944 Form Instructions

944 Form Instructions - Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Web if it is determined that your business should file an annual employment tax return, irs form 944 must be filed by january 31st of each tax year. It's a version of form 941 appropriate for. Web street suite or room number who must file form 944 you must file annual form 944 instead of filing quarterly forms 941 only if the irs notified you in writing. Get ready for tax season deadlines by completing any required tax forms today. Web where to get form 944 form 944 is available on the irs website. Web go to www.irs.gov/form944 for instructions and the latest information. For the vast majority of these. Before you begin to file, gather the payroll data. That means employers eligible to file form 944 are only required to complete and submit it once per year.

Ad access irs tax forms. Web read the separate instructions before you complete form 944. Web irs form 944: When you file irs form 944, you. Irs form 944 contains 5 parts in which certain information should be reported. Businesses typically use form 941 to report on their employment tax liability. Ad access irs tax forms. Web if it is determined that your business should file an annual employment tax return, irs form 944 must be filed by january 31st of each tax year. How should you complete form 944? Web where to get form 944 form 944 is available on the irs website.

Businesses typically use form 941 to report on their employment tax liability. Type or print within the boxes. Irs form 944 contains 5 parts in which certain information should be reported. The finalized versions of the 2020 form. Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. The deadline for filing the form is feb. Small business employers with an. How should you complete form 944? It's a version of form 941 appropriate for. Before you begin to file, gather the payroll data.

IRS Form 944 Instructions and Who Needs to File It

Web finalized versions of the 2020 form 944 and its instructions are available. It's a version of form 941 appropriate for. Irs form 944 contains 5 parts in which certain information should be reported. How should you complete form 944? You can complete it online, download a copy, or you can print out a copy from the website.

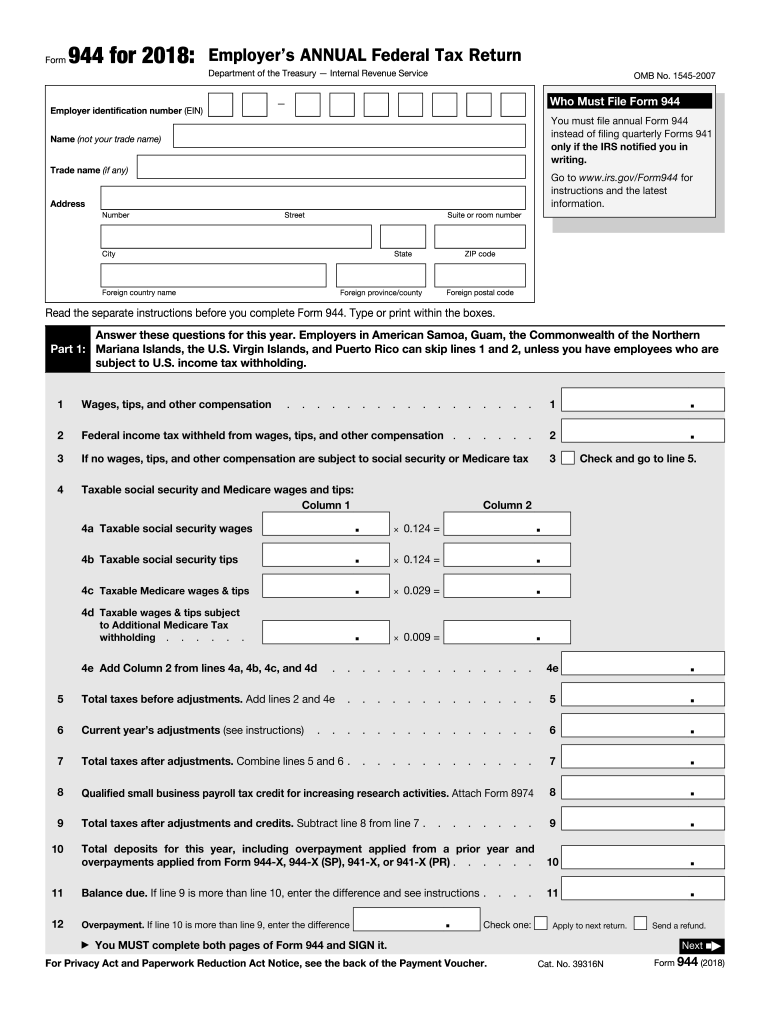

2018 Form IRS 944 Fill Online, Printable, Fillable, Blank pdfFiller

How to fill out form 944 for 2022? Web go to www.irs.gov/form944 for instructions and the latest information. The finalized versions of the 2020 form. Answer these questions for this year. For the vast majority of these.

