2023 Form 940

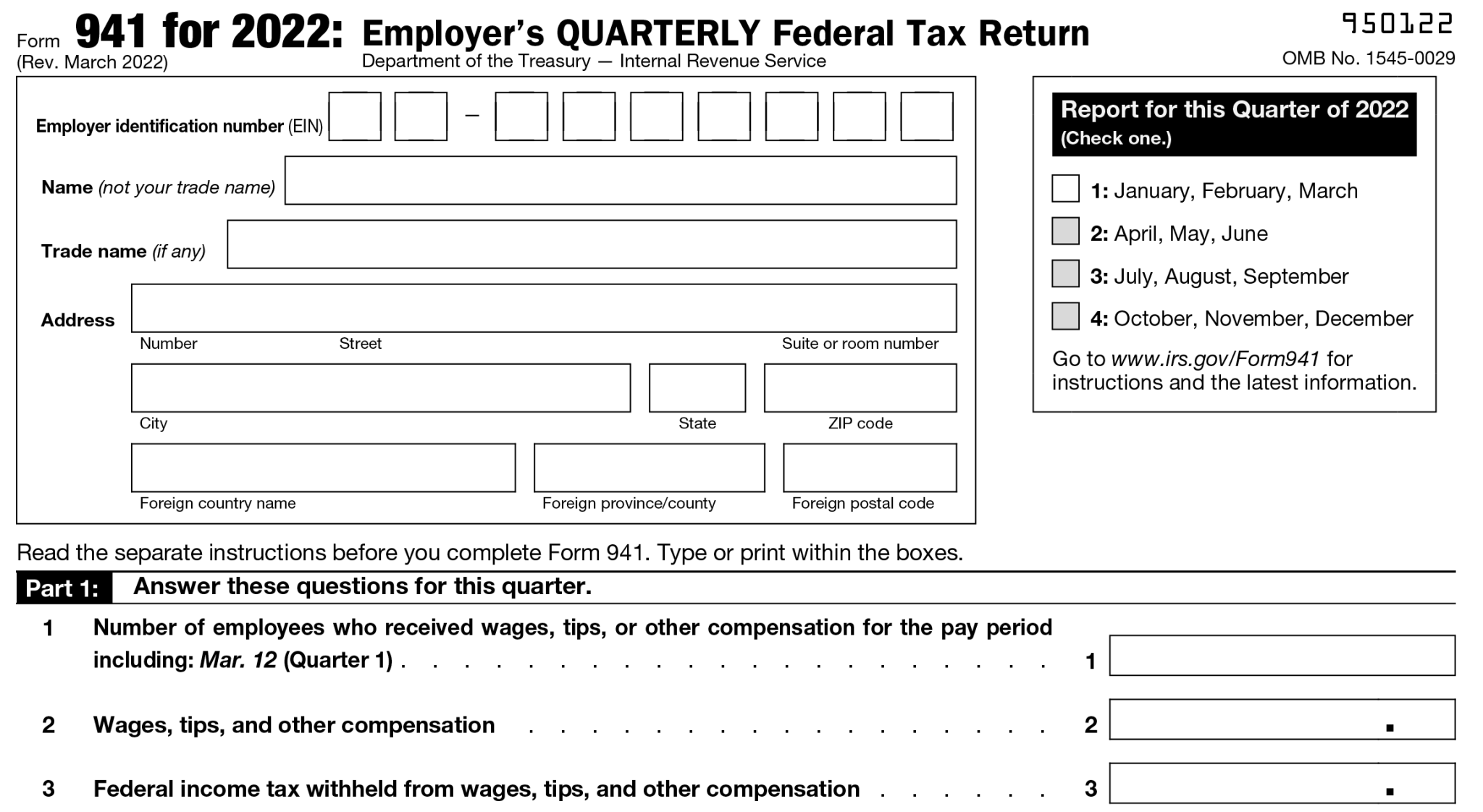

2023 Form 940 - Web employment tax forms: 940 form 2023 printable pdf. Employers should consult each form’s instructions or publication 15 to determine when and how to make deposits. Web 940 form 2023 printable. Web the irs released draft versions of form 940 and its schedule a california, connecticut, illinois, new york, and the us virgin islands might face credit reductions Recent 940 form [.pdf] (current revision: Table of contents what is irs tax form 940? If you deposited all the futa tax when due, then you have 10 additional calendar days to file the form 940. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Form 941, employer's quarterly federal tax return.

