Adp 401K Rollover Form

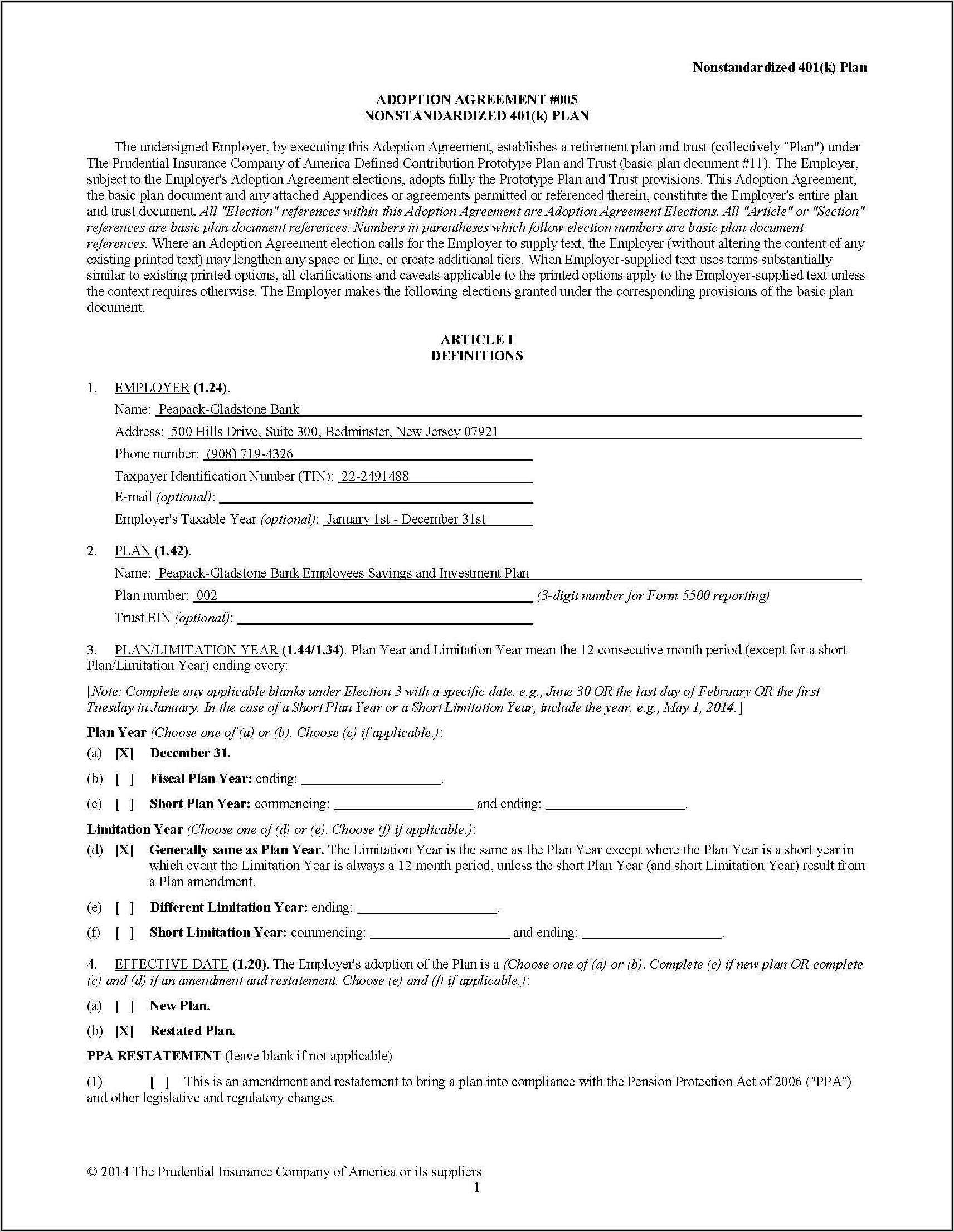

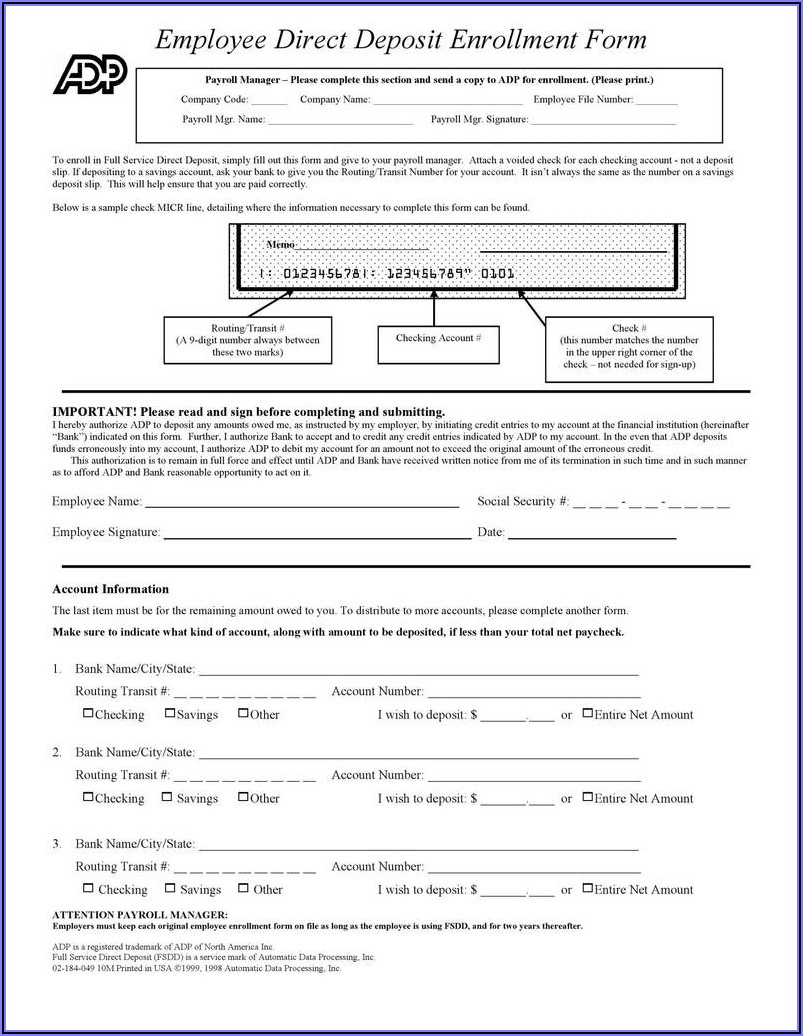

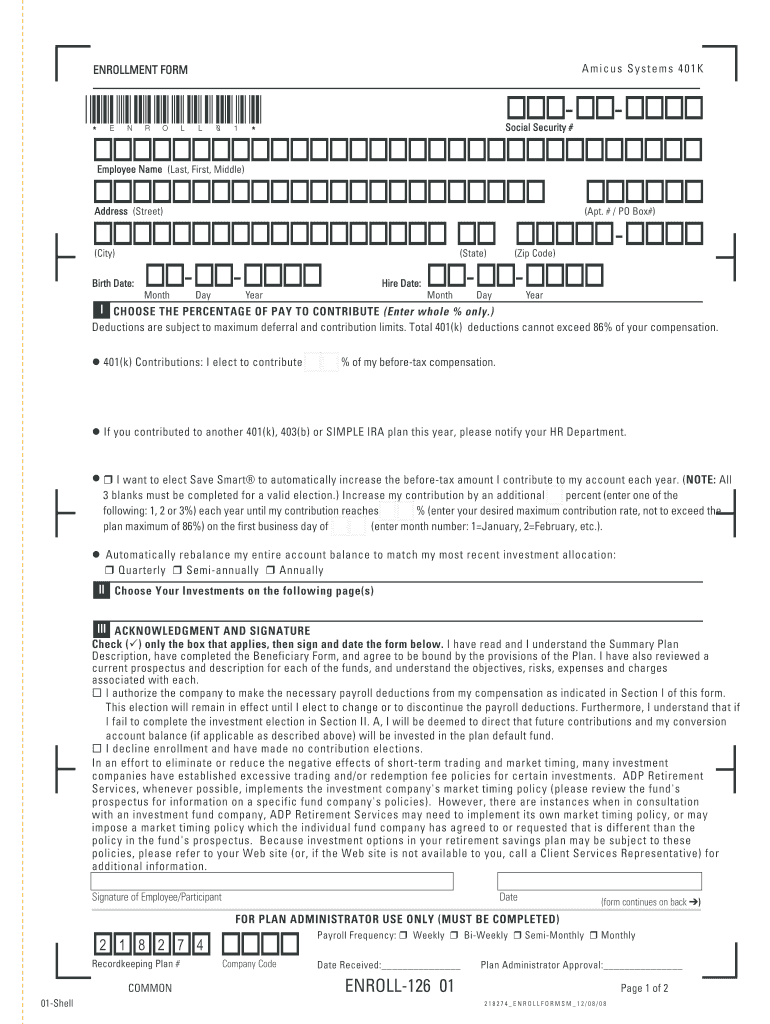

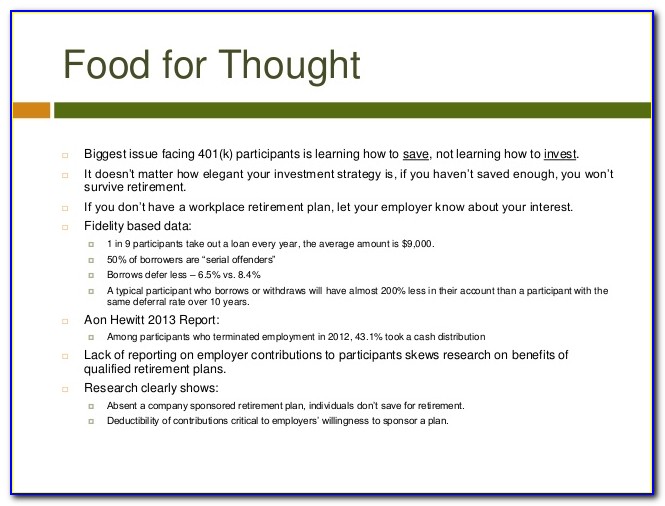

Adp 401K Rollover Form - Please refer to the distribution statement provided by prior 401(k) provider for this information. Please contact your plan administrator for the appropriate distribution forms. Web you may be able to make a rollover contribution to your current employer plan even if you are not yet eligible to participate. Request form to roll savings from another qualified retirement plan into your plan. Web for roth 401(k) rollover amounts: Decide where to move your money; Adp helps organizations of all types and sizes unlock their potential. Indicate the year your roth 401(k) contributions began. Rolling these assets into your current retirement plan allows you to: Web not ready to enroll but interested in rolling over money from another retirement plan?

