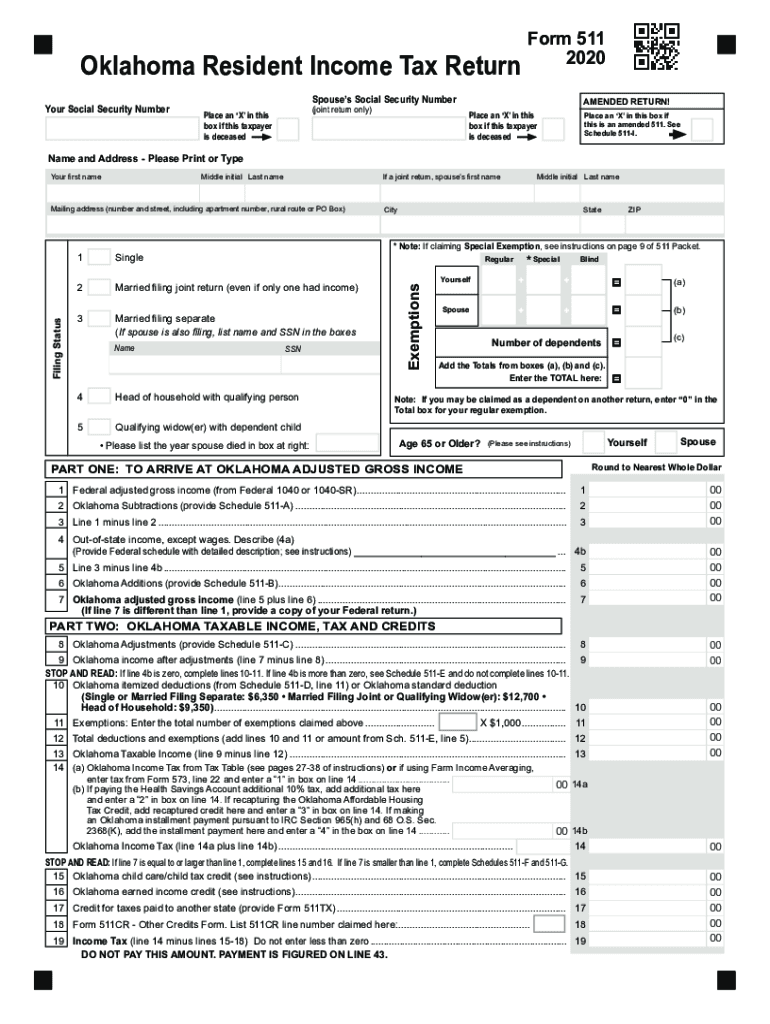

2020 Oklahoma Tax Form 511

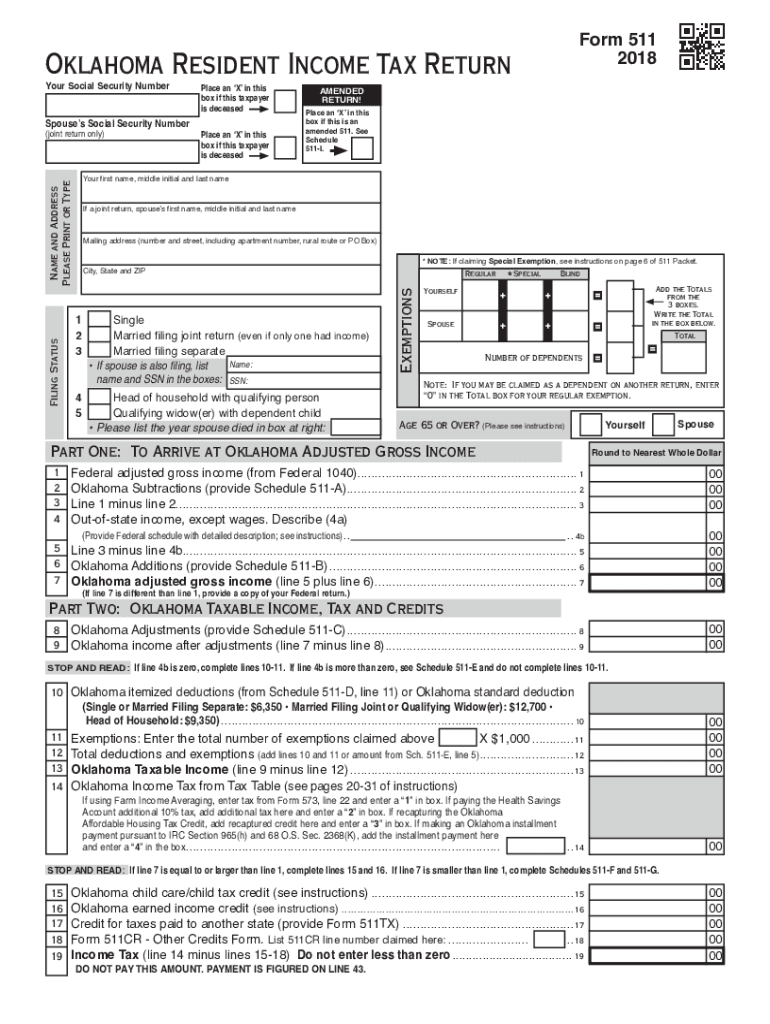

2020 Oklahoma Tax Form 511 - Web form 511nr 2020 your social security number spouse’s social security number (joint return only) name and address please print or typemailing address (number and street,. See instructions on page 2 to. Name(s) shown on form 511: If your taxable income is $100,000 or more,. If you are required to mail. Web income tax from tax table (see instructions). Web provide this form and supporting documents with your oklahoma tax return. Download or email ok form 511 & more fillable forms, register and subscribe now! • this form is also used to file an. Complete, edit or print tax forms instantly.

Download or email ok form 511 & more fillable forms, register and subscribe now! Name as shown on return: • generally, your return must be postmarked by april 15, 2022. Complete, edit or print tax forms instantly. For additional information, see the “due date” section on page 4. Web income tax from tax table (see instructions). Web instructions on requirement to mail or retain this form. Web provide this form and supporting documents with your oklahoma tax return. Web the 2020 511 packet instructions (oklahoma)form is 73 pageslong and contains: Download or email ok form 511 & more fillable forms, register and subscribe now!

