1099 S Form 2021

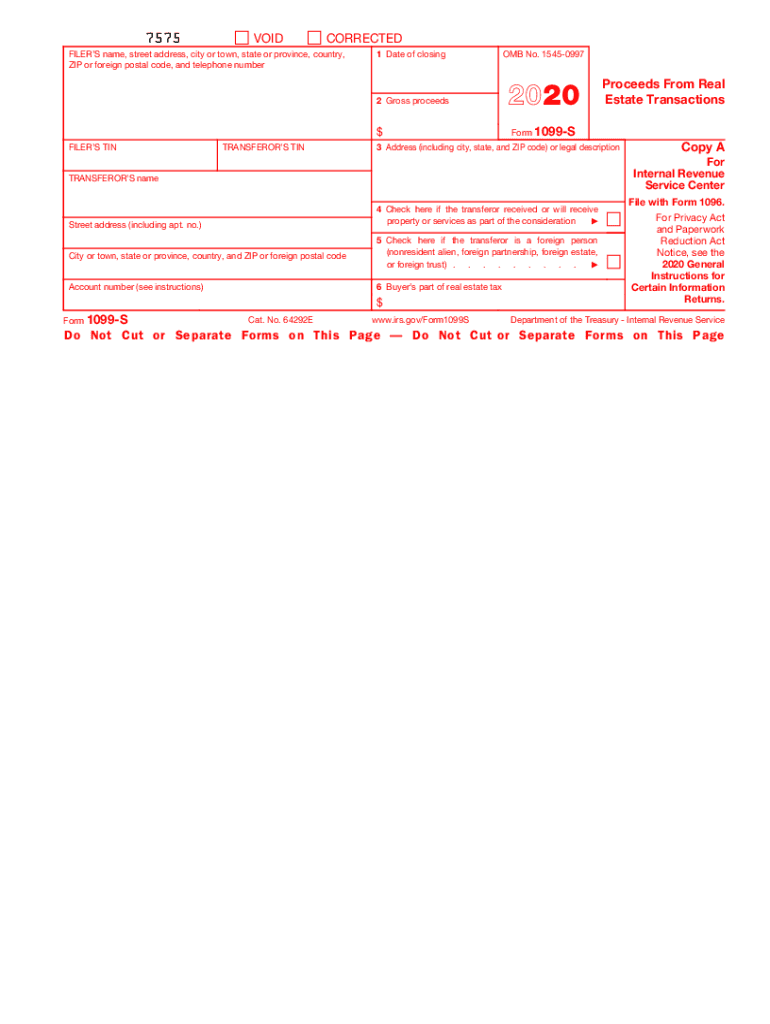

1099 S Form 2021 - File this form to report the sale or exchange of real estate. This is important tax information and is being furnished to the irs. Reportable real estate generally, you are required to report a transaction that consists in whole or in part of the sale or exchange for money, indebtedness, property, or services of any present or future For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). A sale of real estate under threat or imminence of seizure, requisition, or condemnation is generally a reportable transaction. How the property is used (personal, investment, business) will determine where the information is reported. For 2020 taxes this would be february 1st 2021. Follow the steps below to report real estate for personal, investment, or business use. The due date for irs paper filing march 15th 2021. Web instructions for recipient recipient’s taxpayer identification number (tin).

The due date for irs paper filing march 15th 2021. Web what is a 1099 s? Proceeds from real estate transactions. Follow the steps below to report real estate for personal, investment, or business use. For 2020 taxes this would be february 1st 2021. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be. Web instructions for recipient recipient’s taxpayer identification number (tin). It must be used whenever you make a real estate transaction in the tax year. A sale of real estate under threat or imminence of seizure, requisition, or condemnation is generally a reportable transaction. How the property is used (personal, investment, business) will determine where the information is reported.

This is important tax information and is being furnished to the irs. For 2020 taxes this would be february 1st 2021. The due date for irs paper filing march 15th 2021. Web what is a 1099 s? If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be. File this form to report the sale or exchange of real estate. Proceeds from real estate transactions. Follow the steps below to report real estate for personal, investment, or business use. It must be used whenever you make a real estate transaction in the tax year. A sale of real estate under threat or imminence of seizure, requisition, or condemnation is generally a reportable transaction.

