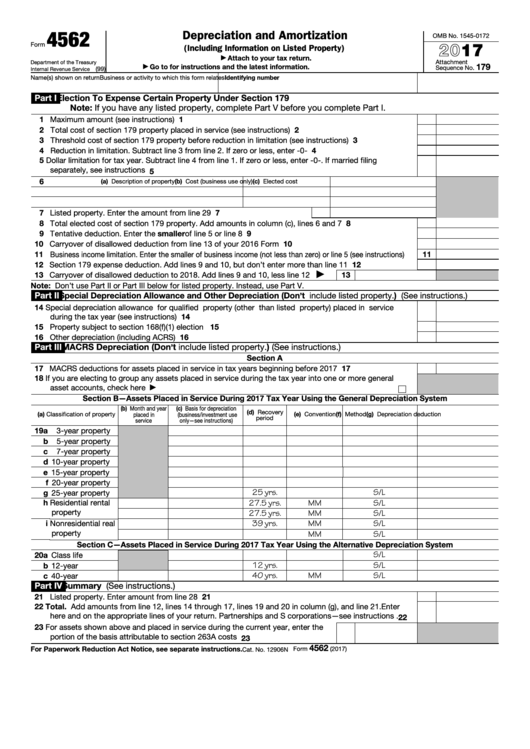

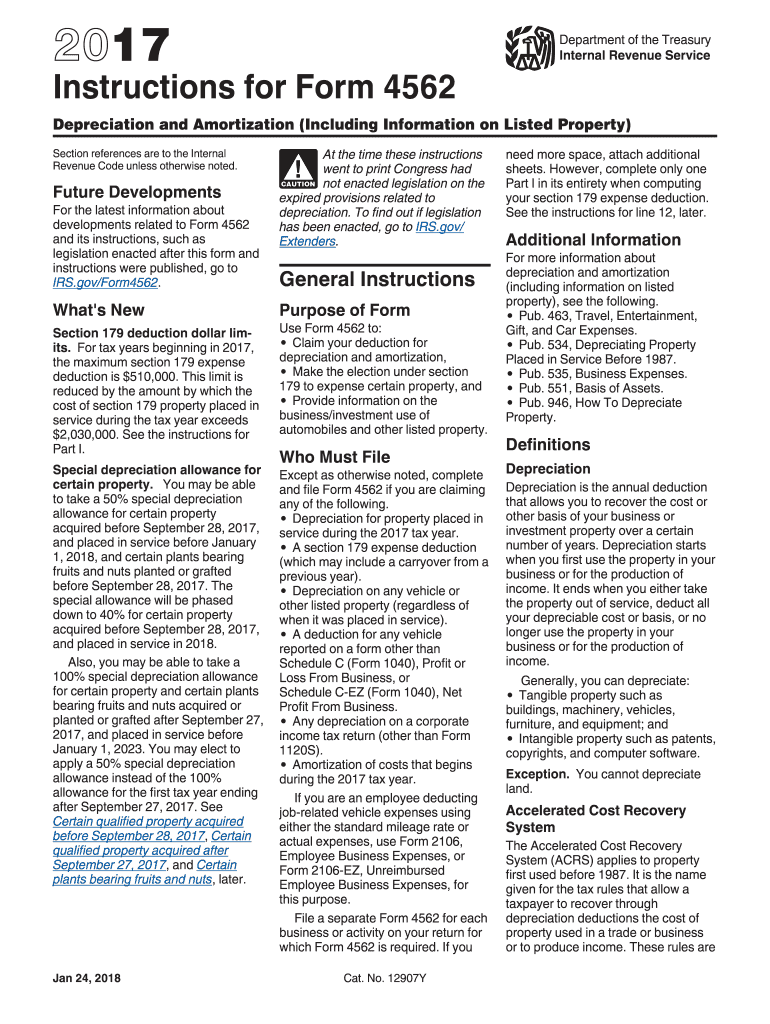

2022 Form 4562 Instructions

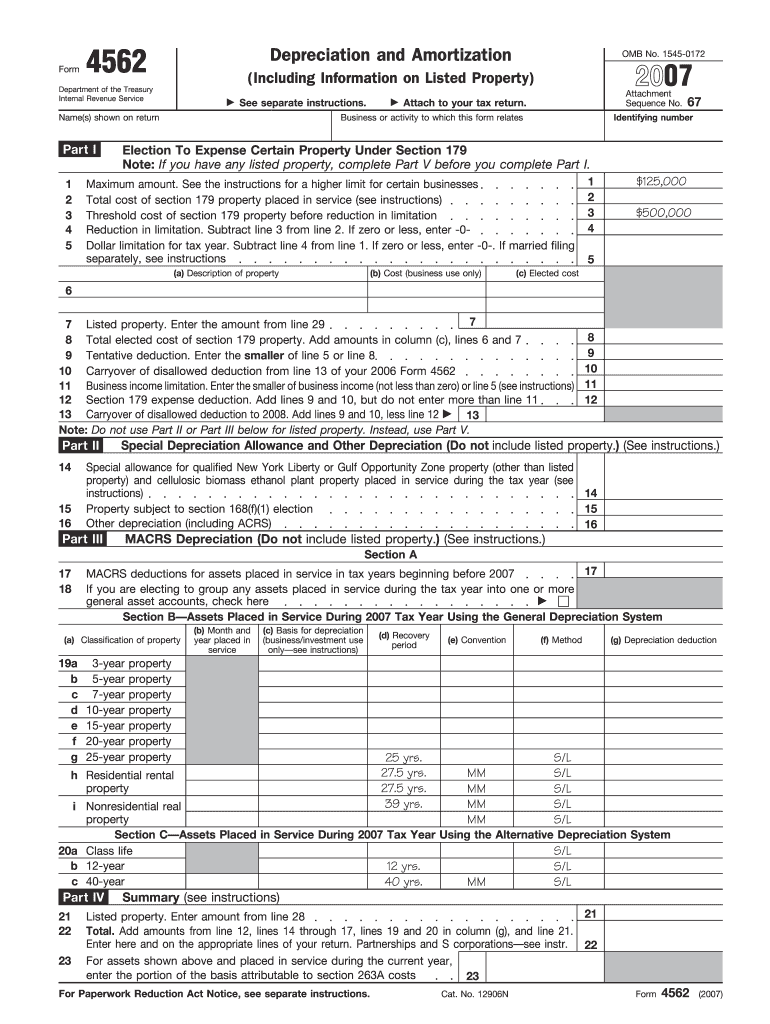

2022 Form 4562 Instructions - Page last reviewed or updated: Web generally, the irs places an annual limit on the amount of purchases eligible for this accelerated deduction. Save or instantly send your ready documents. Irs form 4562 is used to calculate and claim deductions for depreciation and. 946) for 2022 can be carried over to 2023. Web department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. To complete form 4562, you'll need to know the cost of assets like. Complete and sign it in seconds from your desktop or mobile device,. Web federal 4562 instructions 2022 form; We last updated the depreciation and amortization in february 2023, so this is the latest version of form.

Web federal 4562 instructions 2022 form; Web we last updated federal form 4562 in december 2022 from the federal internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Web where do i enter form 4562? Page last reviewed or updated: Easily fill out pdf blank, edit, and sign them. Web forms, instructions and publications search. Ad fill, sign, email irs 4562 & more fillable forms, register and subscribe now! Thus, the amount of any. Complete and sign it in seconds from your desktop or mobile device,.

