8814 Tax Form

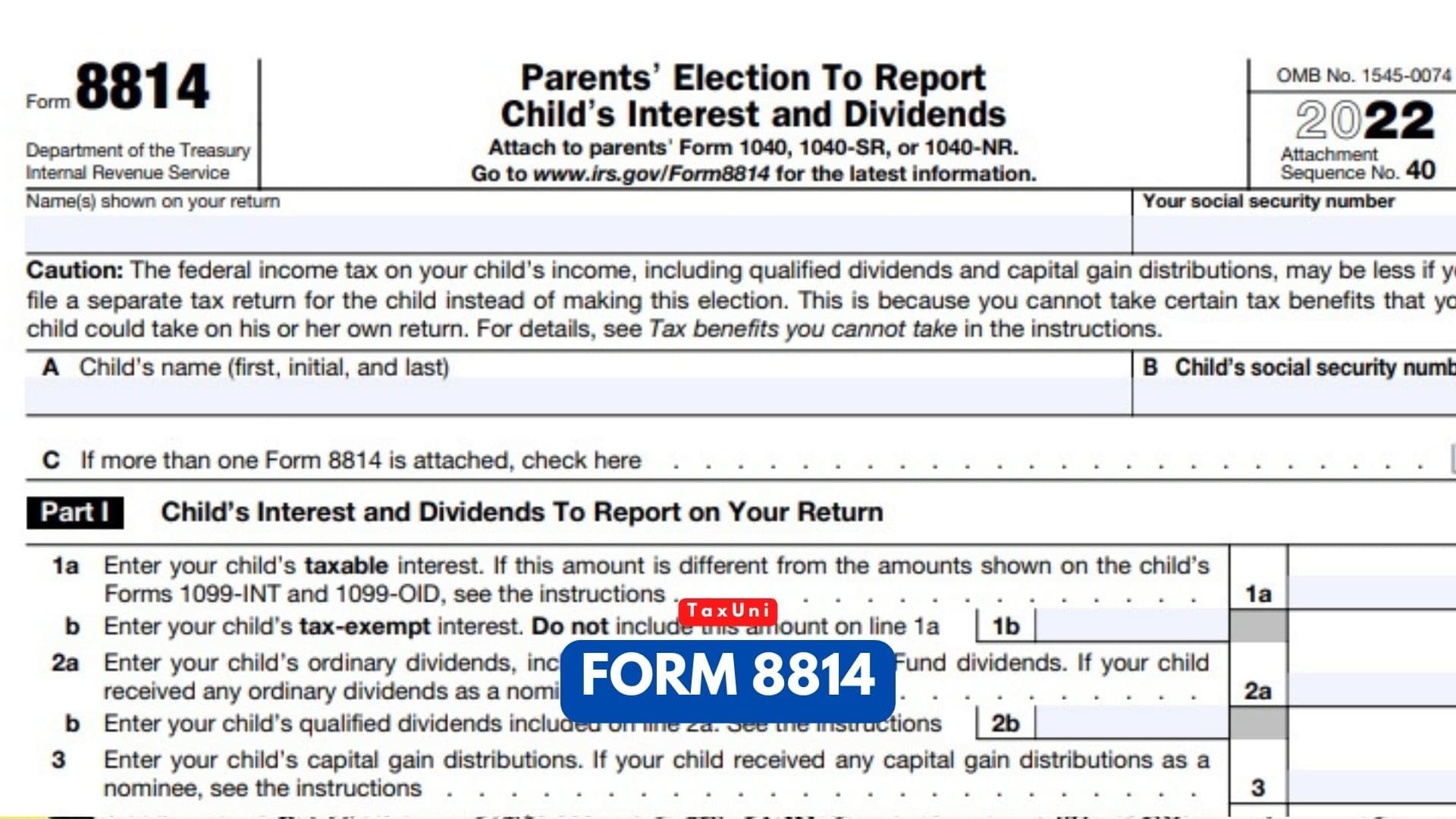

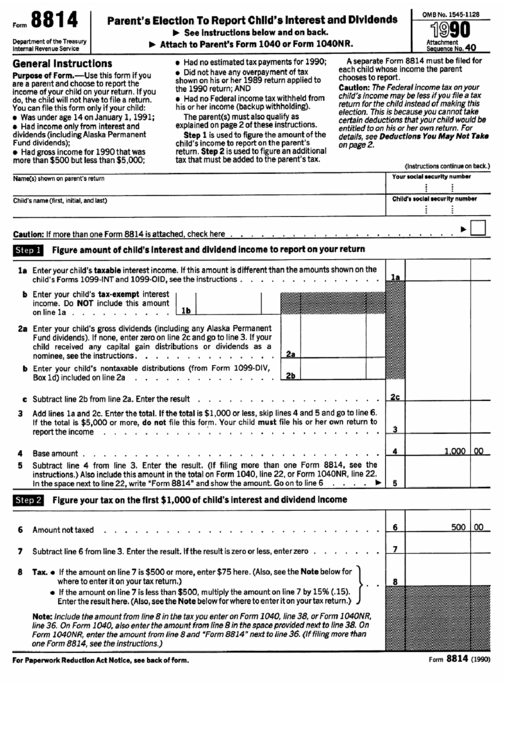

8814 Tax Form - Download this form print this form Web you do that by attaching irs form 8814, which reports your child’s interest income on the parent’s tax return. Types of unearned income in form 8814 this tax may apply to any child who is a dependent and under 19 years old. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. See the form 8938 instructions for details. Web open the irs form 8814 tax table and follow the instructions easily sign the 2021 8814 with your finger send filled & signed 8814 or save rate the 2022 8814 4.8 satisfied 32 votes what makes the irs form 8814 tax table legally binding? C had no estimated tax payments for 1994. If income is reported on a parent's return, the child doesn't have to file a return. Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of the return. Web separate form 8814 must be filed for each child whose income you choose to report.

Web if you file form 8814 with your income tax return to report your child’s foreign financial account, you have an interest in the assets from that account and may be required to file form 8938, statement of specified foreign financial assets. Parents use form 8814 to report their child’s income on their return, so their child will not have to file a. See the form 8938 instructions for details. Web you do that by attaching irs form 8814, which reports your child’s interest income on the parent’s tax return. Web open the irs form 8814 tax table and follow the instructions easily sign the 2021 8814 with your finger send filled & signed 8814 or save rate the 2022 8814 4.8 satisfied 32 votes what makes the irs form 8814 tax table legally binding? The two rules that follow may affect the tax on the unearned income of certain children. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Download this form print this form Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of the return. Types of unearned income in form 8814 this tax may apply to any child who is a dependent and under 19 years old.

Web if you file form 8814 with your income tax return to report your child’s foreign financial account, you have an interest in the assets from that account and may be required to file form 8938, statement of specified foreign financial assets. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. Web federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't have a pdf plugin for this browser. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. If income is reported on a parent's return, the child doesn't have to file a return. Types of unearned income in form 8814 this tax may apply to any child who is a dependent and under 19 years old. Download this form print this form Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of the return. The two rules that follow may affect the tax on the unearned income of certain children. C had no estimated tax payments for 1994.

8814 Form 2023

This form is for income earned in tax year 2022, with tax returns due in april 2023. Parents use form 8814 to report their child’s income on their return, so their child will not have to file a. Types of unearned income in form 8814 this tax may apply to any child who is a dependent and under 19 years.

