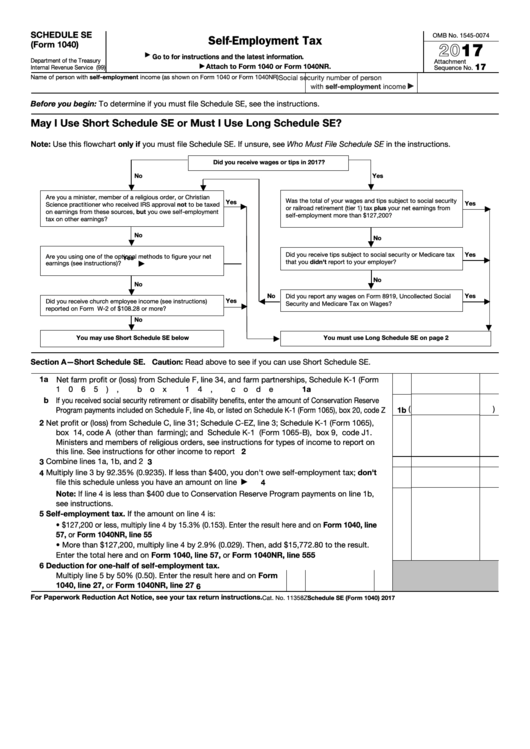

1040 Schedule Se Tax Form

1040 Schedule Se Tax Form - Your net earnings from self. Multiply line 12 by 50%. If line 4c is zero, skip lines 18 through. Enter your profit or (perish the thought) your loss on line 2. Web the 1040 se form is dependent on that number. Please use the link below to. Web schedule se (form 1040) 2020. You can get this from your schedule c on line 3, add all the lines. Web you must complete the following federal tax forms by april 15 following any year in which you have net earnings of $400 or more: Certain expenses, payments, contributions, fees, etc.

Certain expenses, payments, contributions, fees, etc. Your net earnings from self. Web the 1040 se form is dependent on that number. Where to enter schedule se calculations. Please use the link below to. You can download or print. If line 4c is zero, skip lines 18 through. Form 1040, schedule 1, allows you to claim the resulting amount. Multiply line 12 by 50%. Enter your profit or (perish the thought) your loss on line 2.

You must file schedule se and. Add lines 10 and 11. Please use the link below to. If line 4c is zero, skip lines 18 through. You can download or print. Web adjustments to income section of form 1040, schedule 1. You must file your return and pay any tax due by the. Your net earnings from self. Form 1040, schedule 1, allows you to claim the resulting amount. Web the 1040 se form is dependent on that number.

