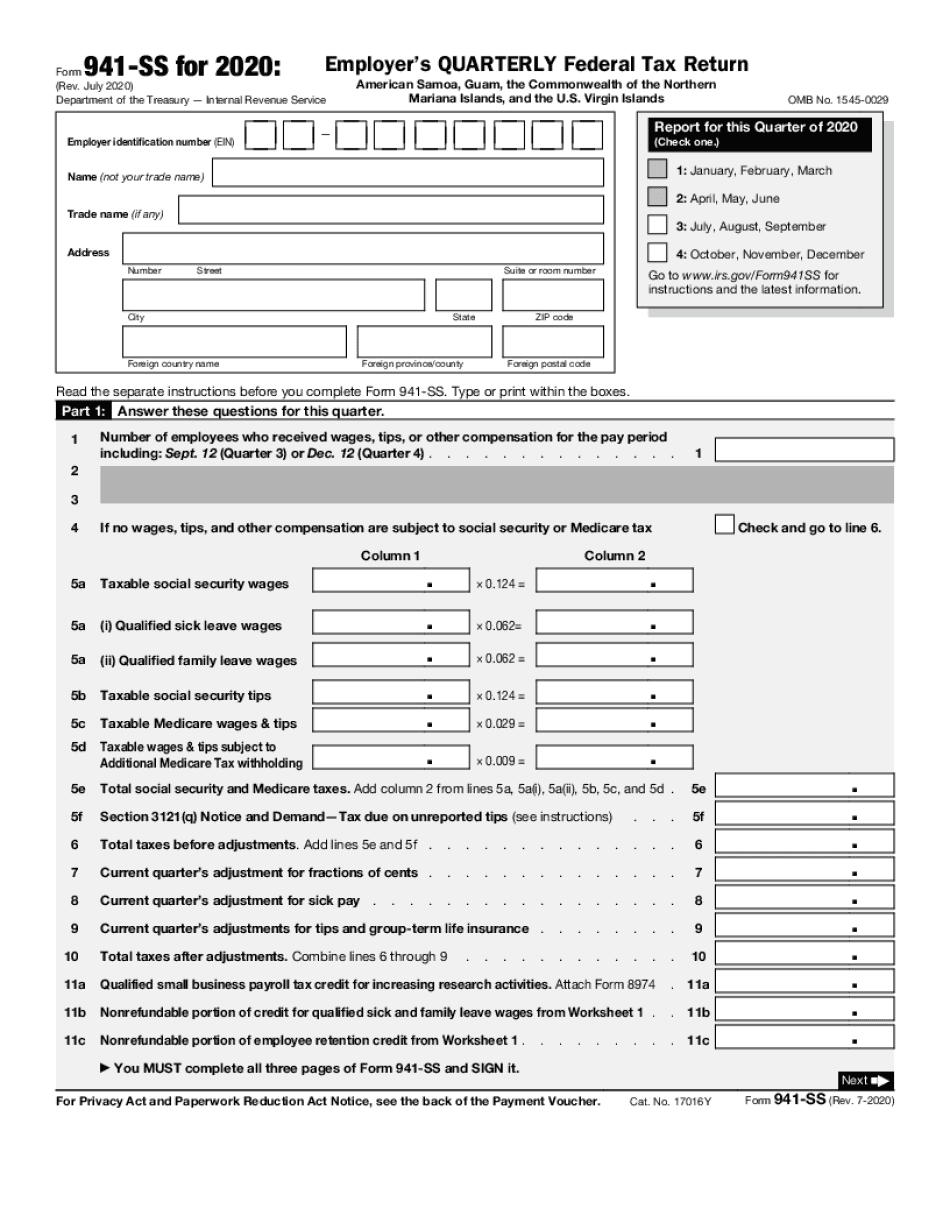

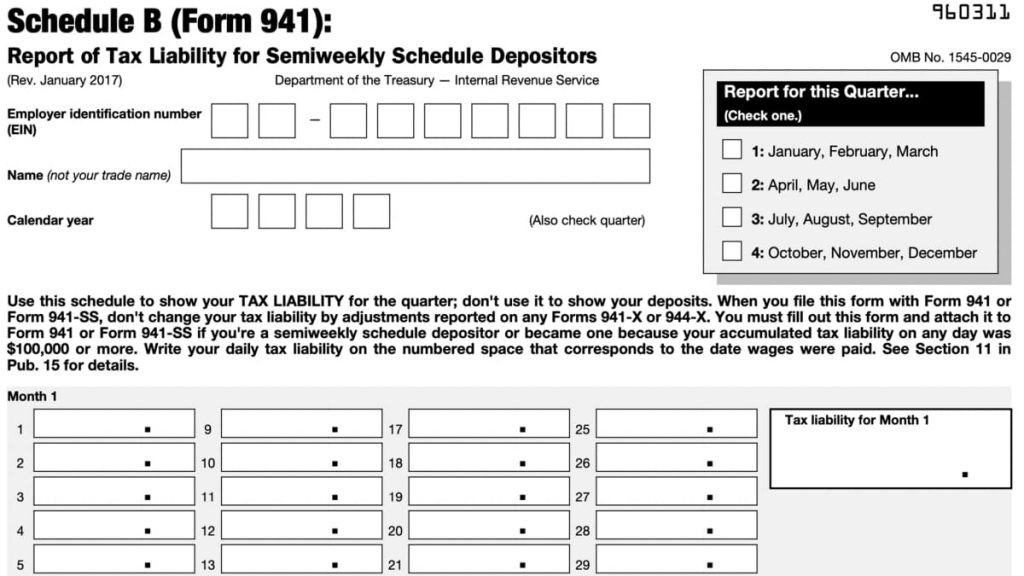

2022 Federal 941 Form Schedule B

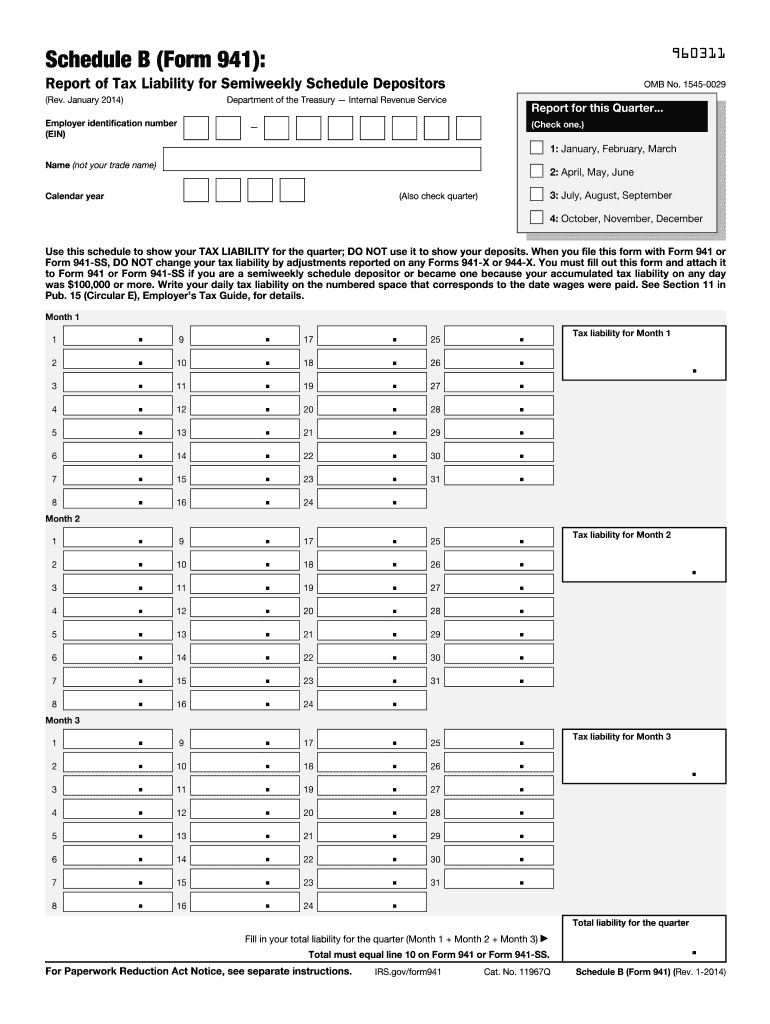

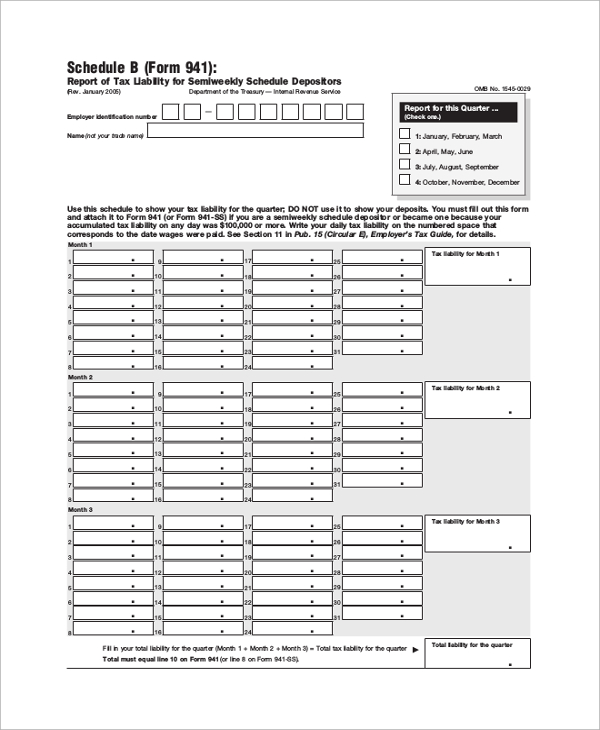

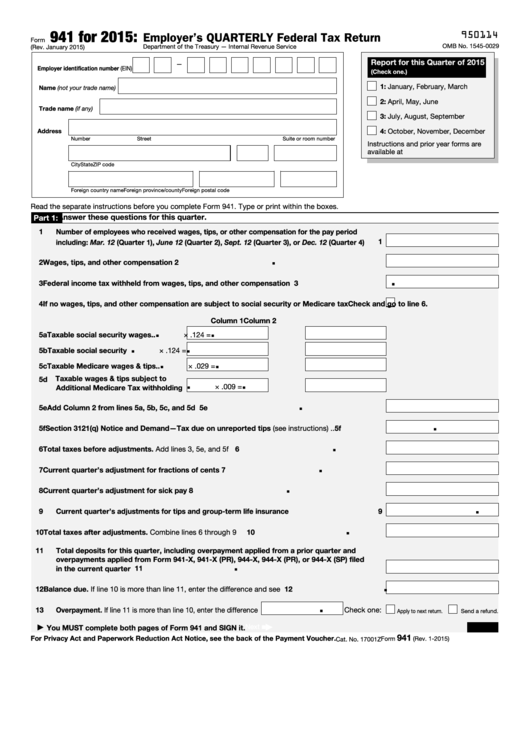

2022 Federal 941 Form Schedule B - Web schedule b is filed with form 941. This form must be completed by a semiweekly schedule depositor who. Web 2022 attachment sequence no. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Web schedule b is filed with form 