Ak Form 6000 Instructions 2021

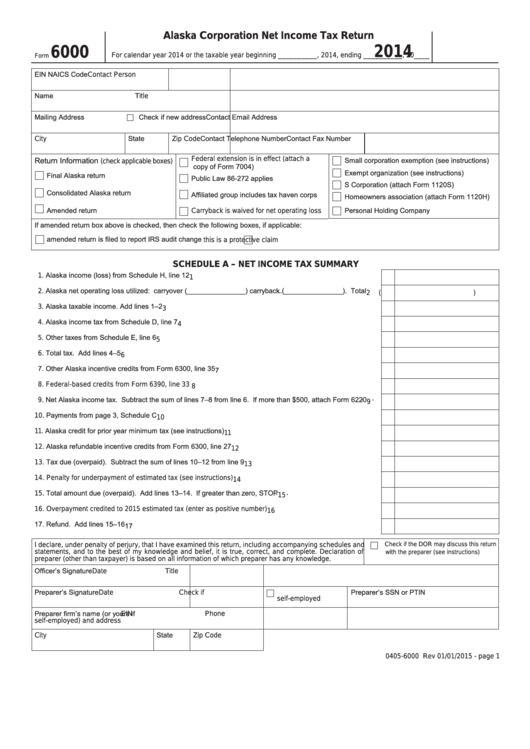

Ak Form 6000 Instructions 2021 - Web how it works browse for the ak return customize and esign alaska form income send out signed ak 6000 or print it rate the alaska corporation income tax return 4.6 satisfied 92. Web instructions for forms 6000 and 6020 2014 alaska. Web get your online template and fill it in using progressive features. Web exempt corporations that have unrelated business income must file an alaska return and pay alaska tax. Web quick steps to complete and design alaska form 6000 instructions online: Go digital and save time with signnow,. Enjoy smart fillable fields and interactivity. Follow the simple instructions below: There are now two ways to file your alaska corporate income tax return! Alaska credit for prior year minimum tax (see instructions) 11.

Web exempt corporations that have unrelated business income must file an alaska return and pay alaska tax. Sign it in a few clicks. Draw your signature, type it,. Form 6000 is the standard alaska corporation net. Alaska corporation net income tax return instructions (rev 1/23/23) 6000: Browse for the alaska dor 6000 corporation income tax form. Web how it works browse for the ak return customize and esign alaska form income send out signed ak 6000 or print it rate the alaska corporation income tax return 4.6 satisfied 92. Appeals request for informal conference. Edit your 2017 alaska online. There are now two ways to file your alaska corporate income tax return!

Sign it in a few clicks. Draw your signature, type it,. Web exempt corporations that have unrelated business income must file an alaska return and pay alaska tax. Edit your 2017 alaska online. Web complete ak dor 6000 in several moments by following the instructions below: There are now two ways to file your alaska corporate income tax return! Follow the simple instructions below: Alaska corporation net income tax return: Get everything done in minutes. It appears you don't have a pdf plugin for this.

Fillable Form 6000 Alaska Corporation Net Tax Return 2014

Browse for the alaska dor 6000 corporation income tax form. Web purposes (hereafter “corporation”), must file a form 6000, 6100 or 6150 (corporation net income tax return), if the corporation is a partner in a partnership doing business in the. Customize and esign alaska dor 6000 income form. Forms 6000 and 6020 (formerly forms 611 and 611sf) alaska corporation net.

