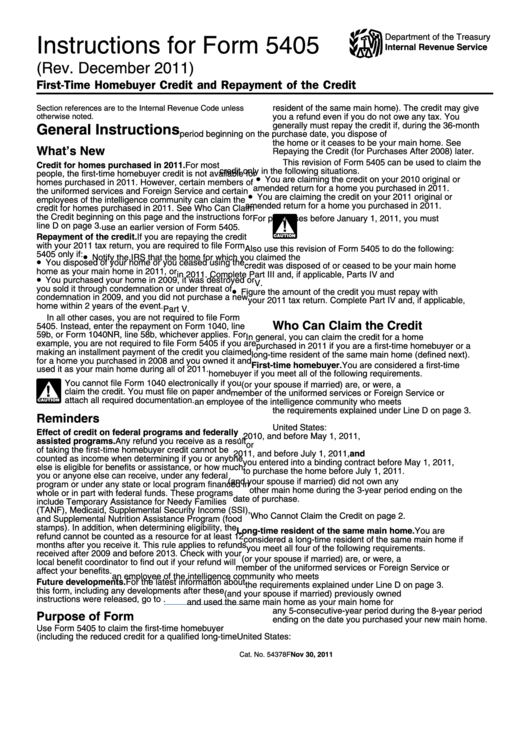

5405 Form Instructions

5405 Form Instructions - Web the instructions for form 540, line 77, and get form ftb 3514, or go to ftb.ca.gov and search for fytc. Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2014. If you file form 540, form 540nr, or form. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. Web you may qualify if you earned less than $50,954 ($56,844 if married filing jointly) and have qualifying children or you have no qualifying children and you earned less. Web farmers and fishermen are required to make one estimate payment. Use form 5405 to do the following: Web per the irs instructions for form 5405: Complete this part only if your home was destroyed or you.

You must file form 5405 if you sell your home, gain money from the sale, and meet certain other. Web farmers and fishermen are required to make one estimate payment. Get ready for tax season deadlines by completing any required tax forms today. Complete this part only if your home was destroyed or you. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 5405 pdf rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★. Save or instantly send your ready documents. Web department of the treasury instructions for form 5405 internal revenue service (rev. Web if you are filing joint return for 2022 with the deceased taxpayer, see instructions. Web per the irs instructions for form 5405: Easily fill out pdf blank, edit, and sign them.

If you file form 540, form 540nr, or form. Web if you are filing joint return for 2020 with the deceased taxpayer, see instructions. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 5405 pdf rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★. Web per the irs instructions for form 5405: Web complete form 5405 instructions online with us legal forms. Web department of the treasury instructions for form 5405 internal revenue service (rev. Complete, edit or print tax forms instantly. You must file form 5405 if you sell your home, gain money from the sale, and meet certain other. Web form 5405 needs to be completed in the year the home is disposed of or ceases to be the main home. Get ready for tax season deadlines by completing any required tax forms today.

