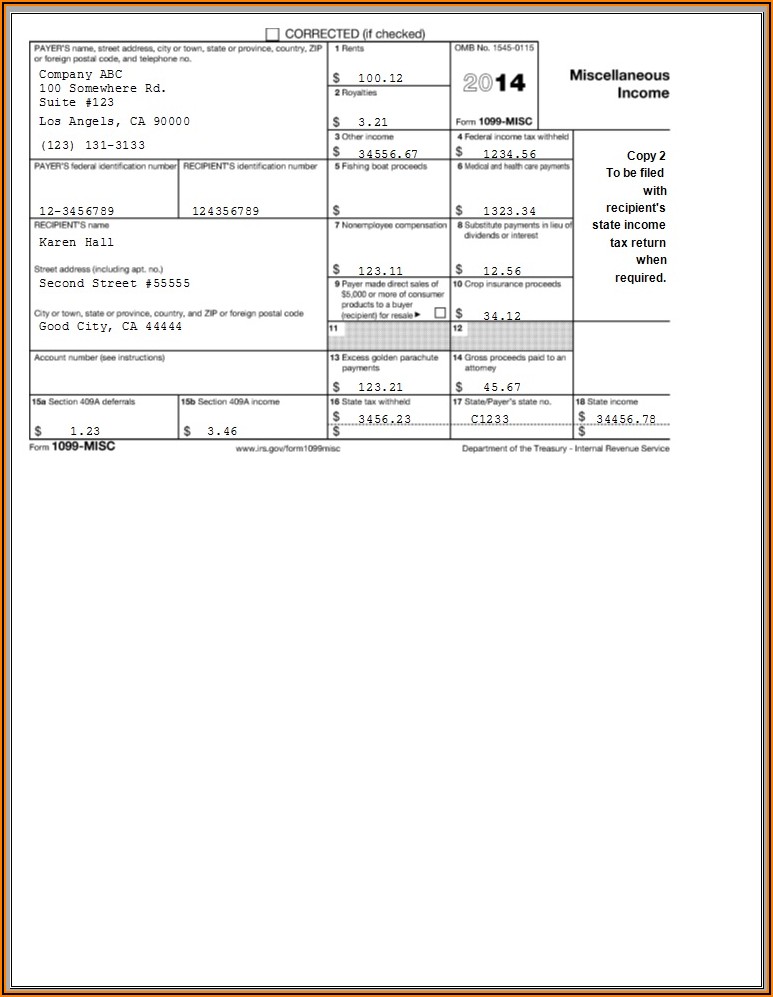

1099 Misc Blank Form

1099 Misc Blank Form - For internal revenue service center. Web copy 1 for state tax department www.irs.gov/form1099misc federal income tax withheld $ nonqualified deferred compensation copy b for recipient this is important. Copy 1 must be filed with our office, along with. Web fill out the form 1099 in seconds using soda pdf online. When you have the form, you can either fill it out. Ad find deals on 1099 tax forms on amazon. Ad discover a wide selection of 1099 tax forms at staples®. Enter a current year in 2022 the irs decided not to update the 1099misc every year, so to specify the current calendar year type the last two digits right under the form. Web you are free to get 1099 tax forms printable right from 1099formirs.com, or the official irs website (there’s no difference). Browse & discover thousands of brands.

Web copy 1 for state tax department www.irs.gov/form1099misc federal income tax withheld $ nonqualified deferred compensation copy b for recipient this is important. Ad discover a wide selection of 1099 tax forms at staples®. For internal revenue service center. Web you are free to get 1099 tax forms printable right from 1099formirs.com, or the official irs website (there’s no difference). Read customer reviews & find best sellers Web fill out the form 1099 in seconds using soda pdf online. You may register with the irs in the combined federal/state reporting program to file the following form (s): Enter a current year in 2022 the irs decided not to update the 1099misc every year, so to specify the current calendar year type the last two digits right under the form. Browse & discover thousands of brands. As a business owner, it is your responsibility to report and submit.

Web fill out the form 1099 in seconds using soda pdf online. Web copy 1 for state tax department www.irs.gov/form1099misc federal income tax withheld $ nonqualified deferred compensation copy b for recipient this is important. Copy 1 must be filed with our office, along with. You may register with the irs in the combined federal/state reporting program to file the following form (s): As a business owner, it is your responsibility to report and submit. This is important tax information. Web you are free to get 1099 tax forms printable right from 1099formirs.com, or the official irs website (there’s no difference). When you have the form, you can either fill it out. Read customer reviews & find best sellers Shop a wide variety of 1099 tax forms from top brands at staples®.

