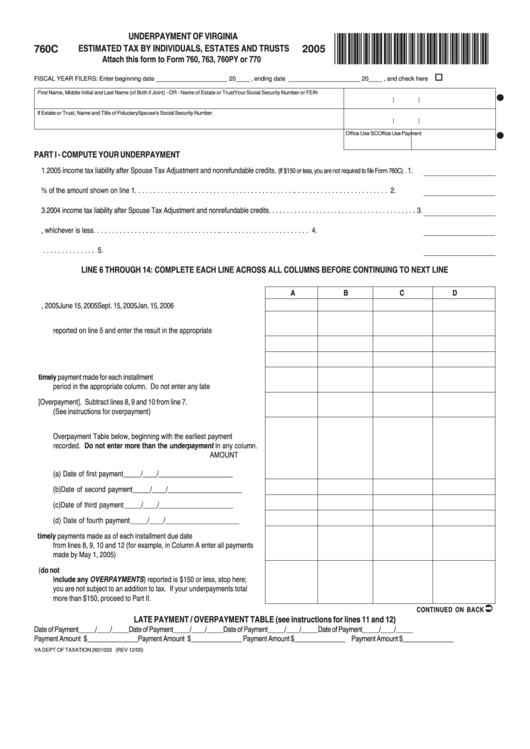

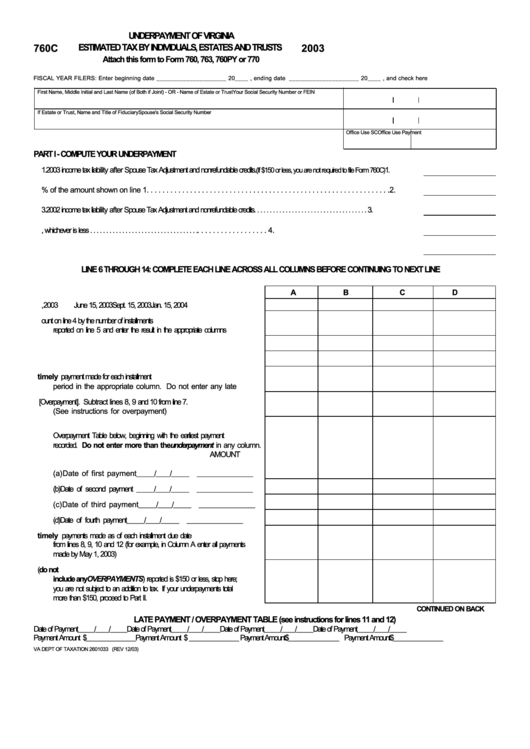

760C Tax Form

760C Tax Form - Web the computation of form 8962 may lead to a change to your tax return. Prior year tax liability must be entered. i have va760cg. Web follow the simple instructions below: With us legal forms the procedure of submitting official. If you meet test 1 but not. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in january 2023, so this is the latest version of form 760c, fully updated for tax year 2022. Web ou filed a form 760, 760py, 763 or 770 income tax return and2.y paid the entire tax due by march 1, 2021. Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax. Send us the following documents: The times of frightening complicated legal and tax documents have ended.

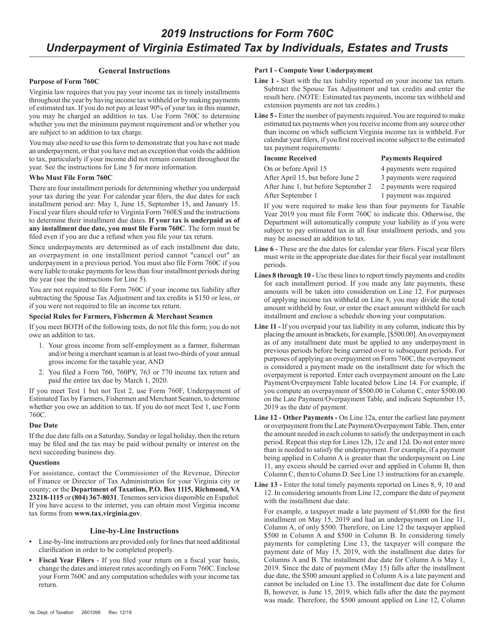

How do i know if i need to complete form 760c?. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web follow the simple instructions below: Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in january 2023, so this is the latest version of form 760c, fully updated for tax year 2022. Web 2020 instructions for form 760c underpayment of virginia estimated tax by individuals, estates and trusts. Web form 760c virginia — underpayment of estimated tax by individuals, estates, and trusts download this form print this form it appears you don't have a pdf plugin for this. With us legal forms the procedure of submitting official. What line (s) are the same on va760cg as line 3 on 760c? Web the computation of form 8962 may lead to a change to your tax return. Test 2, use form 760f, underpayment of.

Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by making payments. Prior year tax liability must be entered. i have va760cg. Cp60 tax year 2016 january 30, 2017 social security. Test 2, use form 760f, underpayment of. 2022 income tax liability after spouse tax adjustment and tax credits. With us legal forms the procedure of submitting official. If you meet test 1 but not. How do i know if i need to complete form 760c?. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web the computation of form 8962 may lead to a change to your tax return.

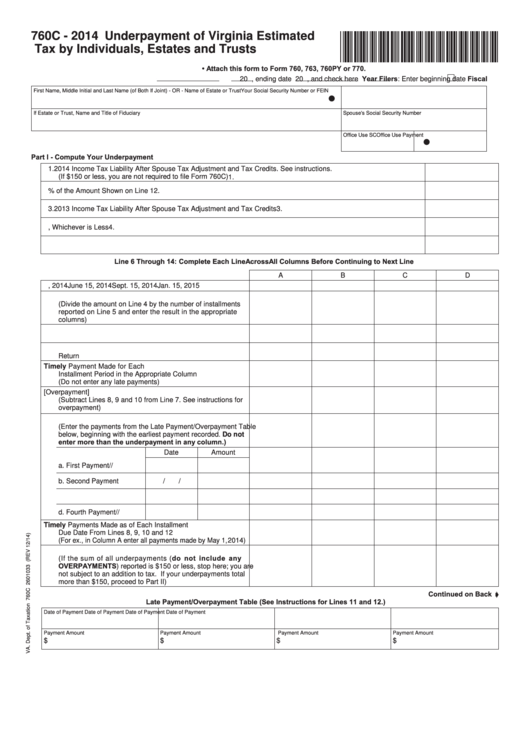

Form 760c Underpayment Of Virginia Estimated Tax By Individuals

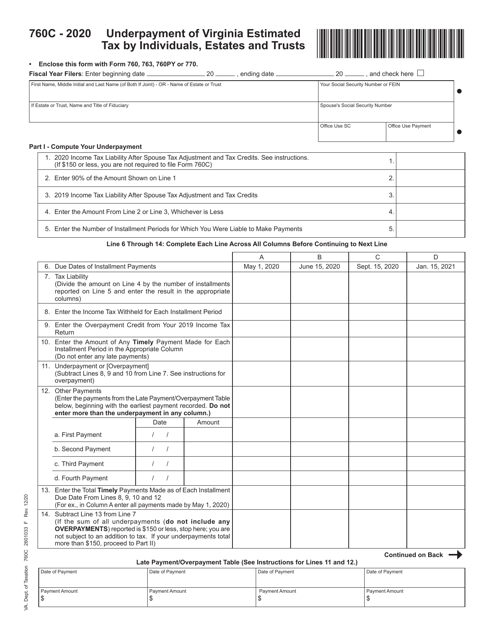

2022 income tax liability after spouse tax adjustment and tax credits. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in january 2023, so this is the latest version of form 760c, fully updated for tax year 2022. With us legal forms the procedure of submitting official. Web 2020 instructions for form 760c underpayment of.

