592-B Form

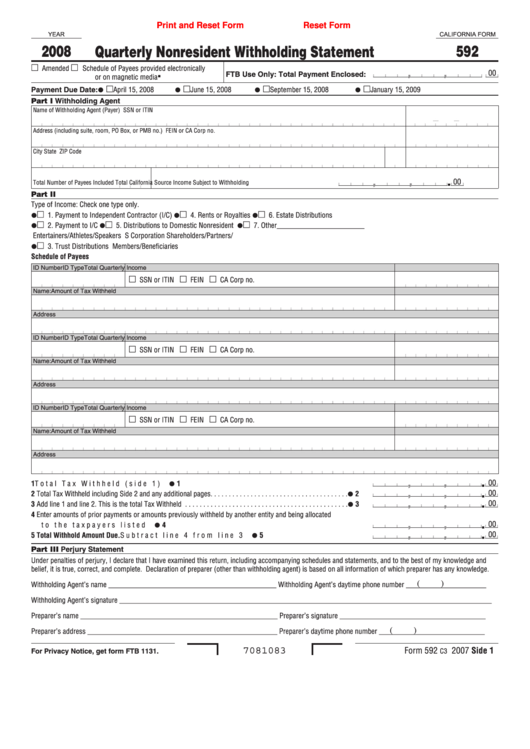

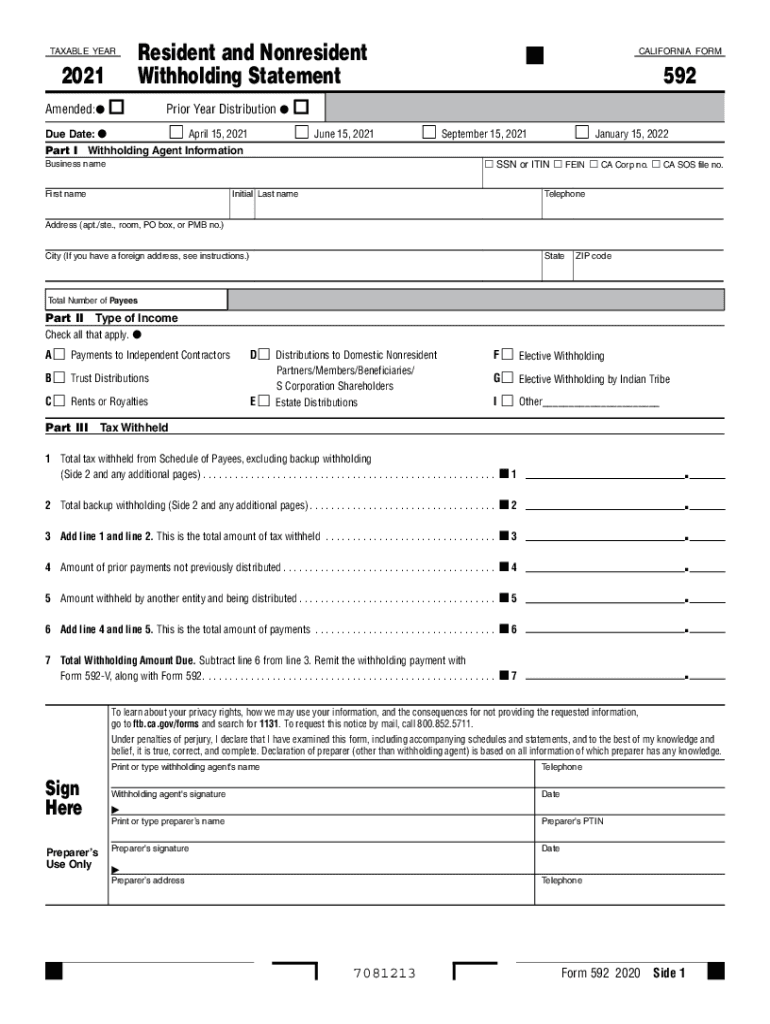

592-B Form - For more information go to ftb.ca.gov and Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, etc. Web file form 592 to report withholding on domestic nonresident individuals. I was able to enter total california tax withheld for both the federal and california returns, but i am not sure where to enter total income subject to withholding on the federal return. With their state tax return. We assess a penalty for failure to file complete, correct, and timely information returns. This form can be provided to the payee electronically. Instead, you withheld an amount to help pay taxes when you do your california return. Do not use form 592 if: Go to the california > california individual (form 540/540nr) > general worksheet.

Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, etc. Web 2022 ca form 592, resident and nonresident withholding statement. 2022, form 592, resident and nonresident withholding statement keywords: For more information go to ftb.ca.gov and I was able to enter total california tax withheld for both the federal and california returns, but i am not sure where to enter total income subject to withholding on the federal return. You are reporting withholding as a pass through entity. Do not use form 592 if: Resident and nonresident withholding statement created date: This form can be provided to the payee electronically. We assess a penalty for failure to file complete, correct, and timely information returns.

