2553 S Corporation Application Form

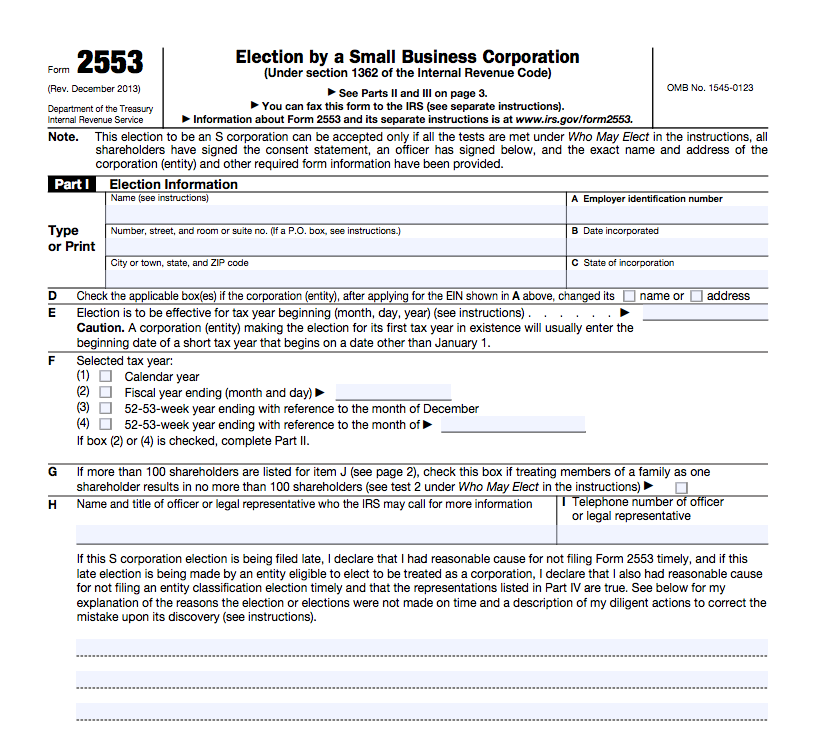

2553 S Corporation Application Form - Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation rather than a c corporation. Web form 2553 part i election information (continued) note: Web you may file form 2553 at any time beforethe tax year that the election will take place. The form should be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second month of a tax year if the tax year is 2½ months or less. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Web use form 2553 (election by a small business corporation) to apply for s corporation status. Download the instructions for this form here: See page 2 of the instructions. See the instructions for form 2553 pdf for all required information and to determine where to file the form. A corporation that meets requirements (1) through (4) must also be able to provide statements from all shareholders who were shareholders during the period between the date entered on line e of form 2553 and the date the completed form 2553.

See page 2 of the instructions. Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. A corporation that meets requirements (1) through (4) must also be able to provide statements from all shareholders who were shareholders during the period between the date entered on line e of form 2553 and the date the completed form 2553. Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation rather than a c corporation. Treasury internal revenue service the corporation may either send or fax this form to the irs. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Web form 2553 part i election information (continued) note: The form should be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second month of a tax year if the tax year is 2½ months or less. Web form 2553 will be filed within 3 years and 75 days of the date entered on line e of form 2553; Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec.

Web form 2553 part i election information (continued) note: If you need more rows, use additional copies of page 2. Download the instructions for this form here: Web form 2553 will be filed within 3 years and 75 days of the date entered on line e of form 2553; Treasury internal revenue service the corporation may either send or fax this form to the irs. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Name and address of each shareholder or former shareholder required to consent to the election. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Web you may file form 2553 at any time beforethe tax year that the election will take place. Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes.

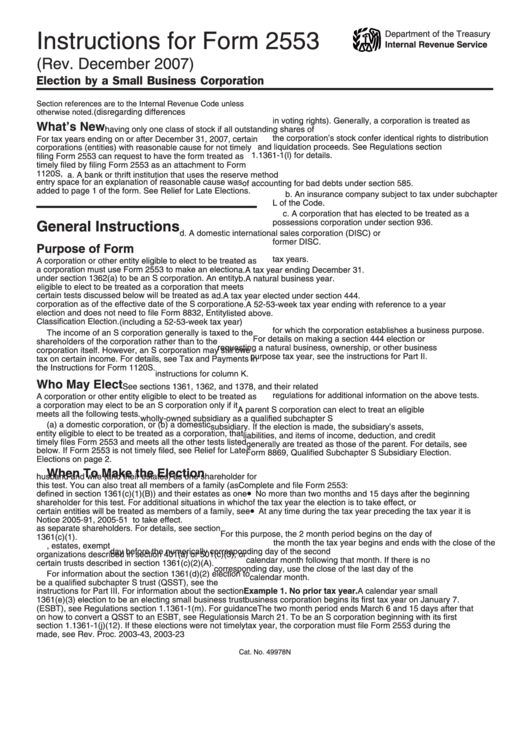

Instructions For Form 2553 (Rev. December 2007) Election By A Small

Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes. However, please do not complete this form now, as your session will time out. The.