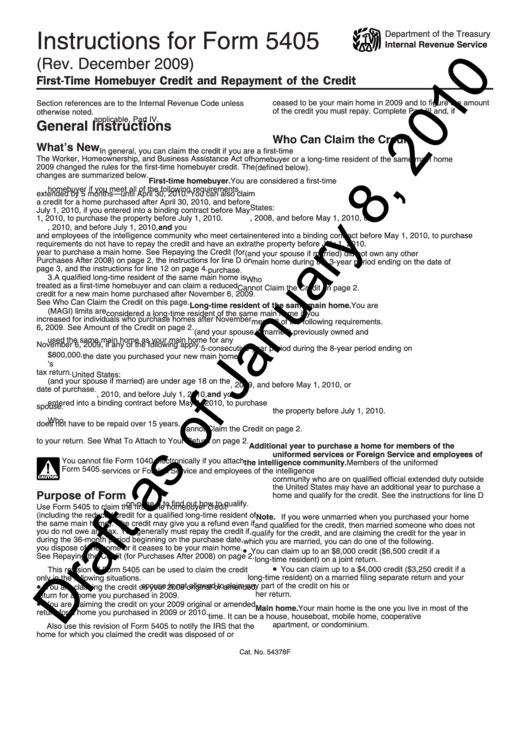

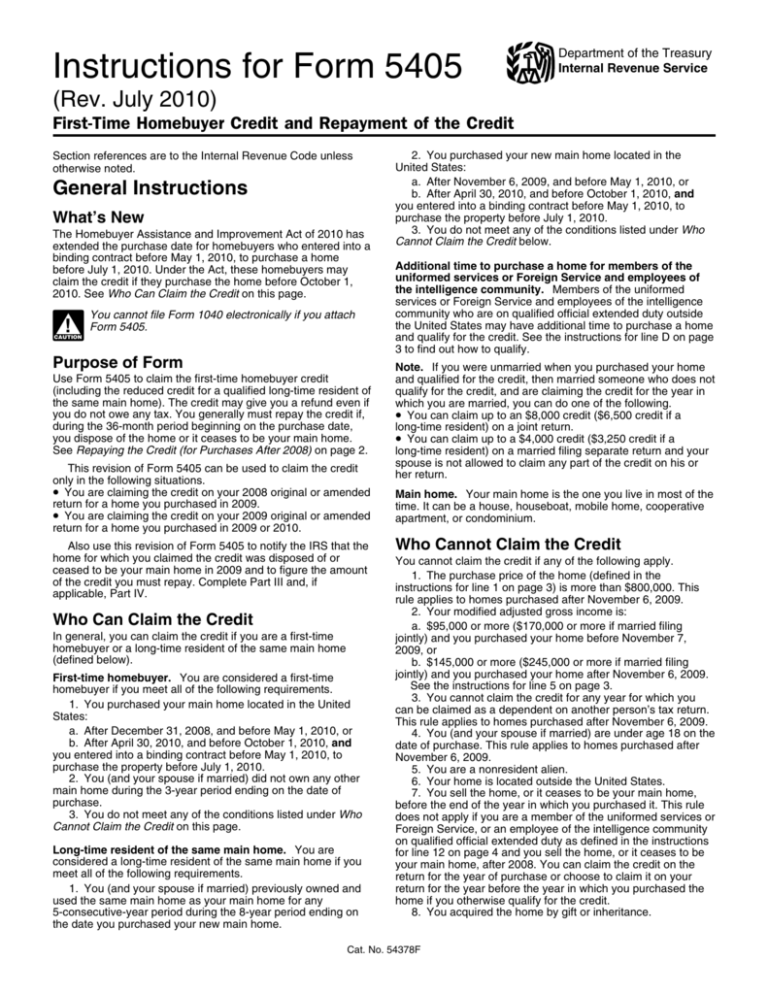

Instruction 5405 (Rev. July 2010)

Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. Web complete form 5405 instructions online with us legal forms. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions. In an effort to stimulate the economy, the.

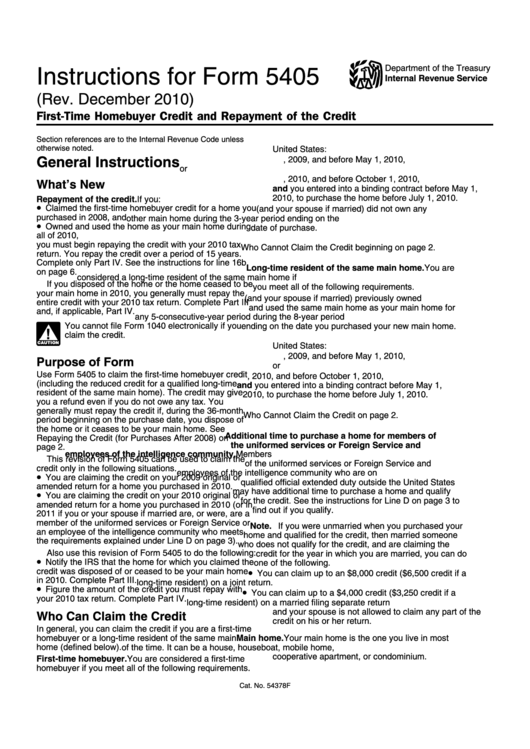

Draft Instructions For Form 5405 FirstTime Homebuyer Credit And

Web complete form 5405 instructions online with us legal forms. Use form 5405 to do the following: Web if you are filing joint return for 2020 with the deceased taxpayer, see instructions. Easily fill out pdf blank, edit, and sign them. Web the instructions for form 540, line 77, and get form ftb 3514, or go to ftb.ca.gov and search.