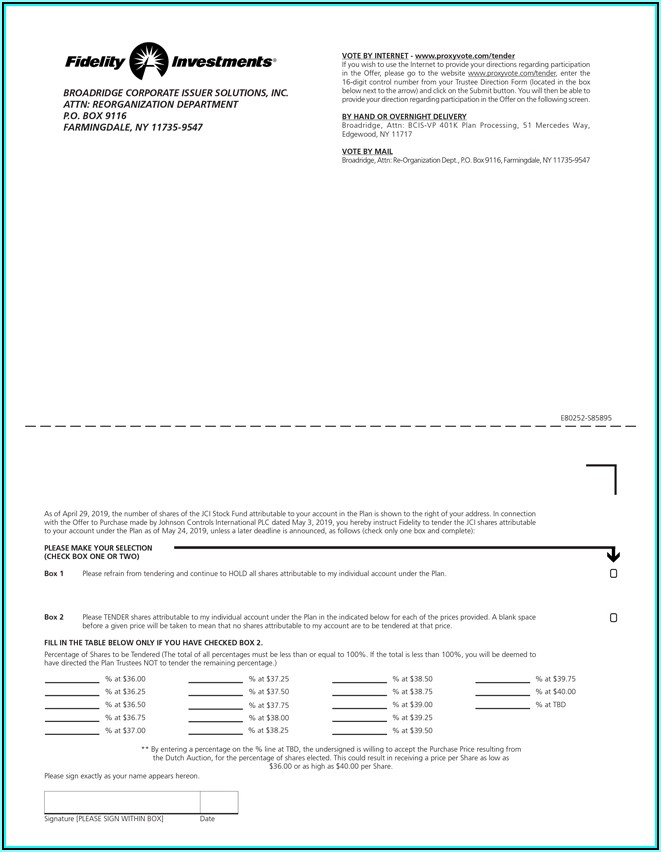

Some plans may allow you to use the fidelity advisor ira direct rollover form. Click here to download and print a rollover form with instructions. If you are converting an ira to a roth ira. Web you may be able to make a rollover contribution to your current employer plan even if you are not yet eligible to participate. Web not ready to enroll but interested in rolling over money from another retirement plan? Request form to roll savings from another qualified retirement plan into your plan. Web for roth 401(k) rollover amounts: Initiate your rollover with adp retirement services get a check in the mail and deposit it into the new account; Make sure your funds are being invested properly Adp helps organizations of all types and sizes unlock their potential.

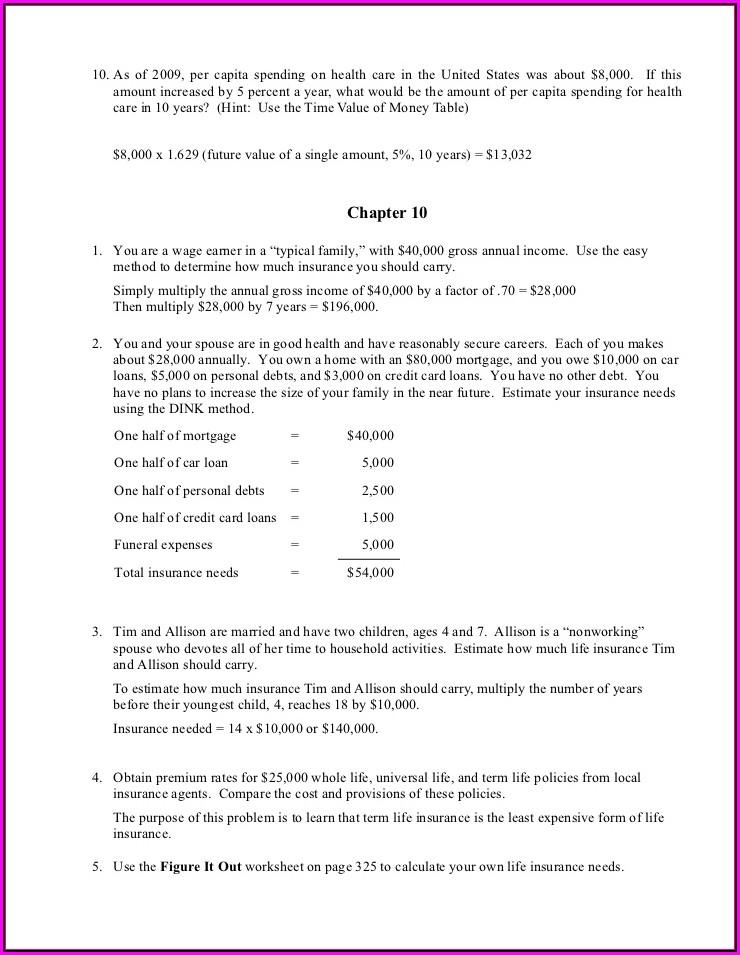

Make sure your funds are being invested properly Web for roth 401(k) rollover amounts: Complete the contribution + earnings = total amount section. Web you may be able to make a rollover contribution to your current employer plan even if you are not yet eligible to participate. Whether you have questions about what a 401 (k) plan is or are looking for ways to enhance your saving strategies, the adp 401 (k) resource library can provide you with the information and resources to keep you on the road to. Please contact your plan administrator for the appropriate distribution forms. Rolling these assets into your current retirement plan allows you to: Small business employers with up to 50 employees are now eligible to receive a credit covering 100% of administrative expenses (up to $5,000) for the first three years of a new plan. Web 401 (k) resource library. Click here to download and print a rollover form with instructions.

401k Rollover Form Fidelity Investments Form Resume Free Nude Porn Photos

Small business employers with up to 50 employees are now eligible to receive a credit covering 100% of administrative expenses (up to $5,000) for the first three years of a new plan. Web 401 (k) resource library. We provide payroll, global hcm and outsourcing services in more than 140 countries. Whether you have questions about what a 401 (k) plan.