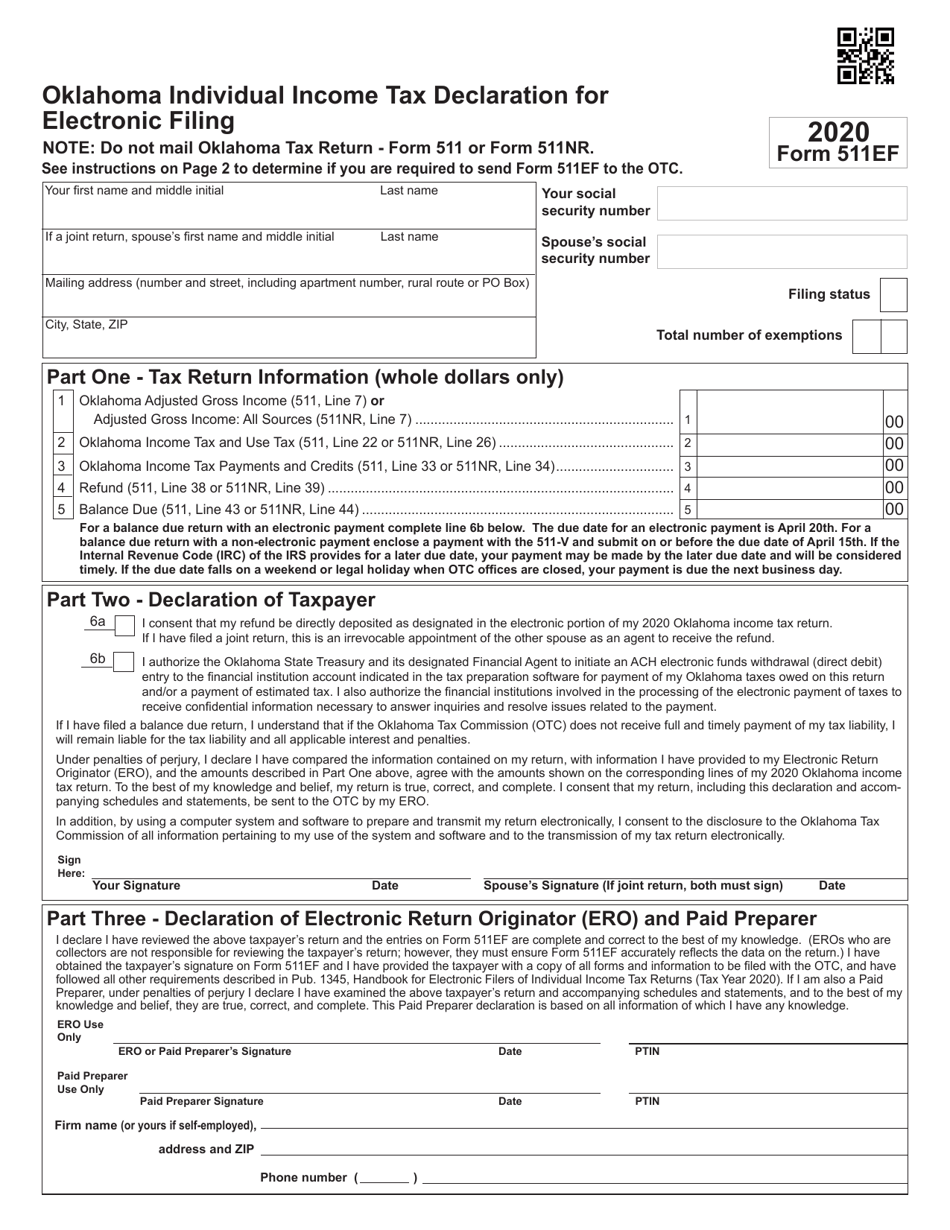

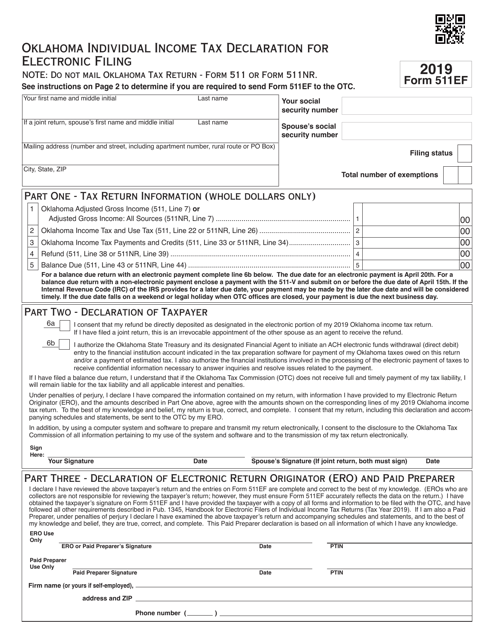

Web oklahoma individual income tax declaration for electronic filing. Web we last updated oklahoma form 511 in january 2023 from the oklahoma tax commission. Download or email ok form 511 & more fillable forms, register and subscribe now! Web provide this form and supporting documents with your oklahoma tax return. This form is for income earned in tax year 2022, with tax returns due in. Web due date generally, your oklahoma income tax is due april 15th. Oklahoma resident income tax return • form 511: Credit for taxes paid to another state (enclose 511tx) c. Web state zip or postal code country single married filing joint return (even if only one had income) 3 married filing separate (if spouse is also filing, list name and ssn in the. • instructions for completing the form 511:

2020 Form OK 511 & 538S Fill Online, Printable, Fillable, Blank

Web form 511nr 2020 your social security number spouse’s social security number (joint return only) name and address please print or typemailing address (number and street,. Web due date generally, your oklahoma income tax is due april 15th. Name(s) shown on form 511: If you electronically file your return and pay electronically, your due date is extended until april. Name.

