943 Form 2020

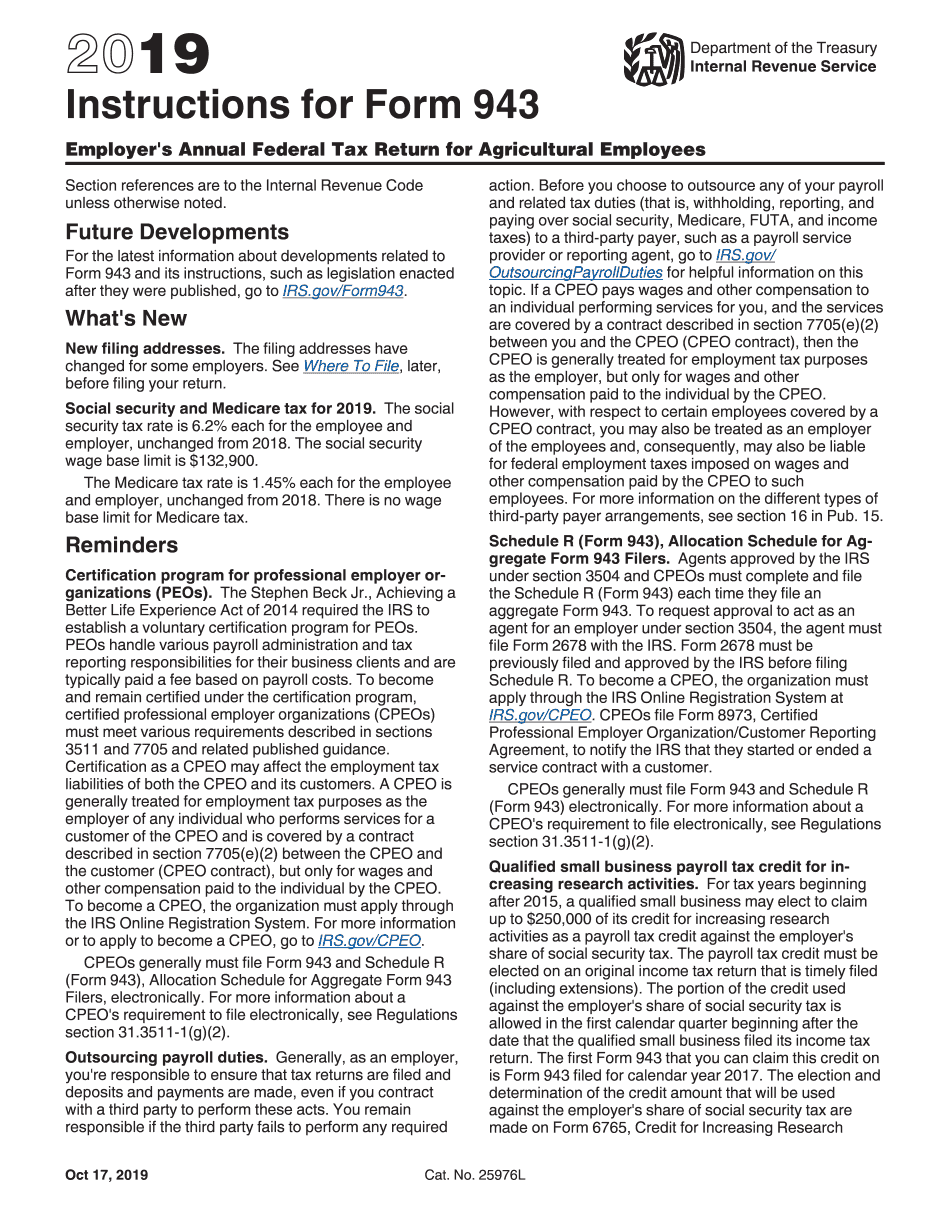

943 Form 2020 - December 2020) agricultural employer’s record of federal tax liability department of the treasury internal revenue service go to www.irs.gov/form943a for. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web see purpose of form 943, earlier, for household employee information. Web october 12, 2020 | tax1099 | 0 comment | 5:46 am. Web 50% of this amount is $20,000 which can now be claimed on the 2020 form 943 filed in january 2021. Use get form or simply click on the template preview to open it in the editor. Try it for free now! Complete, edit or print tax forms instantly. 03 export or print immediately. Web form 943, is the employer’s annual federal tax return for agricultural employees.