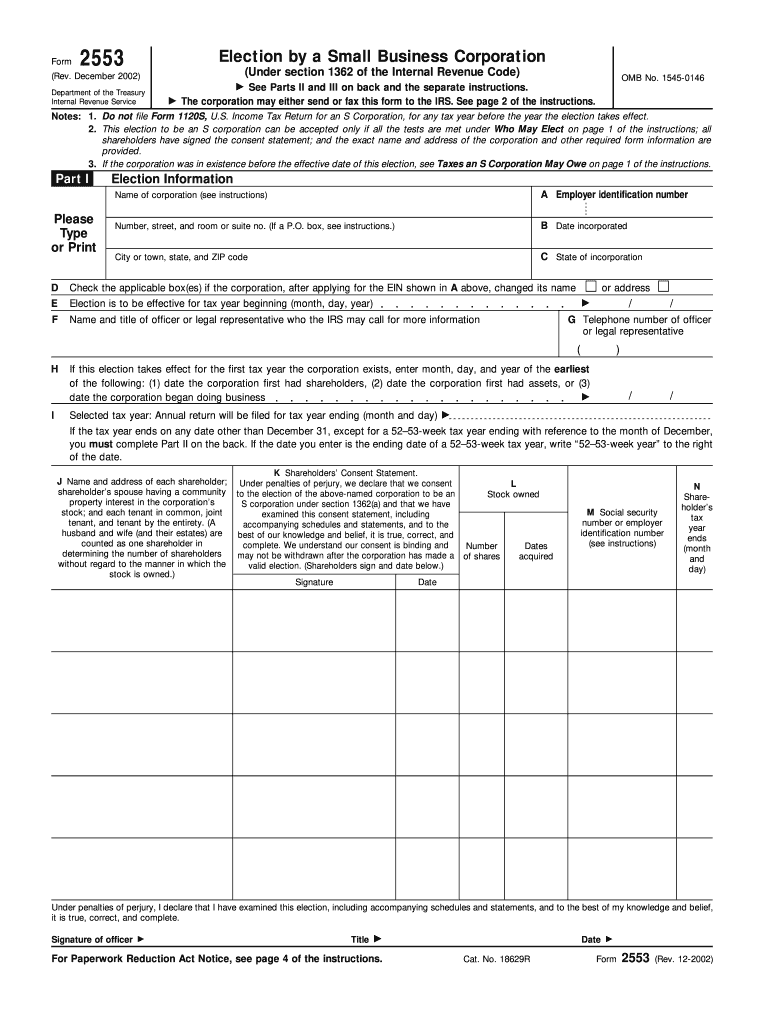

Fill Free fillable form 2553 election by a small business corporation

Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. However, please do not complete this form now, as your session will time out. Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a.

Barbara Johnson Blog Form 2553 Instructions How and Where to File

See page 2 of the instructions. Download the instructions for this form here: Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. To view this form, click here: A corporation or other entity eligible to be treated as a corporation files this form to.

IRS Form 2553 No Error Anymore If Following the Instructions

When a business is registered as a corporation with the irs, it is formed as a c corp by default. Web use form 2553 (election by a small business corporation) to apply for s corporation status. A corporation that meets requirements (1) through (4) must also be able to provide statements from all shareholders who were shareholders during the period.

How to Fill in Form 2553 Election by a Small Business Corporation S

(see instructions) shareholder’s consent statement Web use form 2553 (election by a small business corporation) to apply for s corporation status. To view this form, click here: Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. Web form 2553, election by a small business.

Irs Form 2553 Fill in Fill Out and Sign Printable PDF Template signNow

Web form 2553 part i election information (continued) note: However, please do not complete this form now, as your session will time out. If you need more rows, use additional copies of page 2. (see instructions) shareholder’s consent statement Web form 2553 will be filed within 3 years and 75 days of the date entered on line e of form.

How to Fill Out Form 2553 Instructions, Deadlines [2023]

Download the instructions for this form here: If you need more rows, use additional copies of page 2. The form should be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second month of a tax year if the tax year is 2½ months or less. Treasury internal.

