8300 Form Rules

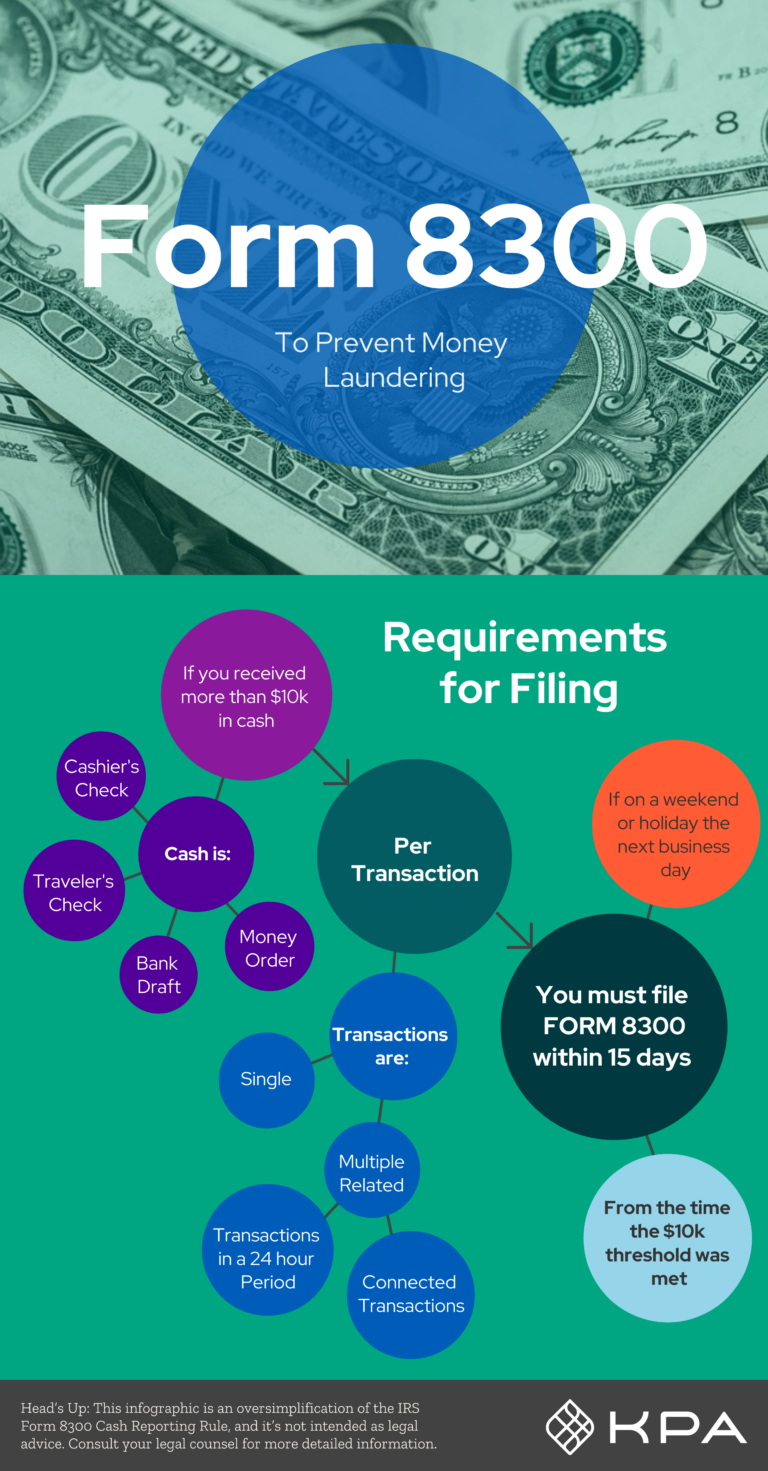

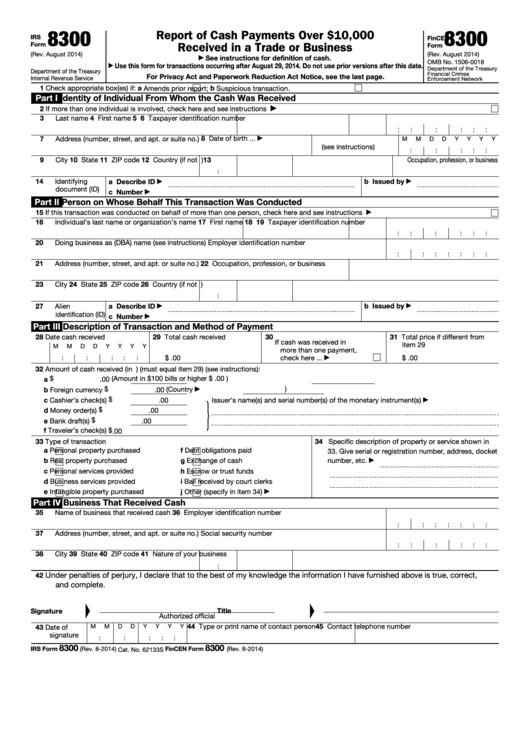

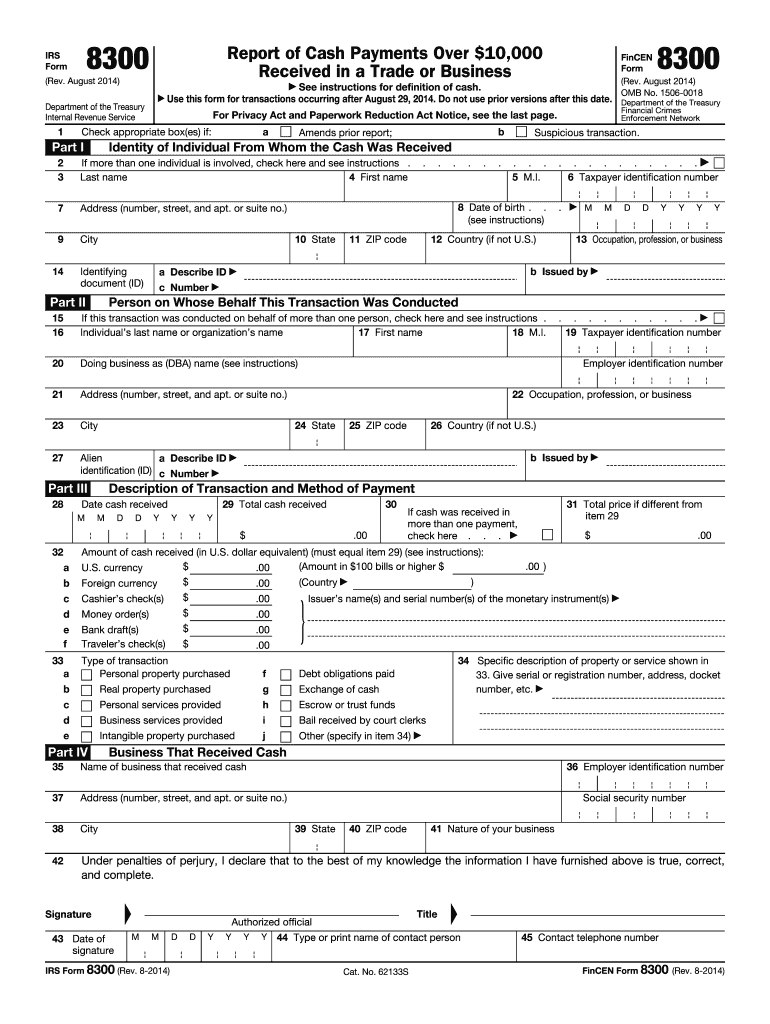

8300 Form Rules - Web your auto dealership should be using an 8300 form to report cash payments over $10,000 to the irs. As of july 1, 2022, form 5300 applications must be submitted electronically through pay.gov. Web a trade or business that receives more than $10,000 in related transactions must file form 8300. Transactions that require form 8300 include, but are not limited to: Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. When you’re running an auto dealership, you have a lot on your. Web applications may be submitted as of june 1, 2022, electronically via pay.gov. When filing electronically, it is important to know that completing only fields designated as. Each person engaged in a trade or business who, in the course. Web you must file form 8300 within 15 days after the date the cash transaction occurred.

Web if you or your business has received a cash payment of over $10,000, the federal law requires that you file form 8300 within a span of 15 days after receiving the. Web once a business receives more than $10,000 in cash, as defined, form 8300 must be filed within 15 days. Web a clerk of a criminal court must file a form 8300 when cash bail of more than $10,000 is paid for an individual that was arrested for: Web a trade or business that receives more than $10,000 in related transactions must file form 8300. When you’re running an auto dealership, you have a lot on your. When filing electronically, it is important to know that completing only fields designated as. Web form 8300, report of cash payments over $10,000 received in a trade or business. The reporting obligation cannot be avoided by separating a. If purchases are more than 24 hours apart and not connected in any way. Transactions that require form 8300 include, but are not limited to:

Web if you or your business has received a cash payment of over $10,000, the federal law requires that you file form 8300 within a span of 15 days after receiving the. It is voluntary but highly encouraged. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more. Web for transactions under the reporting threshold, you can file form 8300, if the transaction appears suspicious. Web a person must file form 8300 if they receive cash of more than $10,000 from the same payer or agent: Web a trade or business that receives more than $10,000 in related transactions must file form 8300. Web you must file form 8300 within 15 days after the date the cash transaction occurred. Web applications may be submitted as of june 1, 2022, electronically via pay.gov. Web once a business receives more than $10,000 in cash, as defined, form 8300 must be filed within 15 days. Form 8300 is a document filed with the irs when an individual or an entity receives a cash payment of over $10,000.

