5329-T Form

5329-T Form - File form 5329 with your 2022 form 1040, 1040. United states (english) united states (spanish). Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, hsas, or able. Irs form 5329 (attach to form 1040) this form only applies if you reported excess contributions. Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. If married, you must complete separate form 8889 for each spouse’s hsa. Web use form 5329 to report additional taxes on: I do not have/need those forms? Web name of individual subject to additional tax married filing jointly 5329 form use a form 5329 t template to make your document workflow more streamlined. Web “2020 form 5329” on the check.

When and where to file. Web name of individual subject to additional tax married filing jointly 5329 form use a form 5329 t template to make your document workflow more streamlined. Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. File form 5329 with your 2022 form 1040, 1040. If married, you must complete separate form 8889 for each spouse’s hsa. Web use form 5329 to report additional taxes on: You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Irs form 5329 (attach to form 1040) this form only applies if you reported excess contributions. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, hsas, or able. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira.

You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. File form 5329 with your 2022 form 1040, 1040. Web use form 5329 to report additional taxes on: Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. United states (english) united states (spanish). When and where to file. Web name of individual subject to additional tax married filing jointly 5329 form use a form 5329 t template to make your document workflow more streamlined. Irs form 5329 (attach to form 1040) this form only applies if you reported excess contributions. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, hsas, or able. I do not have/need those forms?

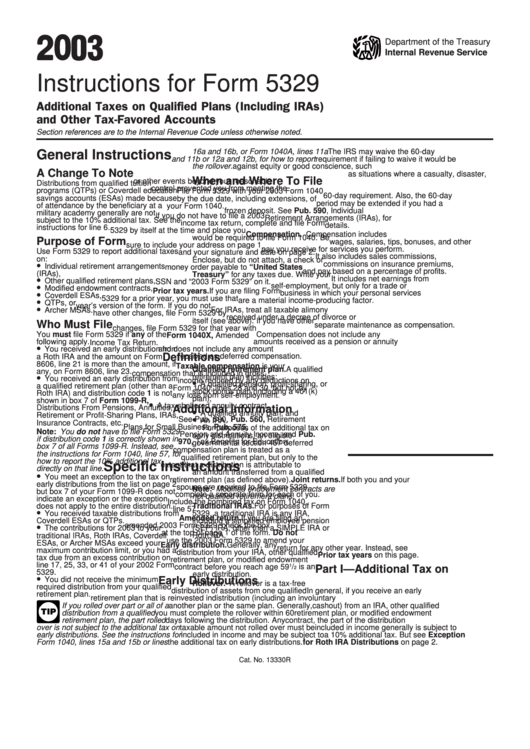

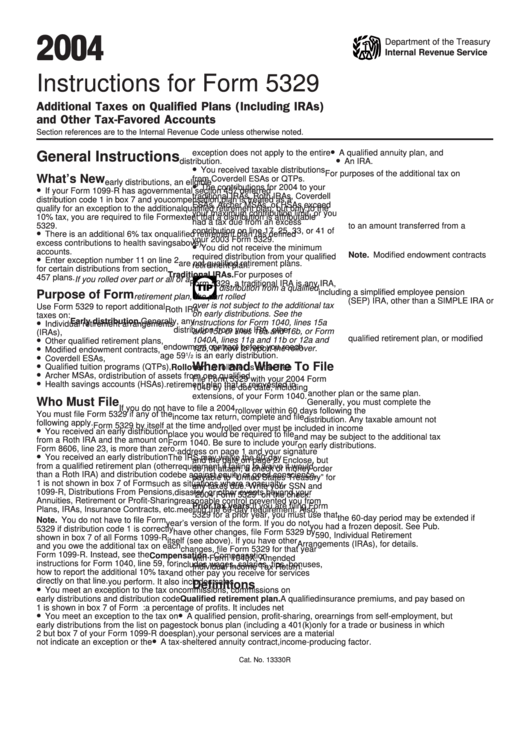

Instructions For Form 5329 Additional Taxes On Qualified Plans And

When and where to file. United states (english) united states (spanish). Web “2020 form 5329” on the check. Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, hsas, or able.

Form 8855 Fill Online, Printable, Fillable, Blank PDFfiller

You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. I do not have/need those forms? File form 5329 with your 2022 form 1040, 1040. United states (english) united states (spanish). Web name of individual subject to additional tax married filing jointly 5329 form use a form 5329 t template to make your.

Instructions For Form 5329 Additional Taxes Attributable To Iras

Web use form 5329 to report additional taxes on: File form 5329 with your 2022 form 1040, 1040. I do not have/need those forms? Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, hsas, or able. Irs form 5329 (attach to form 1040) this form only applies if you reported excess contributions.