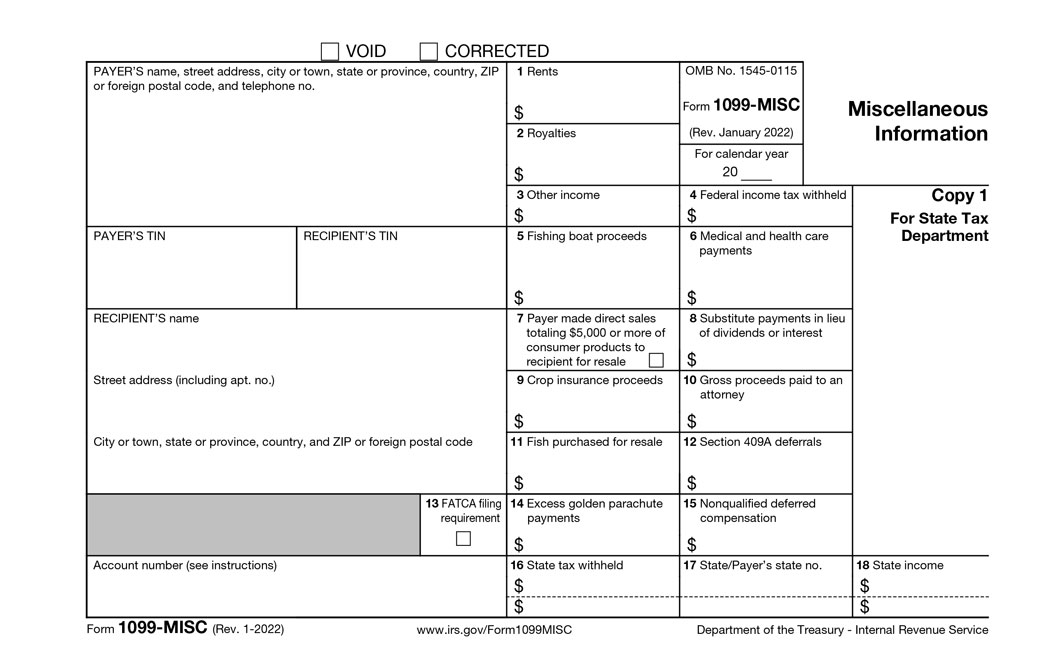

Printable 1099s 2021 Form Printable Form 2022

Web instructions for recipient recipient’s taxpayer identification number (tin). For 2020 taxes this would be february 1st 2021. This could include land, permanent structures, apartments or condominiums, and more. File this form to report the sale or exchange of real estate. A sale of real estate under threat or imminence of seizure, requisition, or condemnation is generally a reportable transaction.

