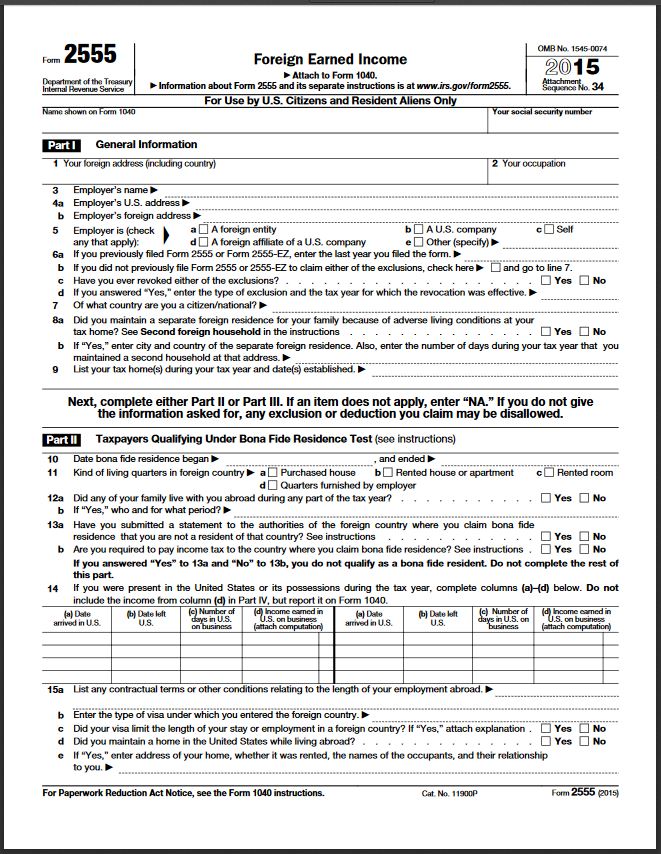

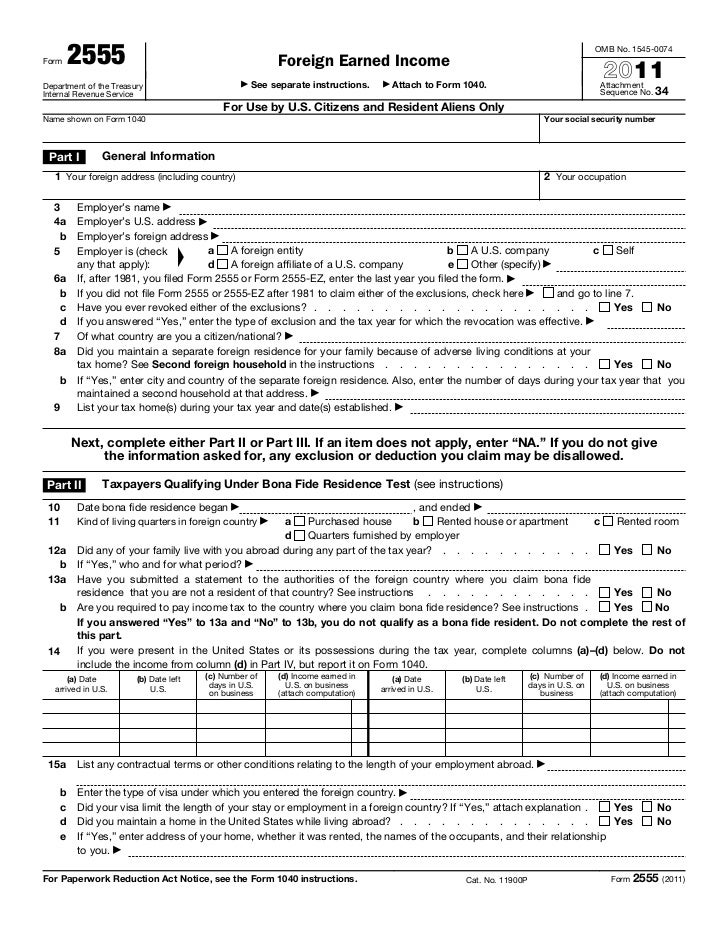

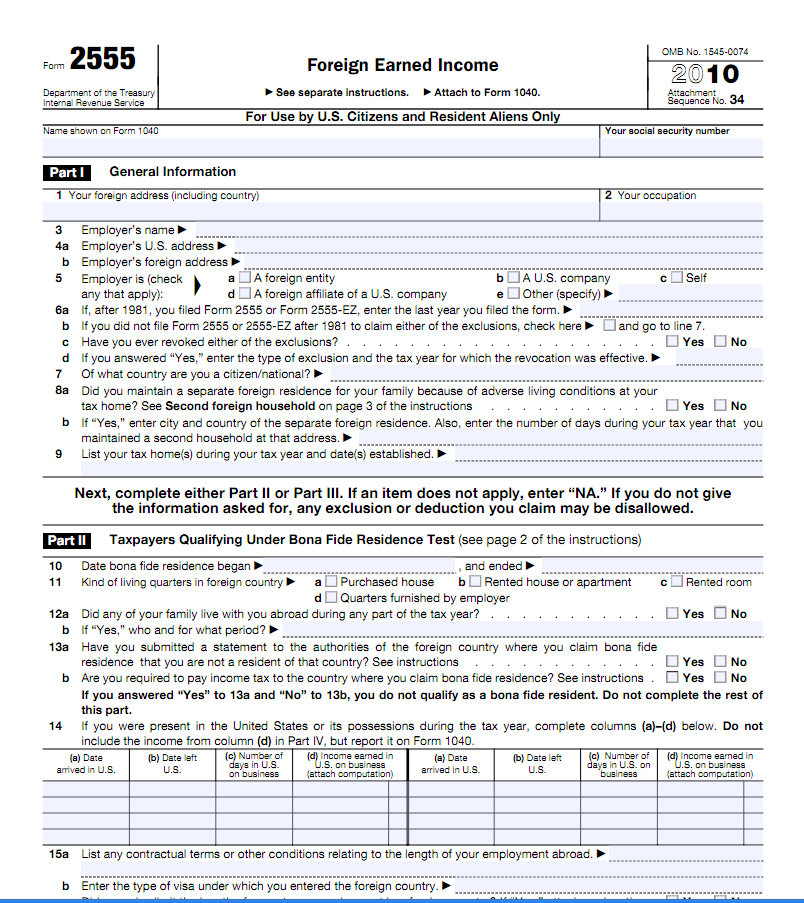

2555 Tax Form

2555 Tax Form - Ad access irs tax forms. Ad access irs tax forms. D a foreign affiliate of a u.s. Web if you live in a foreign country, u.s. Web 235 rows purpose of form. Web a foreign country, u.s. Go to www.irs.gov/form2555 for instructions and the latest. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income exclusion. You cannot exclude or deduct more than the.

If you qualify, you can use form. Web 5 employer is (check a a foreign entity b a u.s. Ad access irs tax forms. Web if you live in a foreign country, u.s. If you qualify, you can use form 2555 to figure your foreign. Web your 2012 tax year for services you performed in a foreign country. If any of the foreign earned income received this tax year was earned in a prior tax year, or will be earned in. You cannot exclude or deduct more than the. Web your 2017 tax year for services you performed in a foreign country. *if you live in american.