For more information go to ftb.ca.gov and Instead, you withheld an amount to help pay taxes when you do your california return. You are reporting withholding as a pass through entity. We assess a penalty for failure to file complete, correct, and timely information returns. Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, etc. Web 2022 form 592 resident and nonresident withholding statement author: Resident and nonresident withholding statement created date: Do not use form 592 if: 2022, form 592, resident and nonresident withholding statement keywords: This form can be provided to the payee electronically.

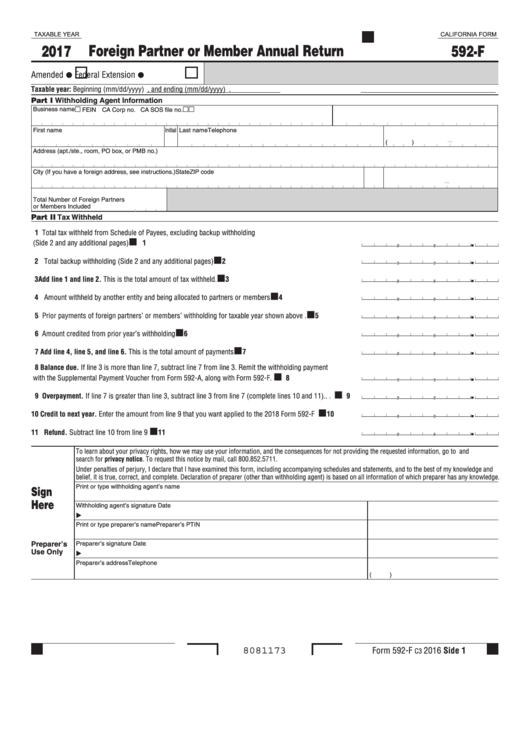

Fillable California Form 592F Foreign Partner Or Member Annual

Do not use form 592 if: Resident and nonresident withholding statement created date: 2022, form 592, resident and nonresident withholding statement keywords: You are reporting withholding as a pass through entity. Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, etc.

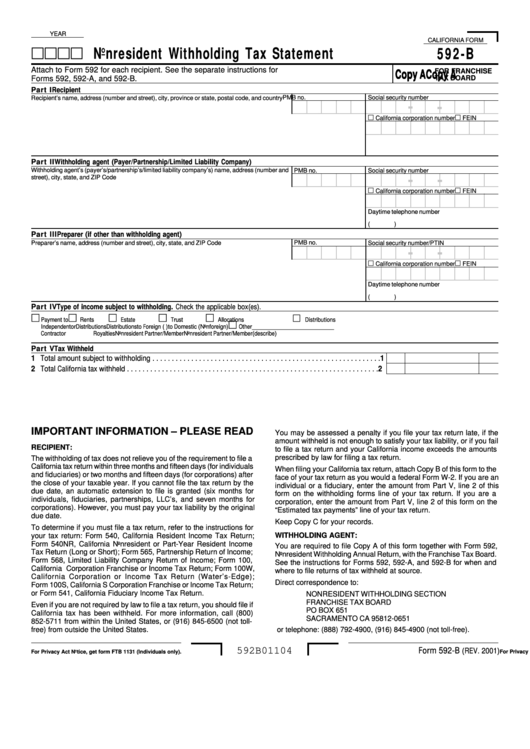

Form 592B Nonresident Withholding Tax Statement 2001 printable pdf

Go to the california > california individual (form 540/540nr) > general worksheet. 2022, form 592, resident and nonresident withholding statement keywords: I was able to enter total california tax withheld for both the federal and california returns, but i am not sure where to enter total income subject to withholding on the federal return. With their state tax return. Web.

ftb.ca.gov forms 09_592v

Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, etc. 2022, form 592, resident and nonresident withholding statement keywords: Go to the california > california individual (form 540/540nr) > general worksheet. This form can be provided to the payee electronically. Web file form 592 to report withholding on domestic nonresident.

2013 Form CA FTB 592 Fill Online, Printable, Fillable, Blank pdfFiller

Go to the california > california individual (form 540/540nr) > general worksheet. This form can be provided to the payee electronically. Resident and nonresident withholding statement created date: For more information go to ftb.ca.gov and We assess a penalty for failure to file complete, correct, and timely information returns.

