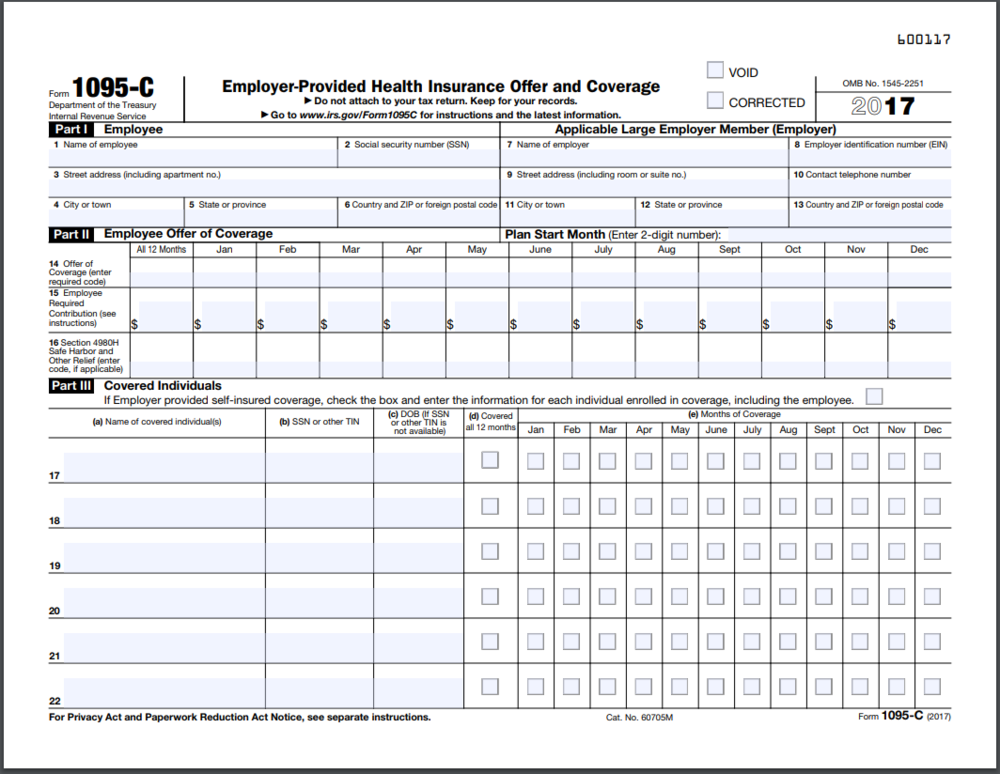

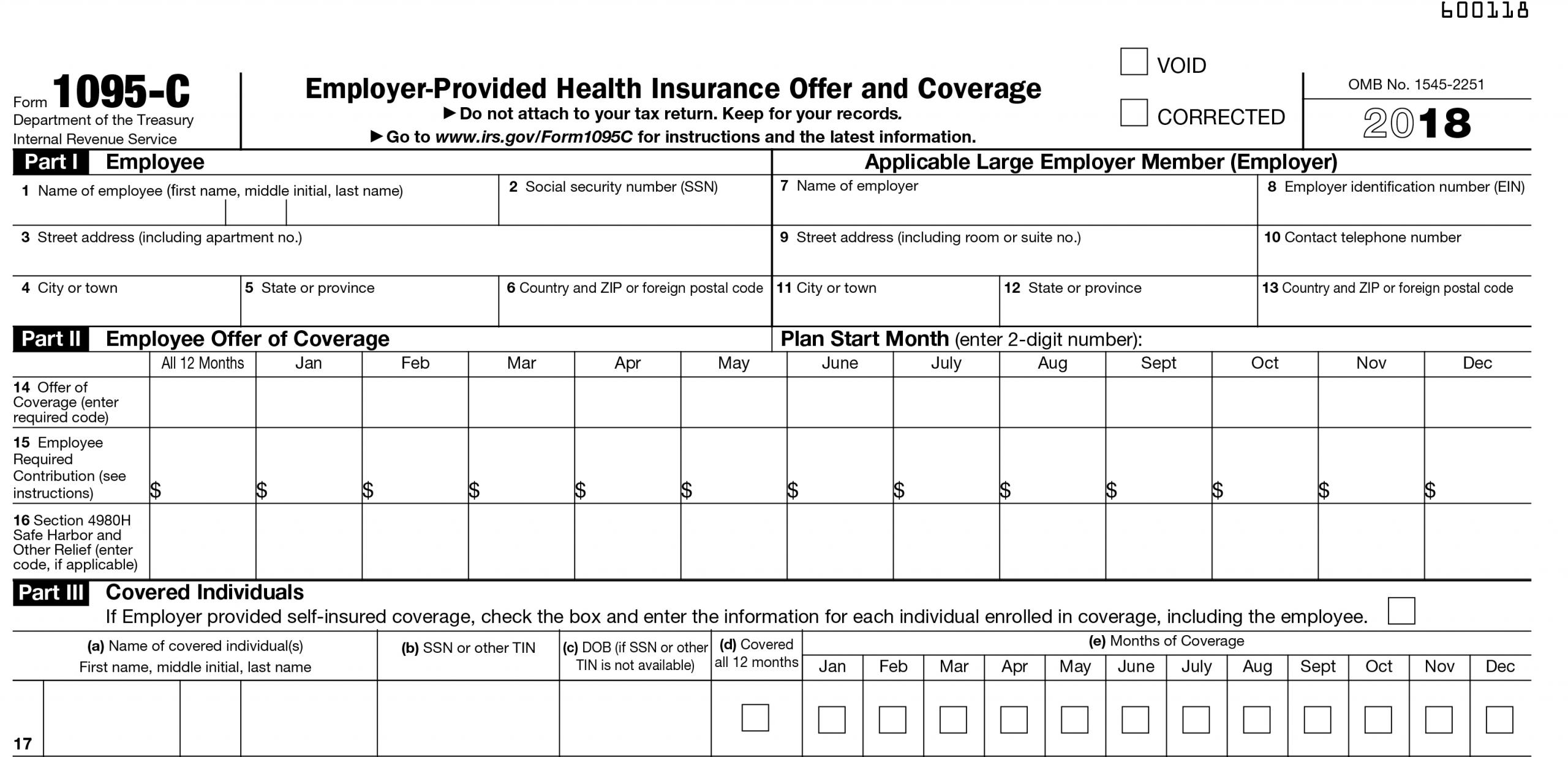

1095 C Form 1E Meaning

1095 C Form 1E Meaning - The amount reported on line 15 may not be the amount you paid for coverage if, for example, you chose to enroll. The section 6056 reporting requirement relates to the employer shared responsibility/play or. Department of the treasury internal revenue service. Your employer made a qualifying offer of healthcare coverage to you and your dependent (s). Do not attach to your tax return. Keep it in your tax records, however. Web what information must an ale member furnish to its employees? The code on line 14 may vary as to the quality of the coverage offering. Department of the treasury internal revenue service. Additionally, it isn’t filed or attached to your individual tax return.

Web what information must an ale member furnish to its employees? Department of the treasury internal revenue service. It is used by the irs to determine offer and election of health. Your employer made a qualifying offer of healthcare coverage to you and your dependent (s). Your employer made a qualifying offer of healthcare coverage to you. Do not attach to your tax return. Department of the treasury internal revenue service. The section 6056 reporting requirement relates to the employer shared responsibility/play or. This is a form that employers are required to send employees in accordance with the affordable care act. The amount reported on line 15 may not be the amount you paid for coverage if, for example, you chose to enroll.

The code on line 14 may vary as to the quality of the coverage offering. It is used by the irs to determine offer and election of health. The 1e code confirms the employee, their dependents, and their spouse received an offer of health coverage that meets mec and mv. Your employer made a qualifying offer of healthcare coverage to you. Department of the treasury internal revenue service. Web what information must an ale member furnish to its employees? Your employer made a qualifying offer of healthcare coverage to you and your dependent (s). Do not attach to your tax return. This form must confirm minimum essential coverage and. Department of the treasury internal revenue service.

