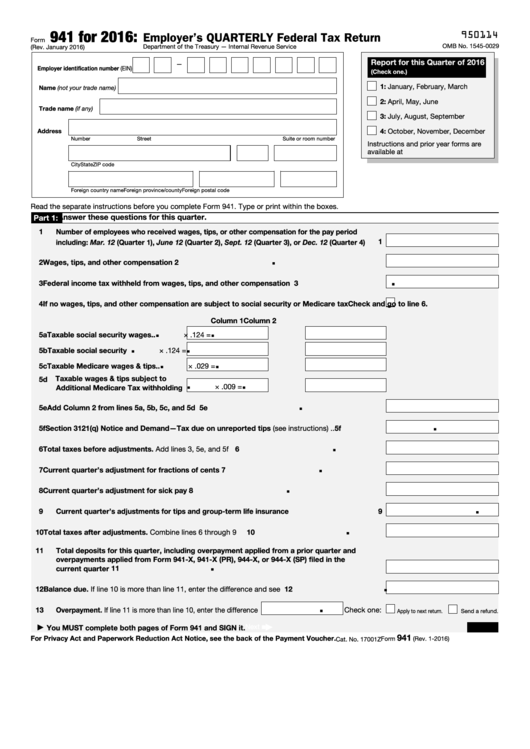

2016 Form 941

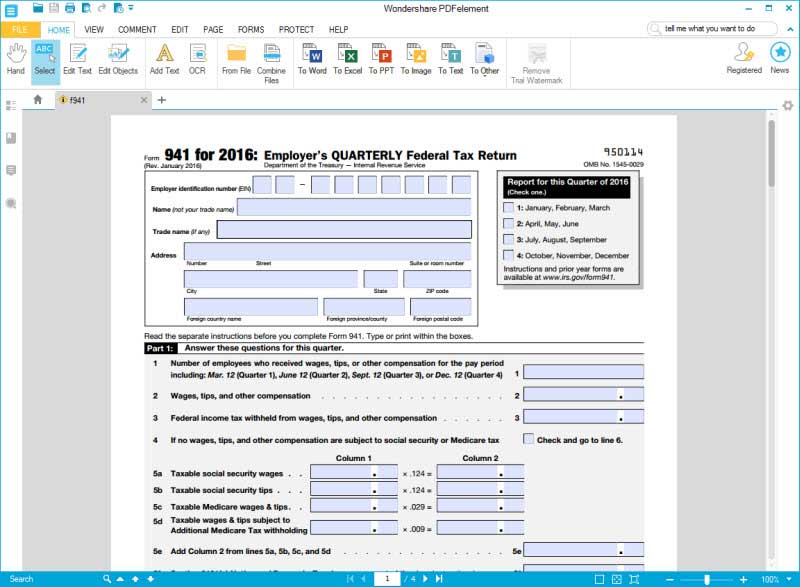

2016 Form 941 - For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. Web fill out the { 941 2016 pdf} form for free? Employer’s quarterly federal tax return. Web failure to timely file a form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late. Complete, edit or print tax forms instantly. Web use a 2016 form 941 2020 template to make your document workflow more streamlined. October, november, december instructions and prior year. You must complete all three pages. Complete irs tax forms online or print government tax documents. Ad access irs tax forms.

You must complete all three pages. January 2016) department of the treasury — internal revenue service. October, november, december instructions and prior year. Web failure to timely file a form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late. Employer's return of income taxes withheld (note: Third quarter, october 31, 2016; Complete irs tax forms online or print government tax documents. Get form for the latest information about developments related to form 941 and its. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. Do not mail this form if you file.

Second quarter, july 31, 2016; Ad access irs tax forms. Do not mail this form if you file. October, november, december instructions and prior year. Sign it in a few clicks. For optimal functionality, save the form to your computer before completing and utilize adobe reader.). Complete, edit or print tax forms instantly. Employer's return of income taxes withheld (note: Web use a 2016 form 941 2020 template to make your document workflow more streamlined. Get form for the latest information about developments related to form 941 and its.

Fillable Form 941 Employer's Quarterly Federal Tax Return 2016

Web form 941 for 2023: Get form for the latest information about developments related to form 941 and its. Web failure to timely file a form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late. Web fill out the { 941 2016.