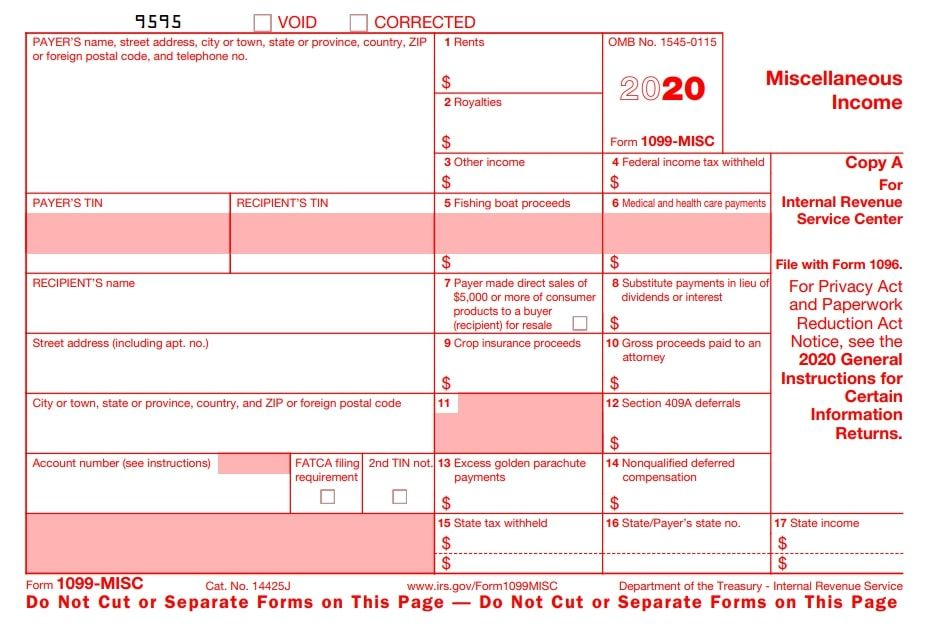

25 ++ sample completed 1099 misc form 2020 325140How to fill in 1099

This is important tax information and is being furnished to the irs. The due date for irs paper filing march 15th 2021. Follow the steps below to report real estate for personal, investment, or business use. How the property is used (personal, investment, business) will determine where the information is reported. Web what is a 1099 s?

Form 1099 Fillable Form Resume Examples yKVBbLrgVM

For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). A sale of real estate under threat or imminence of seizure, requisition, or condemnation is generally a reportable transaction. If you are required to file a return,.

Understanding the 1099 5 Straightforward Tips to File

The due date for irs paper filing march 15th 2021. This could include land, permanent structures, apartments or condominiums, and more. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this item is required to be. A sale of real estate under threat or imminence of seizure, requisition, or.

1099 vs W2 Calculator (To Estimate Your Tax Difference)

For 2020 taxes this would be february 1st 2021. This is important tax information and is being furnished to the irs. Proceeds from real estate transactions. Web what is a 1099 s? Reportable real estate generally, you are required to report a transaction that consists in whole or in part of the sale or exchange for money, indebtedness, property, or.

Irs Printable 1099 Form Printable Form 2022

Follow the steps below to report real estate for personal, investment, or business use. How the property is used (personal, investment, business) will determine where the information is reported. It must be used whenever you make a real estate transaction in the tax year. This is important tax information and is being furnished to the irs. This could include land,.

What the Heck is "IRS Form 1099S" and Why Does it Matter? REtipster

Reportable real estate generally, you are required to report a transaction that consists in whole or in part of the sale or exchange for money, indebtedness, property, or services of any present or future For 2020 taxes this would be february 1st 2021. This is important tax information and is being furnished to the irs. Proceeds from real estate transactions..

1099 Form 2019 Fill and Sign Printable Template Online US Legal Forms

This could include land, permanent structures, apartments or condominiums, and more. Follow the steps below to report real estate for personal, investment, or business use. For 2020 taxes this would be february 1st 2021. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification.