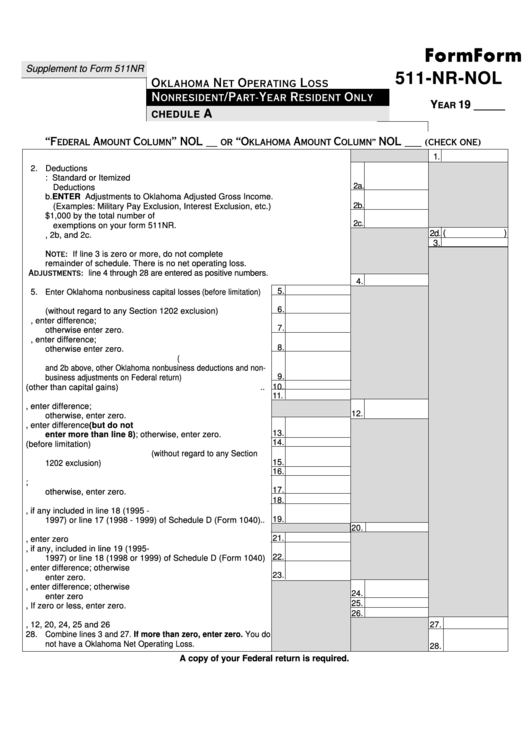

Form 511NrNol N.o.l. Schedule A Oklahoma Net Operating Loss

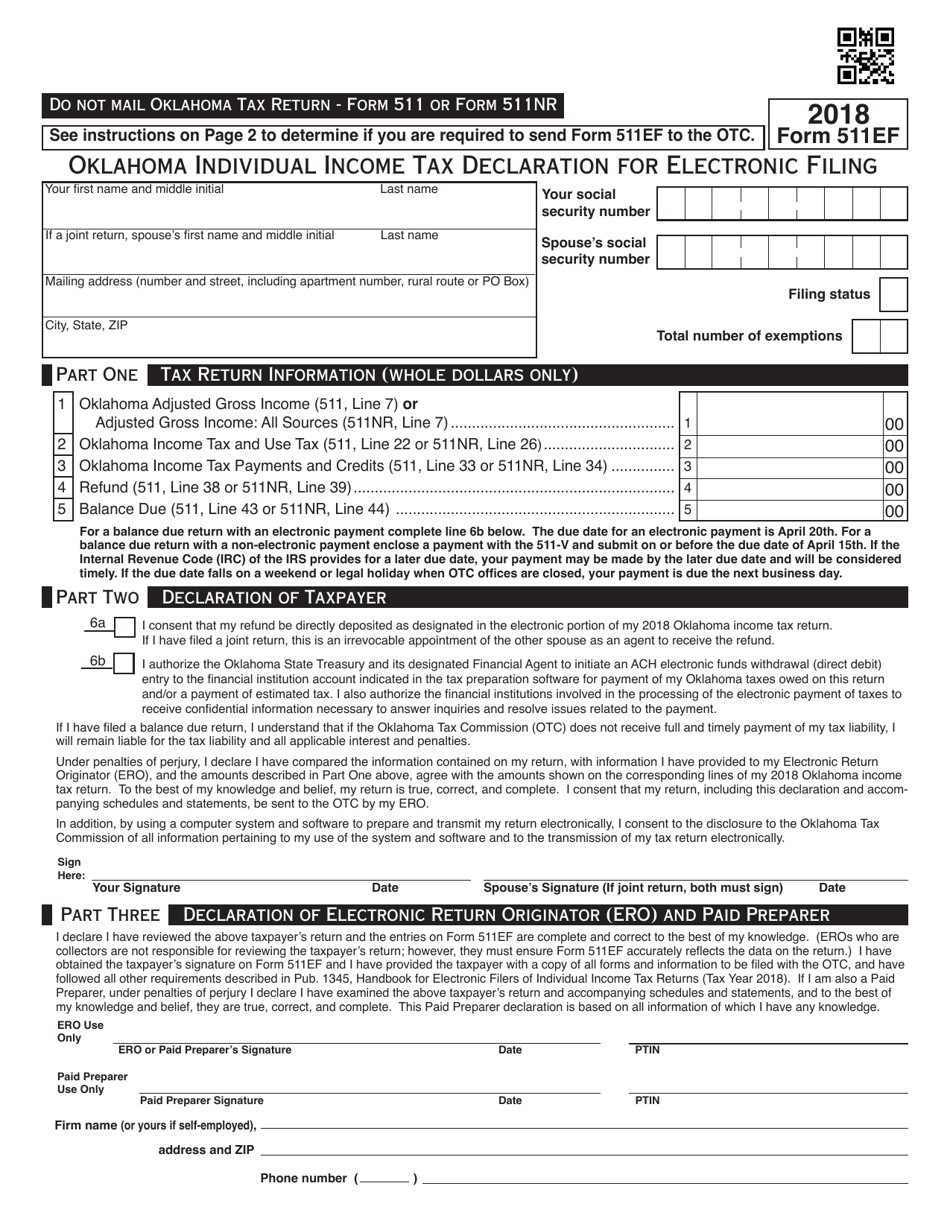

Download or email ok form 511 & more fillable forms, register and subscribe now! Name(s) shown on form 511: Download or email ok form 511 & more fillable forms, register and subscribe now! Web oklahoma individual income tax declaration for electronic filing. • instructions for completing the form 511:

2019 Form OK 511NR Packet Fill Online, Printable, Fillable, Blank

Web the 2020 511 packet instructions (oklahoma)form is 73 pageslong and contains: Web instructions on requirement to mail or retain this form. Name(s) shown on form 511: For additional information, see the “due date” section on page 4. If you are required to mail.

OTC Form 511EF Download Fillable PDF or Fill Online Oklahoma Individual

Use this table if your taxable income is less than $100,000. • this form is also used to file an. Sales tax relief credit •. • instructions for completing the form 511: Web provide this form and supporting documents with your oklahoma tax return.

Form 511EF Download Fillable PDF or Fill Online Individual Tax

Web due date generally, your oklahoma income tax is due april 15th. Download or email ok form 511 & more fillable forms, register and subscribe now! Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. This form is for income earned in tax year 2022, with tax returns.

2019 Form OK 511 & 538S Fill Online, Printable, Fillable, Blank

Form 511 can be efiled, or a paper copy can be filed via mail. • instructions for completing the form 511: Web income tax from tax table (see instructions). Sign, mail form 511 or 511nr to. Credit for taxes paid to another state (enclose 511tx) c.

Form 511NR (NonResident/PartYear Resident) OklahomaOklahoma Tax

Download or email ok form 511 & more fillable forms, register and subscribe now! Web form 511 is the general income tax return for oklahoma residents. Complete, edit or print tax forms instantly. See instructions on page 2 to. • generally, your return must be postmarked by april 15, 2022.