Start completing the fillable fields and carefully. December 2020) agricultural employer’s record of federal tax liability department of the treasury internal revenue service go to www.irs.gov/form943a for. Complete irs tax forms online or print government tax documents. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web 50% of this amount is $20,000 which can now be claimed on the 2020 form 943 filed in january 2021. Revision of a currently approved. Form 943 (2020) easily fill out and sign forms download. Use get form or simply click on the template preview to open it in the editor. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. Get your online template and fill it in using.

Get your online template and fill it in using. Use get form or simply click on the template preview to open it in the editor. Complete, edit or print tax forms instantly. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. 01 fill and edit template. 03 export or print immediately. December 2020) agricultural employer’s record of federal tax liability department of the treasury internal revenue service go to www.irs.gov/form943a for. Web mailing addresses for forms 943. Web form 943, is the employer’s annual federal tax return for agricultural employees. For 2021, the rate of social security tax on taxable wages, except for qualified sick leave wages and qualified.

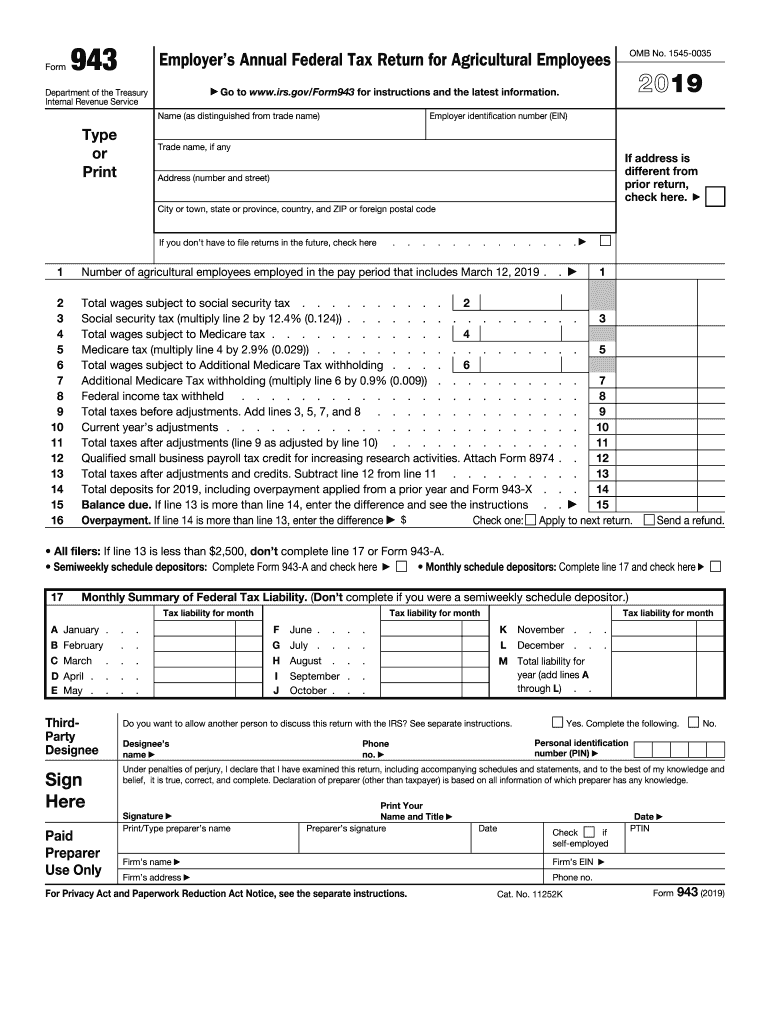

2019 Form IRS 943 Fill Online, Printable, Fillable, Blank pdfFiller

Web mailing addresses for forms 943. Use get form or simply click on the template preview to open it in the editor. Revision of a currently approved. Web 50% of this amount is $20,000 which can now be claimed on the 2020 form 943 filed in january 2021. Web schedule r (form 943) has been revised to accommodate all of.

Drafts of Form 943, 944 and 940 are Now Available with COVID19 Changes

Web form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Use get form or simply click on the template preview to open it in the editor. Web october 12, 2020 | tax1099 | 0 comment | 5:46 am. Revision of a currently approved. Web up to $32 cash.

