2023 Ca Form 3522

2023 Ca Form 3522 - Finding a authorized specialist, creating a scheduled visit and coming to the workplace for a personal conference makes finishing a ca ftb. Web complete ca ftb 3522 2023 online with us legal forms. Show sources > form 3522 is a california corporate income tax form. Easily fill out pdf blank, edit, and sign them. 16, 2023, to file and pay taxes. Said another way, there’s no. An llc should use this. Web use a form 3522 2023 template to make your document workflow more streamlined. Web no, since your california llc doesn’t need to pay the $800 franchise tax for its 1st year, you don’t need to file form 3522. Form 3522 will need to be filed in the 2nd.

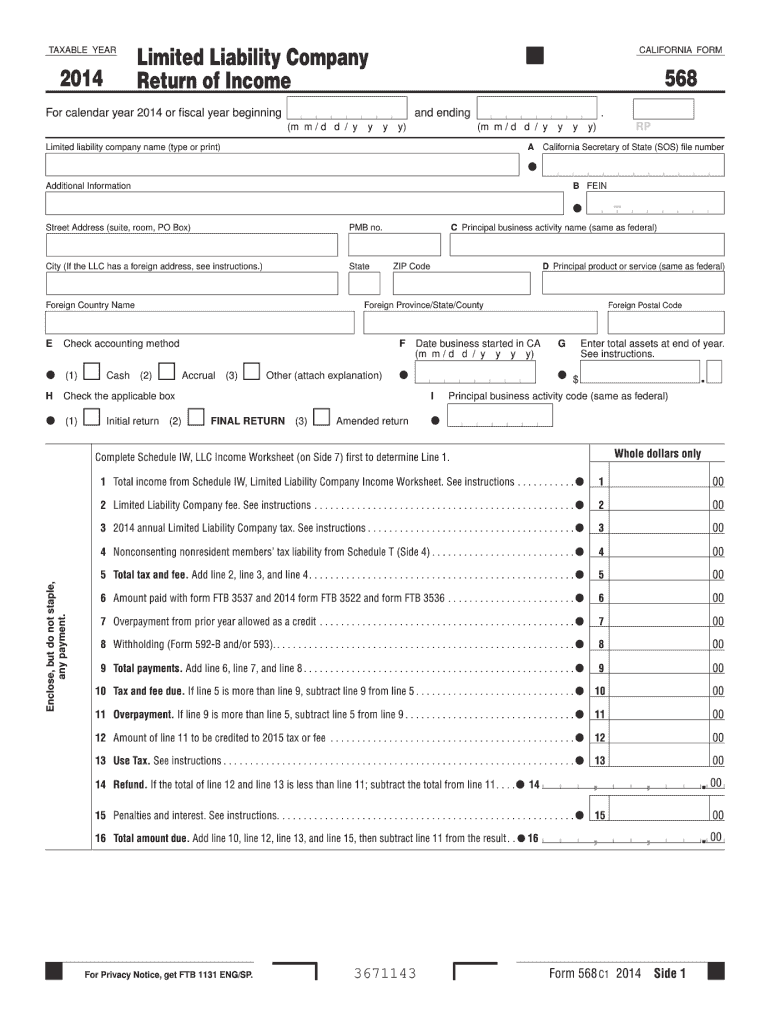

Finding a authorized specialist, creating a scheduled visit and coming to the workplace for a personal conference makes finishing a ca ftb. Web california form 3522 extensions extensions when it comes to filing form 3522 vary depending on the type of business, according to the franchise tax board. Use this screen to complete 2022 form 568, limited liability company return of income, side 1; Who must pay the annual tax? Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. Web we last updated california form 3522 in january 2023 from the california franchise tax board. Easily fill out pdf blank, edit, and sign them. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. Get your online template and fill it in using. Web all llcs in california must file form 3522 and pay the $800 annual franchise tax every year, regardless of revenue or activity.