Recent 940 form [.pdf] (current revision: Employers should consult each form’s instructions or publication 15 to determine when and how to make deposits. However, you’ll receive an extension on this filing due date to february 10, 2023 if you’ve made all your required futa tax deposits. We will provide an update for the 2023 edition once it is released by the irs. The most recent version of form 940 is the 2022 edition. Web monthly or semiweekly deposits may be required for taxes reported on form 941 (or form 944), and quarterly deposits may be required for taxes reported on form 940. Web the irs released draft versions of form 940 and its schedule a california, connecticut, illinois, new york, and the us virgin islands might face credit reductions Form 941, employer's quarterly federal tax return. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. 940 form 2023 printable pdf.

Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. However, if you deposited all your futa tax when it was due, you may file form 940 by february 10, 2023. Form 940, employer's annual federal unemployment tax return. Form 941, employer's quarterly federal tax return. Employers should consult each form’s instructions or publication 15 to determine when and how to make deposits. Recent 940 form [.pdf] (current revision: Web monthly or semiweekly deposits may be required for taxes reported on form 941 (or form 944), and quarterly deposits may be required for taxes reported on form 940. Web 940 form 2023 printable. Web the irs released draft versions of form 940 and its schedule a california, connecticut, illinois, new york, and the us virgin islands might face credit reductions Web you must file your form 940 for 2022 by january 31, 2023.