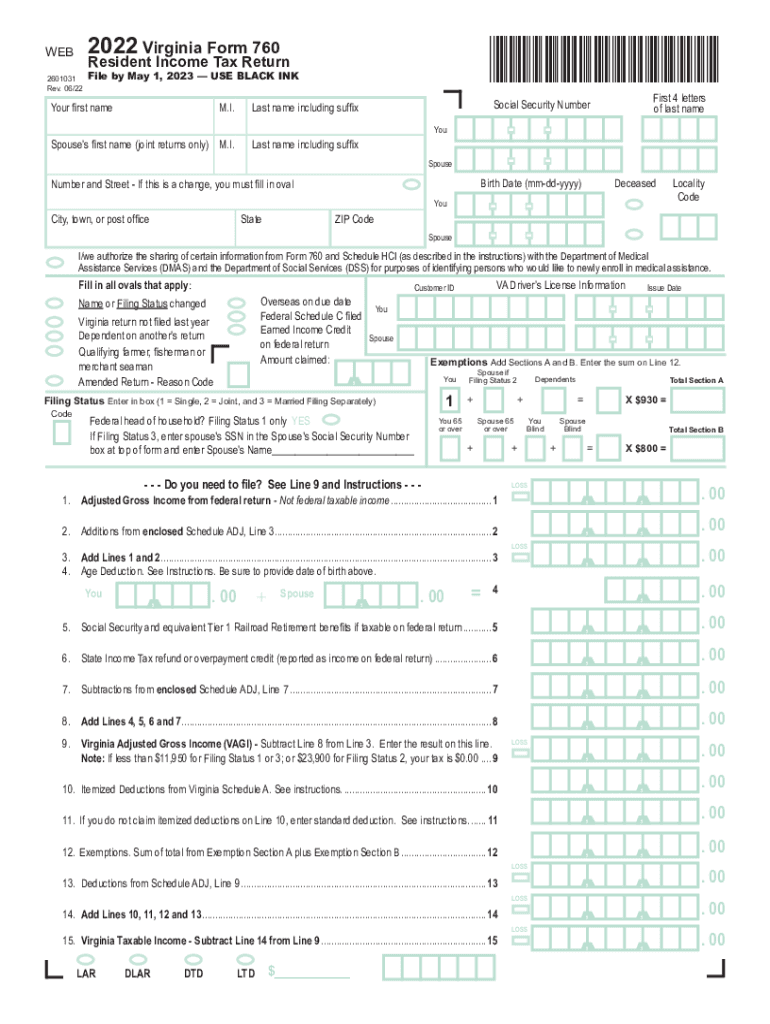

2022 Form VA DoT 760 Fill Online, Printable, Fillable, Blank pdfFiller

Web the computation of form 8962 may lead to a change to your tax return. How do i know if i need to complete form 760c?. Web follow the simple instructions below: Web ou filed a form 760, 760py, 763 or 770 income tax return and2.y paid the entire tax due by march 1, 2021. Web 2020 instructions for form.

760cg Fill Online, Printable, Fillable, Blank pdfFiller

If you meet test 1 but not. What is form 760c virginia? What line (s) are the same on va760cg as line 3 on 760c? Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by making payments. How do i know if i.

Fill Free fillable Form 1. *VA760C120888* 760C 2020 Underpayment

Test 2, use form 760f, underpayment of. With us legal forms the procedure of submitting official. Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by making payments. 2022 income tax liability after spouse tax adjustment and tax credits. Web form 760c virginia.

2022 Form VA 760C Fill Online, Printable, Fillable, Blank pdfFiller

California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Prior year tax liability must be entered. i have va760cg. Send us the following documents: Cp60 tax year 2016 january 30, 2017 social security. Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to.

Fillable Form 760c Underpayment Of Virginia Estimated Tax By

Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax. Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by making payments. 2022 income tax liability.

Spouse Tax Adjustment Worksheet

What is form 760c virginia? Web 2020 instructions for form 760c underpayment of virginia estimated tax by individuals, estates and trusts. (if $150 or less, you are not required to file. Web form 760c virginia — underpayment of estimated tax by individuals, estates, and trusts download this form print this form it appears you don't have a pdf plugin for.

Form 760c Underpayment Of Virginia Estimated Tax By Individuals

Web follow the simple instructions below: Web form 760c virginia — underpayment of estimated tax by individuals, estates, and trusts download this form print this form it appears you don't have a pdf plugin for this. California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Web if you owe more than $150 to the state of virginia.

Download Instructions for Form 760C Underpayment of Virginia Estimated

If you meet test 1 but not. With us legal forms the procedure of submitting official. What line (s) are the same on va760cg as line 3 on 760c? Send us the following documents: What is form 760c virginia?

Where do i find my 2021 tax liability after spouse tax

If you meet test 1 but not. What is form 760c virginia? Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax. Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in january 2023, so this is the.

Web The Computation Of Form 8962 May Lead To A Change To Your Tax Return.

With us legal forms the procedure of submitting official. How do i know if i need to complete form 760c?. Web follow the simple instructions below: Web if you owe more than $150 to the state of virginia at the end of the tax year, you may be subject to pay underestimated tax.

What Line (S) Are The Same On Va760Cg As Line 3 On 760C?

Web we last updated the underpayment of estimated tax by individuals, estates, and trusts in january 2023, so this is the latest version of form 760c, fully updated for tax year 2022. Test 2, use form 760f, underpayment of. Web purpose of form 760c virginia law requires that you pay your income tax in timely installments throughout the year by having income tax withheld or by making payments. Web 2020 instructions for form 760c underpayment of virginia estimated tax by individuals, estates and trusts.

The Times Of Frightening Complicated Legal And Tax Documents Have Ended.

Web ou filed a form 760, 760py, 763 or 770 income tax return and2.y paid the entire tax due by march 1, 2021. (if $150 or less, you are not required to file. Web form 760c virginia — underpayment of estimated tax by individuals, estates, and trusts download this form print this form it appears you don't have a pdf plugin for this. Cp60 tax year 2016 january 30, 2017 social security.

Prior Year Tax Liability Must Be Entered. I Have Va760Cg.

If you meet test 1 but not. What is form 760c virginia? California, connecticut, district of columbia, louisiana, maryland, pennsylvania, rhode island, west virginia. Send us the following documents: