1042-S 2022 Form

1042-S 2022 Form - Source income subject to withholding, is used to report any payments made to foreign persons. Source income subject to withholding. Source income of foreign persons go to www.irs.gov/form1042 for. Web what's new for 2022. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Web understanding when u.s. Get ready for tax season deadlines by completing any required tax forms today.

Get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web understanding when u.s. Source income subject to withholding, is used to report any payments made to foreign persons. So, i see, it is the top of the hour. Source income of foreign persons go to www.irs.gov/form1042 for. Ad get ready for tax season deadlines by completing any required tax forms today. Additionally, a withholding agent may use the extended due date for filing a form 1042. Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. The amounts that make up this total are detailed.

Complete, edit or print tax forms instantly. Source income of foreign persons go to www.irs.gov/form1042 for. Source income subject to withholding. Ad get ready for tax season deadlines by completing any required tax forms today. So, i see, it is the top of the hour. Web understanding when u.s. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. 56 dividend equivalents under irc section 871(m) as a result of applying the combined transaction rules added:. Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return.

2022 Master Guide to Form 1042S Compliance Institute of Finance

Ad get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Source income subject to withholding, to the internal revenue service. Source income of foreign persons go to www.irs.gov/form1042 for. Source income subject to withholding, is used to report any payments made to foreign persons.

IRS Form 1042s What It is & 1042s Instructions Tipalti

Additionally, a withholding agent may use the extended due date for filing a form 1042. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. The amounts that make up this total.

1042 S Form slideshare

Source income subject to withholding, to the internal revenue service. Complete, edit or print tax forms instantly. So, i see, it is the top of the hour. Source income subject to withholding. Get ready for tax season deadlines by completing any required tax forms today.

Form 1042S USEReady

Complete, edit or print tax forms instantly. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. Additionally, a withholding agent may use the extended due date for filing a form 1042. Source income of foreign persons go to www.irs.gov/form1042 for. Web what's new for 2022.

Form 1042S It's Your Yale

Web understanding when u.s. 56 dividend equivalents under irc section 871(m) as a result of applying the combined transaction rules added:. Additionally, a withholding agent may use the extended due date for filing a form 1042. Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your.

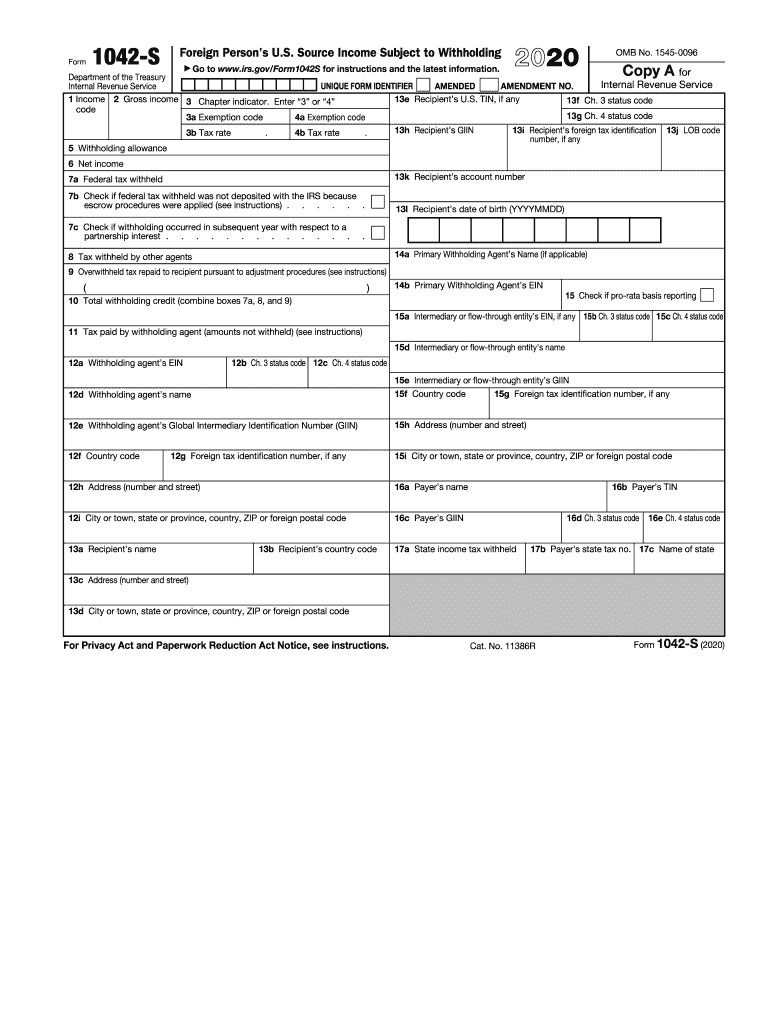

2020 Form IRS 1042S Fill Online, Printable, Fillable, Blank pdfFiller

Source income subject to withholding, is used to report any payments made to foreign persons. 56 dividend equivalents under irc section 871(m) as a result of applying the combined transaction rules added:. The amounts that make up this total are detailed. Source income subject to withholding, to the internal revenue service. Source income subject to withholding.