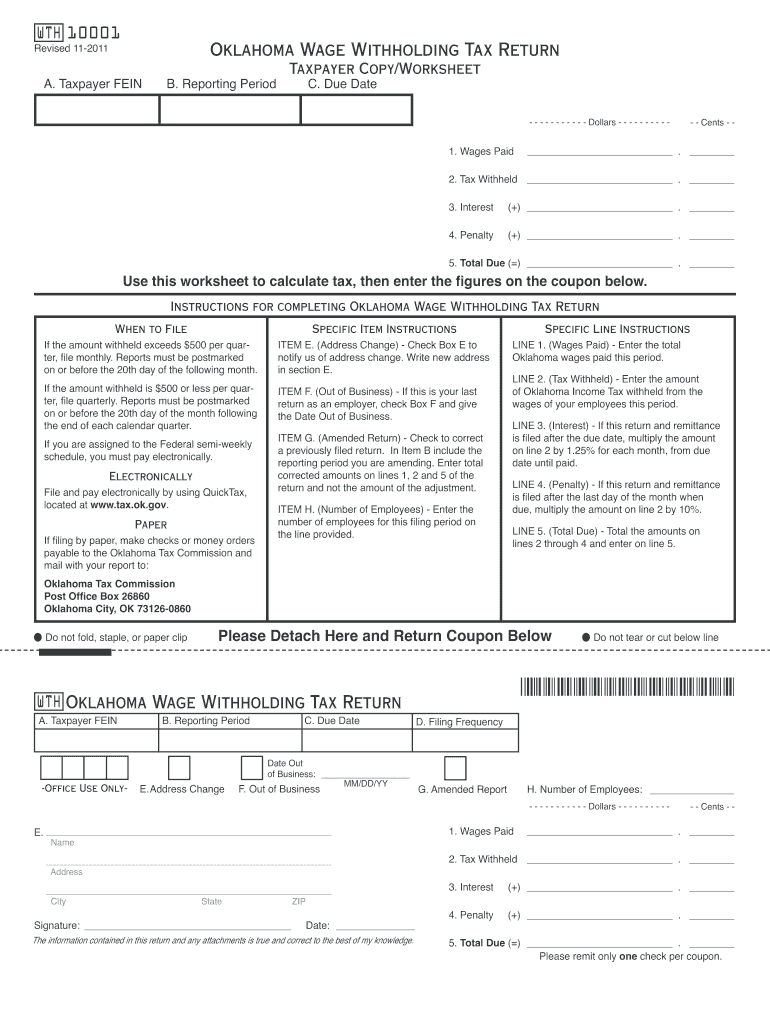

Oklahoma Withholding Tax Fill Out and Sign Printable PDF Template

Sign, mail form 511 or 511nr to. For additional information, see the “due date” section on page 4. • generally, your return must be postmarked by april 15, 2022. Web the oklahoma tax commission is not required to give actual notice to taxpayers of changes in any state tax law. • instructions for completing the form 511:

Oklahoma State Tax Form 511 for Fill Out and Sign Printable PDF

• generally, your return must be postmarked by april 15, 2022. If your taxable income is $100,000 or more,. For additional information, see the “due date” section on page 4. Complete, edit or print tax forms instantly. If you are required to mail.

Form 511EF Download Fillable PDF or Fill Online Oklahoma Individual

If you are required to mail. Web instructions on requirement to mail or retain this form. Name as shown on return: Form 511 can be efiled, or a paper copy can be filed via mail. Use this table if your taxable income is less than $100,000.

Web Form 511Nr 2020 Your Social Security Number Spouse’s Social Security Number (Joint Return Only) Name And Address Please Print Or Typemailing Address (Number And Street,.

Web form 511 is the general income tax return for oklahoma residents. Name(s) shown on form 511: Download or email ok form 511 & more fillable forms, register and subscribe now! Credit for taxes paid to another state (enclose 511tx) c.

Complete, Edit Or Print Tax Forms Instantly.

Web state zip or postal code country single married filing joint return (even if only one had income) 3 married filing separate (if spouse is also filing, list name and ssn in the. For additional information, see the “due date” section on page 4. Web provide this form and supporting documents with your oklahoma tax return. Web due date generally, your oklahoma income tax is due april 15th.

Oklahoma Resident Income Tax Return • Form 511:

Web instructions on requirement to mail or retain this form. Sales tax relief credit •. Name as shown on return: Web oklahoma individual income tax declaration for electronic filing.

Web The Oklahoma Tax Commission Is Not Required To Give Actual Notice To Taxpayers Of Changes In Any State Tax Law.

Download or email ok form 511 & more fillable forms, register and subscribe now! Web income tax from tax table (see instructions). Sign, mail form 511 or 511nr to. • generally, your return must be postmarked by april 15, 2022.