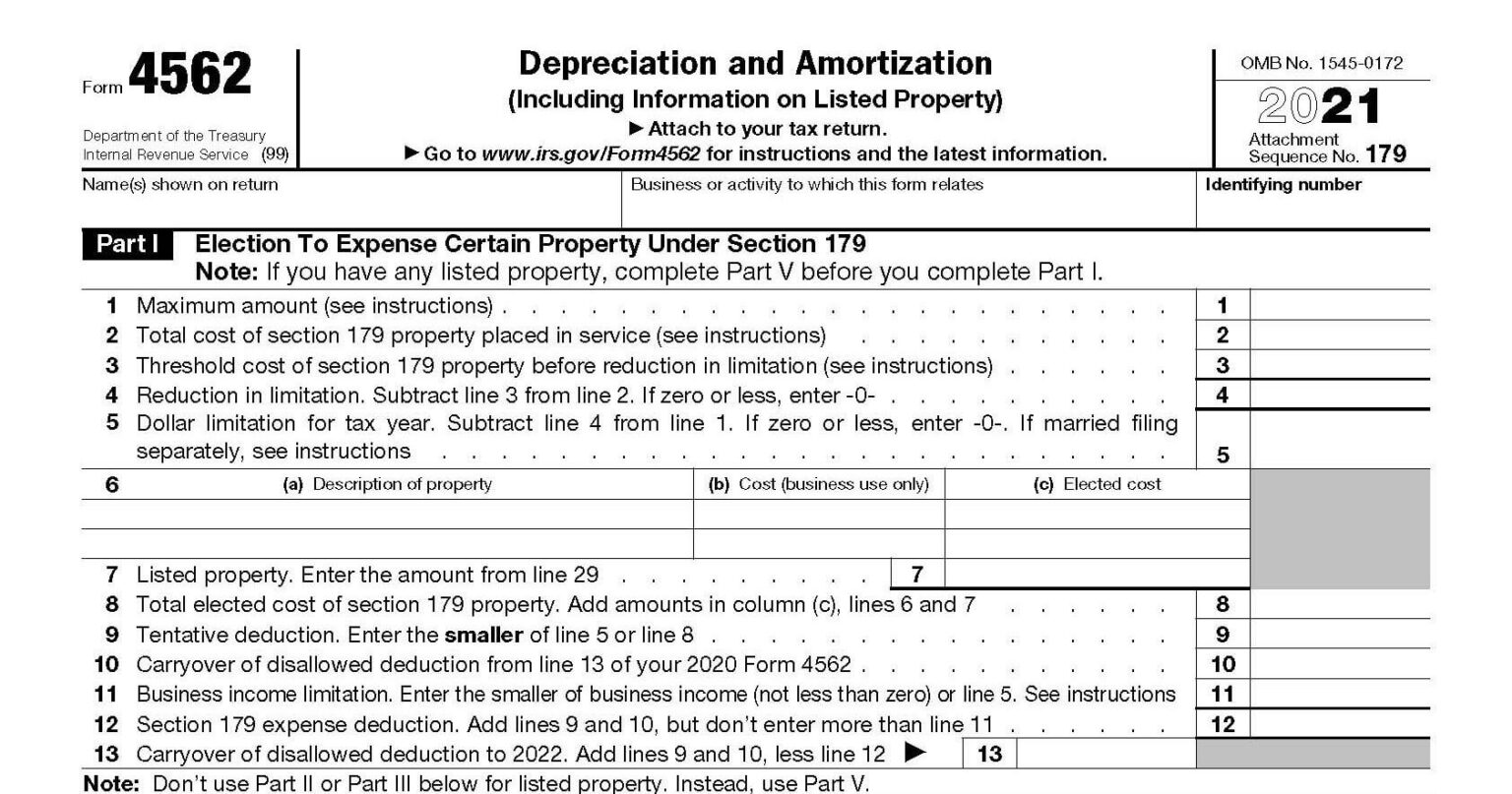

2022 4562 depreciation amortization including. Web we last updated federal form 4562 in december 2022 from the federal internal revenue service. Web 4562 depreciation & amortization. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. To complete form 4562, you'll need to know the cost of assets like. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Georgia depreciation and amortization form, includes information on listed property. Web instructions for form 4562 2022 georgi a department of revenue instructions for form 4562 (rev. Web on form 4562 turbotax has populated line 1 with $1,080,000 when the irs instructions for 2022 say it should be the smaller of total cost of 179 property and the. Solved•by turbotax•1623•updated january 13, 2023.