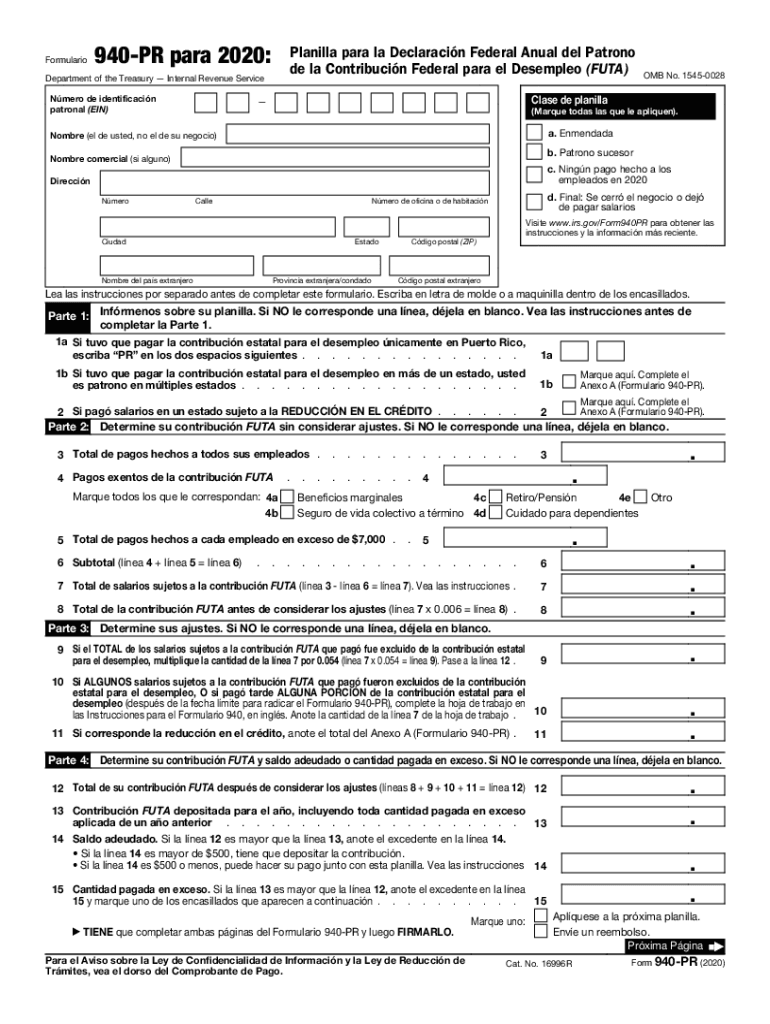

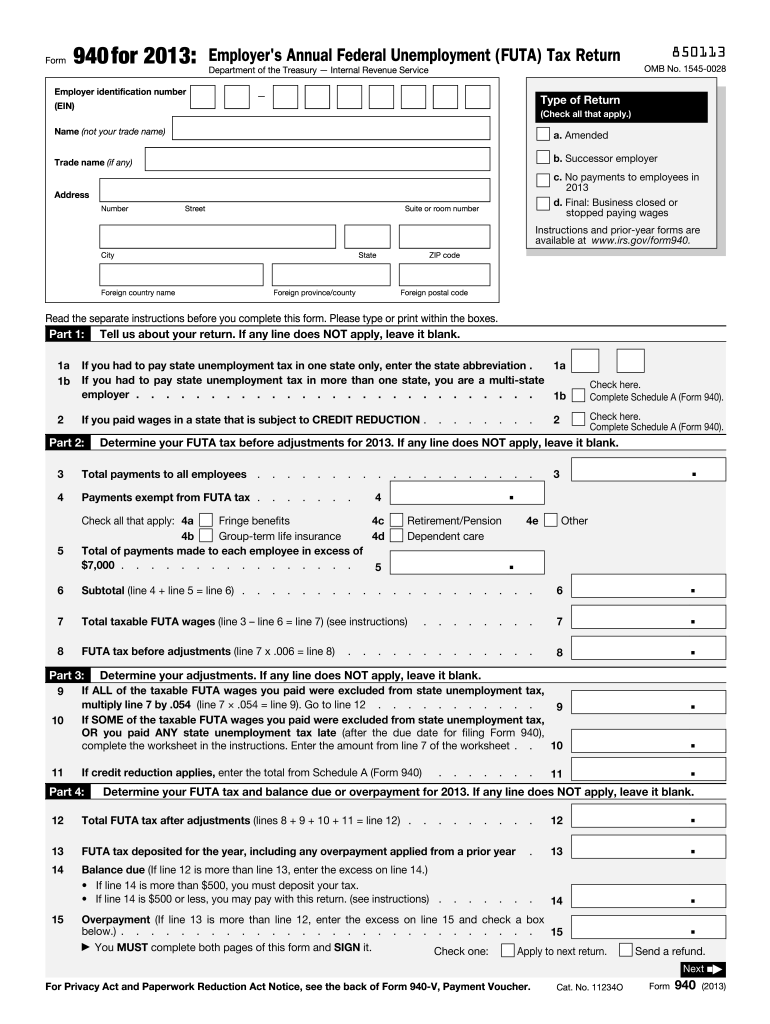

Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return

If you deposited all the futa tax when due, then you have 10 additional calendar days to file the form 940. However, if you deposited all your futa tax when it was due, you may file form 940 by february 10, 2023. Use form 940 to report your annual federal unemployment tax act (futa) tax. Table of contents what is.