IRS Form 8300 Reporting Cash Sales Over 10,000

If purchases are more than 24 hours apart and not connected in any way. Web generally, form 8300 must be filed with the irs by the 15th day after the date the cash is received. Web transaction that is reportable on form 8300 or on fincen report 112, and discloses all the information necessary to complete part ii of form.

Form 8300 Do You Have Another IRS Issue? ACCCE

Web applications may be submitted as of june 1, 2022, electronically via pay.gov. When filing electronically, it is important to know that completing only fields designated as. Web for transactions under the reporting threshold, you can file form 8300, if the transaction appears suspicious. Web once a business receives more than $10,000 in cash, as defined, form 8300 must be.

Form 8300 Cheat Sheet When Should I Report Suspicious Activity? KPA

Web what is form 8300? If purchases are more than 24 hours apart and not connected in any way. Web a person must file form 8300 if they receive cash of more than $10,000 from the same payer or agent: The reporting obligation cannot be avoided by separating a. Web a clerk of a criminal court must file a form.

IRS Form 8300 Info & Requirements for Reporting Cash Payments

Each person engaged in a trade or business who, in the course. Web a trade or business that receives more than $10,000 in related transactions must file form 8300. In two or more related payments within 24 hours. Web once a business receives more than $10,000 in cash, as defined, form 8300 must be filed within 15 days. Web transaction.

Form 8300 Explanation And Reference Guide

Web you must file form 8300 within 15 days after the date the cash transaction occurred. When you’re running an auto dealership, you have a lot on your. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more..

Fillable Form 8300 Report Of Cash Payments Over 10,000 Dollars

In two or more related payments within 24 hours. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more. In the case of related transactions or multiple cash payments which relate to a. Web transaction that is reportable.

Irs 8300 Form Fill Out and Sign Printable PDF Template signNow

Web the help desk is available monday through friday from 8 a.m. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. While the form 8300 instructions mention. Web your auto dealership should be using an 8300.

The IRS Form 8300 and How it Works

Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more. Web once a business receives more than $10,000 in cash, as defined, form 8300 must be filed within 15 days. Web applications may be submitted as of june.

IRS Form 8300 It's Your Yale

Web what is form 8300? Web about form 8300, report of cash payments over $10,000 received in a trade or business. Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. When filing electronically, it is important.

Filing Form 8300 for 2020 YouTube

Each person engaged in a trade or business who, in the course. While the form 8300 instructions mention. Any federal offense involving a controlled. Besides filing form 8300, you also need to provide a written statement to each party. Transactions that require form 8300 include, but are not limited to:

Web A Person Must File Form 8300 If They Receive Cash Of More Than $10,000 From The Same Payer Or Agent:

Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more. Web a clerk of a criminal court must file a form 8300 when cash bail of more than $10,000 is paid for an individual that was arrested for: Web about form 8300, report of cash payments over $10,000 received in a trade or business. Web if you or your business has received a cash payment of over $10,000, the federal law requires that you file form 8300 within a span of 15 days after receiving the.

Web Your Auto Dealership Should Be Using An 8300 Form To Report Cash Payments Over $10,000 To The Irs.

Form 8300 is a document filed with the irs when an individual or an entity receives a cash payment of over $10,000. Web what is form 8300? Web transaction that is reportable on form 8300 or on fincen report 112, and discloses all the information necessary to complete part ii of form 8300 or fincen report 112 to the. As of july 1, 2022, form 5300 applications must be submitted electronically through pay.gov.

The Reporting Obligation Cannot Be Avoided By Separating A.

Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. Web form 8300, report of cash payments over $10,000 received in a trade or business. Web generally, form 8300 must be filed with the irs by the 15th day after the date the cash is received. When filing electronically, it is important to know that completing only fields designated as.

Web For Transactions Under The Reporting Threshold, You Can File Form 8300, If The Transaction Appears Suspicious.

Web each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash in one transaction or in two or more related. In the case of related transactions or multiple cash payments which relate to a. Web you must file form 8300 within 15 days after the date the cash transaction occurred. Web once a business receives more than $10,000 in cash, as defined, form 8300 must be filed within 15 days.