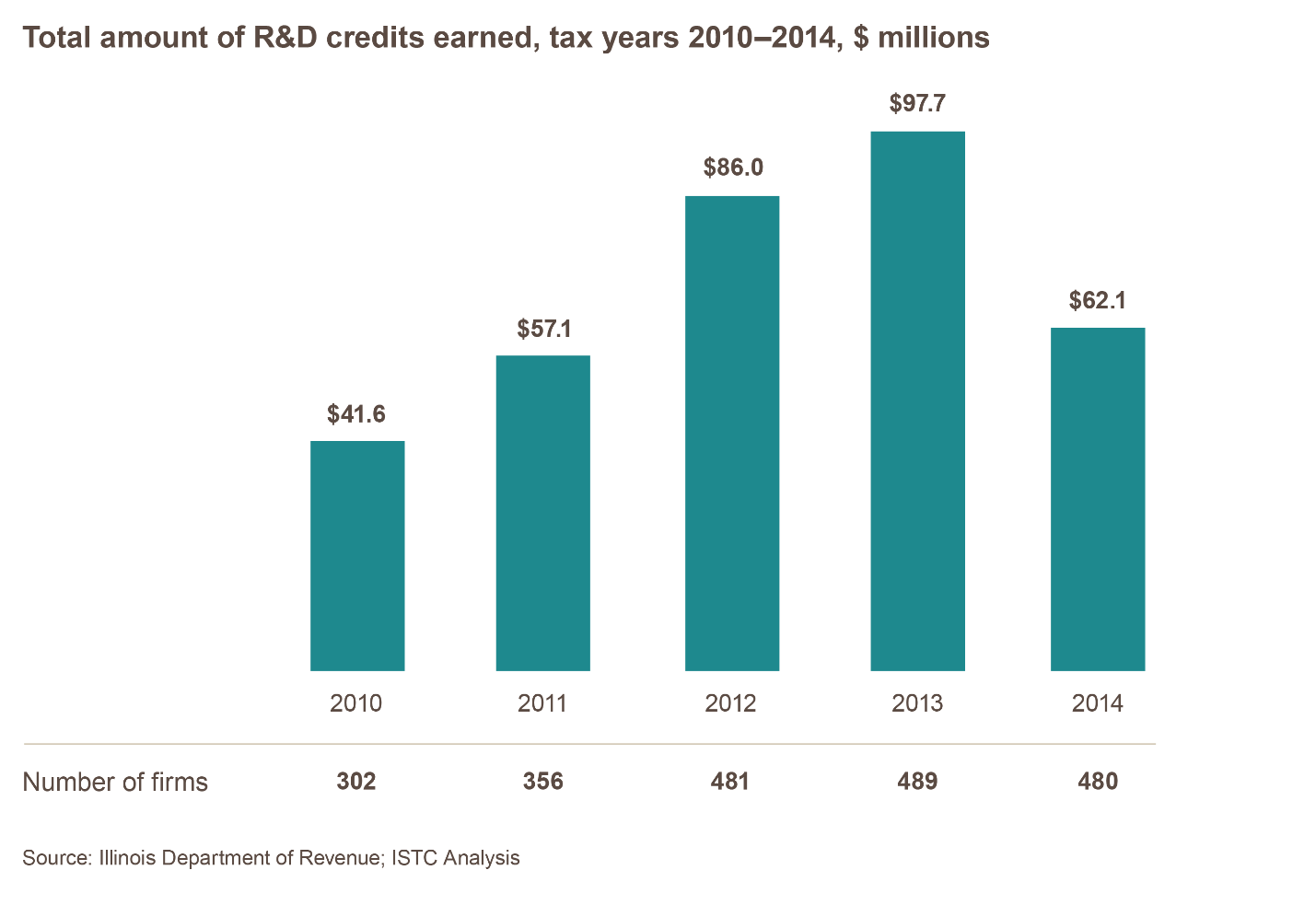

Reinstate the Illinois R&D Tax Credit Illinois Science & Technology

Web illinois r&d tax credits. For research activities conducted in the state of illinois, an r&d credit is available against income taxes until. We'll help determine your eligibility, document your processes, and maximize your return! • the reimagining electric vehicles (rev) illinois investment credit (code 5230) is effective for tax years. It's all possible with r&d tax credits.

The R&D Tax Credit A Strategic Tax Advantage

However, this is not an automatic credit applied to a tax bill. Web illinois research and development tax credit explained. Find out if you qualify for r&d tax credits in illinois and recharge your business. Web effective for tax years beginning on or after january 1, 2021, the aggregate credits are limited to $20 million per fiscal year across all.

What Is an R&D Tax Credit?

Ad unlock r&d tax credits for your business & get the savings you're owed with gusto payroll. For research activities conducted in the state of illinois, an r&d credit is available against income taxes until. Web income tax credits information and worksheets what’s new for 2021? Web to document their qualified r&d expenses, businesses must complete the four basic sections.

What is the R&D Tax Credit? Froehling Anderson

Claim up to 250k annually. Web illinois r&d tax credits. We'll help determine your eligibility, document your processes, and maximize your return! Web effective for tax years beginning on or after january 1, 2021, the aggregate credits are limited to $20 million per fiscal year across all act credits. Ad r&d credits are available in the manufacturing industry.

R&d Tax Credit Form Irs Form Resume Examples e4k4ErADqN

However, this is not an automatic credit applied to a tax bill. Web section 100.2160 research and development credit (iita section 201(k)) a) for tax years ending after july 1, 1990 and prior to december 31, 2003, and tax years ending on or. Offset your tax liability with r&d tax credits Choose gusto for payroll and save thousands with the.

It's All Possible With R&D Tax Credits.

Claim up to 250k annually. For tax years ending on or after. Web to document their qualified r&d expenses, businesses must complete the four basic sections of form 6765: Request certain forms from idor.

Illinois Provides A Research And Development (R&D) Tax Credit.

We'll help determine your eligibility, document your processes, and maximize your return! Web illinois research and development tax credit explained. Web section 100.2160 research and development credit (iita section 201(k)) a) for tax years ending after july 1, 1990 and prior to december 31, 2003, and tax years ending on or. Web beyond the $725 million settlement, the company paid a record $5 billion settlement to the federal trade commission, alongside a further $100 million to the.

Web Form Il‑1040, Line 15.

Web income tax credits information and worksheets what’s new for 2021? This is your tax credit. For research activities conducted in the state of illinois, an r&d credit is available against income taxes until. Ad unlock r&d tax credits for your business & get the savings you're owed with gusto payroll.

Find Out If You Qualify For R&D Tax Credits In Illinois And Recharge Your Business.

Web illinois r&d tax credits. Offset your tax liability with r&d tax credits • the reimagining electric vehicles (rev) illinois investment credit (code 5230) is effective for tax years. Ad sign up for a no obligation r&d tax credit consultation today.