2023 Form 941 Schedule B

2023 Form 941 Schedule B - July 22, 2023 5:00 a.m. Taxbandits also supports prior year filings of form 941 for 2022, 2021, and 2020. Web semiweekly schedule depositor, attach schedule b (form 941). Businesses seeking a solution for getting caught up on their quarterly 941 filings can benefit greatly from this. Web rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Reserve assets data for the latest week. If you haven't received a payment. Reserve assets totaled $246,206 million as of the end of that week, compared to $247,977 million as of the end of the prior week. Report of tax liability for semiweekly schedule depositors (rev. Total must equal line 12.

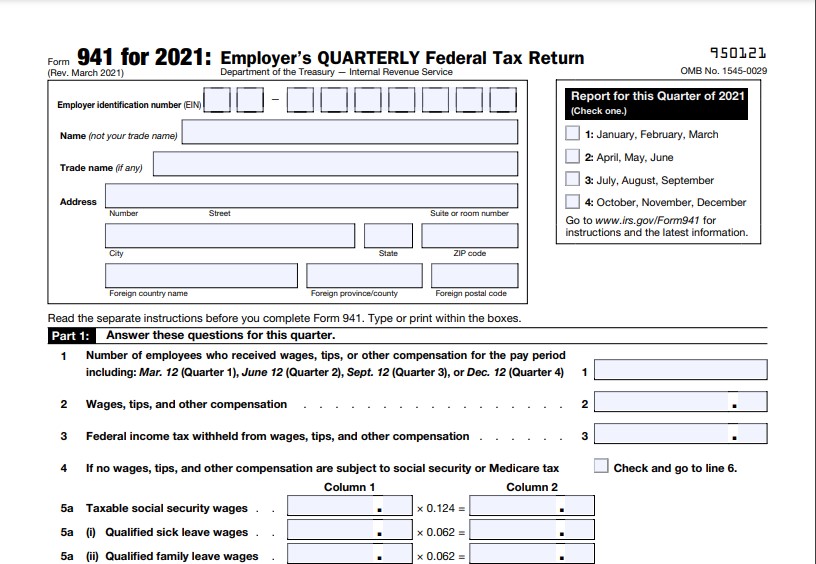

Report of tax liability for semiweekly schedule depositors (rev. Official reserve assets and other foreign currency assets (approximate market value, in us. Businesses seeking a solution for getting caught up on their quarterly 941 filings can benefit greatly from this. Web the treasury department today released u.s. Web semiweekly schedule depositor, attach schedule b (form 941). It discusses what is new for this version as well as the requirements for completing each form line by line. This is the final week the social security administration is sending out payments for july. It includes the filing requirements and tips on reconciling and balancing the two forms. You were a monthly schedule depositor for the entire quarter. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023.

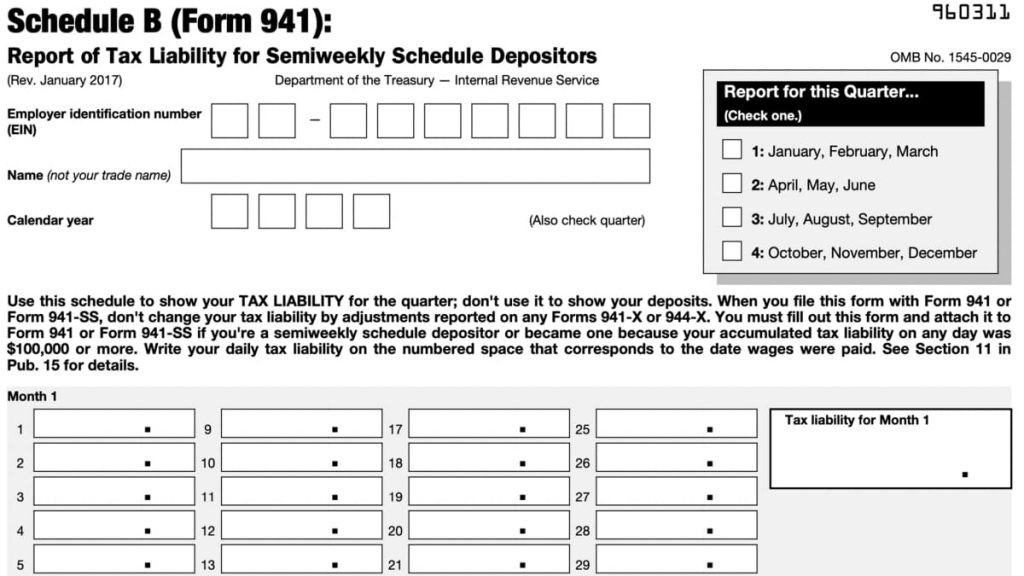

If you haven't received a payment. Enter your tax liability for each month and total liability for the quarter, then go to part 3. As indicated in this table, u.s. Web semiweekly schedule depositor, attach schedule b (form 941). Reserve assets totaled $246,206 million as of the end of that week, compared to $247,977 million as of the end of the prior week. Reserve assets data for the latest week. It discusses what is new for this version as well as the requirements for completing each form line by line. Web the form 941 for 2023 contains no major changes. Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Web schedule b (form 941):

