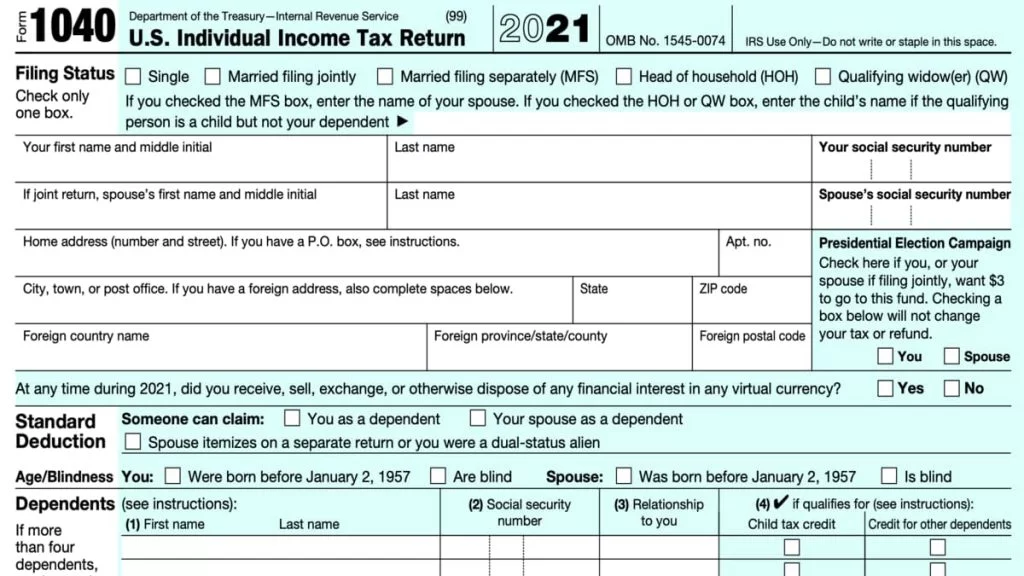

8615 Form Instructions

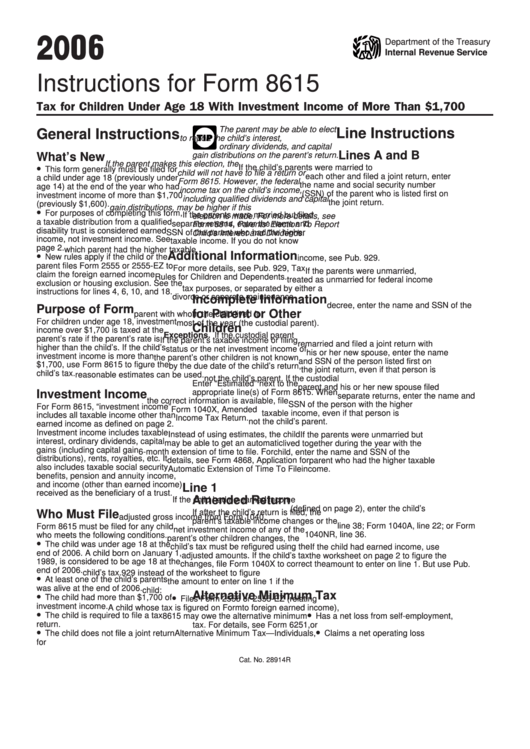

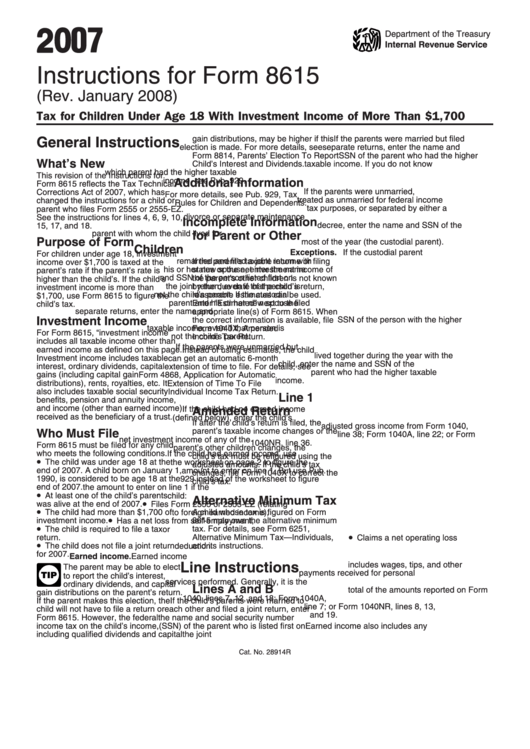

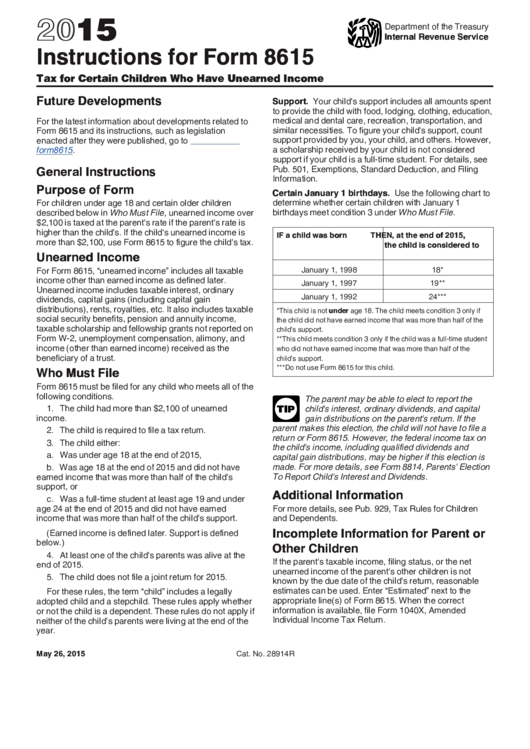

8615 Form Instructions - The government will assume that you were living under the care of a parent and/or. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are older. You are required to file a tax return. Web form 8615 must be filed for any child who meets all of the following conditions: The child had more than $1,100 in unearned income. The child is required to. The child is required to file a tax return. The child is required to file a tax return.

The government will assume that you were living under the care of a parent and/or. The child had more than $2,300 of unearned income. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Form 1040a, line 28, minus any alternative minimum tax; The child had more than $2,200 of unearned income. The child is required to file a tax return. The child is required to file a tax return. The child had more than $2,000 of unearned income. Web per irs instructions for form 8615: Web who must file form 8615 must be filed for any child who meets all of the following conditions.

Form 1040a, line 28, minus any alternative minimum tax; Web the form will not appear because you supported yourself. The child had more than $2,200 of unearned income. Form 8615, tax for certain children who have. Web form 8615 must be filed for any child who meets all of the following conditions. The child had more than $1,100 in unearned income. The child is required to file a tax return. Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. The child is required to file a tax return.

Instructions for IRS Form 8615 Tax for Certain Children Who Have

Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. The child had more than $2,300 of unearned income. The child had more than $2,000 of unearned income. The child had more than $2,200 of unearned income. Web general instructions purpose.

LEGO Bordakh Set 8615 Instructions Brick Owl LEGO Marketplace

