2020 Form 5329

2020 Form 5329 - In the search box, type. If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution limit for the. Try it for free now! Ad register and subscribe now to work on your irs 5329 form & more fillable forms. Upload, modify or create forms. To fill out form 5329: Complete, edit or print tax forms instantly. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira.

If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution limit for the. In the search box, type. Upload, modify or create forms. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Complete, edit or print tax forms instantly. Ad register and subscribe now to work on your irs 5329 form & more fillable forms. Try it for free now! You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. To fill out form 5329:

You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Try it for free now! Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution limit for the. To fill out form 5329: In the search box, type. Ad register and subscribe now to work on your irs 5329 form & more fillable forms. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Upload, modify or create forms. Complete, edit or print tax forms instantly.

2011 Form 5329 Edit, Fill, Sign Online Handypdf

If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution limit for the. In the search box, type. Try it for free now! Open your return and click on search on the top of your screen. You must file form 5329 for 2020 and 2021 to pay the additional taxes.

IRS Approves New Option for Structured Settlements!

Try it for free now! Open your return and click on search on the top of your screen. Ad register and subscribe now to work on your irs 5329 form & more fillable forms. Upload, modify or create forms. Complete, edit or print tax forms instantly.

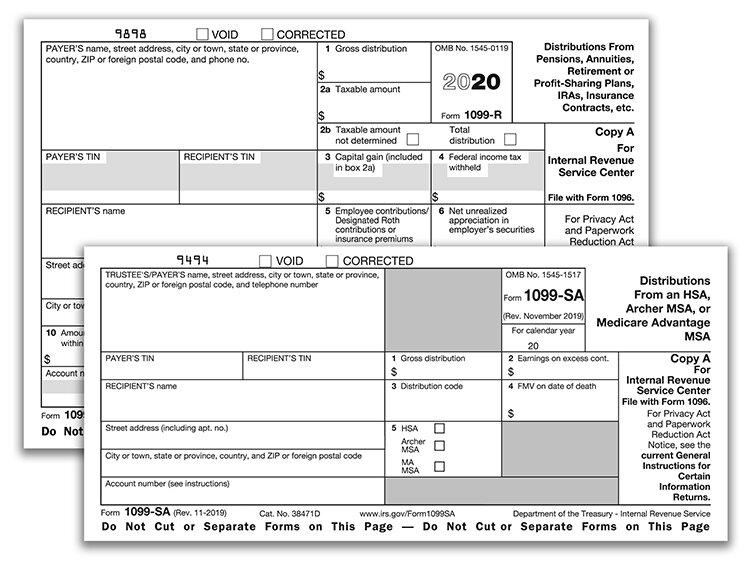

Reporting Distributions on Forms 1099R and 1099SA — Ascensus

If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution limit for the. In the search box, type. Upload, modify or create forms. Complete, edit or print tax forms instantly. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps,.

IRS 8843 2020 Fill out Tax Template Online US Legal Forms

Ad register and subscribe now to work on your irs 5329 form & more fillable forms. If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution limit for the. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Open your return and click on.

Form 5329 Additional Taxes on Qualified Plans Definition

Ad register and subscribe now to work on your irs 5329 form & more fillable forms. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution.

Fill Free fillable Form 5329 2019 Additional Taxes on Qualified Plans

Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Upload, modify or create forms. To fill out form 5329: Try it for free now! Complete, edit or print tax forms instantly.

irs form 5329 missed rmd 2019 2020 Fill Online, Printable, Fillable

If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution limit for the. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. To fill out form 5329: Upload, modify or create forms. In the search box, type.

Instructions For Form 5329 2016 printable pdf download

Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Try it for free now! If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution limit for the. Complete, edit or print tax forms instantly. Upload, modify or create forms.

Form 5329 Instructions & Exception Information for IRS Form 5329

In the search box, type. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. To fill out form 5329: You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Web on september 7, 2022, you withdrew $800, the.

Form 5329 Additional Taxes on Qualified Plans and Other TaxFavored

Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Try it for free now! To fill out form 5329: You must file form 5329 for 2020 and 2021 to pay.

In The Search Box, Type.

Open your return and click on search on the top of your screen. Web use form 5329 to report additional taxes on iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, or hsas. Ad register and subscribe now to work on your irs 5329 form & more fillable forms. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years.

To Fill Out Form 5329:

Try it for free now! Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. If the contributions made to your traditional ira, roth ira, coverdell esa, archer msa, or hsa exceed your maximum contribution limit for the. Complete, edit or print tax forms instantly.

:max_bytes(150000):strip_icc()/ScreenShot2021-12-15at3.19.44PM-291c5fe0726d489fb990ff40378b295f.png)