Form 540 Ca amulette

Use form 5405 to do the following: Easily fill out pdf blank, edit, and sign them. Complete this part only if your home was destroyed or you. Web department of the treasury instructions for form 5405 internal revenue service (rev. Save or instantly send your ready documents.

Form 5405 Edit, Fill, Sign Online Handypdf

Web complete form 5405 instructions online with us legal forms. Web farmers and fishermen are required to make one estimate payment. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 5405 pdf rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★.

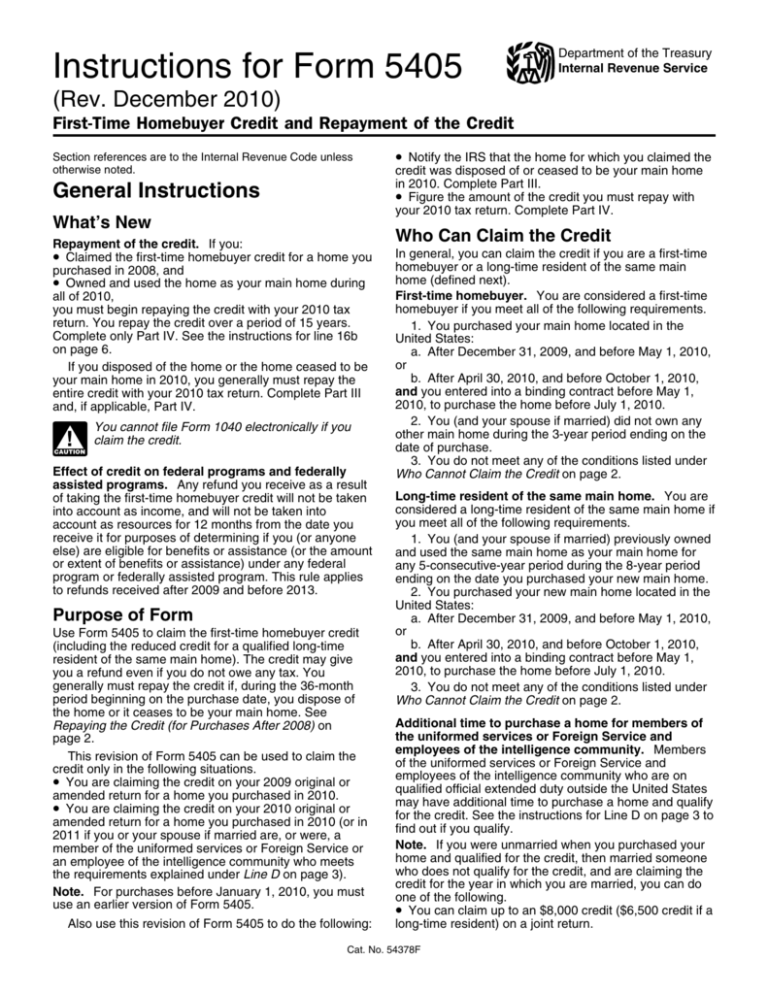

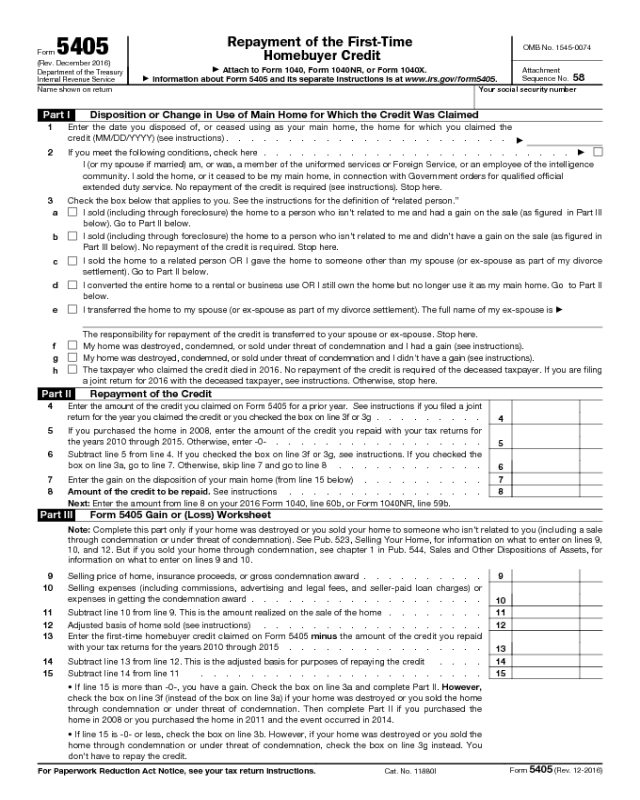

Form 5405 FirstTime Homebuyer Credit and Repayment of the Credit

If you file form 540, form 540nr, or form. Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. You must file form 5405 if you sell your home, gain money from the sale, and meet certain other. Easily fill out pdf blank, edit, and sign them. In an effort to stimulate the.

Form 5405 FirstTime Homebuyer Credit

Complete this part only if your home was destroyed or you. Web form 5405 needs to be completed in the year the home is disposed of or ceases to be the main home. You must file form 5405 if you sell your home, gain money from the sale, and meet certain other. Sign it in a few clicks draw your.

Instructions For Form 5405 FirstTime Homebuyer Credit And Repayment

Web the instructions for form 540, line 77, and get form ftb 3514, or go to ftb.ca.gov and search for fytc. Sign it in a few clicks draw your signature, type it,. Web complete form 5405 instructions online with us legal forms. In an effort to stimulate the economy, the federal government. For calendar year taxpayers, the due date is.

Instructions For Form 5405 2009 printable pdf download

Get ready for tax season deadlines by completing any required tax forms today. Web you may qualify if you earned less than $50,954 ($56,844 if married filing jointly) and have qualifying children or you have no qualifying children and you earned less. In an effort to stimulate the economy, the federal government. Web complete form 5405 instructions online with us.