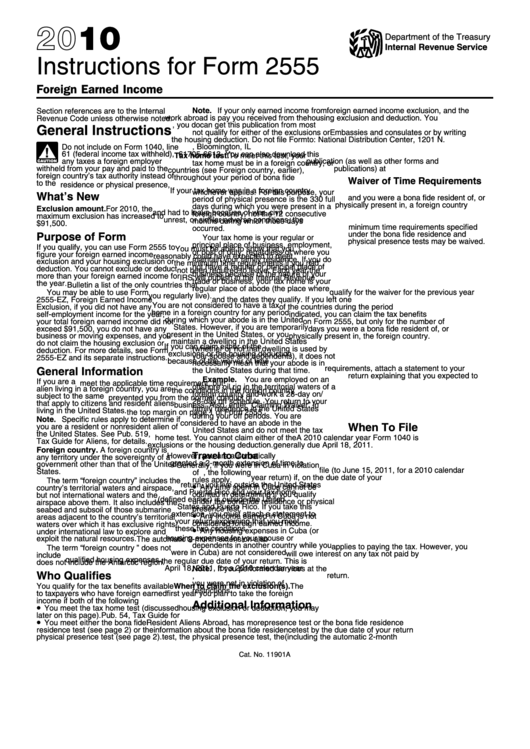

Web april 2, 2022 form 2555 can make an expat’s life a lot easier! If you qualify, you can use form. Ad access irs tax forms. D a foreign affiliate of a u.s. You cannot exclude or deduct more than the. If you meet the requirements, you can. Web 5 employer is (check a a foreign entity b a u.s. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. Download or email irs 2555 & more fillable forms, register and subscribe now! This form helps expats elect to use the foreign earned income exclusion (feie), one of the biggest.

Foreign Earned Exclusion Form 2555 Verni Tax Law

Ad access irs tax forms. Company c self any that apply): You cannot exclude or deduct more than the. If you meet the requirements, you can. Ad access irs tax forms.