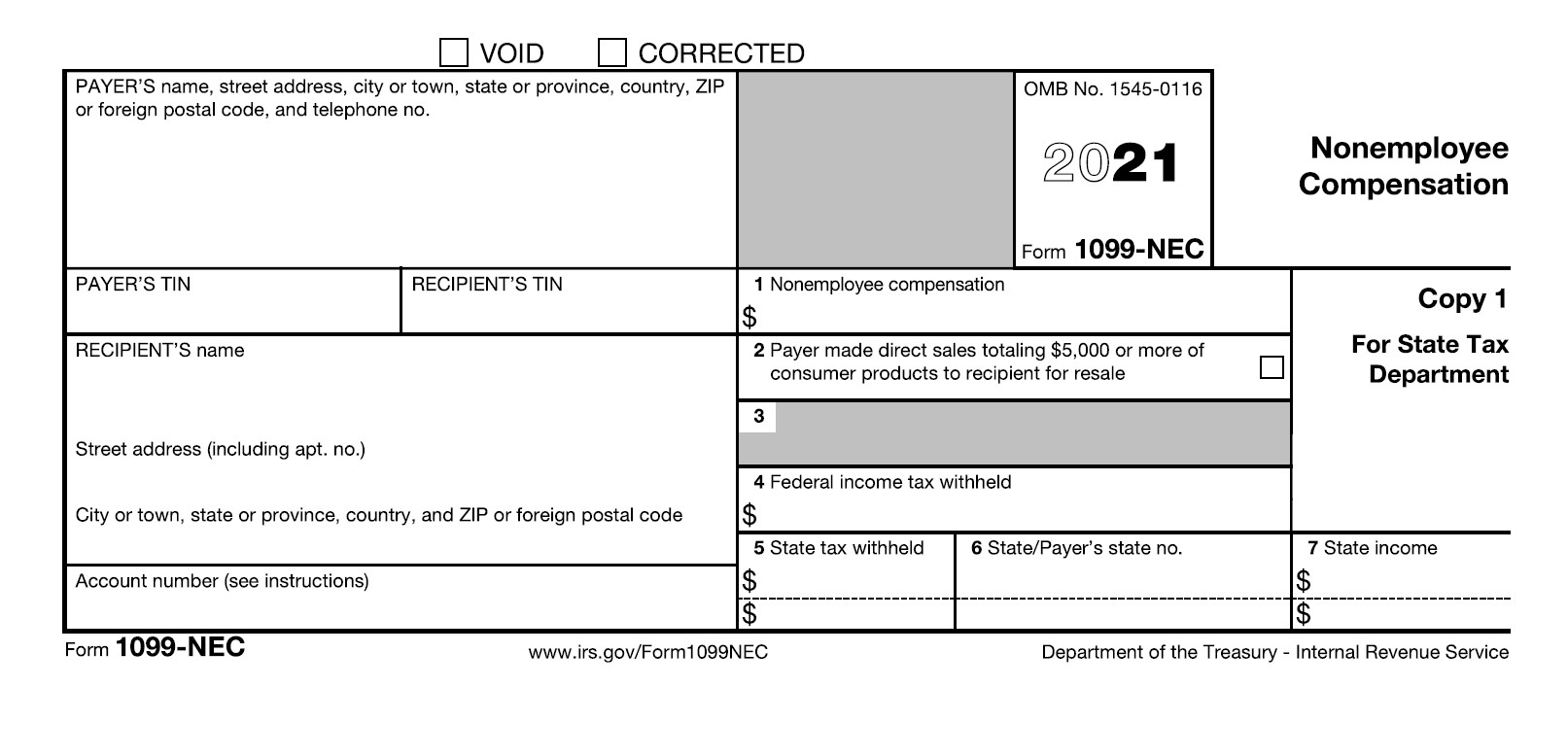

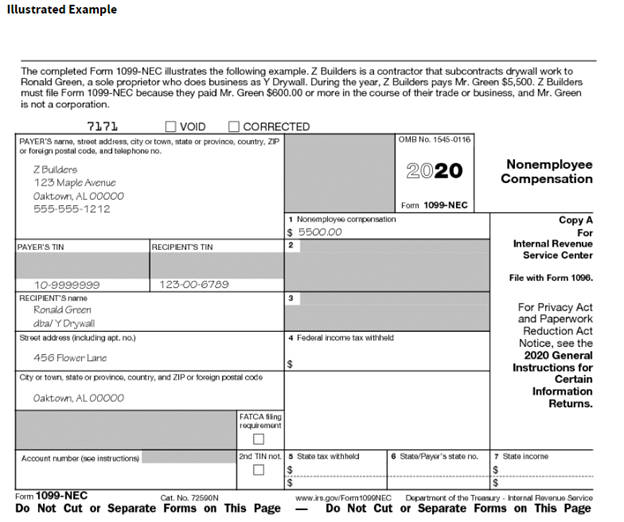

Nonemployee Compensation now reported on Form 1099NEC instead of Form

Reportable real estate generally, you are required to report a transaction that consists in whole or in part of the sale or exchange for money, indebtedness, property, or services of any present or future Proceeds from real estate transactions. How the property is used (personal, investment, business) will determine where the information is reported. File this form to report the.