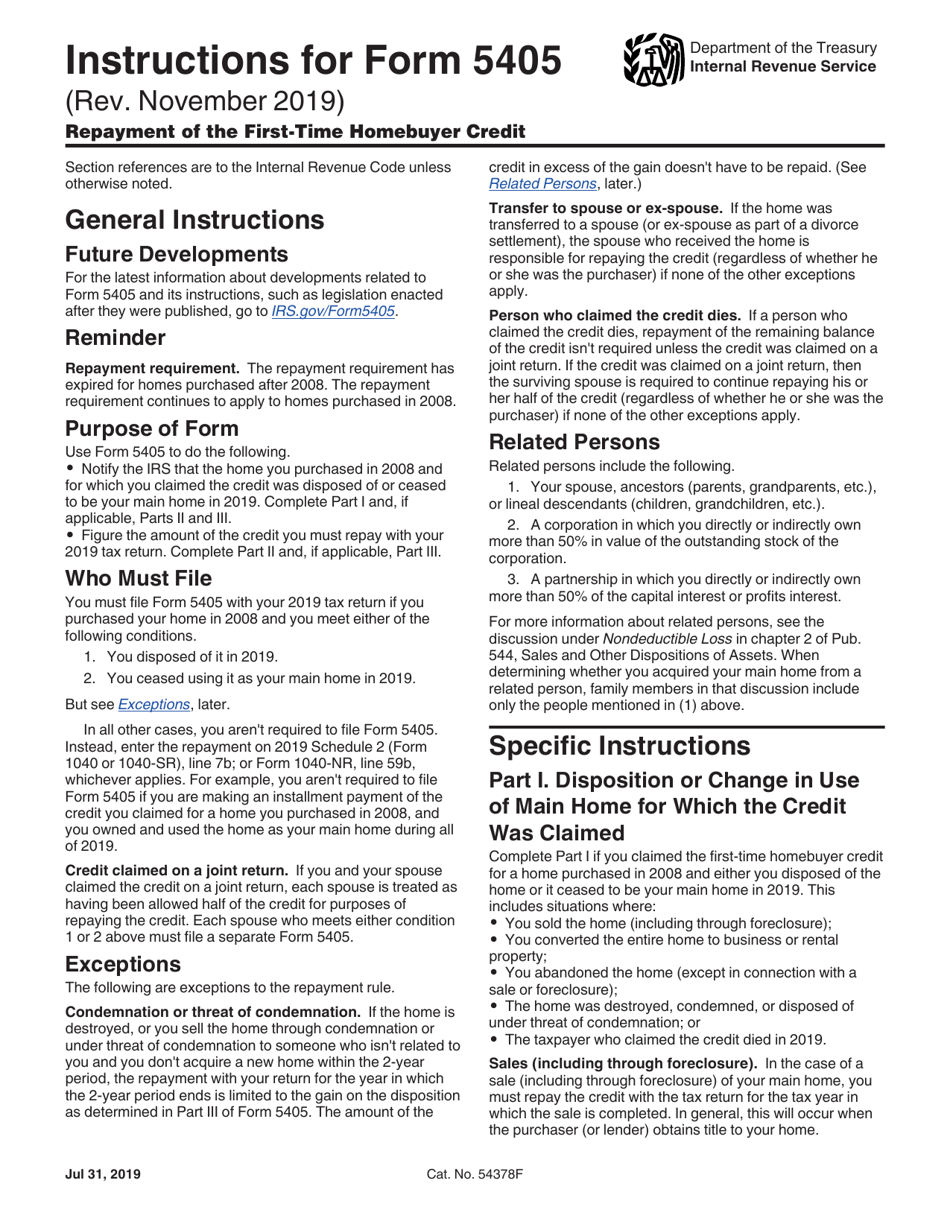

Download Instructions for IRS Form 5405 Repayment of the FirstTime

Web department of the treasury instructions for form 5405 internal revenue service (rev. Edit your form 5405 online type text, add images, blackout confidential details, add comments, highlights and more. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save form 5405 pdf rating ★ ★ ★.

5405 Form Instructions

Complete this part only if your home was destroyed or you. Web form 5405 needs to be completed in the year the home is disposed of or ceases to be the main home. Web to claim the homebuyer's tax credit for 2010, you will need to file irs form 5405. Save or instantly send your ready documents. Get ready for.

Web Form 5405 Needs To Be Completed In The Year The Home Is Disposed Of Or Ceases To Be The Main Home.

Web if you are filing joint return for 2020 with the deceased taxpayer, see instructions. You must file form 5405 if you sell your home, gain money from the sale, and meet certain other. In the case of a sale, including through foreclosure, this is the year in which. You must file form 5405 with your 2022 tax return if you purchased your home in 2008 and you meet either of the following conditions.

Sign It In A Few Clicks Draw Your Signature, Type It,.

Notify the irs that the home for which you claimed the credit was disposed of or ceased to be your main home in 2014. Easily fill out pdf blank, edit, and sign them. December 2011) department of the treasury internal revenue service. Web you may qualify if you earned less than $50,954 ($56,844 if married filing jointly) and have qualifying children or you have no qualifying children and you earned less.

Web How It Works Open Form Follow The Instructions Easily Sign The Form With Your Finger Send Filled & Signed Form Or Save Form 5405 Pdf Rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★.

Complete this part only if your home was destroyed or you. Web per the irs instructions for form 5405: Get ready for tax season deadlines by completing any required tax forms today. Web complete form 5405 instructions online with us legal forms.

Save Or Instantly Send Your Ready Documents.

Complete this part only if your home was destroyed or you. Use form 5405 to do the following: November 2022) department of the treasury internal revenue service. Web farmers and fishermen are required to make one estimate payment.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-23at12.21.54PM-9f1fd40798a54df0b41b2473e3541290.png)