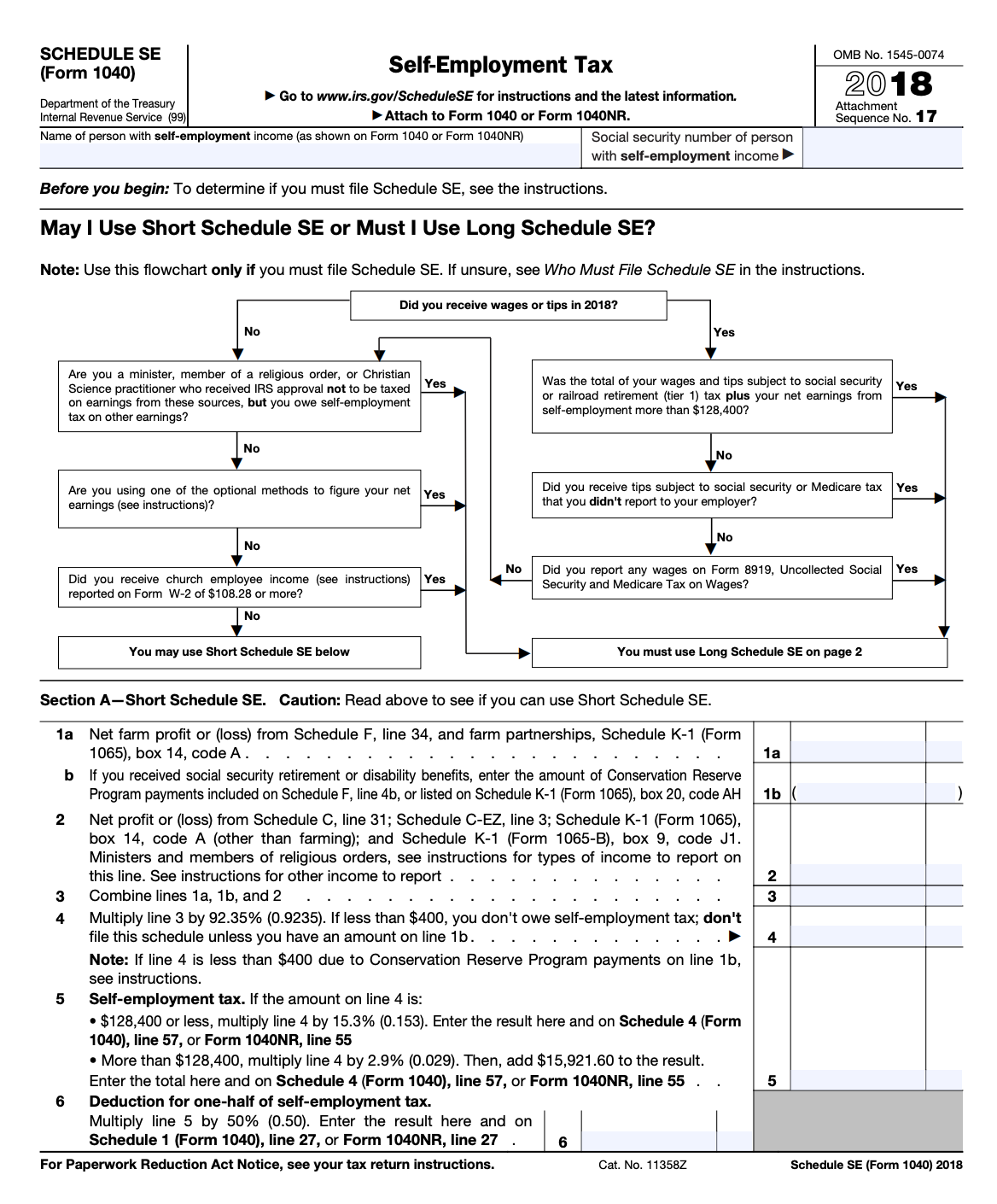

2018 Form 1040 Schedule 1 Se 1040 Form Printable

Add lines 10 and 11. You must file your return and pay any tax due by the. Web adjustments to income section of form 1040, schedule 1. Web schedule se (form 1040) 2020. Enter your profit or (perish the thought) your loss on line 2.