Form 592 B ≡ Fill Out Printable PDF Forms Online

Do not use form 592 if: We assess a penalty for failure to file complete, correct, and timely information returns. With their state tax return. For more information go to ftb.ca.gov and Web 2022 form 592 resident and nonresident withholding statement author:

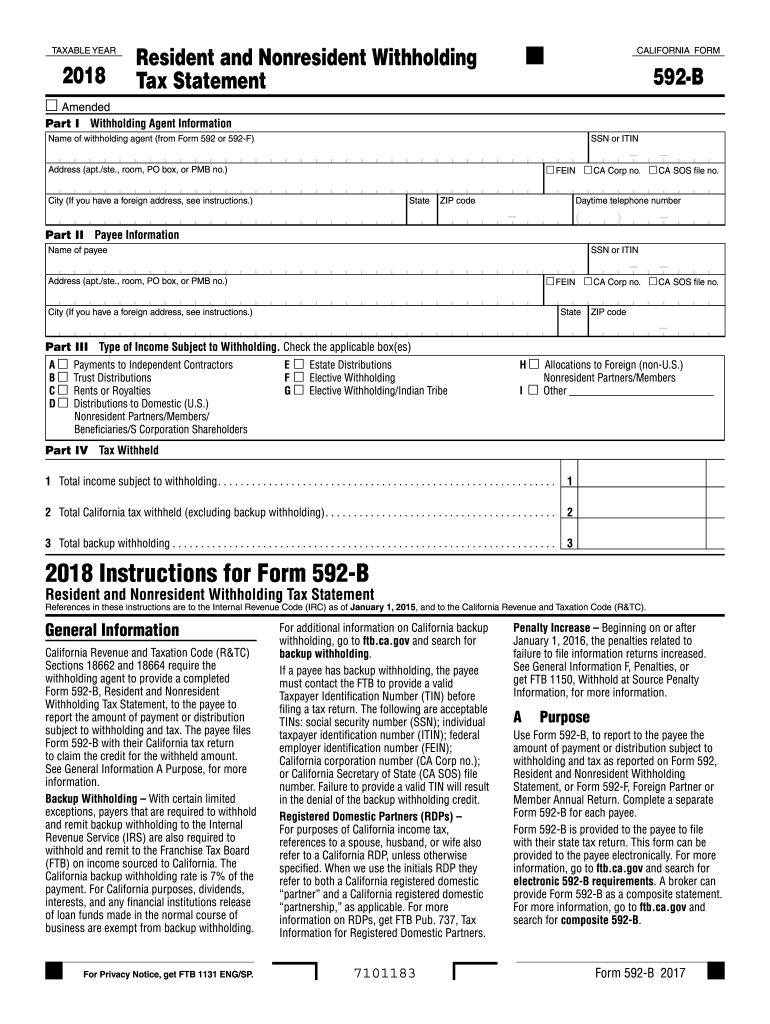

2018 Form CA FTB 592B Fill Online, Printable, Fillable, Blank pdfFiller

For more information go to ftb.ca.gov and We assess a penalty for failure to file complete, correct, and timely information returns. Go to the california > california individual (form 540/540nr) > general worksheet. Web 2022 form 592 resident and nonresident withholding statement author: I was able to enter total california tax withheld for both the federal and california returns, but.

48 Form 592 Templates free to download in PDF

Resident and nonresident withholding statement created date: Web 2022 form 592 resident and nonresident withholding statement author: With their state tax return. We assess a penalty for failure to file complete, correct, and timely information returns. Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, etc.

CA FTB 592 20212022 Fill out Tax Template Online US Legal Forms

2022, form 592, resident and nonresident withholding statement keywords: Go to the california > california individual (form 540/540nr) > general worksheet. I was able to enter total california tax withheld for both the federal and california returns, but i am not sure where to enter total income subject to withholding on the federal return. Web 2022 ca form 592, resident.

ponderorb Pair of earrings in the form of vines, enameled gold mounted

Go to the california > california individual (form 540/540nr) > general worksheet. With their state tax return. Instead, you withheld an amount to help pay taxes when you do your california return. Web 2022 ca form 592, resident and nonresident withholding statement. For more information go to ftb.ca.gov and

592B Form Franchise Tax Board Edit, Fill, Sign Online Handypdf

We assess a penalty for failure to file complete, correct, and timely information returns. You are reporting withholding as a pass through entity. Go to the california > california individual (form 540/540nr) > general worksheet. Do not use form 592 if: 2022, form 592, resident and nonresident withholding statement keywords:

Web 2022 Ca Form 592, Resident And Nonresident Withholding Statement.

Go to the california > california individual (form 540/540nr) > general worksheet. Instead, you withheld an amount to help pay taxes when you do your california return. For more information go to ftb.ca.gov and Web file form 592 to report withholding on domestic nonresident individuals.

2022, Form 592, Resident And Nonresident Withholding Statement Keywords:

Do not use form 592 if: This form can be provided to the payee electronically. Web 2022 form 592 resident and nonresident withholding statement author: We assess a penalty for failure to file complete, correct, and timely information returns.

With Their State Tax Return.

I was able to enter total california tax withheld for both the federal and california returns, but i am not sure where to enter total income subject to withholding on the federal return. Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, etc. Resident and nonresident withholding statement created date: You are reporting withholding as a pass through entity.