Accounts Receivable In Balance Sheet

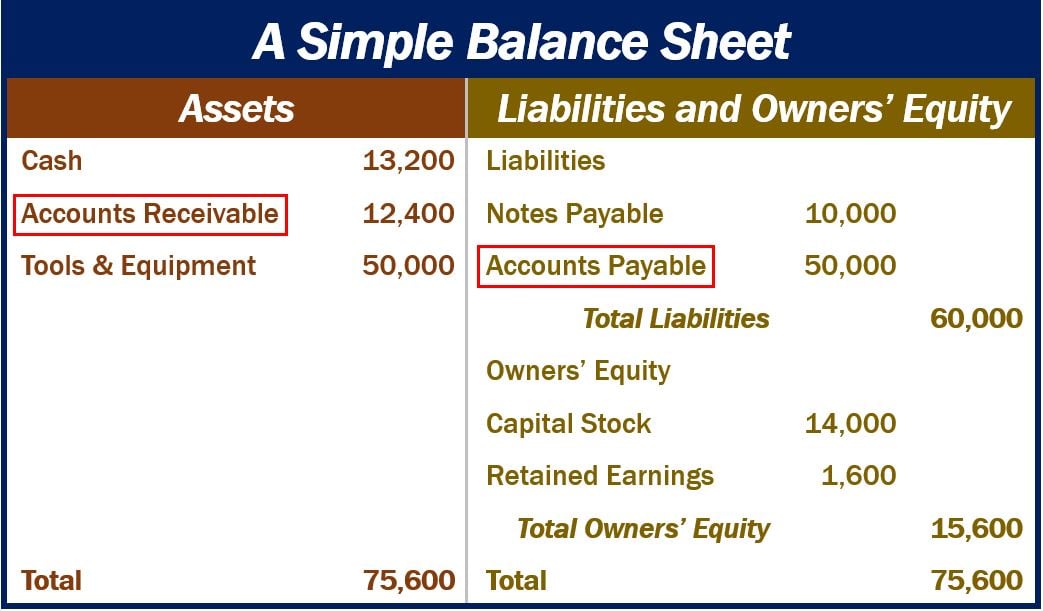

Accounts Receivable In Balance Sheet - Accounts receivable (a/r) is defined as payments owed to a company by its customers for products and/or services already delivered to them. Here are some examples of current assets: Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Web balance sheet guide what is accounts receivable? Web companies will generally disclose what equivalents it includes in the footnotes to the balance sheet. Web key takeaways accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short. If your accounts receivable balance is going up, that means you're invoicing more. This account includes the balance of all sales revenue still on credit, net of any. If a company has delivered products or services but not yet received. Accounts receivable are created when a company.

Here are some examples of current assets: If your accounts receivable balance is going up, that means you're invoicing more. Web balance sheet guide what is accounts receivable? Web accounts receivable appears as a current asset on the balance sheet. Accounts receivable (a/r) is defined as payments owed to a company by its customers for products and/or services already delivered to them. This account includes the balance of all sales revenue still on credit, net of any. If a company has delivered products or services but not yet received. Accounts receivable are created when a company. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Web companies will generally disclose what equivalents it includes in the footnotes to the balance sheet.

Accounts receivable (a/r) is defined as payments owed to a company by its customers for products and/or services already delivered to them. Accounts receivable are created when a company. Here are some examples of current assets: Web balance sheet guide what is accounts receivable? If your accounts receivable balance is going up, that means you're invoicing more. Web accounts receivable appears as a current asset on the balance sheet. This account includes the balance of all sales revenue still on credit, net of any. Web companies will generally disclose what equivalents it includes in the footnotes to the balance sheet. If a company has delivered products or services but not yet received. Web key takeaways accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short.

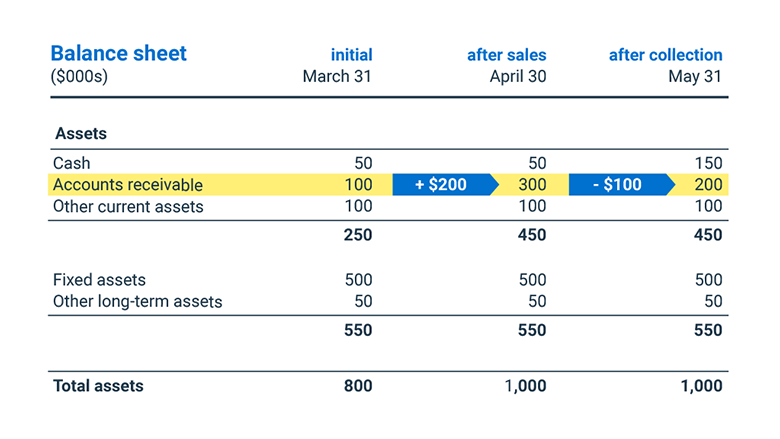

Accounts Receivable on the Balance Sheet

If your accounts receivable balance is going up, that means you're invoicing more. Web key takeaways accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short. Web accounts receivable appears as a current asset on the balance sheet. If a company has delivered products or services but not yet.

What is accounts receivable? Definition and examples

Web key takeaways accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Here are some examples of current assets: Web balance sheet guide what is accounts receivable? Web companies will.

Accounts Receivable Opening Balance Plan Projections

Accounts receivable are created when a company. Web companies will generally disclose what equivalents it includes in the footnotes to the balance sheet. If a company has delivered products or services but not yet received. Here are some examples of current assets: If your accounts receivable balance is going up, that means you're invoicing more.

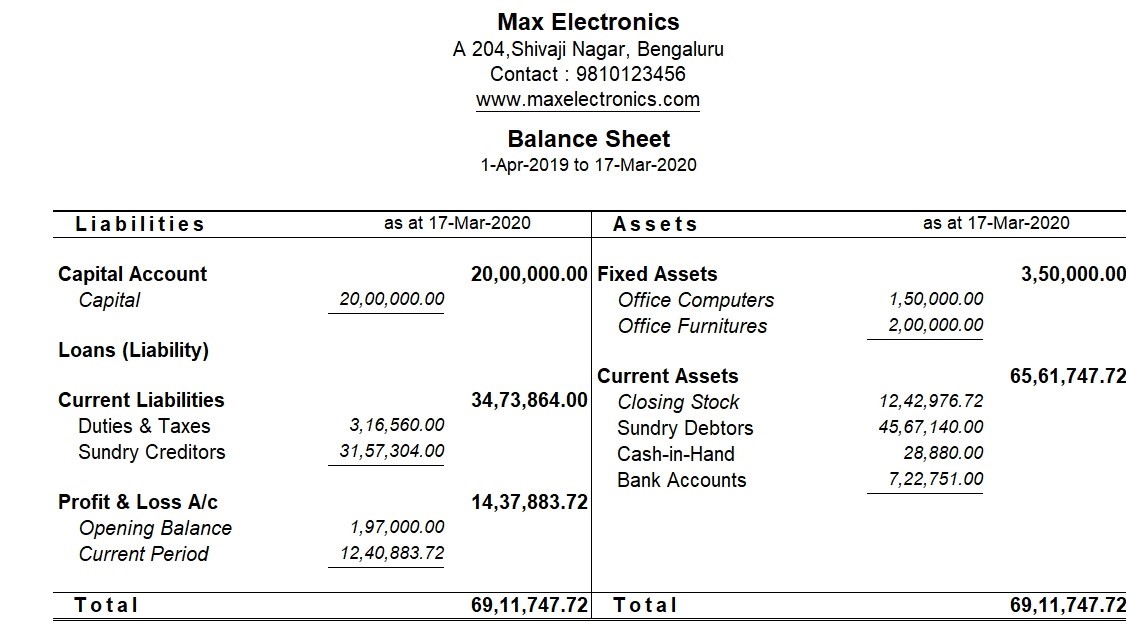

What is Accounts Receivables Examples, Process & Importance Tally

Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Web key takeaways accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short. Here are some examples of current assets: Web balance sheet guide what is accounts receivable? Web companies will.

PPT Receivables PowerPoint Presentation ID1657894

Web balance sheet guide what is accounts receivable? If a company has delivered products or services but not yet received. This account includes the balance of all sales revenue still on credit, net of any. Web key takeaways accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short. Here.

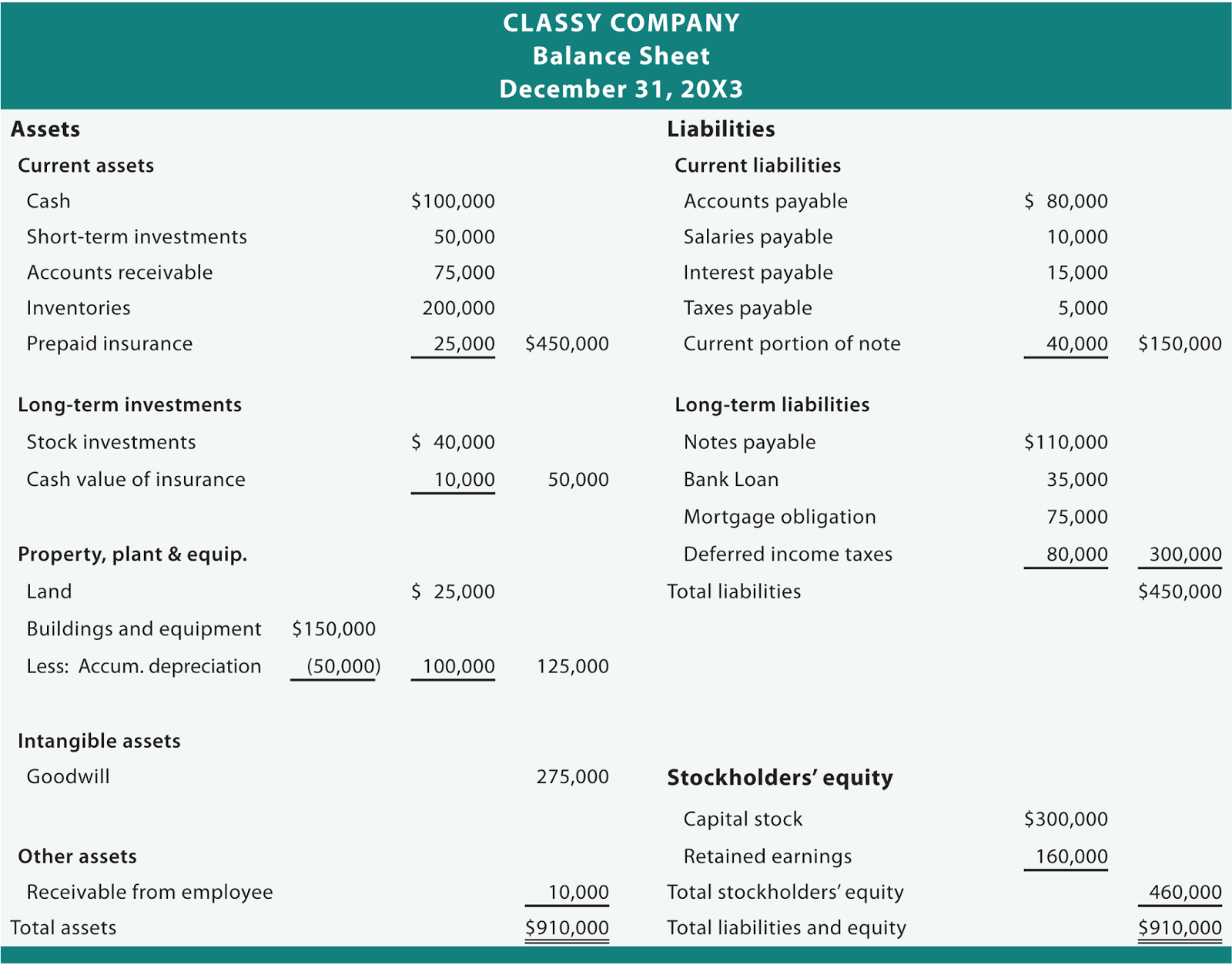

English for Banking and Finance Topic 3 Accounting and Financial

Web key takeaways accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Here are some examples of current assets: This account includes the balance of all sales revenue still on.