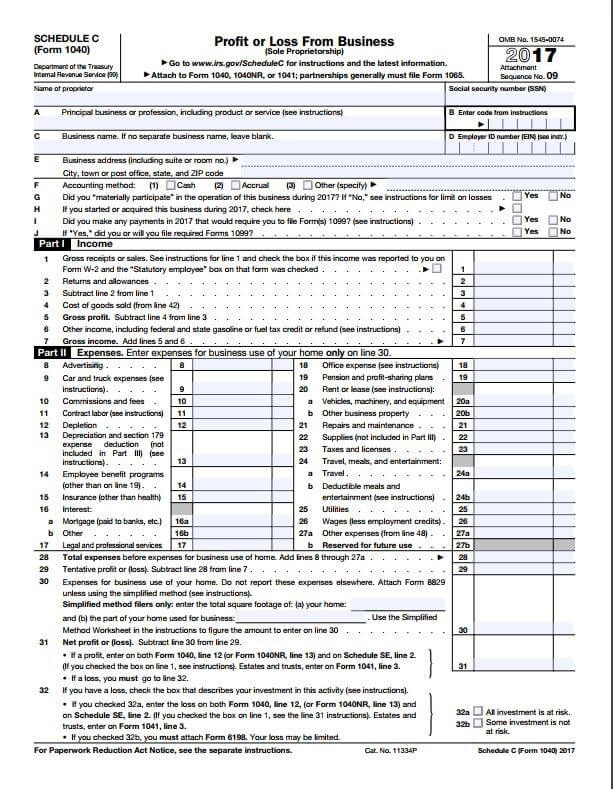

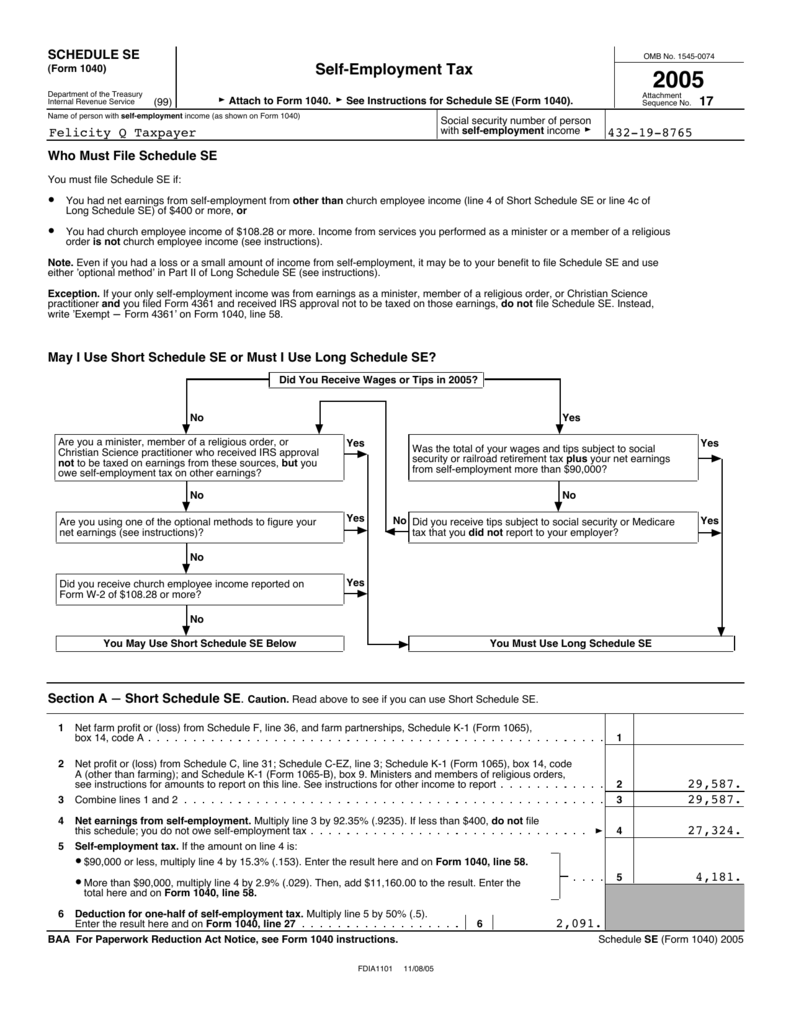

Schedule SE A Simple Guide to Filing the SelfEmployment Tax Form

You can download or print. Certain expenses, payments, contributions, fees, etc. Web schedule se (form 1040) 2020. You must file schedule se and. Your net earnings from self.

Form 1040 (Schedule SE) SelfEmployment Tax Form (2015) Free Download

Where to enter schedule se calculations. You can get this from your schedule c on line 3, add all the lines. Your net earnings from self. Enter your profit or (perish the thought) your loss on line 2. Form 1040, schedule 1, allows you to claim the resulting amount.

Schedule Se (Form 1040) Social Security (United States) Irs Tax Forms

Add lines 10 and 11. Web adjustments to income section of form 1040, schedule 1. Web the 1040 se form is dependent on that number. Where to enter schedule se calculations. You can download or print.

Form 1040, Schedule SE SelfEmployment Tax

Form 1040, schedule 1, allows you to claim the resulting amount. If line 4c is zero, skip lines 18 through. Web you must complete the following federal tax forms by april 15 following any year in which you have net earnings of $400 or more: Web schedule se (form 1040) 2020. You must file schedule se and.

Schedule SE

You must file schedule se and. Web schedule se (form 1040) 2020. Web adjustments to income section of form 1040, schedule 1. Form 1040, schedule 1, allows you to claim the resulting amount. Web the 1040 se form is dependent on that number.

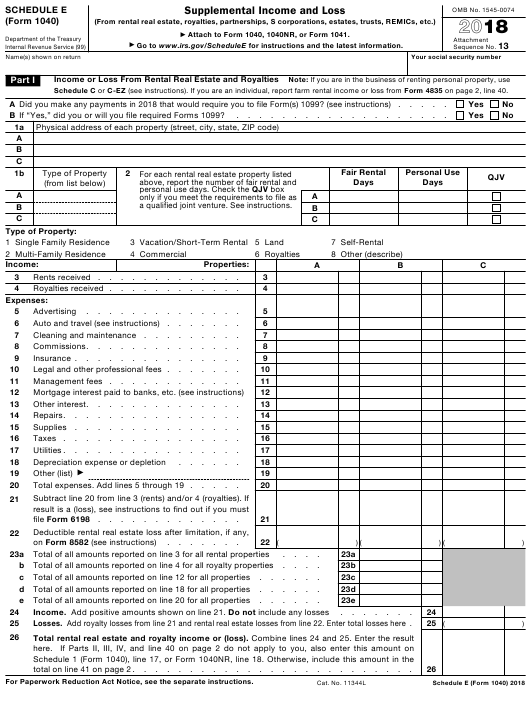

2019 IRS Tax Form 1040 (schedule A) Itemized Deductions U.S

You must file your return and pay any tax due by the. Web the 1040 se form is dependent on that number. Form 1040, schedule 1, allows you to claim the resulting amount. If line 4c is zero, skip lines 18 through. Your net earnings from self.

How To Make A 1040 Schedule C 2020 Hampel Bloggen

Where to enter schedule se calculations. You must file schedule se and. Add lines 10 and 11. Please use the link below to. Your net earnings from self.

IRS Form 1040 Schedule E Download Fillable PDF Or Fill 2021 Tax Forms

Web schedule se (form 1040) 2020. You must file schedule se and. Please use the link below to. You can get this from your schedule c on line 3, add all the lines. Certain expenses, payments, contributions, fees, etc.

You Can Get This From Your Schedule C On Line 3, Add All The Lines.

You must file schedule se and. Web the 1040 se form is dependent on that number. Add lines 10 and 11. Enter your profit or (perish the thought) your loss on line 2.

If Line 4C Is Zero, Skip Lines 18 Through.

Web adjustments to income section of form 1040, schedule 1. Multiply line 12 by 50%. Your net earnings from self. Web you must complete the following federal tax forms by april 15 following any year in which you have net earnings of $400 or more:

Please Use The Link Below To.

Where to enter schedule se calculations. Certain expenses, payments, contributions, fees, etc. Web schedule se (form 1040) 2020. Form 1040, schedule 1, allows you to claim the resulting amount.

You Can Download Or Print.

You must file your return and pay any tax due by the.