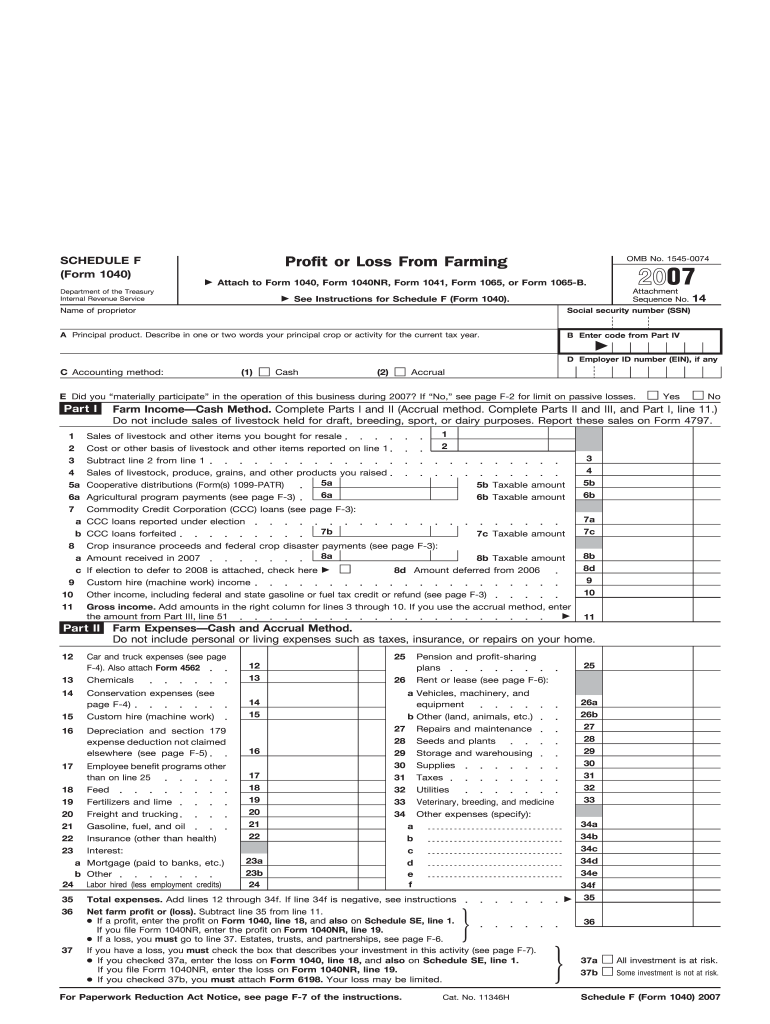

Form 1040 Schedule F Fill in Capable Profit or Loss from Farming Fill

Georgia depreciation and amortization form, includes information on listed property. Web department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web forms, instructions and publications search. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of.

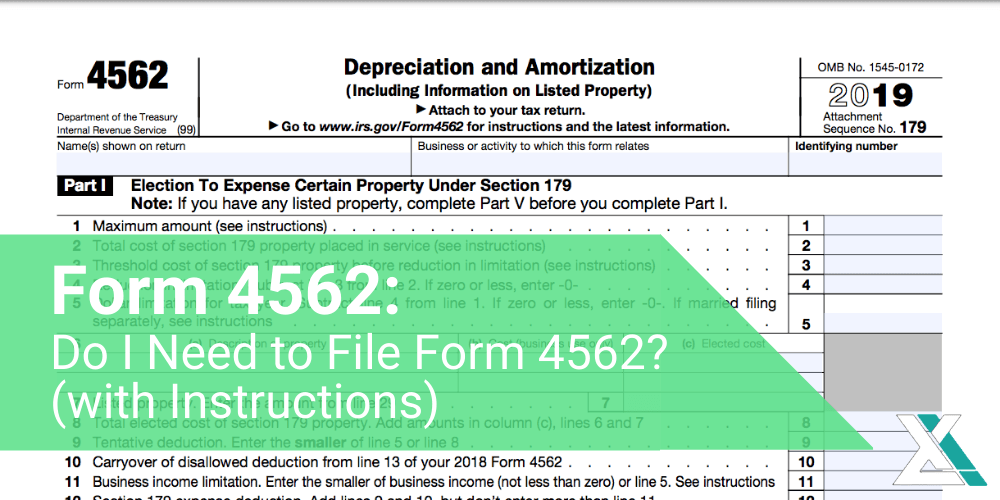

How to Complete IRS Form 4562

946) for 2022 can be carried over to 2023. Form 4562 is used to. Get ready for tax season deadlines by completing any required tax forms today. 2022 4562 depreciation amortization including. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets.