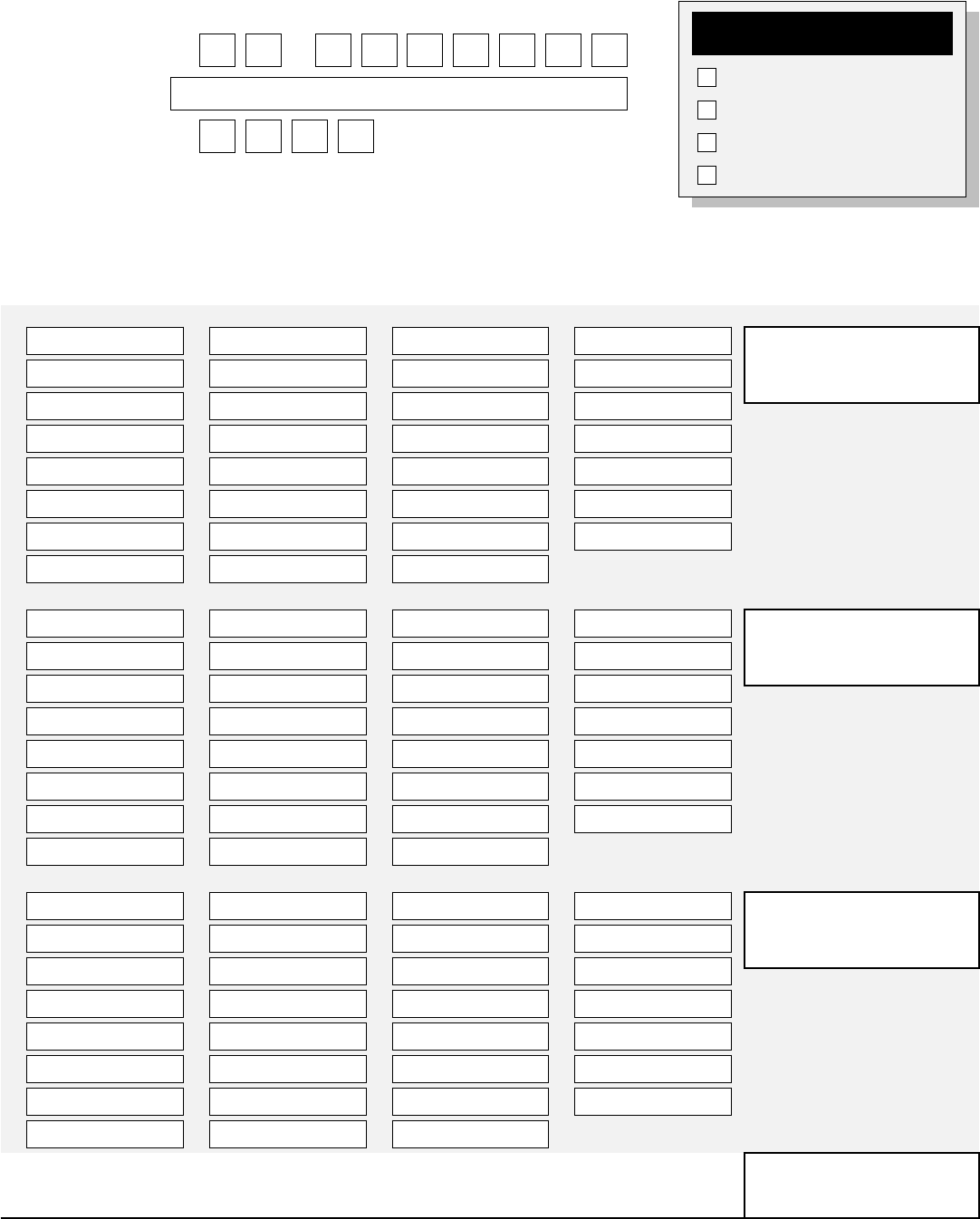

Form 941 Employer's Quarterly Federal Tax Return Form 941 Employer…

Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. Web the form 941 for 2023 contains no major changes. This includes medicare, social security, and federal income taxes. It includes the filing requirements and tips on reconciling and balancing the two forms. This will help taxpayers feel more prepared.