Form 2555EZ Foreign Earned Exclusion (2014) Free Download

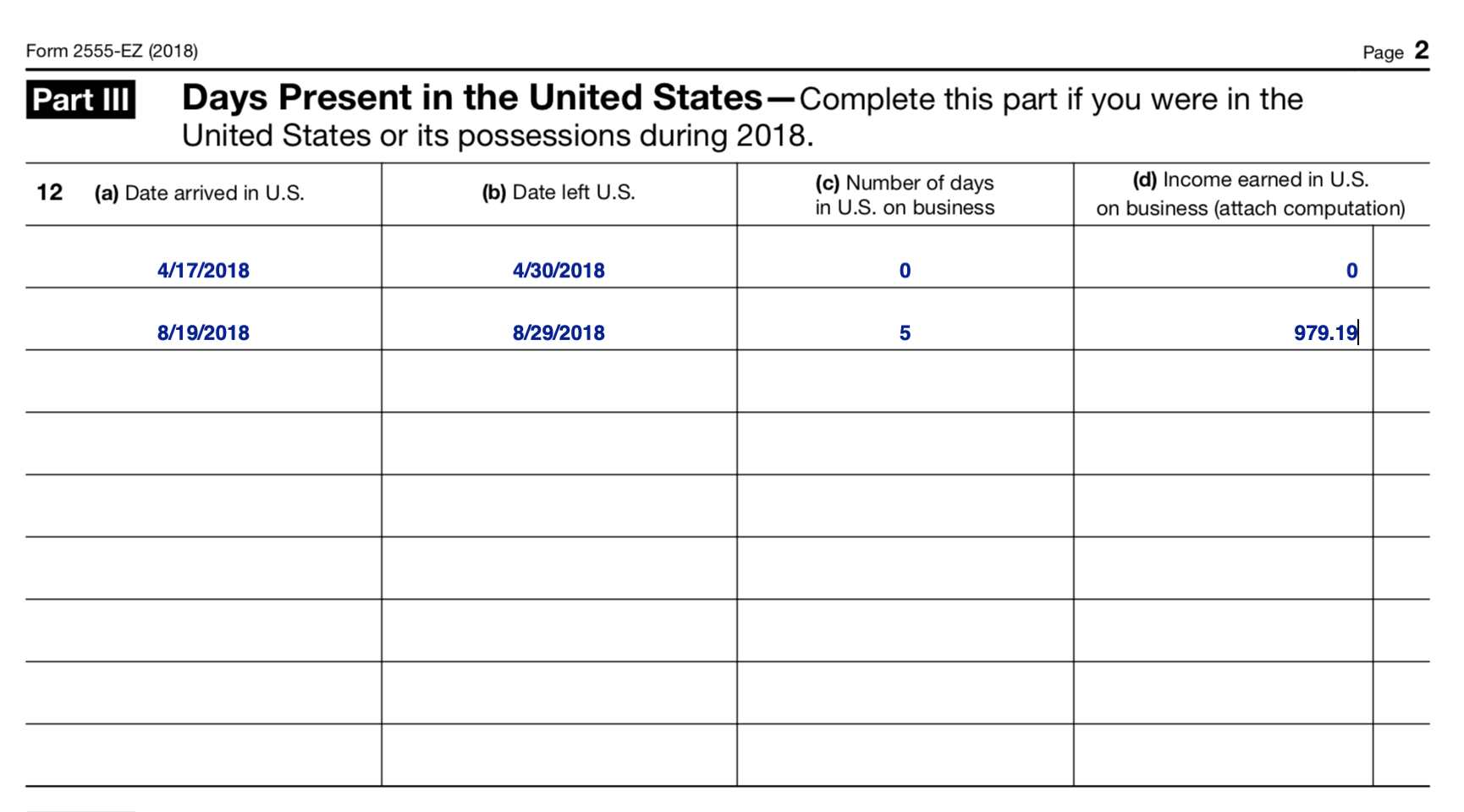

If any of the foreign earned income received this tax year was earned in a prior tax year, or will be earned in. Ad access irs tax forms. If you meet the requirements, you can. Web your 2012 tax year for services you performed in a foreign country. Company e other (specify) 6 a if you previously filed form 2555.

US Expat Taxes Form 2555EZ & Foreign Earned Exclusion

Ad access irs tax forms. Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income exclusion. If any of the foreign earned income received this tax year was earned in a prior tax year, or will be earned in. If you meet the requirements, you can. Web information.

US Tax Abroad Expatriate Form 2555