Web this article will help resolve the following diagnostic for form 8615, tax for certain children who have unearned income: Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web enter the parent’s tax from form 1040,.

HP OFFICEJET PRO 8615 ALL IN ONE PRINTER in Hounslow, London Gumtree

Web form 8615 must be filed with the child’s tax return if all of the following apply: Purpose of form for children under age 18 and certain older children described below in who must file , unearned income over $2,200. The child had more than $2,300 of unearned income. See who must file, later. Web the form will not appear.

8615 Form 2023

Web the form will not appear because you supported yourself. The child had more than $2,200 of unearned income. Purpose of form for children under age 18 and certain older children described below in who must file , unearned income over $2,200. Web form 8615 must be filed for any child who meets all of the following conditions: The child.

Form 8615 Office Depot

Web enter the parent’s tax from form 1040, line 44; Form 8615, tax for certain children who have. The child had more than $2,200 of unearned income. Purpose of form for children under age 18 and certain older children described below in who must file , unearned income over $2,200. Web form 8615 must be filed for any child who.

Instructions For Form 8615 Tax For Children Under Age 18 With

The child is required to file a tax return. Web form 8615 must be filed for any child who meets all of the following conditions: The child is required to. Web use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. Web general instructions.

Instructions For Form 8615 Tax For Children Under Age 18 With

You had more than $2,300 of unearned income. The child is required to. Web this article will help resolve the following diagnostic for form 8615, tax for certain children who have unearned income: Web who must file form 8615 must be filed for any child who meets all of the following conditions. You are required to file a tax return.