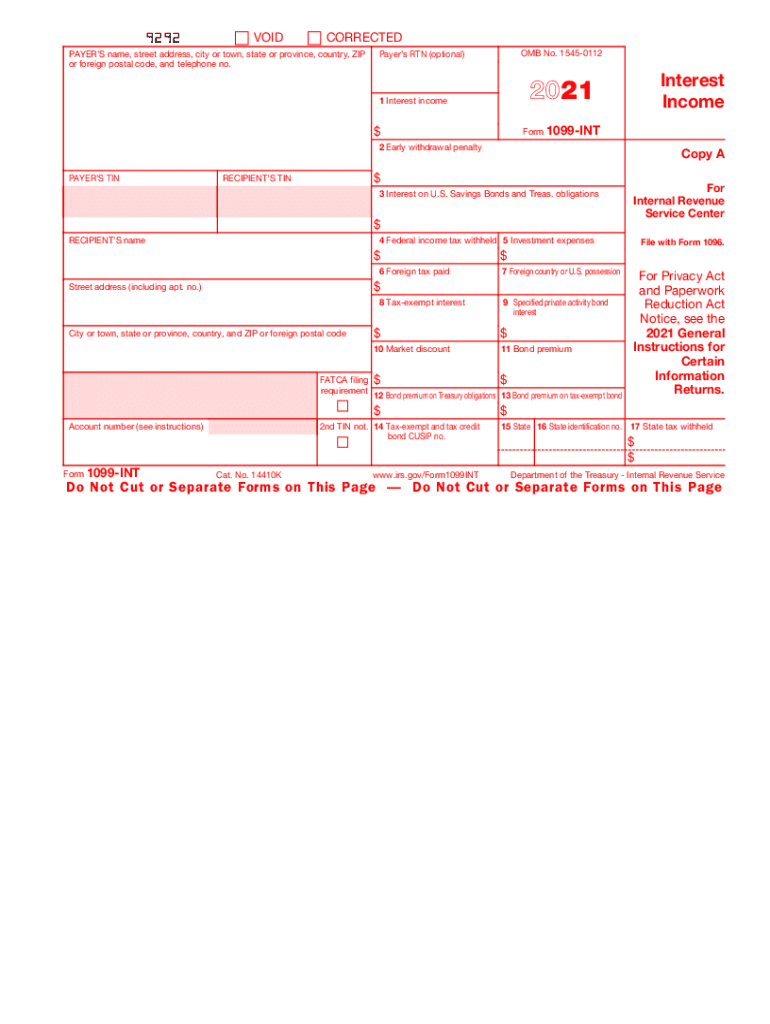

2021 Form IRS 1099INT Fill Online, Printable, Fillable, Blank pdfFiller

Reportable real estate generally, you are required to report a transaction that consists in whole or in part of the sale or exchange for money, indebtedness, property, or services of any present or future The due date for irs paper filing march 15th 2021. Follow the steps below to report real estate for personal, investment, or business use. This could.

For Your Protection, This Form May Show Only The Last Four Digits Of Your Social Security Number (Ssn), Individual Taxpayer Identification Number (Itin), Adoption Taxpayer Identification Number (Atin), Or Employer Identification Number (Ein).

Proceeds from real estate transactions. Reportable real estate generally, you are required to report a transaction that consists in whole or in part of the sale or exchange for money, indebtedness, property, or services of any present or future Web instructions for recipient recipient’s taxpayer identification number (tin). How the property is used (personal, investment, business) will determine where the information is reported.

If You Are Required To File A Return, A Negligence Penalty Or Other Sanction May Be Imposed On You If This Item Is Required To Be.

For 2020 taxes this would be february 1st 2021. A sale of real estate under threat or imminence of seizure, requisition, or condemnation is generally a reportable transaction. The due date for irs paper filing march 15th 2021. Web what is a 1099 s?

File This Form To Report The Sale Or Exchange Of Real Estate.

Follow the steps below to report real estate for personal, investment, or business use. This could include land, permanent structures, apartments or condominiums, and more. It must be used whenever you make a real estate transaction in the tax year. This is important tax information and is being furnished to the irs.