1099 Oid Form 2022

1099 Oid Form 2022 - Original issue discount (oid) is a form of interest. For your protection, this form may show only the last four digits of your social security number. Complete, edit or print tax forms instantly. Get ready for this year's tax season quickly and safely with pdffiller! It usually occurs when companies issue bonds at a price less. Sign into your turbotax account; January 2022) miscellaneous information and nonemployee compensation section references are to the internal revenue code unless otherwise noted. Create a blank & editable 1099. Web instructions for recipient recipient’s taxpayer identification number (tin). (ubs) provides to you and to the irs on:

Complete, edit or print tax forms instantly. Get ready for this year's tax season quickly and safely with pdffiller! It usually occurs when companies issue bonds at a price less. Original issue discount (oid) is a form of interest. (ubs) provides to you and to the irs on: For your protection, this form may show only the last four digits of your social security number. January 2022) miscellaneous information and nonemployee compensation section references are to the internal revenue code unless otherwise noted. If the obligation was held the entire year, the amount in box 2 should be reported as interest income on the tax return. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Information returns, with the internal revenue service.

Web your consolidated form 1099 reflects tax reporting information that ubs financial services inc. It usually occurs when companies issue bonds at a price less. Open or continue your return and then search for this exact. Web instructions for recipient recipient’s taxpayer identification number (tin). This means that debt instruments were issued. If the obligation was held the entire year, the amount in box 2 should be reported as interest income on the tax return. Get ready for this year's tax season quickly and safely with pdffiller! Sign into your turbotax account; Create a blank & editable 1099. (ubs) provides to you and to the irs on:

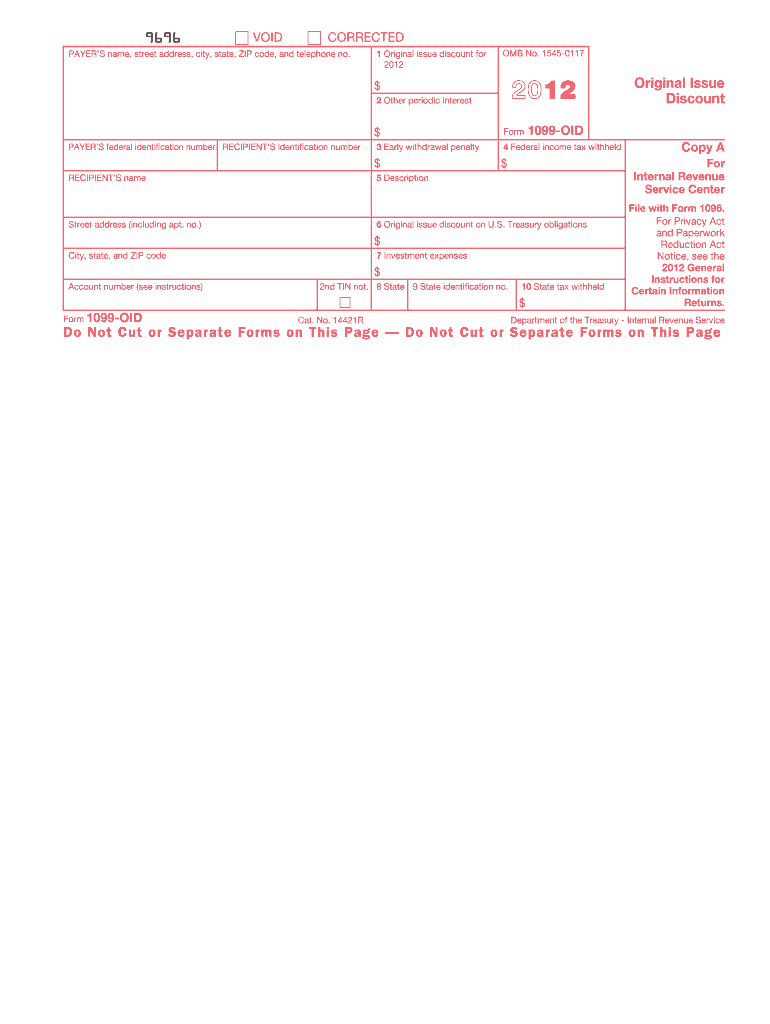

20192022 Form IRS 1099OID Fill Online, Printable, Fillable, Blank

Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Complete, edit or print tax forms instantly. Web your consolidated form 1099 reflects tax reporting information that ubs financial services inc. January 2022) miscellaneous information and nonemployee compensation section references are to the internal revenue code unless otherwise noted. Get ready for this year's.