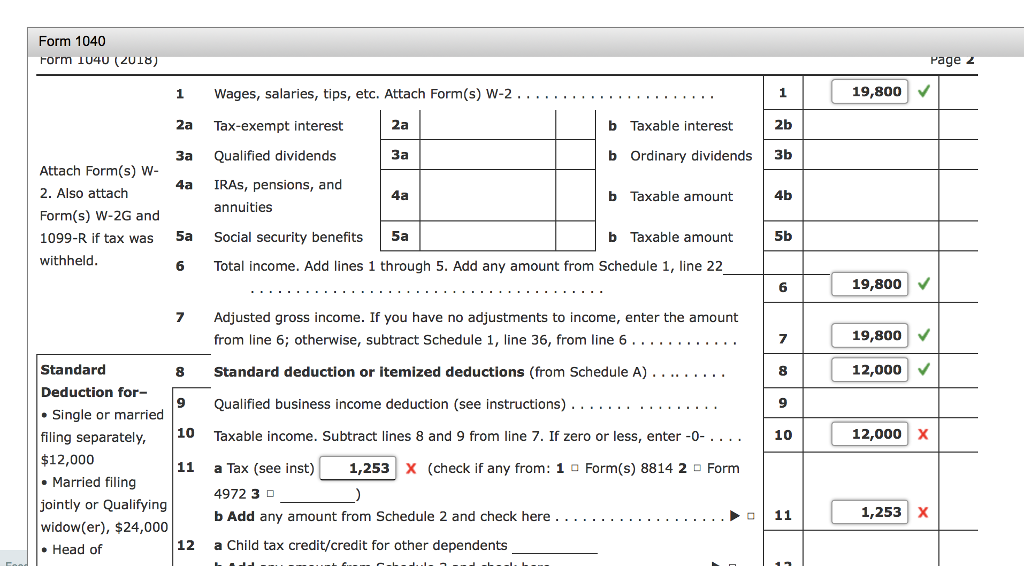

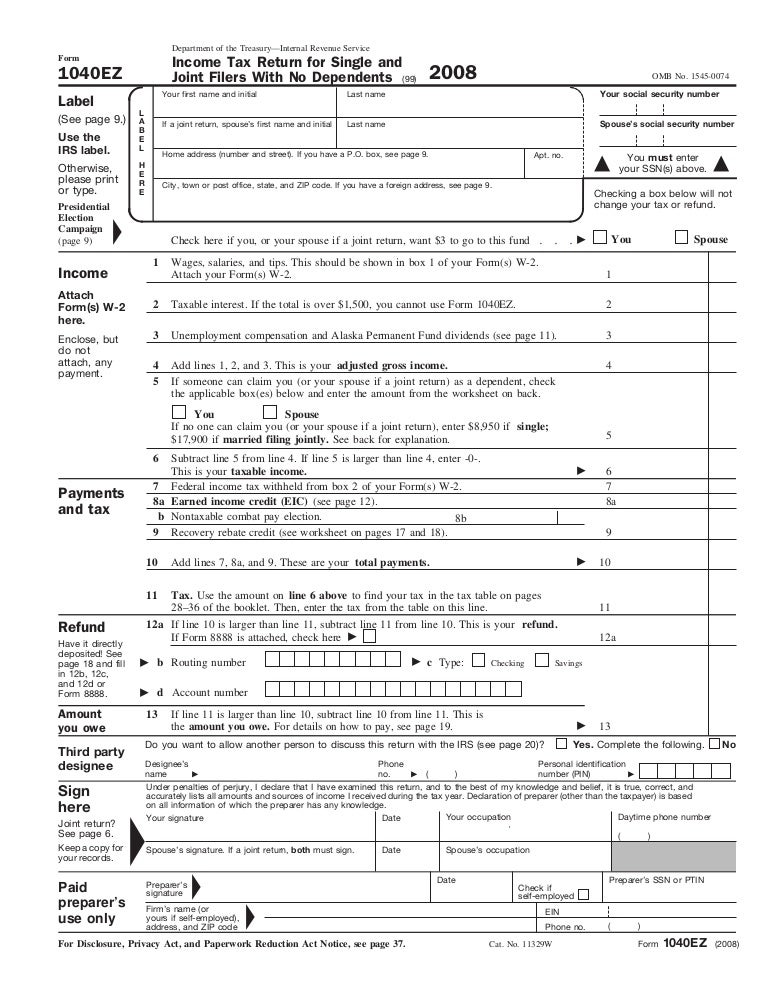

Solved Form 1040 Complete Patty's Form 1040 Form Department

C had no estimated tax payments for 1994. See the form 8938 instructions for details. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. Purpose of form.—use this form if you elect to report your child’s income on your return. If income is reported on a parent's return, the child doesn't have to.

Form 8814 Parent's Election to Report Child's Interest and Dividends

Download this form print this form C had no estimated tax payments for 1994. Web open the irs form 8814 tax table and follow the instructions easily sign the 2021 8814 with your finger send filled & signed 8814 or save rate the 2022 8814 4.8 satisfied 32 votes what makes the irs form 8814 tax table legally binding? Web.