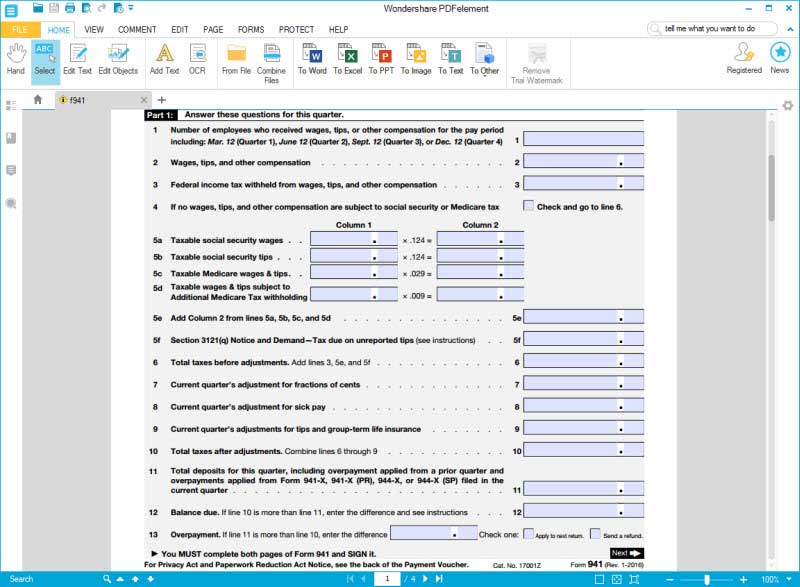

IRS Form 941 Find the Instructions Here to Fill it Right

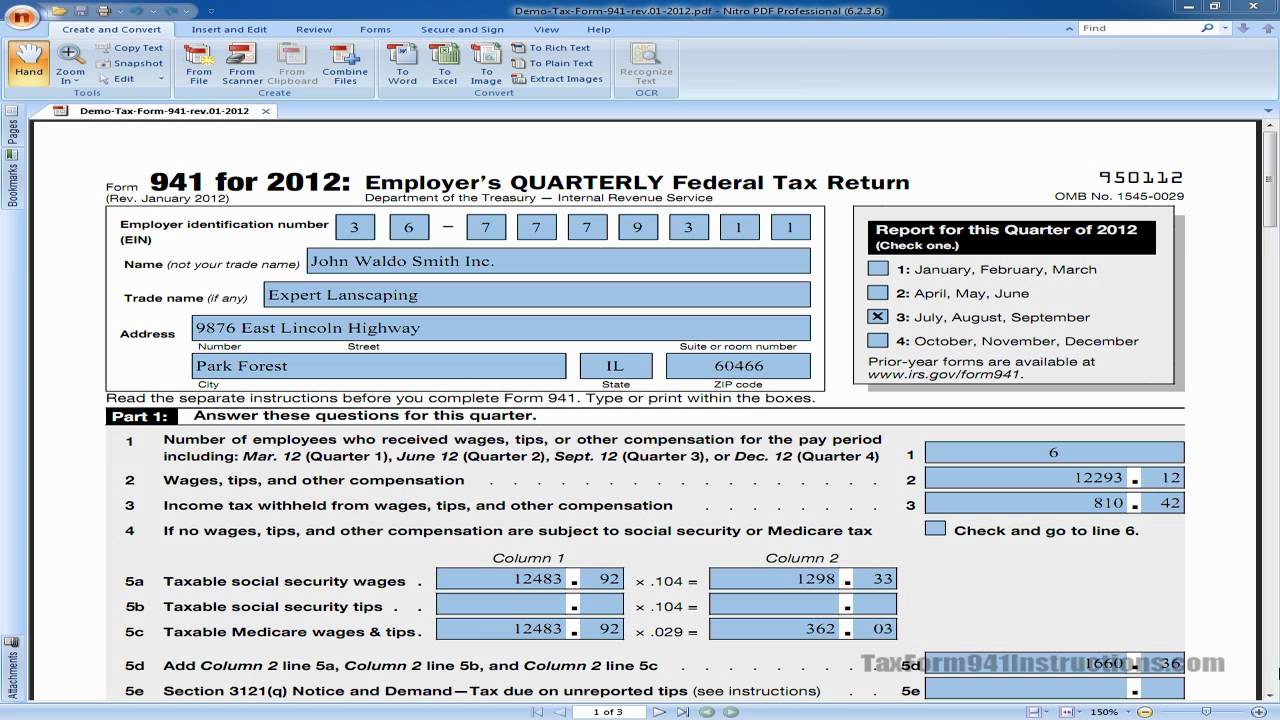

Web edit your 941 form 2016 online. Second quarter, july 31, 2016; Complete irs tax forms online or print government tax documents. Web failure to timely file a form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late. Web employer's quarterly federal.

IRS 941 Form 2022 Complete and Download PDF Template Online

Complete irs tax forms online or print government tax documents. October, november, december instructions and prior year. Type text, add images, blackout confidential details, add comments, highlights and more. Web fill out the { 941 2016 pdf} form for free? Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages.

How to Fill out Tax Form 941 Intro Video YouTube

For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. Keep it simple when filling out your { 941 2016 pdf} and use pdfsimpli, the simple solution to editing,. Web employer's quarterly federal tax return for 2021. Employer’s quarterly federal tax return. March 2023) employer’s quarterly federal tax return department of the treasury —.

IRS Form 941 Find the Instructions Here to Fill it Right

Web report for this quarter of 2016 (check one.) 1: Type or print within the boxes. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. And fourth quarter, january 31,. Get form for the latest information about developments related to form 941 and its.

