2020 California Form 568

2020 California Form 568 - Ca and unique secretary of state (sos) account number in the state use code section in the federal c, rent, f,. Web 3671203 form 568 2020 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. Llcs classified as a disregarded entity or. California form 568 i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50%. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022. Web 3671213 form 568 2021 side 1. The llc is organized in. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california.

Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. California form 568 i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50%. The amount entered on form 568, line 1, may not be a negative number. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. If you have income or loss inside and outside california, use apportionment and allocation of. Web enter the llc’s “total california income” as computed on line 17 of schedule iw. Web 3671213 form 568 2021 side 1. Web california form 568 for limited liability company return of income is a separate state formset. Web 3671203 form 568 2020 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership.

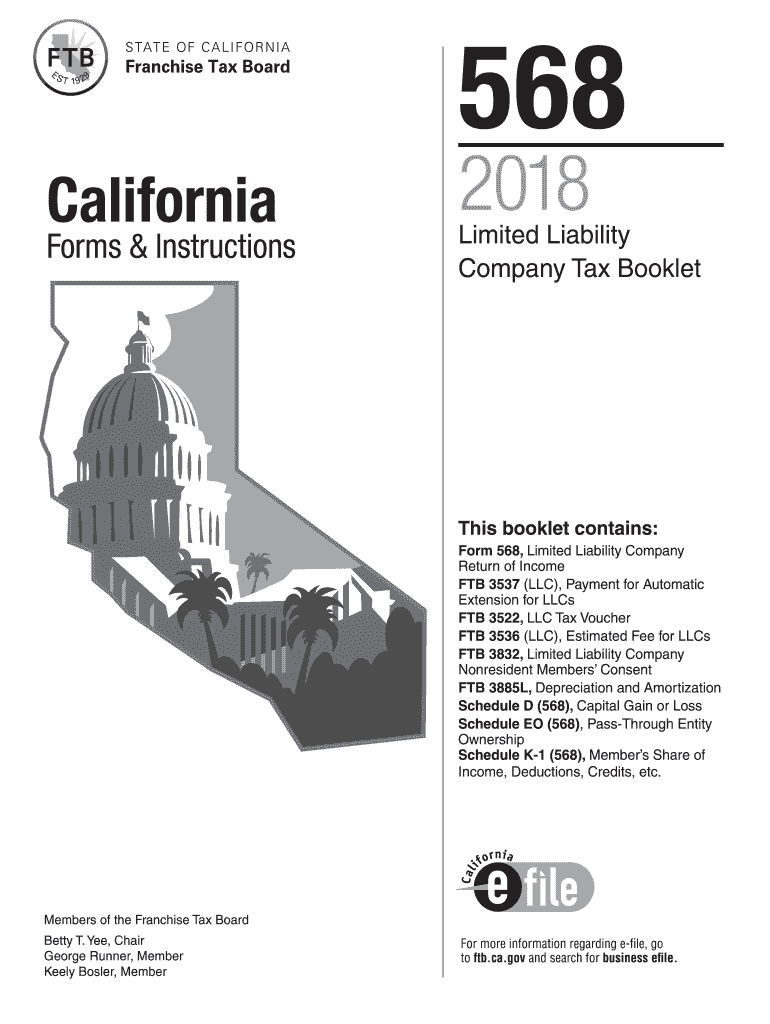

Web visit limited liability company tax booklet (568 booklet) for more information; Ca and unique secretary of state (sos) account number in the state use code section in the federal c, rent, f,. 540 form (pdf) | 540 booklet (instructions included) 540 2ez form (pdf) |. It isn't included with the regular ca state partnership formset. Llcs classified as a disregarded entity or. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web to complete california form 568 for a partnership, from the main menu of the california return, select: Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. Web you still have to file form 568 if the llc is registered in california. The llc is doing business in california.