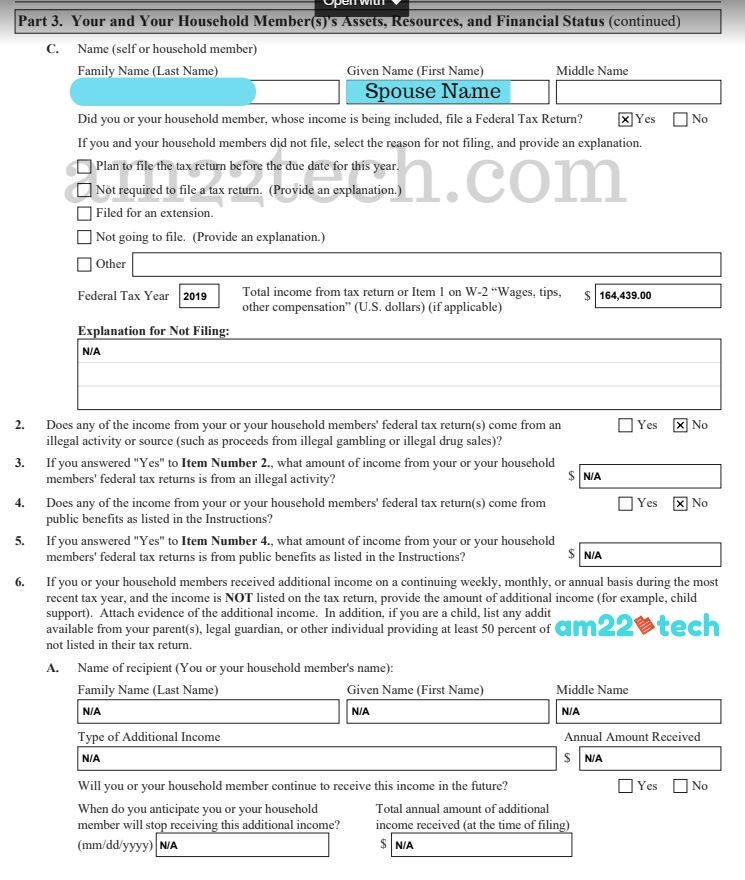

How To Fill Out Form I944 StepByStep Instructions [2021]

Web irs form 944 is an annual filing. It's a version of form 941 appropriate for. Ad access irs tax forms. Web street suite or room number who must file form 944 you must file annual form 944 instead of filing quarterly forms 941 only if the irs notified you in writing. Small business employers with an.