401k Rollover Form Fidelity Form Resume Examples 76YGLXQVoL

Adp helps organizations of all types and sizes unlock their potential. Web a 401(k) plan may now be more affordable than ever, thanks to the recent secure 2.0 legislation passed in december 2022. Rolling these assets into your current retirement plan allows you to: Initiate your rollover with adp retirement services get a check in the mail and deposit it.

401k Rollover Form Charles Schwab Form Resume Examples MoYo65B9ZB

Small business employers with up to 50 employees are now eligible to receive a credit covering 100% of administrative expenses (up to $5,000) for the first three years of a new plan. See your plan’s provisions or contact your plan administrator for information. Web for roth 401(k) rollover amounts: Complete the contribution + earnings = total amount section. Request form.

Fidelity 401k Distribution Form Universal Network

Complete the contribution + earnings = total amount section. Click here to download and print a rollover form with instructions. Some plans may allow you to use the fidelity advisor ira direct rollover form. Initiate your rollover with adp retirement services get a check in the mail and deposit it into the new account; Web not ready to enroll but.

Adp 401K Login Fill Out and Sign Printable PDF Template signNow

Rolling these assets into your current retirement plan allows you to: If you are converting an ira to a roth ira. Whether you have questions about what a 401 (k) plan is or are looking for ways to enhance your saving strategies, the adp 401 (k) resource library can provide you with the information and resources to keep you on.

401k Rollover Tax Form Universal Network

Web you may be able to make a rollover contribution to your current employer plan even if you are not yet eligible to participate. Confirm a few key details about your 401(k) plan; Rolling these assets into your current retirement plan allows you to: If you are converting an ira to a roth ira. Click here to download and print.