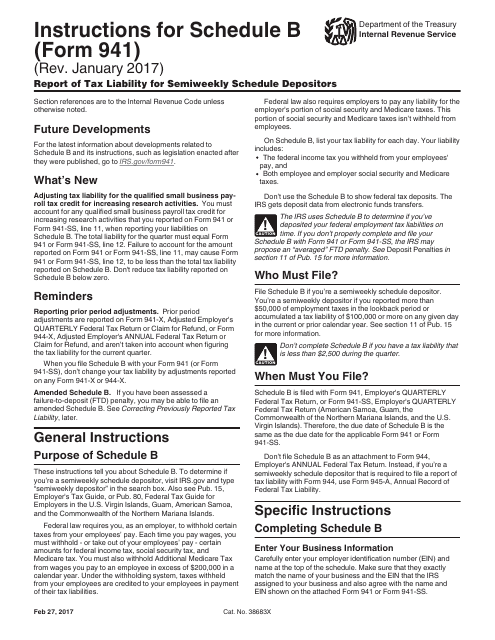

Download Instructions for IRS Form 941 Schedule B Report of Tax

This includes medicare, social security, and federal income taxes. This is the final week the social security administration is sending out payments for july. Report of tax liability for semiweekly schedule depositors (rev. Total must equal line 12. It includes the filing requirements and tips on reconciling and balancing the two forms.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

Taxbandits also supports prior year filings of form 941 for 2022, 2021, and 2020. This will help taxpayers feel more prepared when it is time to meet. July 22, 2023 5:00 a.m. This includes medicare, social security, and federal income taxes. Web schedule b (form 941):

941 Form 2023 schedule b Fill online, Printable, Fillable Blank

Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Web semiweekly schedule depositor, attach schedule b (form 941). Reserve assets totaled $246,206 million as of the end of that week, compared to $247,977 million as of the end of.

IRS Form 941 Schedule B 2023

As indicated in this table, u.s. Reserve assets data for the latest week. This includes medicare, social security, and federal income taxes. It discusses what is new for this version as well as the requirements for completing each form line by line. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter.

IRS Fillable Form 941 2023

Rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Reserve assets data for the latest week. Web the treasury department today released u.s. Enter your tax liability for each month and total liability for the quarter, then go to.

Form 941 Schedule B Edit, Fill, Sign Online Handypdf

Reserve assets totaled $246,206 million as of the end of that week, compared to $247,977 million as of the end of the prior week. It includes the filing requirements and tips on reconciling and balancing the two forms. Web rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is the deadline.

Form 941 Printable & Fillable Per Diem Rates 2021

Web the form 941 for 2023 contains no major changes. Employers engaged in a trade or business who pay compensation. Businesses seeking a solution for getting caught up on their quarterly 941 filings can benefit greatly from this. It discusses what is new for this version as well as the requirements for completing each form line by line. Web taxbandits.

2023 Form 941 Generator Create Fillable Form 941 Online

This will help taxpayers feel more prepared when it is time to meet. Taxbandits also supports prior year filings of form 941 for 2022, 2021, and 2020. January 2017) department of the treasury — internal revenue service 960311 omb no. Web rock hill, sc / accesswire / july 28, 2023 / the next business day, monday, july 31, 2023, is.

ezPaycheck Payroll How to Prepare Quarterly Tax Report

Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. It includes the filing requirements and tips on reconciling and balancing the two forms. Web the treasury department today released u.s. Web the form 941 for 2023 contains no major changes. Taxbandits also supports prior year filings of form 941.

Reserve Assets Totaled $246,206 Million As Of The End Of That Week, Compared To $247,977 Million As Of The End Of The Prior Week.

Web the form 941 for 2023 contains no major changes. Total must equal line 12. It discusses what is new for this version as well as the requirements for completing each form line by line. Web the treasury department today released u.s.

Updates To The Instructions Include The Removal Of Information Related To The Cobra Premium Assistance Tax Credit (The Lines To Claim The Credit Were Already Removed From Form 941 In June 2022), And Information On The Increase In The Payroll Tax Credit Qualified Small Business May.

It includes the filing requirements and tips on reconciling and balancing the two forms. This is the final week the social security administration is sending out payments for july. Businesses seeking a solution for getting caught up on their quarterly 941 filings can benefit greatly from this. This includes medicare, social security, and federal income taxes.

Rock Hill, Sc / Accesswire / July 28, 2023 / The Next Business Day, Monday, July 31, 2023, Is The Deadline For Employers To File Form 941 With The Irs.

Reserve assets data for the latest week. Web semiweekly schedule depositor, attach schedule b (form 941). Enter your tax liability for each month and total liability for the quarter, then go to part 3. January 2017) department of the treasury — internal revenue service 960311 omb no.

This Will Help Taxpayers Feel More Prepared When It Is Time To Meet.

Employers engaged in a trade or business who pay compensation. Web this webinar covers the irs form 941 and its accompanying form schedule b for the first quarter of 2023. You were a monthly schedule depositor for the entire quarter. Web taxbandits supports form 941 schedule r for peos, cpeos, 3504 agents, and other reporting agents.