941. You are a semiweekly depositor if you: In some situations, schedule b may be filed. Web form 941 schedule b is the irs tax form used by the semiweekly schedule depositor to report tax liability, including federal income taxes and fica. Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. Web file schedule b (form 941) if you are a semiweekly schedule depositor.

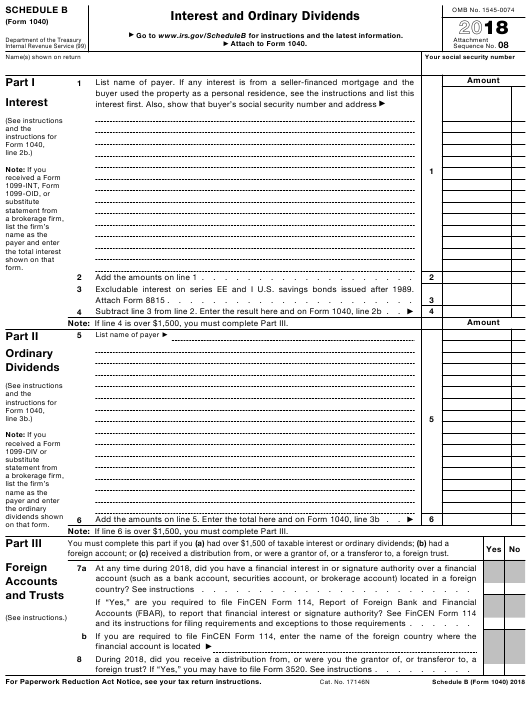

If you're a semiweekly schedule depositor and you don’t properly. In some situations, schedule b may be filed with. You can download or print. Web we last updated federal 941 (schedule b) in january 2023 from the federal internal revenue service. Web in recent years several changes to the 941 form has made is difficult to understand. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. In some situations, schedule b may be filed. This form is for income earned in tax year 2022, with tax returns due. If line 6 is over $1,500, you must complete part iii. Web schedule b is filed with form 941.