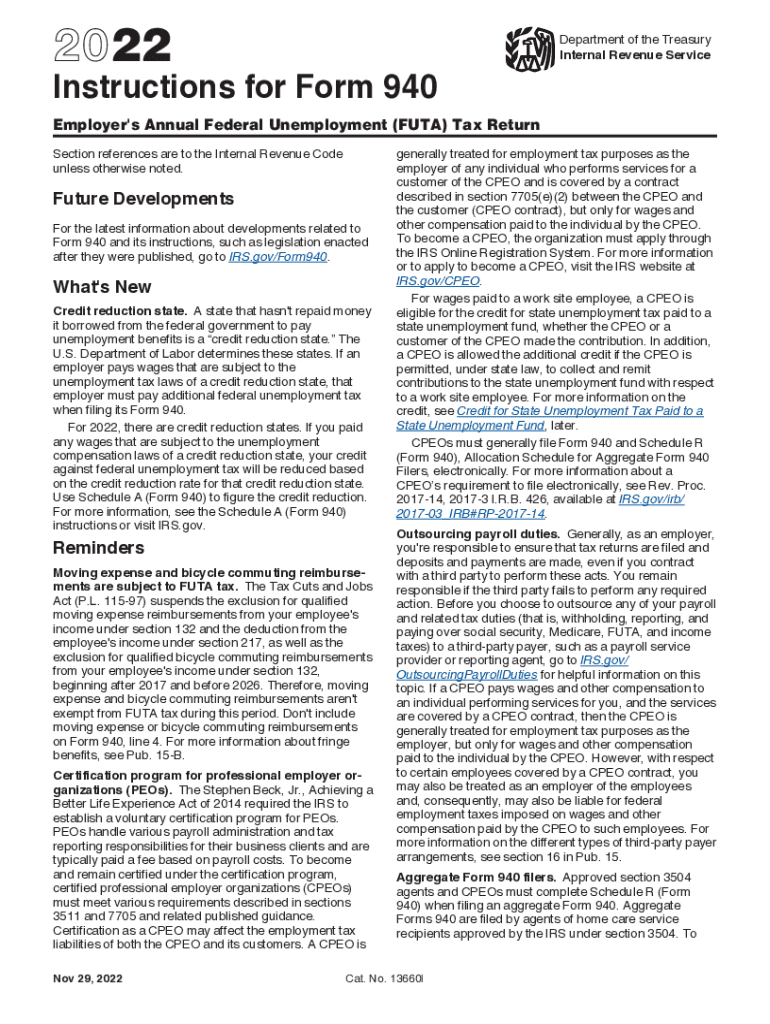

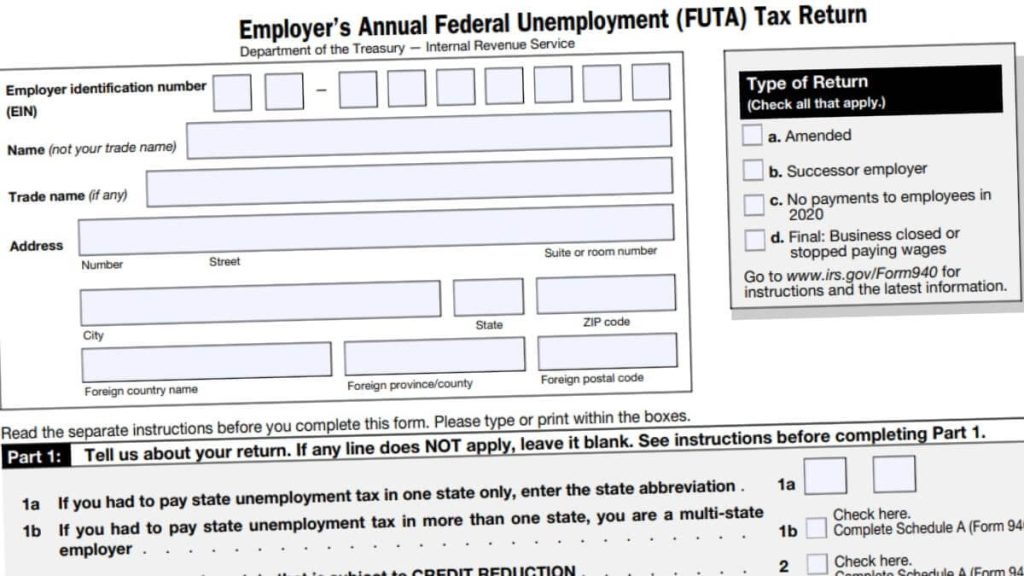

F940 Instructions 2021 Fill Out and Sign Printable PDF Template signNow

Web file form 940, employer’s annual federal unemployment (futa) tax return, with the irs to report taxable futa wages paid in the previous year. Use form 940 to report your annual federal unemployment tax act (futa) tax. Table of contents what is irs tax form 940? Employers should consult each form’s instructions or publication 15 to determine when and how.