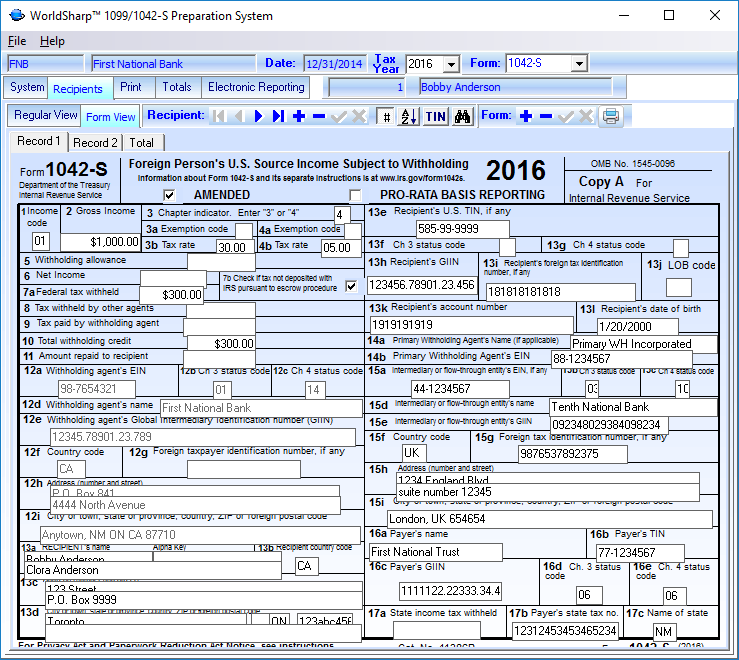

1042S Software WorldSharp 1099/1042S Software features

The amounts that make up this total are detailed. Complete, edit or print tax forms instantly. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding, is used to report any payments made to foreign persons.

The Tax Times The Newly Issued Form 1042S Foreign Person's U.S

Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Web what's new for 2022. Complete, edit or print tax forms instantly. Ad.

Form 1042s 2022 instructions Fill online, Printable, Fillable Blank

Ad get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. So, i see, it is the top of the hour. Web understanding when u.s. Web get tax form (1099/1042s) get tax form (1099/1042s) download.

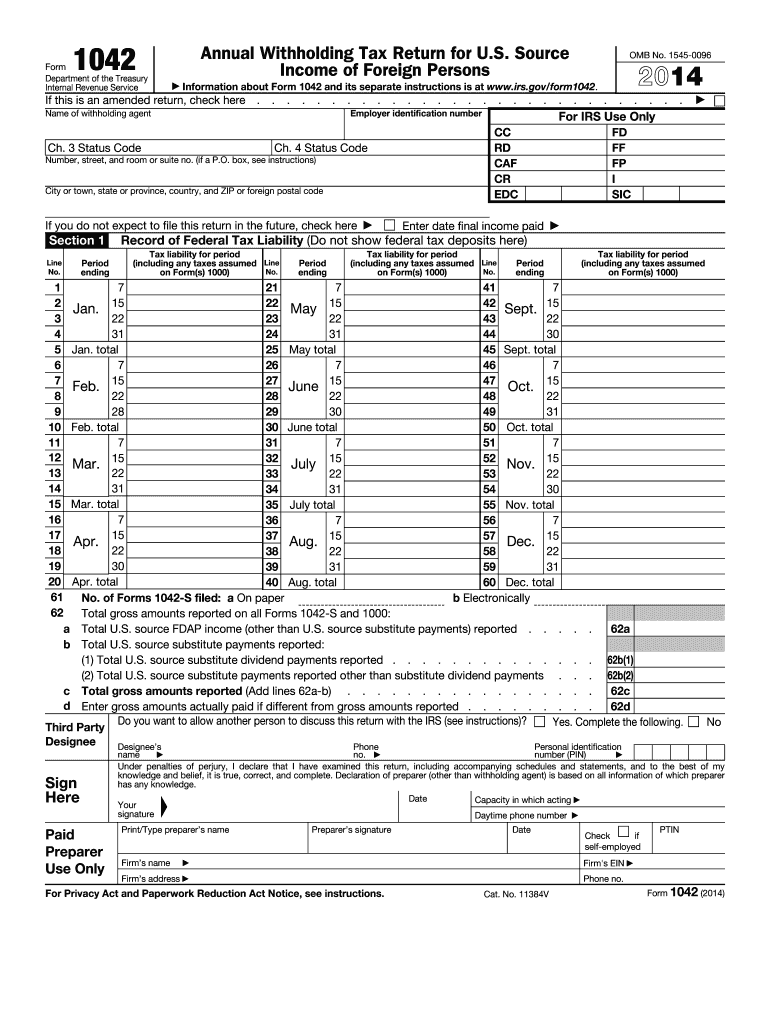

2014 form 1042 Fill out & sign online DocHub

56 dividend equivalents under irc section 871(m) as a result of applying the combined transaction rules added:. Source income subject to withholding, to the internal revenue service. Source income subject to withholding is used to report amounts paid to foreign persons (including persons presumed to be foreign) that are. The amounts that make up this total are detailed. Web form.

Additionally, A Withholding Agent May Use The Extended Due Date For Filing A Form 1042.

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Source income of foreign persons go to www.irs.gov/form1042 for. Source income subject to withholding, including recent updates, related forms, and instructions on how to file.

Source Income Subject To Withholding Is Used To Report Amounts Paid To Foreign Persons (Including Persons Presumed To Be Foreign) That Are.

So, i see, it is the top of the hour. Source income subject to withholding, is used to report any payments made to foreign persons. Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today.

Source Income Subject To Withholding, To The Internal Revenue Service.

56 dividend equivalents under irc section 871(m) as a result of applying the combined transaction rules added:. Source income subject to withholding. Web get tax form (1099/1042s) get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Web what's new for 2022.

Web Form 1042 Department Of The Treasury Internal Revenue Service Annual Withholding Tax Return For U.s.

Web understanding when u.s. The amounts that make up this total are detailed.