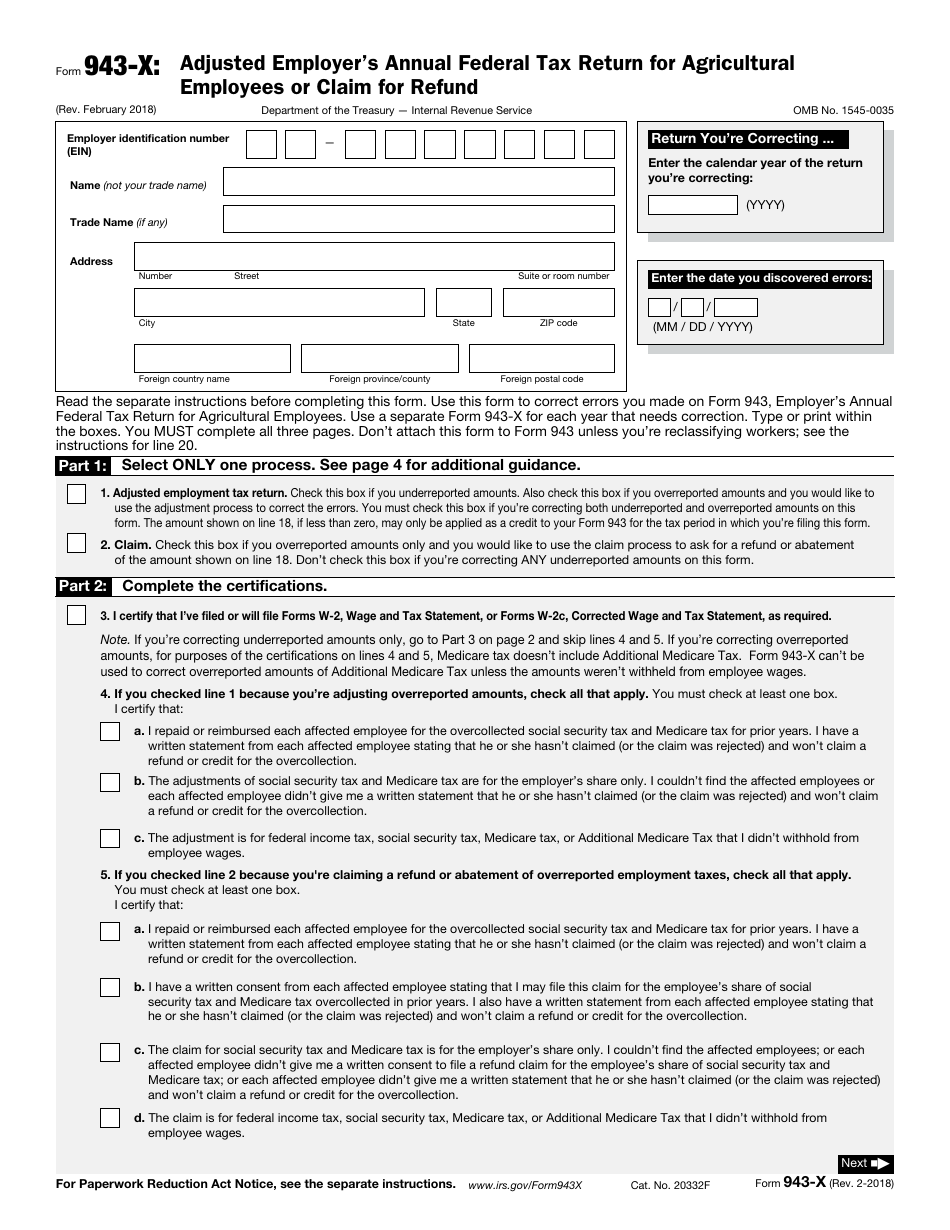

IRS Form 943X Download Fillable PDF or Fill Online Adjusted Employer's

Web 50% of this amount is $20,000 which can now be claimed on the 2020 form 943 filed in january 2021. Web form 943, is the employer’s annual federal tax return for agricultural employees. Complete irs tax forms online or print government tax documents. It is used to record how much income tax,. Connecticut, delaware, district of columbia, georgia, illinois,.

943 Form 2021 IRS Forms Zrivo

Web form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Web 943 form 2020 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 56 votes how to fill out and sign form 943 online? In other words, it is.