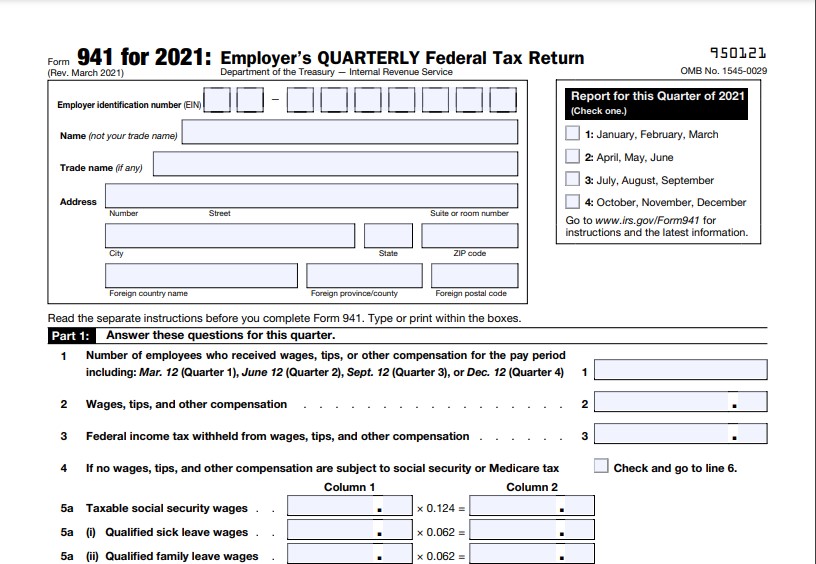

October, november, december go to www.irs.gov/form941 for instructions and the latest. Web irs releases 2022 form 941, instructions for form and schedules b and r duration 60 mins level basic & intermediate & advanced webinar id iqw22a0139 what you'll. This form must be completed by a semiweekly schedule depositor who. Web file schedule b (form 941) if you are a semiweekly schedule depositor. The employer is required to withhold federal income tax and. In some situations, schedule b may be filed. 08 your social security number on that form. Fill in your total liability for the quarter (month 1 + month 2 + month 3) total liability for the quarter. You can download or print. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes.

Irs Fillable Form 1040 il1040es 2019 Fill Online, Printable

Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web irs releases 2022 form 941, instructions for form and schedules b and r duration 60 mins.

Form 941 Printable & Fillable Per Diem Rates 2021

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. If you're a semiweekly schedule depositor and you don’t properly. This form must be completed by a semiweekly schedule depositor who..

2014 Form IRS 941 Schedule B Fill Online, Printable, Fillable, Blank

In some situations, schedule b may be filed. Web file schedule b (form 941) if you are a semiweekly schedule depositor. You must complete all three. Web 2022 attachment sequence no. Web we last updated federal 941 (schedule b) in january 2023 from the federal internal revenue service.

FREE 8+ Sample Schedule Forms in PDF

Web form 941 schedule b is the irs tax form used by the semiweekly schedule depositor to report tax liability, including federal income taxes and fica. Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. If you're a semiweekly schedule depositor and you don’t properly. Web.

schedule b form 941 2020 Fill Online, Printable, Fillable Blank

If you're a semiweekly schedule depositor and you don’t properly. This form must be completed by a semiweekly schedule depositor who. Web schedule b is filed with form 941. Web we last updated the report of tax liability for semiweekly schedule depositors in january 2023, so this is the latest version of 941 (schedule b), fully updated for tax year.