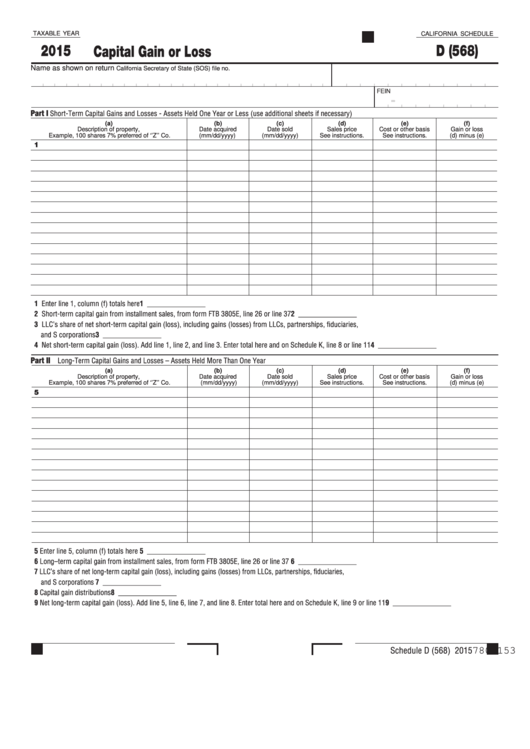

Fillable California Schedule D (568) Capital Gain Or Loss 2015

Web to create an llc unit, enter a state use code 3 form 568: If you have income or loss inside and outside california, use apportionment and allocation of. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. Web i.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Download blank or fill out online in pdf format. Web 3671203 form 568 2020 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. It isn't included with the regular ca state partnership formset. How to fill in california form 568 if you have an.

Regarding California LLC formed Nov 2020, Form 568, EIN, Tax year 2020

Web you still have to file form 568 if the llc is registered in california. Ca and unique secretary of state (sos) account number in the state use code section in the federal c, rent, f,. The amount entered on form 568, line 1, may not be a negative number. Web 3671203 form 568 2020 side 1 limited liability company.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Web visit limited liability company tax booklet (568 booklet) for more information; The llc is organized in. Web 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: Web enter the llc’s “total california income” as computed on line 17 of schedule iw. Web you still have to file form 568.

20182022 Form CA FTB 568BK Fill Online, Printable, Fillable, Blank

Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. Web you still have to file form 568 if the llc is registered in california. Web form 568 must be filed by every llc that is not taxable as a corporation if any.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Download blank or fill out online in pdf format. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. Web 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: Web you still have.

Download Instructions for Form 568 Schedule EO PassThrough Entity

If you have income or loss inside and outside california, use apportionment and allocation of. Web to complete california form 568 for a partnership, from the main menu of the california return, select: Web 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: Web form 568, limited liability company return.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

The llc is doing business in california. Web 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: Web 3671203 form 568 2020 side 1 limited liability company return of income i (1) during this taxable year, did another person or legal entity acquire control or majority ownership. Web form 568.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

Web you still have to file form 568 if the llc is registered in california. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. The amount entered on form 568, line 1, may not be a negative number. Web i (1)during this.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option..

Web You Still Have To File Form 568 If The Llc Is Registered In California.

Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web 3671213 form 568 2021 side 1. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Web we last updated the limited liability company return of income in february 2023, so this is the latest version of form 568, fully updated for tax year 2022.

The Llc Is Organized In.

Web enter the llc’s “total california income” as computed on line 17 of schedule iw. Web to create an llc unit, enter a state use code 3 form 568: Ca and unique secretary of state (sos) account number in the state use code section in the federal c, rent, f,. Web visit limited liability company tax booklet (568 booklet) for more information;

How To Fill In California Form 568 If You Have An Llc, Here’s How To Fill In The California Form 568:.

Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. Web form 568, limited liability company return of income • form 565, partnership return of income • form 100, california corporation franchise or income tax return, including. The llc is doing business in california. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option.

Web 3671203 Form 568 2020 Side 1 Limited Liability Company Return Of Income I (1) During This Taxable Year, Did Another Person Or Legal Entity Acquire Control Or Majority Ownership.

Download blank or fill out online in pdf format. The amount entered on form 568, line 1, may not be a negative number. California form 568 i (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50%. Complete, sign, print and send your tax documents easily with us legal forms.