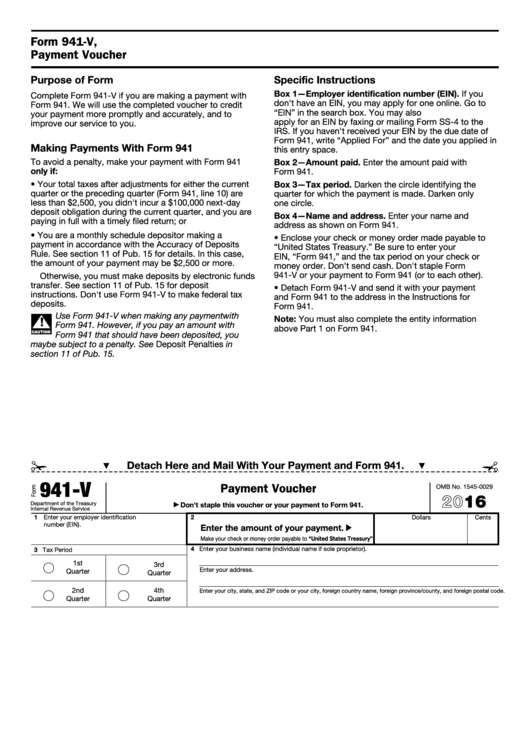

Fillable Form 941V Payment Voucher 2016 printable pdf download

Type or print within the boxes. Second quarter, july 31, 2016; Complete, edit or print tax forms instantly. Web failure to timely file a form 941 may result in a penalty of 5% of the tax due with that return for each month or part of a month the return is late. Draw your signature, type it,.

Form 941SS Employer's Quarterly Federal Tax Return (2015) Free Download

October, november, december instructions and prior year. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of. You must complete all three pages. Type or print within the boxes. Web report for this quarter of 2016 (check one.) 1:

form 941 updated 2 Southland Data Processing

You must complete all three pages. Second quarter, july 31, 2016; March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Web employer's quarterly federal tax return for 2021. Web report for this quarter of 2016 (check one.) 1:

IRS Form 941 Payroll Taxes errors late payroll taxes

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Third quarter, october 31, 2016; Type text, add images, blackout confidential details, add comments, highlights and more. Do not mail this form if you file. January 2016) department of the treasury — internal revenue service.

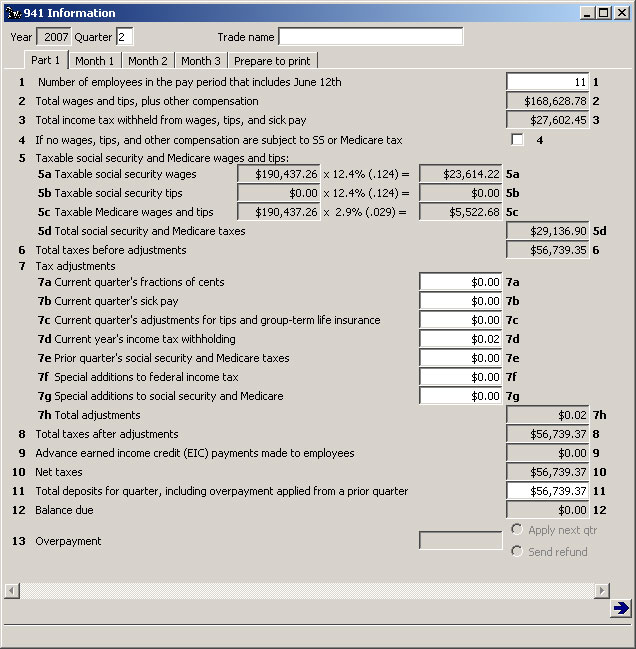

21st Century Accounting Print 941 Information

March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service 950122. Second quarter, july 31, 2016; Employer's return of income taxes withheld (note: Type text, add images, blackout confidential details, add comments, highlights and more. Do not mail this form if you file.

For Optimal Functionality, Save The Form To Your Computer Before Completing And Utilize Adobe Reader.).

Complete, edit or print tax forms instantly. Web employer's quarterly federal tax return for 2021. You must complete all three pages. October, november, december instructions and prior year.

Employer's Return Of Income Taxes Withheld (Note:

Web edit your 941 form 2016 online. Web the rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31,. And fourth quarter, january 31,. Type or print within the boxes.

March 2023) Employer’s Quarterly Federal Tax Return Department Of The Treasury — Internal Revenue Service 950122.

Web fill out the { 941 2016 pdf} form for free? Do not mail this form if you file. January 2016) department of the treasury — internal revenue service. Web use a 2016 form 941 2020 template to make your document workflow more streamlined.

Keep It Simple When Filling Out Your { 941 2016 Pdf} And Use Pdfsimpli, The Simple Solution To Editing,.

Web form 941 for 2023: Type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks. Draw your signature, type it,.