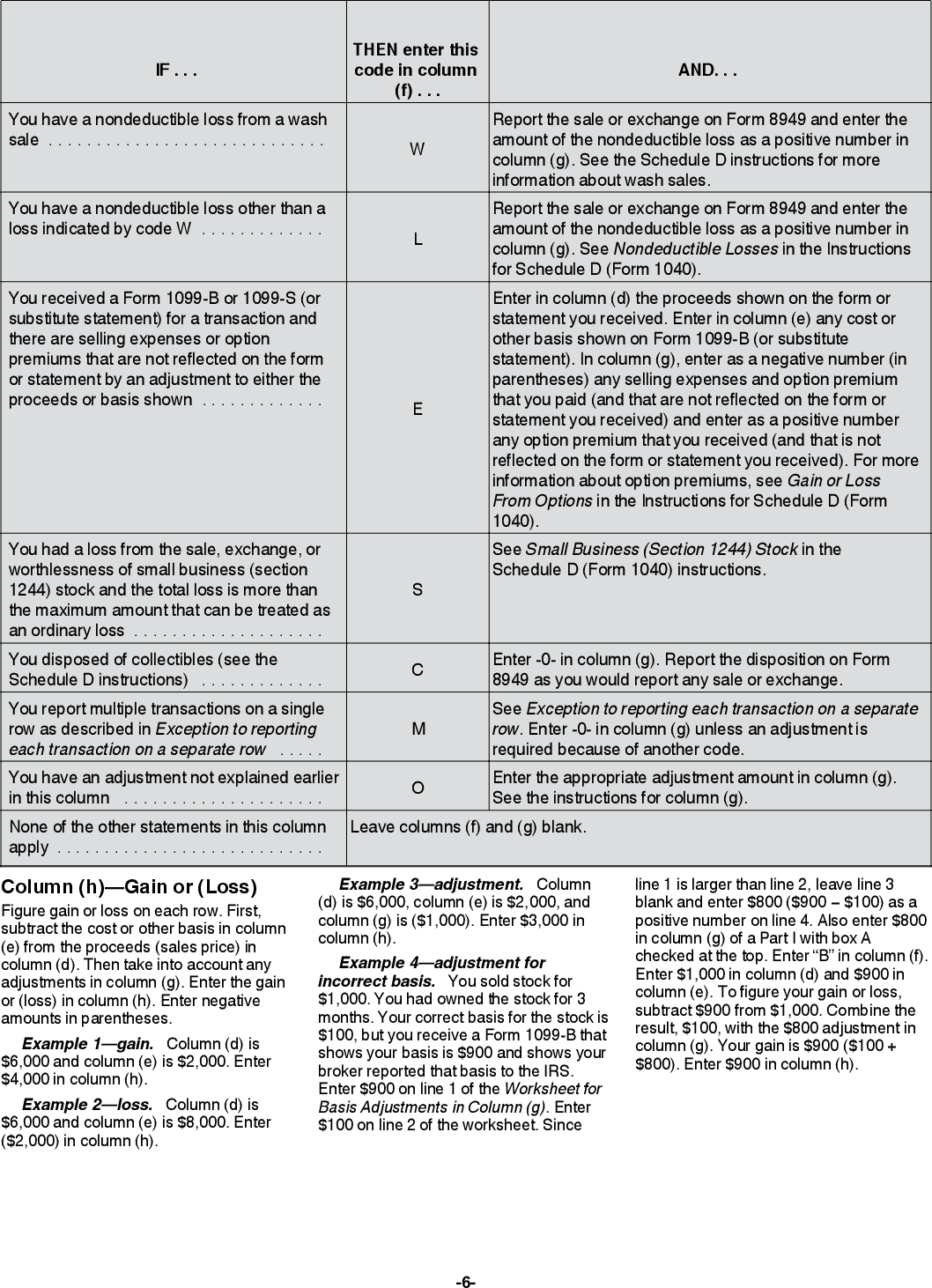

2012 IRS Form 8949 Instructions Images Frompo

The child had more than $2,300 of unearned income. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. You are required to file a tax return. The child is required to. Web form 8615 must be filed.

Form 8615 Instructions (2015) printable pdf download

Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,200 if you are under age 18, and in certain situations if you are older. The child had more than $2,200 of unearned income. The child is required to file a tax return. Web form 8615 must be filed for any child who.

OfficeJet Pro 8615 Printer Ink Cartridges YoYoInk

The child had more than $2,200 of unearned income. Form 8615, tax for certain children who have. Web enter the parent’s tax from form 1040, line 44; The child had more than $2,200 of unearned income. The child had more than $2,000 of unearned income.

The Child Had More Than $2,000 Of Unearned Income.

Web enter the parent’s tax from form 1040, line 44; Purpose of form for children under age 18 and certain older children described below in who must file , unearned income over $2,200. Web general instructions purpose of form use form 8615 to figure your tax on unearned income over $2,100 if you are under age 18, and in certain situations if you are older. The child is required to file a tax return.

Form 1040A, Line 28, Minus Any Alternative Minimum Tax;

You had more than $2,300 of unearned income. The child had more than $1,100 in unearned income. The child is required to file a tax return. The child had more than $2,200 of unearned income.

The Child Is Required To.

The child is required to. See who must file, later. Web who must file form 8615 must be filed for any child who meets all of the following conditions. The government will assume that you were living under the care of a parent and/or.

You Are Required To File A Tax Return.

Web form 8615 department of the treasury internal revenue service (99) tax for certain children who have unearned income a attach only to the child’s form 1040 or form. Web form 8615 must be filed for any child who meets all of the following conditions. The child had more than $2,200 of unearned income. Form 8615, tax for certain children who have.