1099 Form Printable 📝 Get IRS Form 1099 Printable for 2021 in PDF

Shop a wide variety of 1099 tax forms from top brands at staples®. Browse & discover thousands of brands. Ad discover a wide selection of 1099 tax forms at staples®. As a business owner, it is your responsibility to report and submit. Web fill out the form 1099 in seconds using soda pdf online.

1099MISC Form Template Create and Fill Online

Web fill out the form 1099 in seconds using soda pdf online. Read customer reviews & find best sellers Web copy 1 for state tax department www.irs.gov/form1099misc federal income tax withheld $ nonqualified deferred compensation copy b for recipient this is important. Enter a current year in 2022 the irs decided not to update the 1099misc every year, so to.

Free Printable 1099 Misc Forms Free Printable

Ad discover a wide selection of 1099 tax forms at staples®. As a business owner, it is your responsibility to report and submit. Web fill out the form 1099 in seconds using soda pdf online. To learn more about what you need to do when filling. You may register with the irs in the combined federal/state reporting program to file.

1099MISC Tax Basics

Ad find deals on 1099 tax forms on amazon. Read customer reviews & find best sellers You may register with the irs in the combined federal/state reporting program to file the following form (s): Web copy 1 for state tax department www.irs.gov/form1099misc federal income tax withheld $ nonqualified deferred compensation copy b for recipient this is important. As a business.

1099 Misc Blank Form 2019 Form Resume Examples 76YGKqy0Yo

Web fill out the form 1099 in seconds using soda pdf online. This is important tax information. Ad find deals on 1099 tax forms on amazon. Web you are free to get 1099 tax forms printable right from 1099formirs.com, or the official irs website (there’s no difference). You may register with the irs in the combined federal/state reporting program to.

1099 Misc Fillable Form Free amulette

Copy 1 must be filed with our office, along with. To learn more about what you need to do when filling. Ad find deals on 1099 tax forms on amazon. For internal revenue service center. When you have the form, you can either fill it out.

1099MISC Form Printable and Fillable PDF Template

Browse & discover thousands of brands. You may register with the irs in the combined federal/state reporting program to file the following form (s): As a business owner, it is your responsibility to report and submit. Enter a current year in 2022 the irs decided not to update the 1099misc every year, so to specify the current calendar year type.

Blank 1099 Misc Tax Forms Form Resume Examples P32E87MVJ8

Read customer reviews & find best sellers You may register with the irs in the combined federal/state reporting program to file the following form (s): Web you are free to get 1099 tax forms printable right from 1099formirs.com, or the official irs website (there’s no difference). Copy 1 must be filed with our office, along with. As a business owner,.

1099MISC Tax Basics

Enter a current year in 2022 the irs decided not to update the 1099misc every year, so to specify the current calendar year type the last two digits right under the form. Copy 1 must be filed with our office, along with. Browse & discover thousands of brands. As a business owner, it is your responsibility to report and submit..

Where To Get Blank 1099 Misc Forms Form Resume Examples EZVgexk9Jk

Copy 1 must be filed with our office, along with. Web fill out the form 1099 in seconds using soda pdf online. As a business owner, it is your responsibility to report and submit. Read customer reviews & find best sellers This is important tax information.

Web Fill Out The Form 1099 In Seconds Using Soda Pdf Online.

Web copy 1 for state tax department www.irs.gov/form1099misc federal income tax withheld $ nonqualified deferred compensation copy b for recipient this is important. You may register with the irs in the combined federal/state reporting program to file the following form (s): Ad find deals on 1099 tax forms on amazon. Read customer reviews & find best sellers

As A Business Owner, It Is Your Responsibility To Report And Submit.

Browse & discover thousands of brands. To learn more about what you need to do when filling. Web you are free to get 1099 tax forms printable right from 1099formirs.com, or the official irs website (there’s no difference). This is important tax information.

Shop A Wide Variety Of 1099 Tax Forms From Top Brands At Staples®.

Copy 1 must be filed with our office, along with. When you have the form, you can either fill it out. Ad discover a wide selection of 1099 tax forms at staples®. For internal revenue service center.