1095A, 1095B and 1095C What are they and what do I do with them

Department of the treasury internal revenue service. Department of the treasury internal revenue service. The section 6056 reporting requirement relates to the employer shared responsibility/play or. The 1e code confirms the employee, their dependents, and their spouse received an offer of health coverage that meets mec and mv. Your employer made a qualifying offer of healthcare coverage to you.

Affordable Care Act (ACA) forms mailed News Illinois State

Department of the treasury internal revenue service. Keep it in your tax records, however. The 1e code confirms the employee, their dependents, and their spouse received an offer of health coverage that meets mec and mv. Do not attach to your tax return. This is a form that employers are required to send employees in accordance with the affordable care.

IRS Form 1095C UVA HR

The code on line 14 may vary as to the quality of the coverage offering. Additionally, it isn’t filed or attached to your individual tax return. Your employer made a qualifying offer of healthcare coverage to you and your dependent (s). Department of the treasury internal revenue service. It is used by the irs to determine offer and election of.

Form 1095C Adding Another Level of Complexity to Employee Education

This is a form that employers are required to send employees in accordance with the affordable care act. Keep it in your tax records, however. Department of the treasury internal revenue service. Web what information must an ale member furnish to its employees? It is used by the irs to determine offer and election of health.

hr.ua.edu The University of Alabama

Your employer made a qualifying offer of healthcare coverage to you. Do not attach to your tax return. This is a form that employers are required to send employees in accordance with the affordable care act. The section 6056 reporting requirement relates to the employer shared responsibility/play or. It is used by the irs to determine offer and election of.

Form 1095C EmployerProvided Health Insurance Offer and Coverage

Do not attach to your tax return. This form must confirm minimum essential coverage and. Department of the treasury internal revenue service. The 1e code confirms the employee, their dependents, and their spouse received an offer of health coverage that meets mec and mv. The code on line 14 may vary as to the quality of the coverage offering.

Do You Need Your 1095 C To File Your Taxes Tax Walls

Additionally, it isn’t filed or attached to your individual tax return. This is a form that employers are required to send employees in accordance with the affordable care act. Department of the treasury internal revenue service. It is used by the irs to determine offer and election of health. Your employer made a qualifying offer of healthcare coverage to you.

Does Form 1095 C Have To Be Filed With Taxes Tax Walls

The 1e code confirms the employee, their dependents, and their spouse received an offer of health coverage that meets mec and mv. Do not attach to your tax return. Keep it in your tax records, however. Department of the treasury internal revenue service. The section 6056 reporting requirement relates to the employer shared responsibility/play or.

1095C Information Kum & Go

The code on line 14 may vary as to the quality of the coverage offering. Additionally, it isn’t filed or attached to your individual tax return. The section 6056 reporting requirement relates to the employer shared responsibility/play or. It is used by the irs to determine offer and election of health. The 1e code confirms the employee, their dependents, and.

1095C Form 2021 2022 IRS Forms

Additionally, it isn’t filed or attached to your individual tax return. Your employer made a qualifying offer of healthcare coverage to you and your dependent (s). The amount reported on line 15 may not be the amount you paid for coverage if, for example, you chose to enroll. Web what information must an ale member furnish to its employees? It.

Additionally, It Isn’t Filed Or Attached To Your Individual Tax Return.

The section 6056 reporting requirement relates to the employer shared responsibility/play or. Do not attach to your tax return. This form must confirm minimum essential coverage and. The code on line 14 may vary as to the quality of the coverage offering.

The 1E Code Confirms The Employee, Their Dependents, And Their Spouse Received An Offer Of Health Coverage That Meets Mec And Mv.

Web what information must an ale member furnish to its employees? This is a form that employers are required to send employees in accordance with the affordable care act. The amount reported on line 15 may not be the amount you paid for coverage if, for example, you chose to enroll. Department of the treasury internal revenue service.

Department Of The Treasury Internal Revenue Service.

It is used by the irs to determine offer and election of health. Your employer made a qualifying offer of healthcare coverage to you. Your employer made a qualifying offer of healthcare coverage to you and your dependent (s). Keep it in your tax records, however.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)