Complete, edit or print tax forms instantly. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Web if you live in a foreign country, u.s. This form helps expats elect to use the foreign earned income exclusion (feie), one of the biggest. Ad access irs tax forms.

TIMELY FILING THE FORM 2555 Expat Tax Professionals

If you qualify, you can use form 2555 to figure your foreign. Web if you live in a foreign country, u.s. If you meet the requirements, you can. If any of the foreign earned income received this tax year was earned in a prior tax year, or will be earned in. Web if you qualify, you can use form 2555.

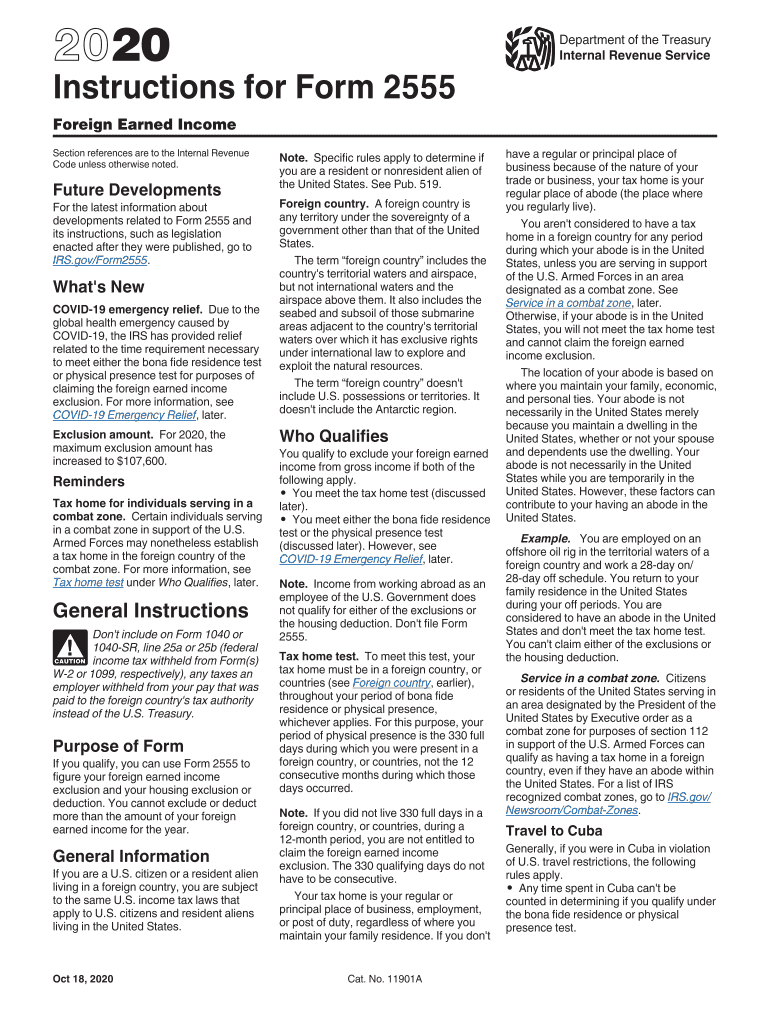

Instructions For Form 2555 Foreign Earned Internal Revenue

Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income exclusion. Company c self any that apply):.