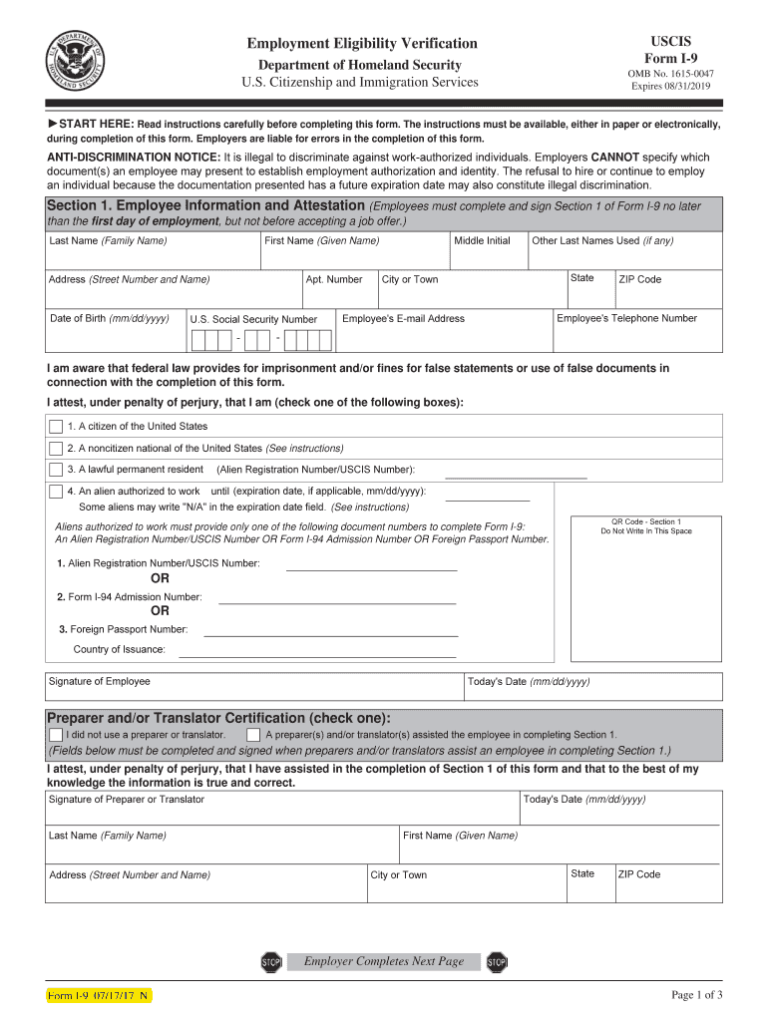

Pdf Fillable Form 940 I9 Form 2023 Printable

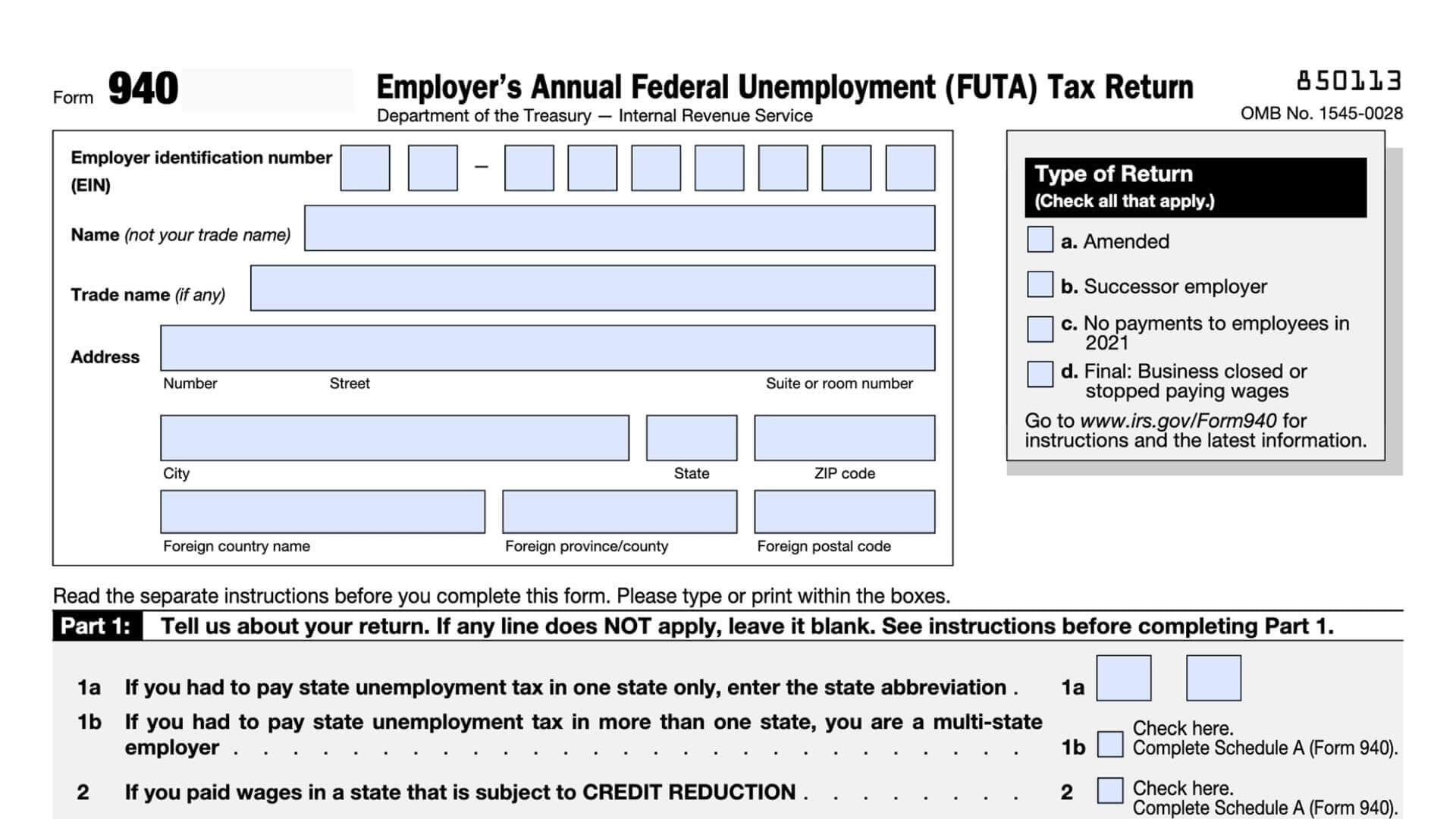

We will provide an update for the 2023 edition once it is released by the irs. Business closed or stopped paying wages go to www.irs.gov/form940 for instructions and the latest. Web 940 form 2023 printable. Web address number street suite or room number city state zip code foreign country name foreign province/county foreign postal code type of return (check all.

Fillable Form 940 For 2023 Fillable Form 2023

The most recent version of form 940 is the 2022 edition. Web you must file your form 940 for 2022 by january 31, 2023. Web file form 940, employer’s annual federal unemployment (futa) tax return, with the irs to report taxable futa wages paid in the previous year. Table of contents what is irs tax form 940? Employers should consult.

2013 Form IRS 940 Fill Online, Printable, Fillable, Blank pdfFiller

Web the irs released draft versions of form 940 and its schedule a california, connecticut, illinois, new york, and the us virgin islands might face credit reductions Form 940, employer's annual federal unemployment tax return. However, if you deposited all your futa tax when it was due, you may file form 940 by february 10, 2023. Web file form 940,.

940 Form 2023

The irs utilizes form 940 to calculate how much an employer owes in futa tax. Web the irs released draft versions of form 940 and its schedule a california, connecticut, illinois, new york, and the us virgin islands might face credit reductions Table of contents what is irs tax form 940? The most recent version of form 940 is the.

Form 940 pr 2023 Fill online, Printable, Fillable Blank

Web you must file your form 940 for 2022 by january 31, 2023. If you deposited all the futa tax when due, then you have 10 additional calendar days to file the form 940. However, you’ll receive an extension on this filing due date to february 10, 2023 if you’ve made all your required futa tax deposits. Web the due.

940 Form 2023 Fillable Form 2023

Form 940, employer's annual federal unemployment tax return. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Web file form 940, employer’s annual federal unemployment (futa) tax return, with the irs to report taxable futa wages paid in the previous year. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to.