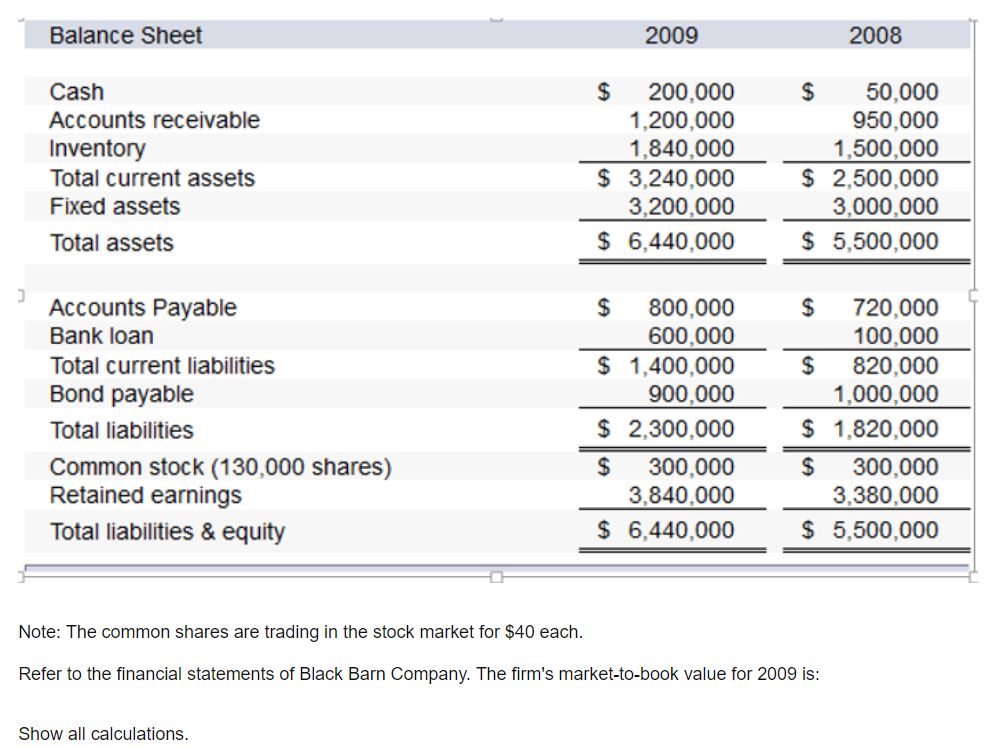

Solved Balance Sheet 2009 2008 Cash Accounts receivable

If a company has delivered products or services but not yet received. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Web balance sheet guide what is accounts receivable? Web companies will generally disclose what equivalents it includes in the footnotes to the balance sheet. Web key takeaways accounts receivable (ar).

M.A AUDITS & ACADEMI Accounts Receivable on the Balance Sheet

Web balance sheet guide what is accounts receivable? Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. This account includes the balance of all sales revenue still on credit, net of any. Web companies will generally disclose what equivalents it includes in the footnotes to the balance sheet. Accounts receivable (a/r).

Accounts receivable BDC.ca

Here are some examples of current assets: Accounts receivable (a/r) is defined as payments owed to a company by its customers for products and/or services already delivered to them. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Accounts receivable are created when a company. Web accounts receivable appears as a.