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. C had no estimated tax payments for 1994. Download this form print this form Types of unearned income in form 8814 this tax may apply to any child who is a dependent and under 19 years.

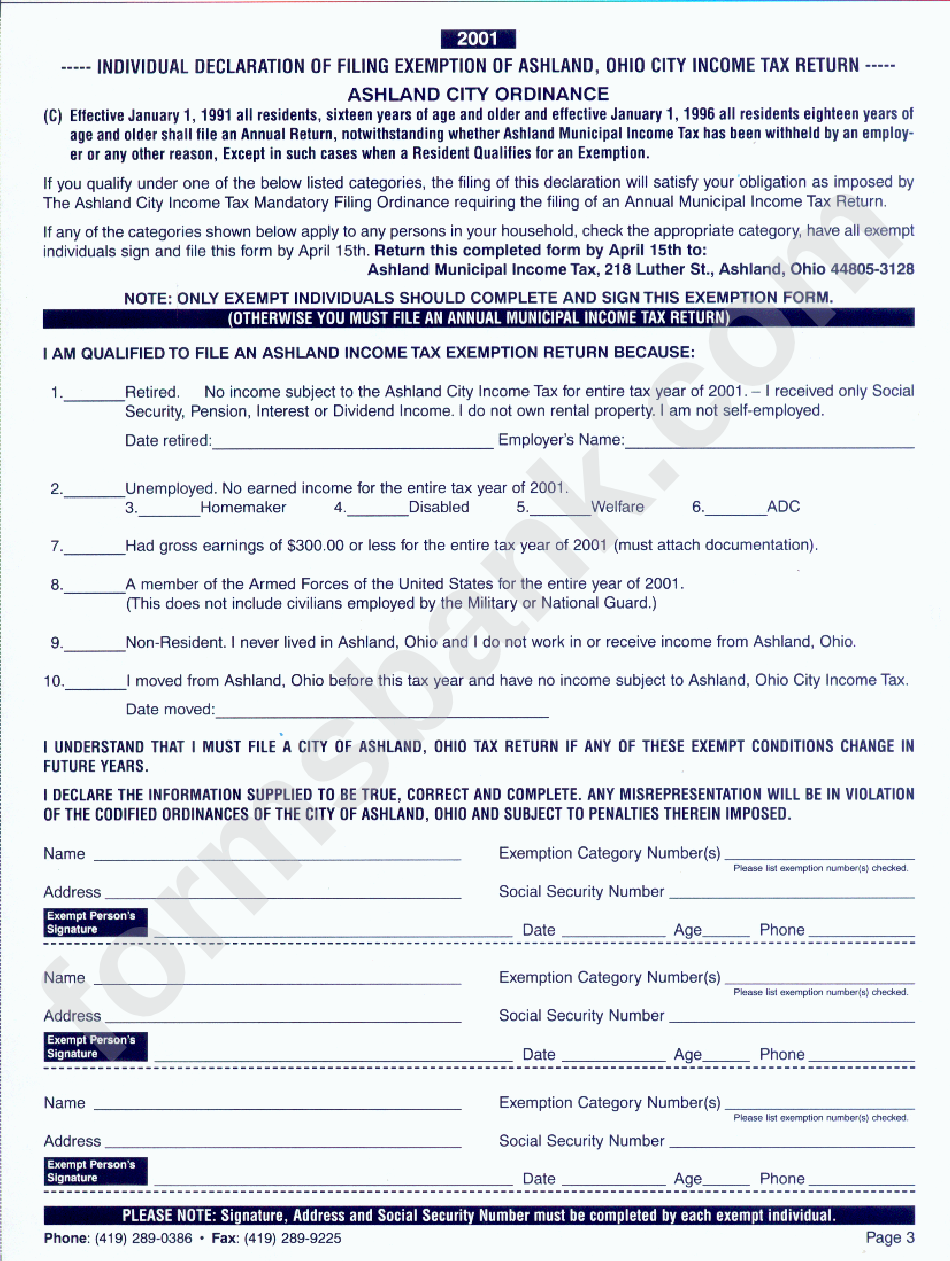

Individual Declaration Of Filing Exemption Of Ashland, Ohio City

Web open the irs form 8814 tax table and follow the instructions easily sign the 2021 8814 with your finger send filled & signed 8814 or save rate the 2022 8814 4.8 satisfied 32 votes what makes the irs form 8814 tax table legally binding? Web you do that by attaching irs form 8814, which reports your child’s interest income.