401k Enrollment Form Examples Form Resume Examples E4Y4ybxVlB

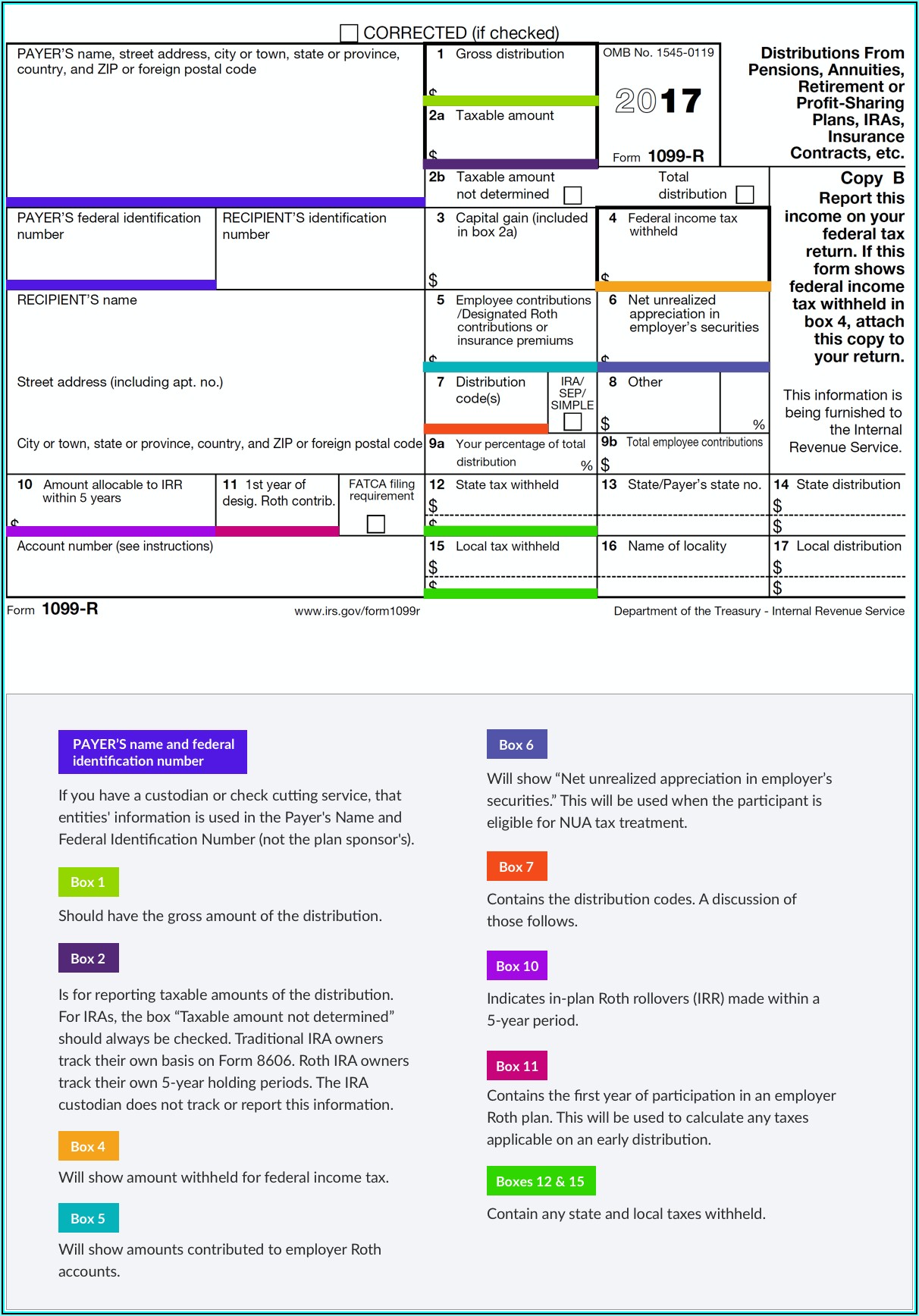

Web for roth 401(k) rollover amounts: Whether you have questions about what a 401 (k) plan is or are looking for ways to enhance your saving strategies, the adp 401 (k) resource library can provide you with the information and resources to keep you on the road to. This year allows adp to track your contribution for taxation purposes. Decide.

Home Depot 401k Rollover Form Form Resume Examples 76YGdnZVoL

Whether you have questions about what a 401 (k) plan is or are looking for ways to enhance your saving strategies, the adp 401 (k) resource library can provide you with the information and resources to keep you on the road to. Request form to roll savings from another qualified retirement plan into your plan. Initiate your rollover with adp.

Schwab 401k Rollover Form Form Resume Examples X42M7qzYkG

Adp helps organizations of all types and sizes unlock their potential. Decide where to move your money; Web for roth 401(k) rollover amounts: Small business employers with up to 50 employees are now eligible to receive a credit covering 100% of administrative expenses (up to $5,000) for the first three years of a new plan. Web 401 (k) resource library.

John Hancock 401k Hardship Withdrawal Form Form Resume Examples

Web you may be able to make a rollover contribution to your current employer plan even if you are not yet eligible to participate. Please refer to the distribution statement provided by prior 401(k) provider for this information. Initiate your rollover with adp retirement services get a check in the mail and deposit it into the new account; Whether you.

Whether You Have Questions About What A 401 (K) Plan Is Or Are Looking For Ways To Enhance Your Saving Strategies, The Adp 401 (K) Resource Library Can Provide You With The Information And Resources To Keep You On The Road To.

Please contact your plan administrator for the appropriate distribution forms. Web you may be able to make a rollover contribution to your current employer plan even if you are not yet eligible to participate. If you are converting an ira to a roth ira. Web 401 (k) resource library.

Please Refer To The Distribution Statement Provided By Prior 401(K) Provider For This Information.

Request form to roll savings from another qualified retirement plan into your plan. Confirm a few key details about your 401(k) plan; Adp helps organizations of all types and sizes unlock their potential. Decide where to move your money;

Some Plans May Allow You To Use The Fidelity Advisor Ira Direct Rollover Form.

See your plan’s provisions or contact your plan administrator for information. Indicate the year your roth 401(k) contributions began. Initiate your rollover with adp retirement services get a check in the mail and deposit it into the new account; Complete the contribution + earnings = total amount section.

Rolling These Assets Into Your Current Retirement Plan Allows You To:

This year allows adp to track your contribution for taxation purposes. Web for roth 401(k) rollover amounts: Web not ready to enroll but interested in rolling over money from another retirement plan? We provide payroll, global hcm and outsourcing services in more than 140 countries.