2020 form 943 instructions Fill Online, Printable, Fillable Blank

December 2020) agricultural employer’s record of federal tax liability department of the treasury internal revenue service go to www.irs.gov/form943a for. Get your online template and fill it in using. Paper filers and efilers must file form 943 to the irs by february 1, 2020. Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees,.

HPSSSB TGT Recruitment 2020 943 TGT, StenoTypist Posts

Complete irs tax forms online or print government tax documents. Web 943 form 2020 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 56 votes how to fill out and sign form 943 online? For 2021, the rate of social security tax on taxable wages, except for qualified sick leave wages.

943a Fill Online, Printable, Fillable, Blank pdfFiller

Web up to $32 cash back form 943, employer’s annual federal tax return for agricultural employees, is used to report federal income tax, social security and medicare. Complete, edit or print tax forms instantly. Get your online template and fill it in using. Web get your form 943 (2020) in 3 easy steps. Paper filers and efilers must file form.

2019 form 943 Fill Online, Printable, Fillable Blank form943

01 fill and edit template. Web get your form 943 (2020) in 3 easy steps. Try it for free now! Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of form 943, fully updated for tax year 2022. Web 943 form 2020 rating ★ ★ ★ ★.

Fill Free fillable F943 Accessible 2019 Form 943 PDF form

Web form 943, employer's annual federal tax return for agricultural employees, is a tax form used employers in the field of agriculture. Paper filers and efilers must file form 943 to the irs by february 1, 2020. Web we last updated the employer's annual federal tax return for agricultural employees in february 2023, so this is the latest version of.

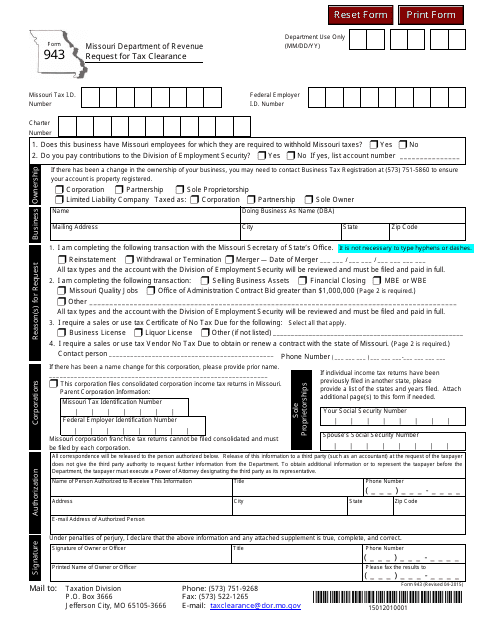

Form 943 Download Printable PDF, Request for Tax Clearance Missouri

It is used to record how much income tax,. Web see purpose of form 943, earlier, for household employee information. Web mailing addresses for forms 943. Web form 943, is the employer’s annual federal tax return for agricultural employees. Get your online template and fill it in using.

For 2021, The Rate Of Social Security Tax On Taxable Wages, Except For Qualified Sick Leave Wages And Qualified.

Use get form or simply click on the template preview to open it in the editor. Web october 12, 2020 | tax1099 | 0 comment | 5:46 am. Try it for free now! Connecticut, delaware, district of columbia, georgia, illinois,.

It Is Used To Record How Much Income Tax,.

During the first two quarters of 2021, the credit. Web information about form 943, employer's annual federal tax return for agricultural employees, including recent updates, related forms and instructions on how to file. 01 fill and edit template. Form 943 (2020) easily fill out and sign forms download.

Complete, Edit Or Print Tax Forms Instantly.

Paper filers and efilers must file form 943 to the irs by february 1, 2020. Start completing the fillable fields and carefully. February 2021) adjusted employer’s annual federal tax return for agricultural employees or claim for refund department of the treasury — internal. Ad access irs tax forms.

Web Up To $32 Cash Back Form 943, Employer’s Annual Federal Tax Return For Agricultural Employees, Is Used To Report Federal Income Tax, Social Security And Medicare.

December 2020) agricultural employer’s record of federal tax liability department of the treasury internal revenue service go to www.irs.gov/form943a for. Ad upload, modify or create forms. Web mailing addresses for forms 943. In other words, it is a tax form used to report federal income tax, social.