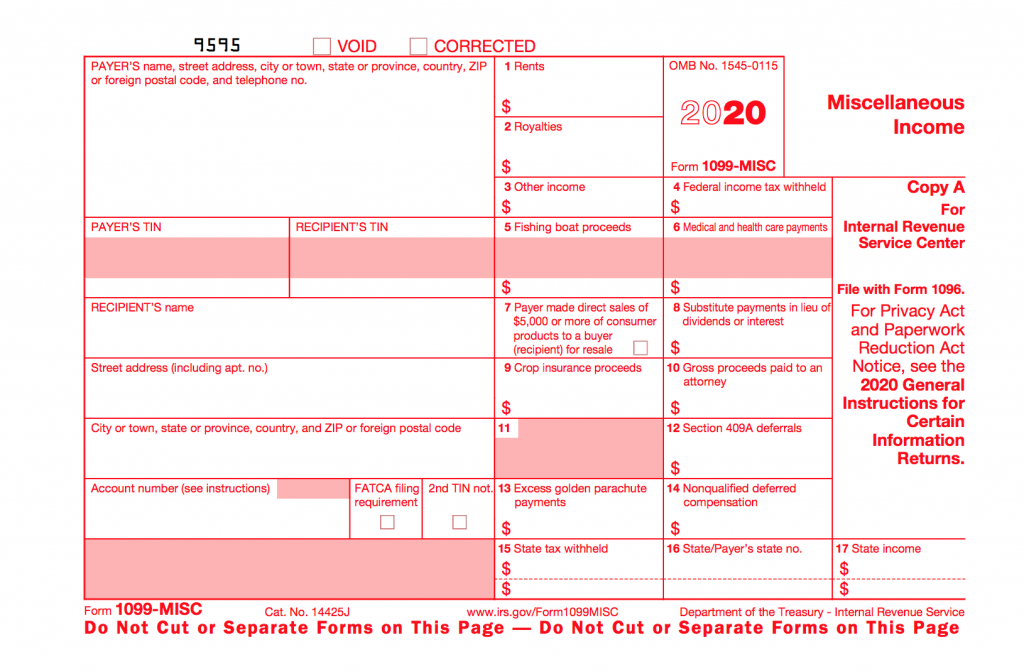

1099 Oid Instructions 2022 Fill online, Printable, Fillable Blank

Get ready for this year's tax season quickly and safely with pdffiller! Web your consolidated form 1099 reflects tax reporting information that ubs financial services inc. For your protection, this form may show only the last four digits of your social security number. Open or continue your return and then search for this exact. Ad ap leaders rely on iofm’s.