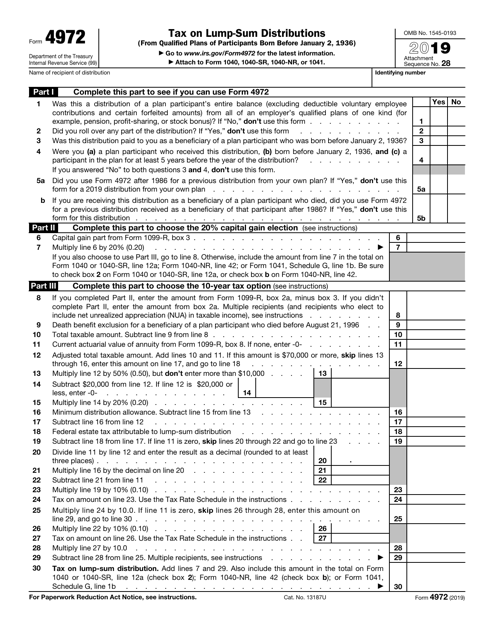

IRS Form 4972 Download Fillable PDF or Fill Online Tax on LumpSum

Download this form print this form We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of the return..

2019 Form IRS 8814 Fill Online, Printable, Fillable, Blank pdfFiller

Download this form print this form This form is for income earned in tax year 2022, with tax returns due in april 2023. Web separate form 8814 must be filed for each child whose income you choose to report. Purpose of form.—use this form if you elect to report your child’s income on your return. If income is reported on.

Breanna Form No 2 For Tax Return

Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of the return. Types of unearned income in form 8814 this tax may apply to any child who is a dependent and under 19 years old. Purpose of form.—use this form if you elect.

Using IRS Form 8814 To Report Your Child's Unearned Silver Tax

Types of unearned income in form 8814 this tax may apply to any child who is a dependent and under 19 years old. If income is reported on a parent's return, the child doesn't have to file a return. We will update this page with a new version of the form for 2024 as soon as it is made available.

Form 8814 Parents' Election To Report Child'S Interest And Dividends

Parents use form 8814 to report their child’s income on their return, so their child will not have to file a. Web you do that by attaching irs form 8814, which reports your child’s interest income on the parent’s tax return. If income is reported on a parent's return, the child doesn't have to file a return. Web open the.

Web You Do That By Attaching Irs Form 8814, Which Reports Your Child’s Interest Income On The Parent’s Tax Return.

General instructions c did not have any overpayment of tax shown on his or her 1993 return applied to the 1994 return. If income is reported on a parent's return, the child doesn't have to file a return. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Web separate form 8814 must be filed for each child whose income you choose to report.

Types Of Unearned Income In Form 8814 This Tax May Apply To Any Child Who Is A Dependent And Under 19 Years Old.

This form is for income earned in tax year 2022, with tax returns due in april 2023. Web open the irs form 8814 tax table and follow the instructions easily sign the 2021 8814 with your finger send filled & signed 8814 or save rate the 2022 8814 4.8 satisfied 32 votes what makes the irs form 8814 tax table legally binding? Per irs publication 929 tax rules for children and dependents, page 9: See the form 8938 instructions for details.

The Two Rules That Follow May Affect The Tax On The Unearned Income Of Certain Children.

C had no estimated tax payments for 1994. Web the choice to file form 8814 with the parents' return or form 8615 with the child's return is one to be made by the preparer of the return. We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. Web if you file form 8814 with your income tax return to report your child’s foreign financial account, you have an interest in the assets from that account and may be required to file form 8938, statement of specified foreign financial assets.

Download This Form Print This Form

Parents use form 8814 to report their child’s income on their return, so their child will not have to file a. Web federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't have a pdf plugin for this browser. Web we last updated federal form 8814 in january 2023 from the federal internal revenue service. Purpose of form.—use this form if you elect to report your child’s income on your return.