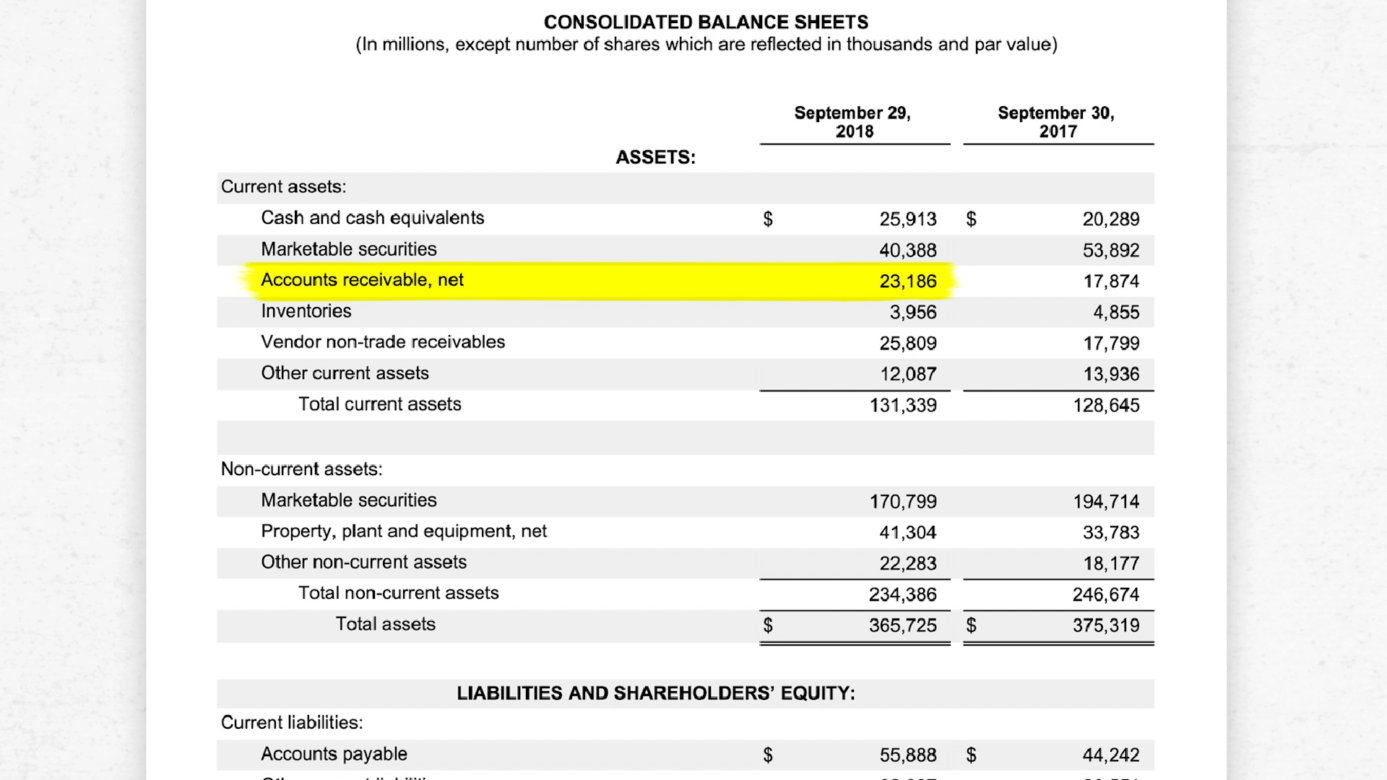

Accounts Receivable (AR) What They Are and How to Interpret Pareto Labs

Web balance sheet guide what is accounts receivable? Web key takeaways accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short. Accounts receivable (a/r) is defined as payments owed to a company by its customers for products and/or services already delivered to them. If a company has delivered products.

If A Company Has Delivered Products Or Services But Not Yet Received.

Web companies will generally disclose what equivalents it includes in the footnotes to the balance sheet. If your accounts receivable balance is going up, that means you're invoicing more. This account includes the balance of all sales revenue still on credit, net of any. Web accounts receivable appears as a current asset on the balance sheet.

Here Are Some Examples Of Current Assets:

Web balance sheet guide what is accounts receivable? Web key takeaways accounts receivable (ar) are an asset account on the balance sheet that represents money due to a company in the short. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Accounts receivable (a/r) is defined as payments owed to a company by its customers for products and/or services already delivered to them.

/accounts-receivables-on-the-balance-sheet-357263-FINAL3-49402f58e70a42ab9468144f84f366d6.png)