Use this screen to complete 2022 form 568, limited liability company return of income, side 1; Easily fill out pdf blank, edit, and sign them. Web how do i enter the amount paid with california forms 3522 and. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. Web california llcs must file form 3522 (llc tax voucher) to pay the california franchise tax the california llc tax due date the due date for the california tax is. Web we last updated california form 3522 from the franchise tax board in january 2023. Show details we are not affiliated with any brand or entity on this form. Web we last updated california form 3522 in january 2023 from the california franchise tax board. The form 3522 which automatically prepares with llc return form 568 works in the software similarly to a type of estimated payment toward the next. View our emergency tax relief page.

CA FTB 568 2014 Fill out Tax Template Online US Legal Forms

Web use a form 3522 2023 template to make your document workflow more streamlined. Form 3522 will need to be filed in the 2nd. Save or instantly send your ready documents. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. Web how do i prepare.

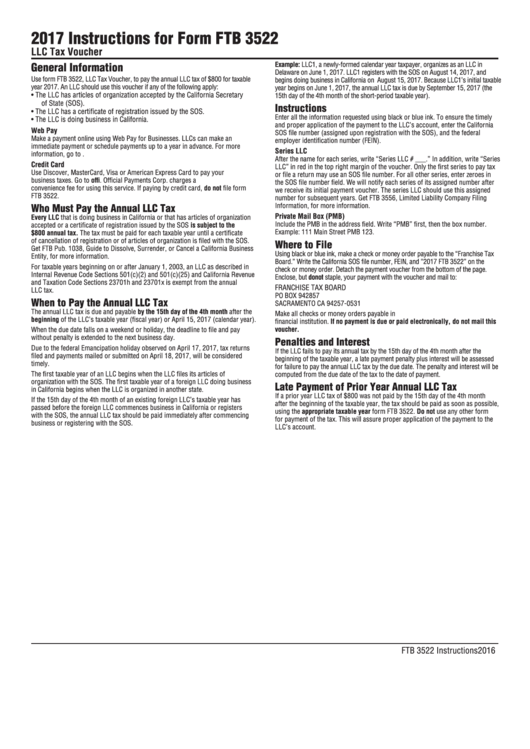

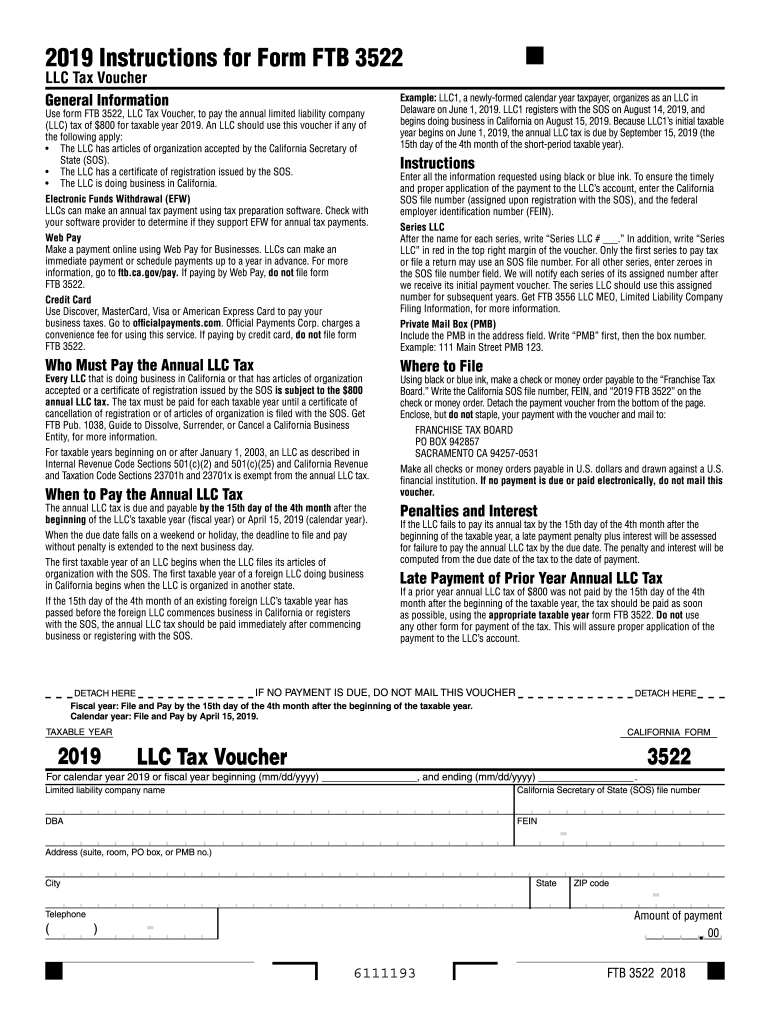

2017 Instructions For Form Ftb 3522 Llc Tax Voucher printable pdf

Save or instantly send your ready documents. Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th. Web no, since your california llc doesn’t need to pay the $800 franchise tax for its 1st year, you don’t.

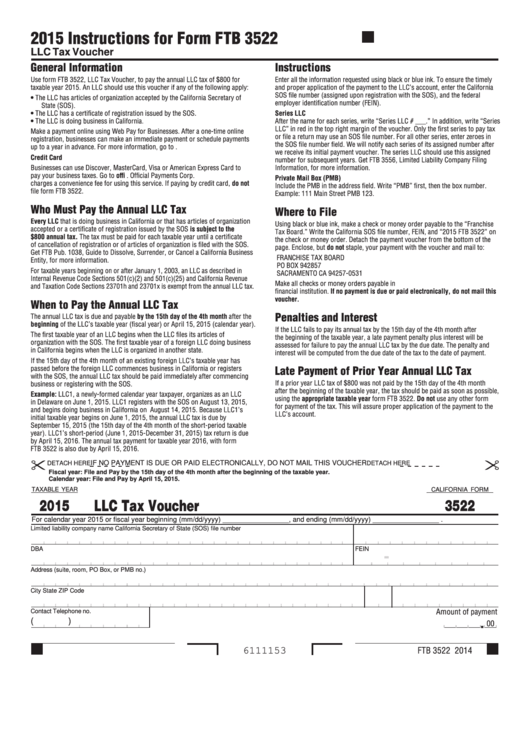

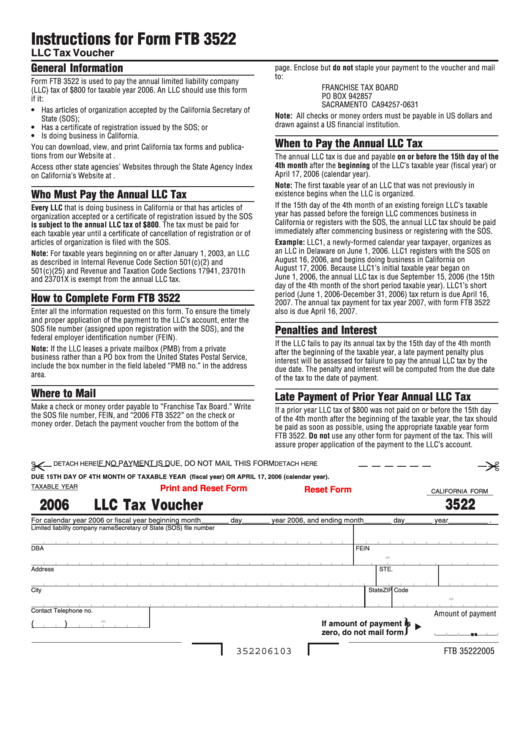

California Form 3522 Llc Tax Voucher 2015 printable pdf download

Web how do i enter the amount paid with california forms 3522 and. How it works open the. Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2021. Save or instantly send your ready documents. Show sources > form 3522 is a california corporate income.

