5304 Simple Form

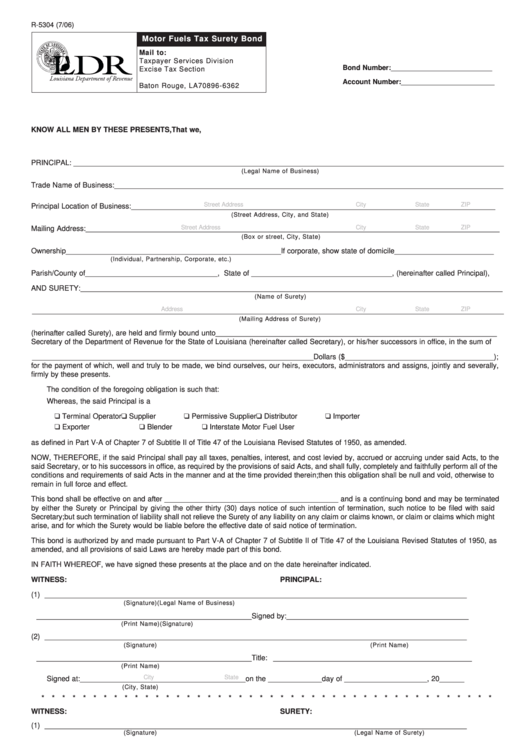

5304 Simple Form - Each form is a simple ira plan document. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. File with the internal revenue service. August 2005) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. This form is for income earned in tax year 2022, with tax returns due in april 2023. Savings incentive match plan for employees of small employers (simple)—not for use with a designated financial institution. Web the notification form is different for a 5304 simple than a 5305 simple. The employer can change certain provisions in this notice for the following year (eg the matching contribution) and the employee must make their elections before the end of the prior year (between 11/2 and 12/31). These forms are not to be filed with irs, but to be retained in the employers' records as proof of establishing such a plan, thereby justifying. Employees of small employers (simple)— for use with a designated financial institution omb no.

Each form is a simple ira plan document. You adopt the simple ira plan when you have completed all appropriate boxes and blanks on the form and you (and the designated financial institution, if any) have signed it. March 2012) department of the treasury internal revenue service. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. March 2012) department of the treasury internal revenue service. Savings incentive match plan for employees of small employers (simple)—not for use with a designated financial institution. File with the internal revenue service. Web the notification form is different for a 5304 simple than a 5305 simple. August 2005) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. This amount has to be not more than 3% of the employee’s compensation but cannot be less than 1%.

Each form is a simple ira plan document. According to the law, when you stick to a simple ira plan, you have to contribute certain amounts of money to an organization chosen by the person who works for you. File with the internal revenue service. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web the notification form is different for a 5304 simple than a 5305 simple. This amount has to be not more than 3% of the employee’s compensation but cannot be less than 1%. Savings incentive match plan for employees of small employers (simple)—not for use with a designated financial institution. File with the internal revenue service. March 2012) department of the treasury internal revenue service. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government.

Form 5304SIMPLE Savings Incentive Match Plan for Employees of Small

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. These forms are not to be filed with irs, but to be retained in the employers' records as proof of establishing such a plan, thereby justifying. According to the law, when you stick to a.

Form 5304SIMPLE Savings Incentive Match Plan for Employees of Small

File with the internal revenue service. March 2012) department of the treasury internal revenue service. This amount has to be not more than 3% of the employee’s compensation but cannot be less than 1%. August 2005) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p).

Fill Free fillable Form 5304SIMPLE Savings Incentive Match Plan PDF form

March 2012) department of the treasury internal revenue service. This form is for income earned in tax year 2022, with tax returns due in april 2023. This amount has to be not more than 3% of the employee’s compensation but cannot be less than 1%. August 2005) do not file with the internal department of the treasury revenue service internal.

Fill Free fillable IRS PDF forms

This form is for income earned in tax year 2022, with tax returns due in april 2023. These forms are not to be filed with irs, but to be retained in the employers' records as proof of establishing such a plan, thereby justifying. August 2005) do not file with the internal department of the treasury revenue service internal revenue service.

Form 5304sim Edit, Fill, Sign Online Handypdf

The employer can change certain provisions in this notice for the following year (eg the matching contribution) and the employee must make their elections before the end of the prior year (between 11/2 and 12/31). File with the internal revenue service. This form is for income earned in tax year 2022, with tax returns due in april 2023. March 2012).