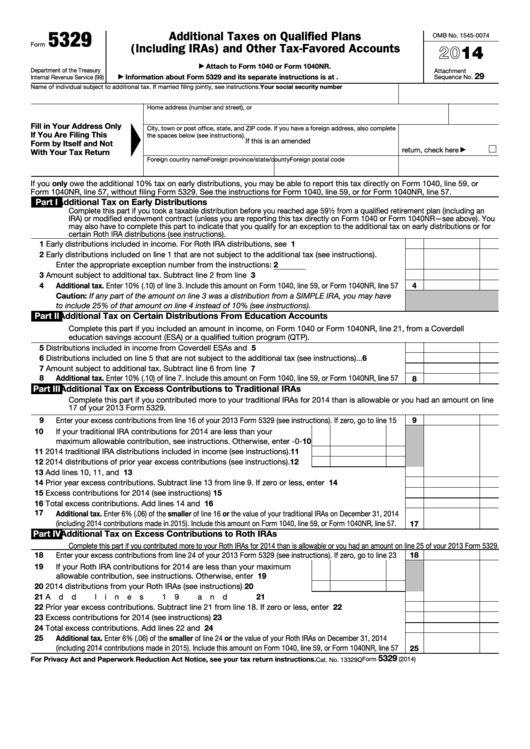

Fillable Form 5329 Additional Taxes On Qualified Plans (Including

Web use form 5329 to report additional taxes on: File form 5329 with your 2022 form 1040, 1040. Irs form 5329 (attach to form 1040) this form only applies if you reported excess contributions. I do not have/need those forms? You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years.

Instructions For Form 5329 2016 printable pdf download

Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. Web use form 5329 to report additional taxes on: You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Web “2020 form 5329” on the check. Web name of individual.

Instructions For Form 5329 Additional Taxes On Qualified Plans And

Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. Irs form 5329 (attach to form 1040) this form only applies if you reported excess contributions. I do not have/need those forms? You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. File form 5329 with your 2022.

Fill Free fillable Form 5329 2019 Additional Taxes on Qualified Plans

Irs form 5329 (attach to form 1040) this form only applies if you reported excess contributions. Web name of individual subject to additional tax married filing jointly 5329 form use a form 5329 t template to make your document workflow more streamlined. I do not have/need those forms? Web use form 5329 to report additional taxes on: Web “2020 form.

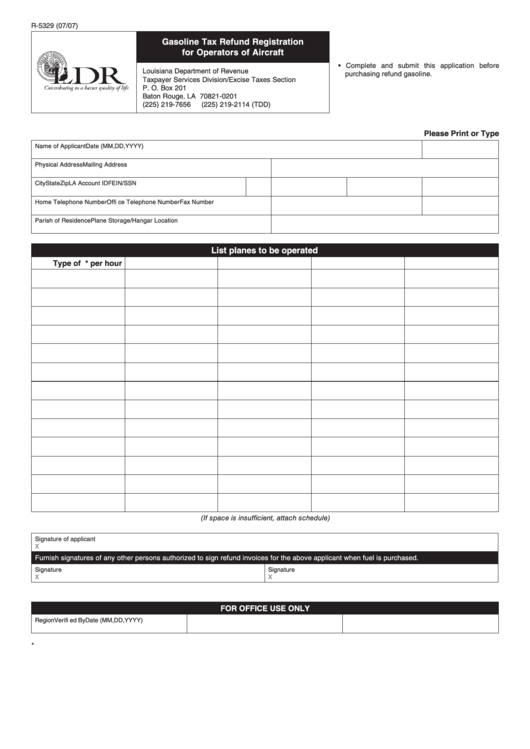

Form R5329 Gasoline Tax Refund Registration For Operators Of

Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, hsas, or able. Web use form 5329 to report additional taxes on: United states (english) united states (spanish). Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries. Web “2020 form 5329” on the.

2.3.32 Command Code MFTRA Internal Revenue Service

I do not have/need those forms? When and where to file. If married, you must complete separate form 8889 for each spouse’s hsa. Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, hsas, or able. You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years.

2013 Form 5329 Edit, Fill, Sign Online Handypdf

I do not have/need those forms? Web on september 7, 2022, you withdrew $800, the entire balance in the roth ira. United states (english) united states (spanish). Web use form 5329 to report additional taxes on: You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years.

When And Where To File.

Iras, other qualified retirement plans, modified endowment contracts, coverdell esas, qtps, archer msas, hsas, or able. I do not have/need those forms? Web “2020 form 5329” on the check. Web name of individual subject to additional tax married filing jointly 5329 form use a form 5329 t template to make your document workflow more streamlined.

Web On September 7, 2022, You Withdrew $800, The Entire Balance In The Roth Ira.

You must file form 5329 for 2020 and 2021 to pay the additional taxes for those years. Irs form 5329 (attach to form 1040) this form only applies if you reported excess contributions. File form 5329 with your 2022 form 1040, 1040. If married, you must complete separate form 8889 for each spouse’s hsa.

Web Use Form 5329 To Report Additional Taxes On:

United states (english) united states (spanish). Web the table below explains exceptions to form 5329, additional tax on early distributions, to assist you with entering this information in proseries.