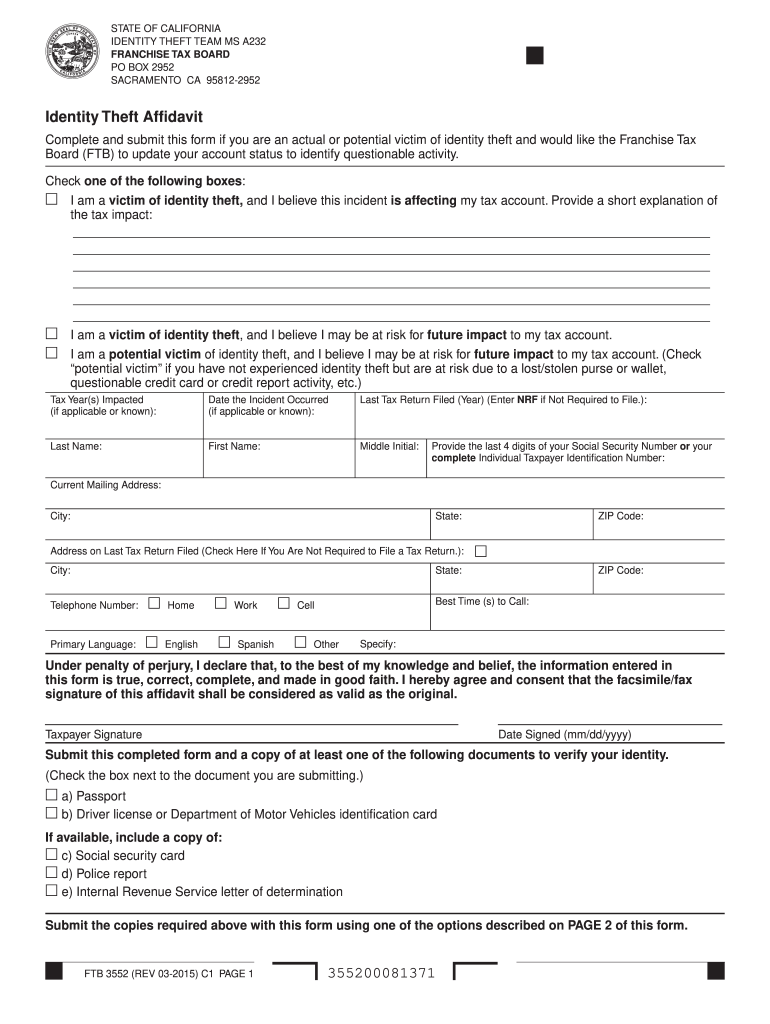

2015 Form CA FTB 3552 PC Fill Online, Printable, Fillable, Blank

16, 2023, to file and pay taxes. Objective provide the steps and variables. Use this screen to complete 2022 form 568, limited liability company return of income, side 1; Web general information use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2021. Web we last updated california form.

CA FTB 540 20202022 Fill out Tax Template Online US Legal Forms

This form is for income earned in tax year 2022, with tax returns due in april. Said another way, there’s no. Web we last updated california form 3522 in january 2023 from the california franchise tax board. Web use a form 3522 2023 template to make your document workflow more streamlined. Web california form 3522 extensions extensions when it comes.