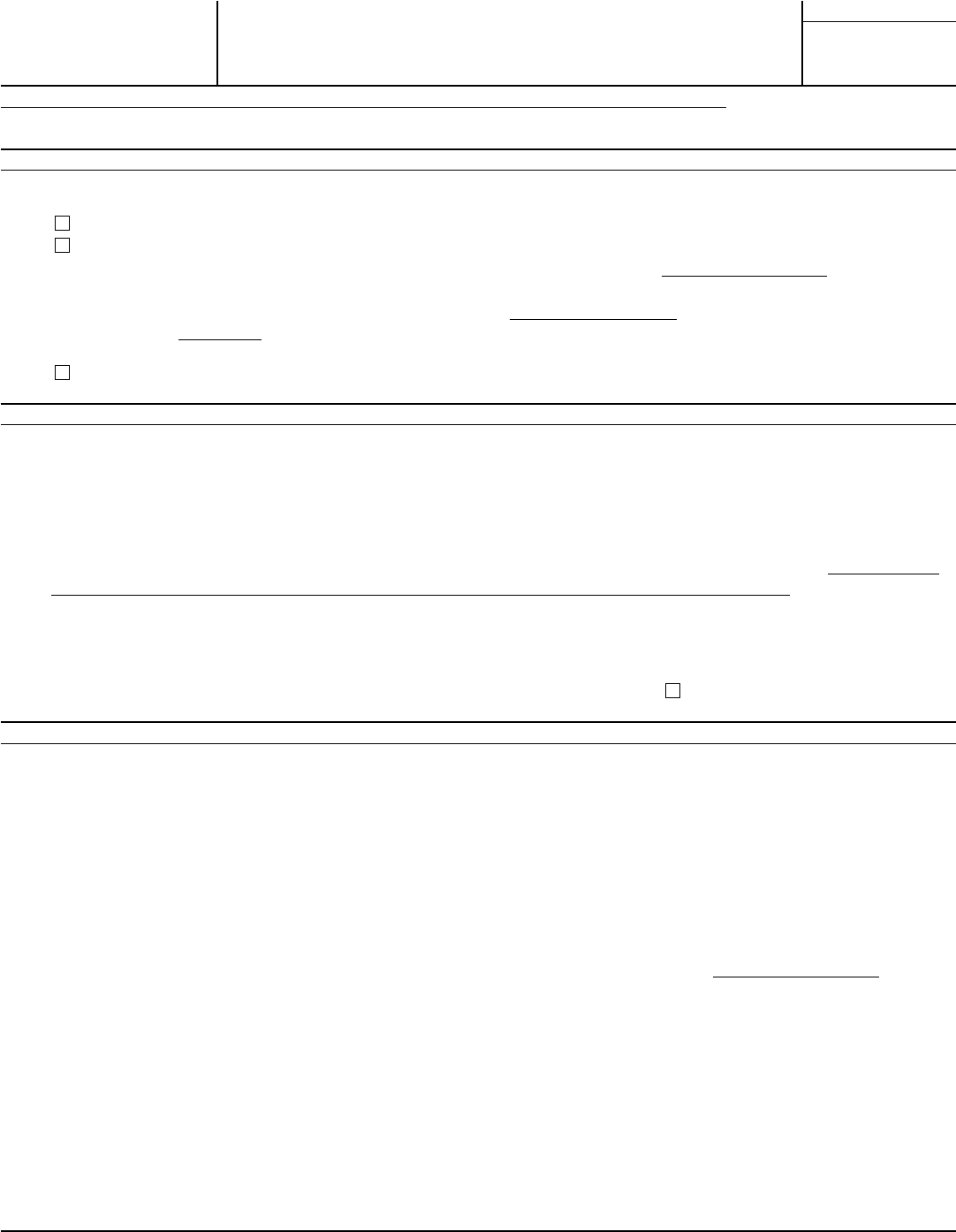

Fillable Form R5304 Motor Fuels Tax Surety Bond printable pdf download

August 2005) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form. This amount has to be not more than 3% of the employee’s compensation but cannot be less than 1%. According.

Fillable Form 5304 Missouri Tobacco Directory NonParticipating

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. The employer can change certain provisions in this notice for the following year (eg the matching contribution) and the employee must make their elections before the end of the prior year (between 11/2 and 12/31)..

Form 5304SIMPLE Savings Incentive Match Plan for Employees of Small

You adopt the simple ira plan when you have completed all appropriate boxes and blanks on the form and you (and the designated financial institution, if any) have signed it. This amount has to be not more than 3% of the employee’s compensation but cannot be less than 1%. The employer can change certain provisions in this notice for the.

IRS Publication 5354 2020 Fill and Sign Printable Template Online

We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. File with the internal revenue service. According to the law, when you stick to a simple ira plan, you have to contribute certain amounts of money to an organization chosen by the person who works.

IRS 5304SIMPLE 20122021 Fill out Tax Template Online US Legal Forms

Web the notification form is different for a 5304 simple than a 5305 simple. According to the law, when you stick to a simple ira plan, you have to contribute certain amounts of money to an organization chosen by the person who works for you. These forms are not to be filed with irs, but to be retained in the.

This Amount Has To Be Not More Than 3% Of The Employee’s Compensation But Cannot Be Less Than 1%.

You adopt the simple ira plan when you have completed all appropriate boxes and blanks on the form and you (and the designated financial institution, if any) have signed it. March 2012) department of the treasury internal revenue service. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. March 2012) department of the treasury internal revenue service.

Savings Incentive Match Plan For Employees Of Small Employers (Simple)—Not For Use With A Designated Financial Institution.

Web the notification form is different for a 5304 simple than a 5305 simple. File with the internal revenue service. Each form is a simple ira plan document. File with the internal revenue service.

The Employer Can Change Certain Provisions In This Notice For The Following Year (Eg The Matching Contribution) And The Employee Must Make Their Elections Before The End Of The Prior Year (Between 11/2 And 12/31).

This form is for income earned in tax year 2022, with tax returns due in april 2023. Employees of small employers (simple)— for use with a designated financial institution omb no. According to the law, when you stick to a simple ira plan, you have to contribute certain amounts of money to an organization chosen by the person who works for you. August 2005) do not file with the internal department of the treasury revenue service internal revenue service establishes the following simple ira plan under section 408(p) of the internal revenue code and pursuant to the instructions contained in this form.