Glossary of Tax Terms TFX

Ad access irs tax forms. If you qualify, you can use form 2555 to figure your foreign. Company e other (specify) 6 a if you previously filed form 2555 or. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign.

Instructions For Form 2555 Instructions For Form 2555, Foreign Earned

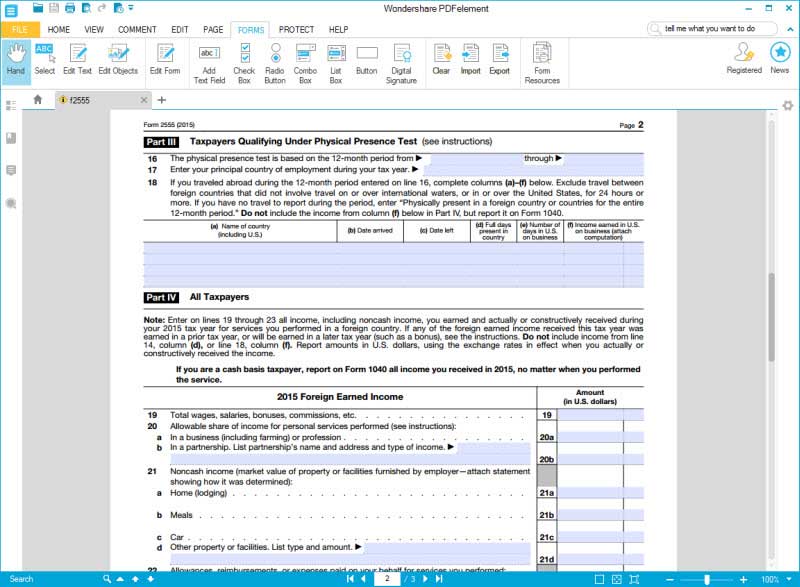

If any of the foreign earned income received this tax year was earned in a prior tax year, or will be earned in. Web a foreign country, u.s. Web 5 employer is (check a a foreign entity b a u.s. If you meet the requirements, you can. If you qualify, you can use form 2555 to figure your foreign.

IRS Form 2555 Fill out with Smart Form Filler

You cannot exclude or deduct more than the. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Company c self any that apply): *if you live in american. Web 235 rows purpose of form.

2 FREE DOWNLOAD U.S. TAX FORM 2555 PDF DOC AND VIDEO TUTORIAL * Tax Form

Company c self any that apply): *if you live in american. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers with the appropriate residency status and citizenship can use to figure out their foreign earned. Company e other (specify) 6 a if you previously filed form 2555 or. Web your 2012 tax year.

Complete, Edit Or Print Tax Forms Instantly.

Web your 2012 tax year for services you performed in a foreign country. Web the foreign earned income exclusion (feie) is an irs tax benefit program that allows american expats to exclude their foreign earned income from their us tax. Web your 2017 tax year for services you performed in a foreign country. Ad access irs tax forms.

You Cannot Exclude Or Deduct More Than The.

If you qualify, you can use form. Web a foreign country, u.s. Go to www.irs.gov/form2555 for instructions and the latest. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction.

Web The Tax Form 2555, Or Foreign Earned Income, Is An Irs Form That Qualifying Taxpayers With The Appropriate Residency Status And Citizenship Can Use To Figure Out Their Foreign Earned.

Web if you live in a foreign country, u.s. Download or email irs 2555 & more fillable forms, register and subscribe now! D a foreign affiliate of a u.s. If you meet the requirements, you can.

Web Form 2555 (Foreign Earned Income Exclusion) Calculates The Amount Of Foreign Earned Income And/Or Foreign Housing You Can Exclude From Taxation.

This form helps expats elect to use the foreign earned income exclusion (feie), one of the biggest. Web 235 rows purpose of form. Web if you are working and/or living abroad and meet certain requirements, you may be eligible to use the foreign earned income exclusion. Get ready for tax season deadlines by completing any required tax forms today.