940 Form 2023 Fillable Form 2023

The most recent version of form 940 is the 2022 edition. Web 940 form 2023 printable. Web monthly or semiweekly deposits may be required for taxes reported on form 941 (or form 944), and quarterly deposits may be required for taxes reported on form 940. 940 form 2023 printable pdf. We will provide an update for the 2023 edition once.

940 Form 2023

Form 941, employer's quarterly federal tax return. We will provide an update for the 2023 edition once it is released by the irs. 940 form 2023 printable pdf. However, you’ll receive an extension on this filing due date to february 10, 2023 if you’ve made all your required futa tax deposits. Web the irs released draft versions of form 940.

However, You’ll Receive An Extension On This Filing Due Date To February 10, 2023 If You’ve Made All Your Required Futa Tax Deposits.

Web file form 940, employer’s annual federal unemployment (futa) tax return, with the irs to report taxable futa wages paid in the previous year. Use form 940 to report your annual federal unemployment tax act (futa) tax. Web employment tax forms: Business closed or stopped paying wages go to www.irs.gov/form940 for instructions and the latest.

Recent 940 Form [.Pdf] (Current Revision:

We will provide an update for the 2023 edition once it is released by the irs. 940 form 2023 printable pdf. Web 940 form 2023 printable. Web monthly or semiweekly deposits may be required for taxes reported on form 941 (or form 944), and quarterly deposits may be required for taxes reported on form 940.

Web You Must File Your Form 940 For 2022 By January 31, 2023.

Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. If you deposited all the futa tax when due, then you have 10 additional calendar days to file the form 940. The most recent version of form 940 is the 2022 edition. However, if you deposited all your futa tax when it was due, you may file form 940 by february 10, 2023.

Table Of Contents What Is Irs Tax Form 940?

Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Form 940, employer's annual federal unemployment tax return. Employers should consult each form’s instructions or publication 15 to determine when and how to make deposits. Web the due date for filing form 940 for 2022 is january 31, 2023.