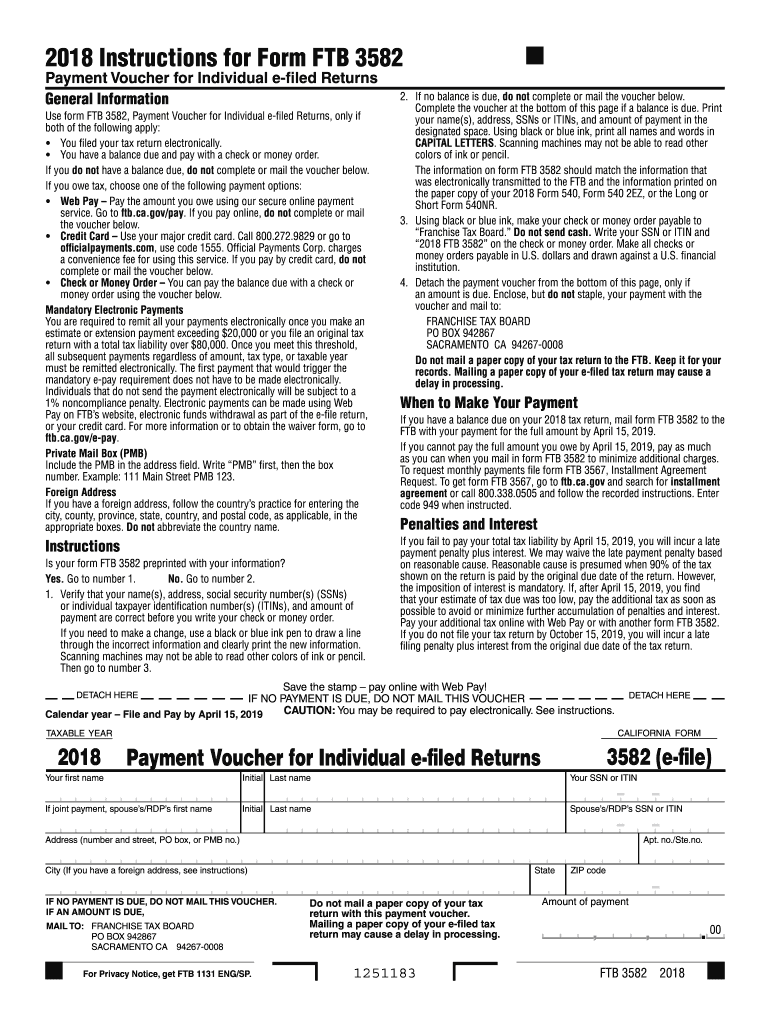

Form 3582 Fill Out and Sign Printable PDF Template signNow

Web we last updated california form 3522 from the franchise tax board in january 2023. Web how do i enter the amount paid with california forms 3522 and. Web the california franchise tax board (ftb) june 1 issued the 2023 instructions for ftb 3522, llc tax voucher, for individual income tax purposes. Show sources > form 3522 is a california.

California Form 3522 ≡ Fill Out Printable PDF Forms Online

This form is for income earned in tax year 2022, with tax returns due in april. View our emergency tax relief page. Web how do i enter the amount paid with california forms 3522 and. An llc should use this. Use this screen to complete 2022 form 568, limited liability company return of income, side 1;

Ftb 3522 Fill Out and Sign Printable PDF Template signNow

2022 form 3536 (llc extension payment); Form 3522 will need to be filed in the 2nd. An llc should use this. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800.6 min read 1. Easily fill out pdf blank, edit, and sign them.

Fillable Form 3522 Llc Tax Voucher California Franchise Tax Board

Show sources > form 3522 is a california corporate income tax form. An llc should use this. Web use a form 3522 2023 template to make your document workflow more streamlined. Web we last updated california form 3522 in january 2023 from the california franchise tax board. Web how do i prepare california form 3522 (prior year) with a 1065.

2017 Form 3522 Llc Tax Voucher Edit, Fill, Sign Online Handypdf

Web use a form 3522 2023 template to make your document workflow more streamlined. Who must pay the annual tax? Web california form 3522 extensions extensions when it comes to filing form 3522 vary depending on the type of business, according to the franchise tax board. Web complete ca ftb 3522 2023 online with us legal forms. Web we last.