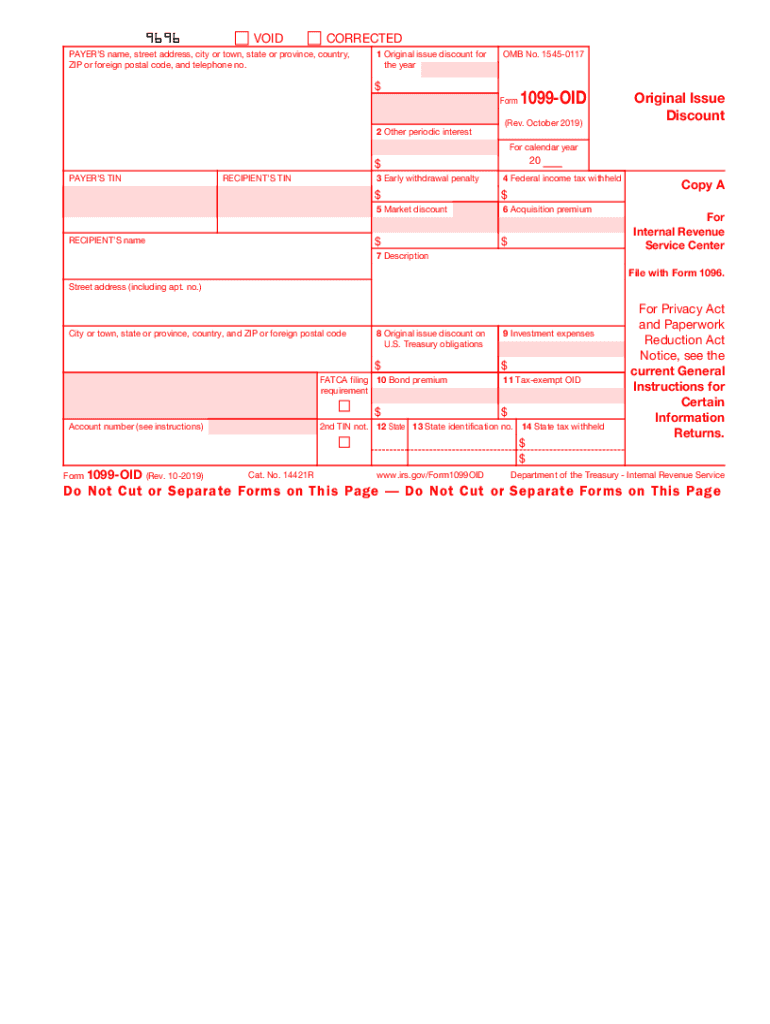

1099 Oid Form Fill Out and Sign Printable PDF Template signNow

January 2022) miscellaneous information and nonemployee compensation section references are to the internal revenue code unless otherwise noted. Web your consolidated form 1099 reflects tax reporting information that ubs financial services inc. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web its primary purpose is to help brokers and other middlemen identify.

Form 1099OID Original Issue Discount Definition

Sign into your turbotax account; Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. For your protection, this form may show only the last four digits of your social security number. If the obligation was held the entire year, the amount in box 2 should be reported as interest income on the tax.

1099 Oid Form Fill Out and Sign Printable PDF Template signNow

Web instructions for recipient recipient’s taxpayer identification number (tin). It usually occurs when companies issue bonds at a price less. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. (ubs) provides to you and to the irs on: Original issue discount (oid) is a form of interest.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

Get ready for this year's tax season quickly and safely with pdffiller! (ubs) provides to you and to the irs on: Original issue discount (oid) is a form of interest. Create a blank & editable 1099. Web your consolidated form 1099 reflects tax reporting information that ubs financial services inc.

1099OID for HR 1424 returnthe1099oidtotheprincipal

Web its primary purpose is to help brokers and other middlemen identify publicly offered original issue discount (oid) debt instruments they may hold as nominees for the true owners, so. It usually occurs when companies issue bonds at a price less. Web instructions for recipient recipient’s taxpayer identification number (tin). Sign into your turbotax account; Web your consolidated form 1099.

SAMPLE 1099OID

Sign into your turbotax account; Web instructions for recipient recipient’s taxpayer identification number (tin). Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web its primary purpose is to help brokers and other middlemen identify publicly offered original issue discount (oid) debt instruments they may hold as nominees for the true owners, so..

Irs Printable 1099 Form Printable Form 2022

Open or continue your return and then search for this exact. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. (ubs) provides to you and to the irs on: Sign into your turbotax account; Information returns, with the internal revenue service.

What Are 1099s and Do I Need to File Them? Singletrack Accounting

This means that debt instruments were issued. Get ready for this year's tax season quickly and safely with pdffiller! Original issue discount (oid) is a form of interest. Web your consolidated form 1099 reflects tax reporting information that ubs financial services inc. Web its primary purpose is to help brokers and other middlemen identify publicly offered original issue discount (oid).

Web Your Consolidated Form 1099 Reflects Tax Reporting Information That Ubs Financial Services Inc.

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Open or continue your return and then search for this exact. It usually occurs when companies issue bonds at a price less. Create a blank & editable 1099.

For Your Protection, This Form May Show Only The Last Four Digits Of Your Social Security Number.

Web instructions for recipient recipient’s taxpayer identification number (tin). Information returns, with the internal revenue service. If the obligation was held the entire year, the amount in box 2 should be reported as interest income on the tax return. January 2022) miscellaneous information and nonemployee compensation section references are to the internal revenue code unless otherwise noted.

Get Ready For This Year's Tax Season Quickly And Safely With Pdffiller!

Original issue discount (oid) is a form of interest. Web its primary purpose is to help brokers and other middlemen identify publicly offered original issue discount (oid) debt instruments they may hold as nominees for the true owners, so. (ubs) provides to you and to the irs on: This means that debt instruments were issued.

Complete, Edit Or Print Tax Forms Instantly.

Sign into your turbotax account; Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)