4562 Form 2022 2023

Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Irs form 4562 is used to calculate and claim deductions for depreciation and. Federal 4562 instructions 2023 form: Web instructions for form 4562 2022 georgi a department of revenue instructions for form 4562 (rev. We last updated the depreciation and amortization.

Form 4562 Do I Need to File Form 4562? (with Instructions)

For example, in 2022 you can elect to deduct up to. 2022 4562 depreciation amortization including. Web more about the georgia form 4562 individual income tax ty 2022. Web forms, instructions and publications search. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully.

Form 4562, Depreciation and Amortization IRS.gov Fill out & sign

Web generally, the irs places an annual limit on the amount of purchases eligible for this accelerated deduction. Web instructions for form 4562 2022 georgi a department of revenue instructions for form 4562 (rev. 05/26/22) georgia depreciation and amortization (i ncludinginformationon. Web on form 4562 turbotax has populated line 1 with $1,080,000 when the irs instructions for 2022 say it.

Fillable Form 4562 Depreciation And Amortization 2017 printable pdf

Web 4562 depreciation & amortization. Federal 4562 instructions 2023 form: 05/26/22) georgia depreciation and amortization (i ncludinginformationon. Web department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. This form is for income earned in tax year 2022, with tax returns due in april.

Irs Form 4562 Instructions Universal Network

Get ready for tax season deadlines by completing any required tax forms today. 05/26/22) georgia depreciation and amortization (i ncludinginformationon. Form 4562 is used to. Web limit in chapter 2 of pub. Web generally, the irs places an annual limit on the amount of purchases eligible for this accelerated deduction.

Irs Form 4562 Instructions Universal Network

Web generally, the irs places an annual limit on the amount of purchases eligible for this accelerated deduction. Web we last updated federal form 4562 in december 2022 from the federal internal revenue service. Get ready for tax season deadlines by completing any required tax forms today. Online solutions help you to manage your record administration along with. 946) for.

Irs.gov Form W 9 Instructions Universal Network

Irs form 4562 is used to calculate and claim deductions for depreciation and. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web more about the georgia form 4562 individual income tax ty 2022. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file..

2017 Instructions 4562 Fill Out and Sign Printable PDF Template signNow

To complete form 4562, you'll need to know the cost of assets like. For example, in 2022 you can elect to deduct up to. Thus, the amount of any. This form is for income earned in tax year 2022, with tax returns due in april. Save or instantly send your ready documents.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web forms, instructions and publications search. Form 4562 is used to. To complete form 4562, you'll need to know the cost of assets like.

Web On Form 4562 Turbotax Has Populated Line 1 With $1,080,000 When The Irs Instructions For 2022 Say It Should Be The Smaller Of Total Cost Of 179 Property And The.

Web where do i enter form 4562? Ad fill, sign, email irs 4562 & more fillable forms, register and subscribe now! Complete and sign it in seconds from your desktop or mobile device,. Save or instantly send your ready documents.

Web We Last Updated Federal Form 4562 In December 2022 From The Federal Internal Revenue Service.

Thus, the amount of any. Web 4562 depreciation & amortization. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for. Web generally, the irs places an annual limit on the amount of purchases eligible for this accelerated deduction.

Web Federal 4562 Instructions 2022 Form;

946) for 2022 can be carried over to 2023. Easily fill out pdf blank, edit, and sign them. Web more about the georgia form 4562 individual income tax ty 2022. 2022 4562 depreciation amortization including.