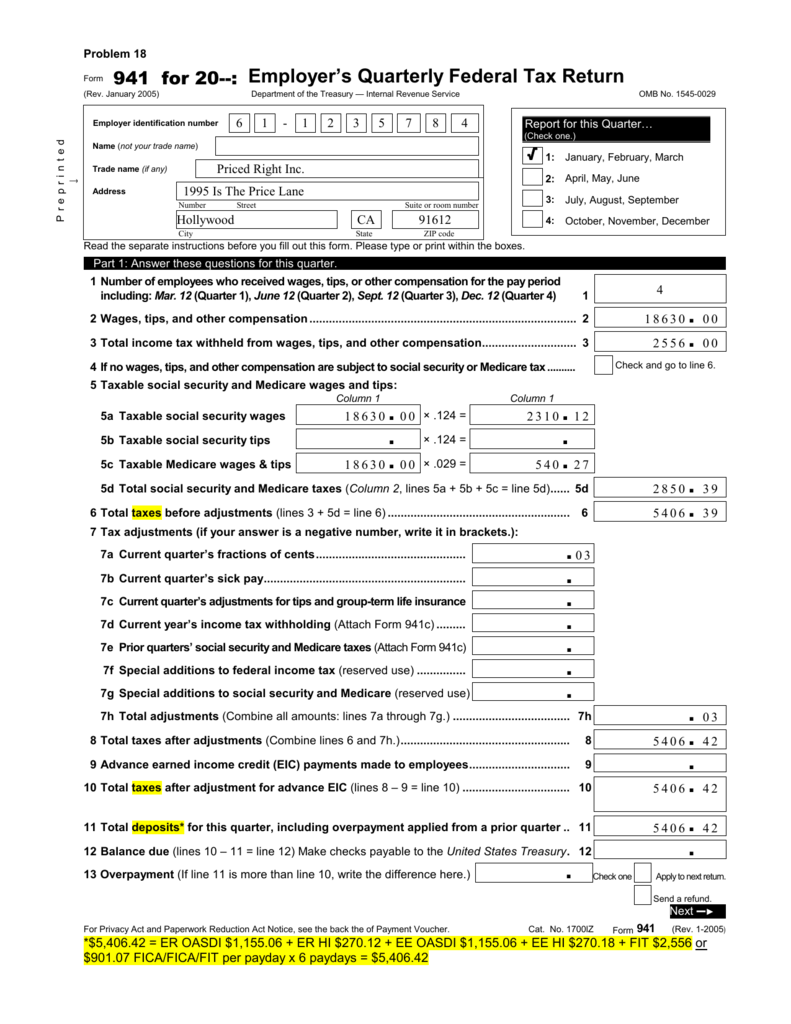

Federal 14 Form 14 Federal 14 Form Tips You Need To Learn Now AH

The employer is required to withhold federal income tax and. Web schedule b is filed with form 941. Web a schedule b form 941 is used by the internal revenue service for tax filing and reporting purposes. If line 6 is over $1,500, you must complete part iii. Part iii you must complete this part if you had.

Printable 941 Tax Form Printable Form 2021

You are a semiweekly depositor if you: If line 6 is over $1,500, you must complete part iii. Therefore, the due date of schedule b is the same as the due date for the applicable form 941. Fill in your total liability for the quarter (month 1 + month 2 + month 3) total liability for the quarter. 08 your.

IRS Fillable Form 941 2023

Web we last updated the report of tax liability for semiweekly schedule depositors in january 2023, so this is the latest version of 941 (schedule b), fully updated for tax year 2022. If line 6 is over $1,500, you must complete part iii. Web schedule b is filed with form 941. Web a schedule b form 941 is used by.

Form 941 (Schedule R) Allocation Schedule for Aggregate Form 941

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. October, november, december go to www.irs.gov/form941 for instructions and the latest. If you reported more than $50,000, you’re a. Web in recent years several changes to the 941 form has made is difficult to understand. Web irs releases 2022 form.

2019 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

You must complete all three. The importance of reconciliation and completed of not only the form 941 but. Fill in your total liability for the quarter (month 1 + month 2 + month 3) total liability for the quarter. Web 2022 attachment sequence no. 08 your social security number on that form.

Web Complete Schedule B (Form 941), Report Of Tax Liability For Semiweekly Schedule Depositors, And Attach It To Form 941.

October, november, december go to www.irs.gov/form941 for instructions and the latest. Web schedule b is filed with form 941. The employer is required to withhold federal income tax and. In some situations, schedule b may be filed with.

The Importance Of Reconciliation And Completed Of Not Only The Form 941 But.

You are a semiweekly depositor if you: Web the irs form 941 schedule b for 2023 is used by semiweekly schedule depositors that report more than $50,000 in employment taxes. Web form 941 schedule b is the irs tax form used by the semiweekly schedule depositor to report tax liability, including federal income taxes and fica. Part iii you must complete this part if you had.

Web In Recent Years Several Changes To The 941 Form Has Made Is Difficult To Understand.

In some situations, schedule b may be filed. Web file schedule b (form 941) if you are a semiweekly schedule depositor. If you reported more than $50,000, you’re a. Web the irs uses schedule b to determine if you’ve deposited your federal employment tax liabilities on time.

Web We Last Updated The Report Of Tax Liability For Semiweekly Schedule Depositors In January 2023, So This Is The Latest Version Of 941 (Schedule B), Fully Updated For Tax Year 2022.

You must complete all three. Reported more than $50,000 of employment taxes in. You can download or print. Web schedule b is filed with form 941.