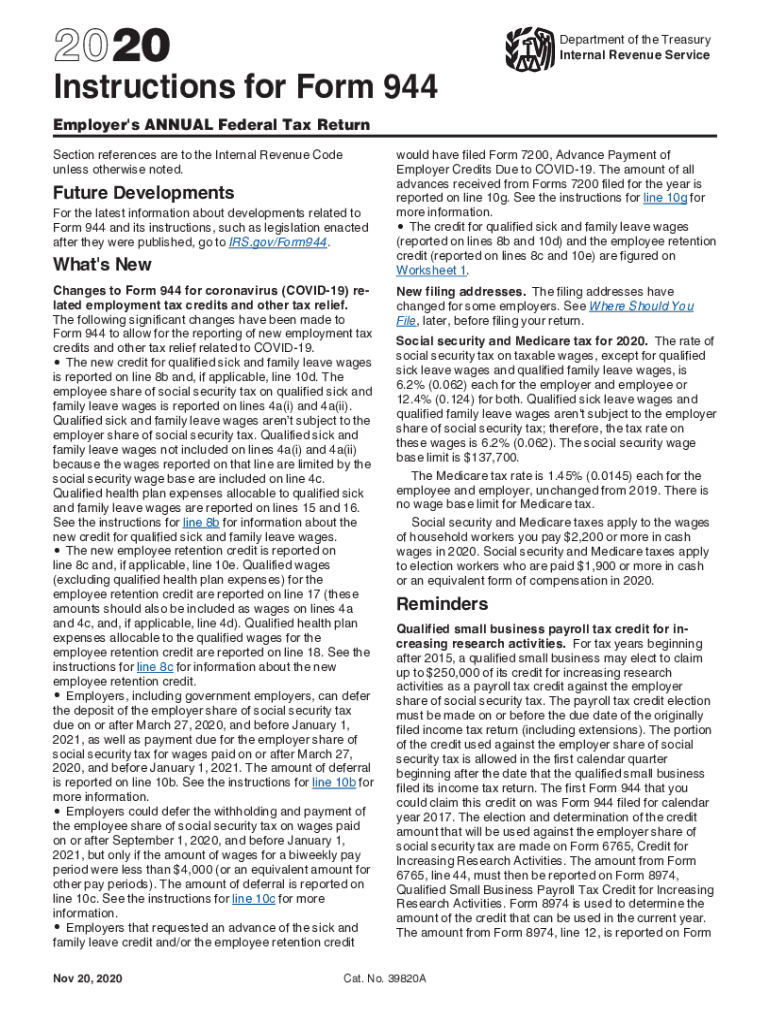

Electronic IRS Instructions 944 2018 2019 Printable PDF Sample

November 2009) adjusted employer’s annual federal tax return or claim for refund section references are to. Web irs form 944 is an annual filing. Web go to www.irs.gov/form944 for instructions and the latest information. How should you complete form 944? The finalized versions of the 2020 form.

How To Fill Out Form I944 StepByStep Instructions [2021]

Number street suite or room number city foreign country namestatezip code foreign. Get ready for tax season deadlines by completing any required tax forms today. Web irs form 944 is an annual filing. You can complete it online, download a copy, or you can print out a copy from the website. November 2009) adjusted employer’s annual federal tax return or.

Form i944 Self Sufficiency US Green Card (Documents Required) USA

Answer these questions for this year. Small business employers with an. Complete, edit or print tax forms instantly. Businesses typically use form 941 to report on their employment tax liability. Get ready for tax season deadlines by completing any required tax forms today.

IRS Form 944 Instructions and Who Needs to File It NerdWallet

Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. You can complete it online, download a copy, or you can print out a copy from the website. Ad access irs tax forms. November 2009) adjusted employer’s annual federal tax return or claim for refund section references are to..

Form I944 StepByStep Instructions How To Fill Out [2021 Guide

Small business employers with an. Before you begin to file, gather the payroll data. Web irs form 944: Web if it is determined that your business should file an annual employment tax return, irs form 944 must be filed by january 31st of each tax year. Web go to www.irs.gov/form944 for instructions and the latest information.

2020 Form IRS 944 Instructions Fill Online, Printable, Fillable, Blank

Web read the separate instructions before you complete form 944. Answer these questions for this year. It's a version of form 941 appropriate for. You can complete it online, download a copy, or you can print out a copy from the website. Web where to get form 944 form 944 is available on the irs website.

Who is Required to File Form I944 for a Green Card? CitizenPath

Complete, edit or print tax forms instantly. Before you begin to file, gather the payroll data. Web if it is determined that your business should file an annual employment tax return, irs form 944 must be filed by january 31st of each tax year. Web irs form 944 is an annual filing. Get ready for tax season deadlines by completing.

Web Irs Form 944:

Businesses typically use form 941 to report on their employment tax liability. Number street suite or room number city foreign country namestatezip code foreign. How should you complete form 944? Small business employers with an.

Web Go To Www.irs.gov/Form944 For Instructions And The Latest Information.

Ad access irs tax forms. The deadline for filing the form is feb. Complete, edit or print tax forms instantly. Before you begin to file, gather the payroll data.

When You File Irs Form 944, You.

That means employers eligible to file form 944 are only required to complete and submit it once per year. Get ready for tax season deadlines by completing any required tax forms today. November 2009) adjusted employer’s annual federal tax return or claim for refund section references are to. Web irs form 944 is an annual filing.

Web Read The Separate Instructions Before You Complete Form 944.

Type or print within the boxes. Instructions and who needs to file it irs form 944 reports taxes withheld from employee paychecks. Web if it is determined that your business should file an annual employment tax return, irs form 944 must be filed by january 31st of each tax year. It's a version of form 941 appropriate for.

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/1-1024x555.png)

![How To Fill Out Form I944 StepByStep Instructions [2021]](https://self-lawyer.com/wp-content/uploads/2020/05/I-944-2-1024x572.png)