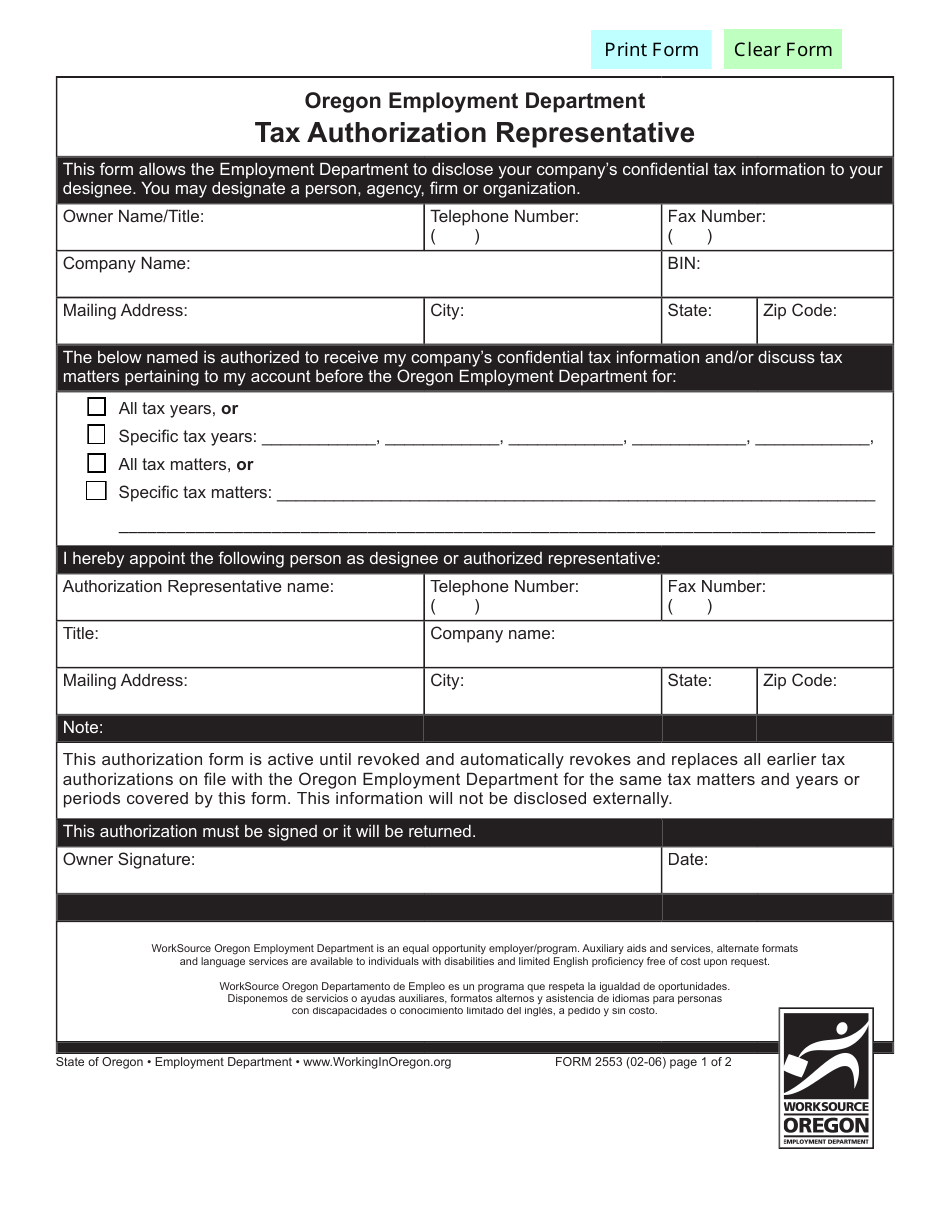

Form 2553 Download Fillable PDF or Fill Online Tax Authorization

A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. Web irs form 2553 is an election to have your business entity recognized as an s.

SCorp Election Harbor Compliance

If you need more rows, use additional copies of page 2. See the instructions for form 2553 pdf for all required information and to determine where to file the form. The form should be filed before the 16th day of the third month of the corporation's tax year, or before the 15th day of the second month of a tax.

Learn How to Fill the Form 2553 Election by a Small Business

Web form 2553, election by a small business corporation, is an internal revenue service form that can be filed by a business to elect to be registered as an s corporation rather than a c corporation. Web 2553 election by a small business corporation (rev. Download the instructions for this form here: A corporation that meets requirements (1) through (4).

However, Please Do Not Complete This Form Now, As Your Session Will Time Out.

Download the instructions for this form here: See the instructions for form 2553 pdf for all required information and to determine where to file the form. Web use form 2553 (election by a small business corporation) to apply for s corporation status. Web irs form 2553 is an election to have your business entity recognized as an s corporation for tax purposes.

Web 2553 Election By A Small Business Corporation (Rev.

Web in order to become an s corporation, the corporation must submit form 2553, election by a small business corporation signed by all the shareholders. To view this form, click here: Treasury internal revenue service the corporation may either send or fax this form to the irs. December 2002) (under section 1362 of the internal revenue code) omb no.

When A Business Is Registered As A Corporation With The Irs, It Is Formed As A C Corp By Default.

If you need more rows, use additional copies of page 2. A corporation or other entity eligible to be treated as a corporation files this form to make an election under section 1362(a) to. Name and address of each shareholder or former shareholder required to consent to the election. See page 2 of the instructions.

Web Form 2553, Election By A Small Business Corporation, Is An Internal Revenue Service Form That Can Be Filed By A Business To Elect To Be Registered As An S Corporation Rather Than A C Corporation.

Web form 2553 is used by qualifying small business corporations and limited liability companies to make the election prescribed by sec. A corporation that meets requirements (1) through (4) must also be able to provide statements from all shareholders who were shareholders during the period between the date entered on line e of form 2553 and the date the completed form 2553. Web you may file form 2553 at any time beforethe tax year that the election will take place. Web form 2553 part i election information (continued) note:

![How to Fill Out Form 2553 Instructions, Deadlines [2023]](https://standwithmainstreet.com/wp-content/uploads/2021/03/pexels-photo-5273563.jpeg)