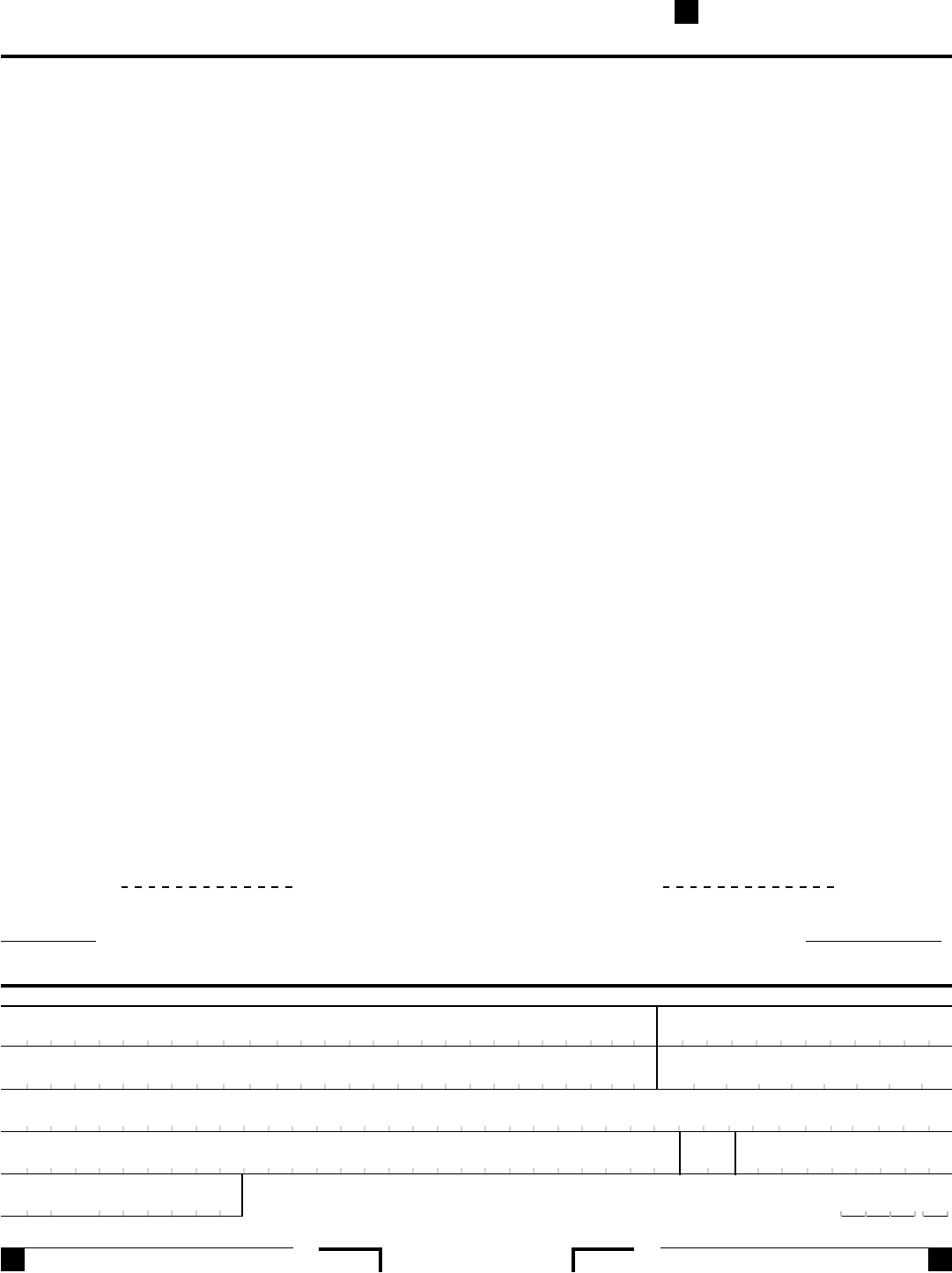

Web Ftb 3522 Form 2023 Rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 Satisfied 34 Votes How To Fill Out And Sign 2023 Ftb 3522 Online?

2022 form 3536 (llc extension payment); An llc should use this. Who must pay the annual tax? Web all llcs in california must file form 3522 and pay the $800 annual franchise tax every year, regardless of revenue or activity.

Web California Form 3522 Extensions Extensions When It Comes To Filing Form 3522 Vary Depending On The Type Of Business, According To The Franchise Tax Board.

Web complete ca ftb 3522 2023 online with us legal forms. Objective provide the steps and variables. Save or instantly send your ready documents. How it works open the.

Show Sources > Form 3522 Is A California Corporate Income Tax Form.

This form is for income earned in tax year 2022, with tax returns due in april. Web how do i enter the amount paid with california forms 3522 and. Web no, since your california llc doesn’t need to pay the $800 franchise tax for its 1st year, you don’t need to file form 3522. Web we last updated california form 3522 from the franchise tax board in january 2023.

Web Form 3522 Is A Form Used By Llcs In California To Pay A Business's Annual Tax Of $800.6 Min Read 1.

Web follow the simple instructions below: Show details we are not affiliated with any brand or entity on this form. Web how do i prepare california form 3522 (prior year) with a 1065 return using cch® prosystem fx® tax and cch axcess™ tax? Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th.