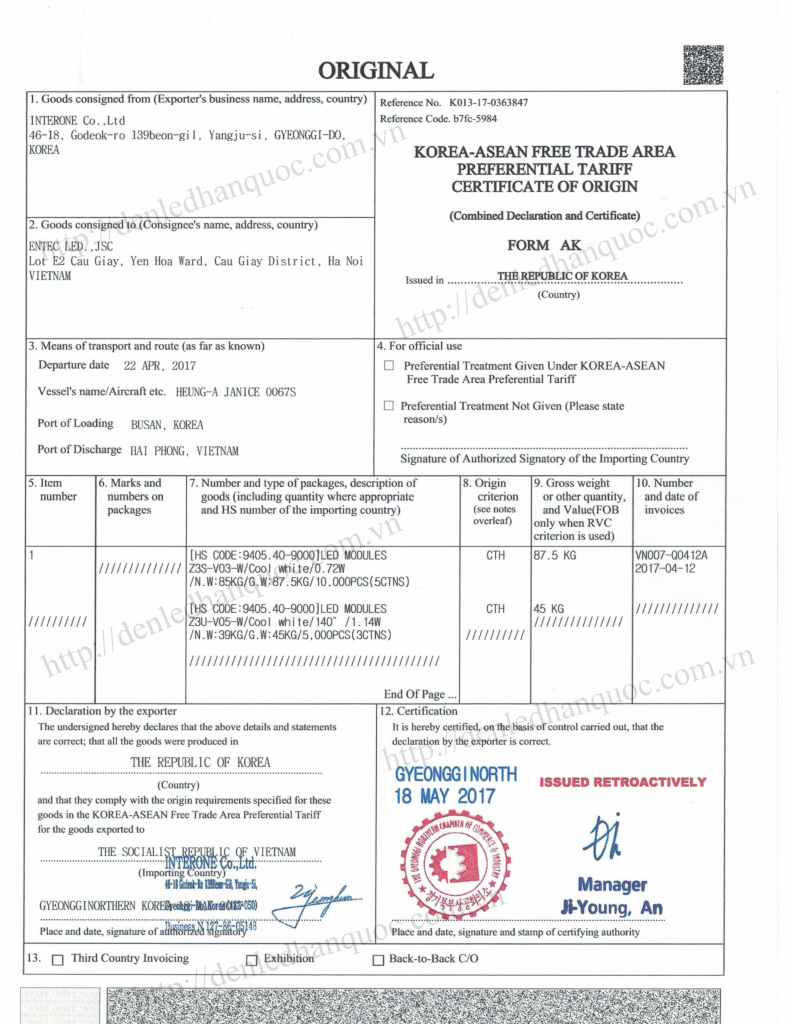

Form ak prophile sound draft co by Oceanexport TBB Issuu

Alaska incentive credits claimed as refund from. Type text, add images, blackout confidential details, add comments, highlights and more. Web tax division forms. Draw your signature, type it,. Use get form or simply click on the template preview to open it in the editor.

C/O form AK for Korea DuyminhjscThe leading ethanol exporter in Vietnam

Alaska incentive credits claimed as refund from. Web complete ak dor 6000 in several moments by following the instructions below: Sign it in a few clicks. Alaska corporation net income tax return instructions (rev 1/23/23) 6000: Web handy tips for filling out alaska form 6900 instructions 2021 online.

AK Form 355 2013 Fill out Tax Template Online US Legal Forms

Web complete ak dor 6000 in several moments by following the instructions below: Appeals request for informal conference. Form 6000 is the standard alaska corporation net. Alaska incentive credits claimed as refund from. Enjoy smart fillable fields and interactivity.

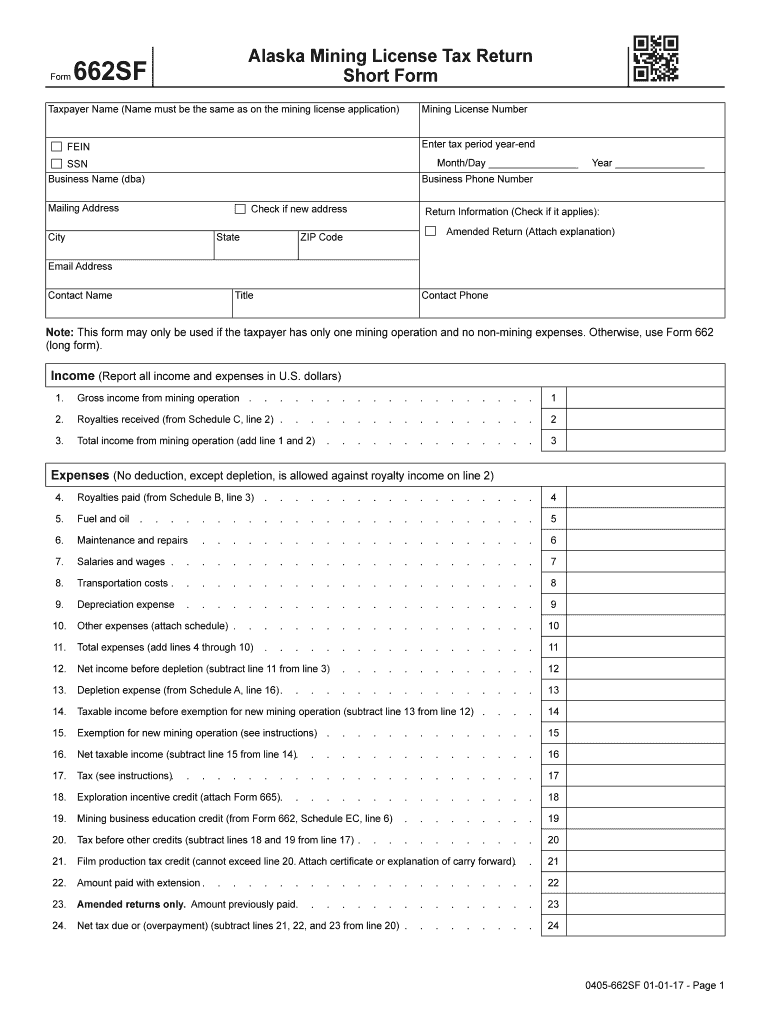

20172021 AK Form 662SF Fill Online, Printable, Fillable, Blank pdfFiller

There are now two ways to file your alaska corporate income tax return! Go digital and save time with signnow,. Web complete ak dor 6000 in several moments by following the instructions below: Send out signed 2021 alaska 6000 or print it. Forms 6000 and 6020 (formerly forms 611 and 611sf) alaska corporation net income tax return instructions.

2021 AK Form 6100 Fill Online, Printable, Fillable, Blank pdfFiller

Get everything done in minutes. Web get your online template and fill it in using progressive features. Web tax division forms. Customize and esign alaska dor 6000 income form. To ensure proper credit, use the same name and ein used on the return.

Thế nào là C/O FORM AK của đèn LED chuẩn trên thị trường?

It appears you don't have a pdf plugin for this. Send out signed 2021 alaska 6000 or print it. Web instructions for forms 6000 and 6020 2014 alaska. Pick the document template you require from the library of legal form samples. Use get form or simply click on the template preview to open it in the editor.

CERTIFICATE OF ORIGIN FORM AK certificateoforiginco

Appeals request for informal conference. To ensure proper credit, use the same name and ein used on the return. Get everything done in minutes. Web instructions for forms 6000 and 6020 2014 alaska. Use get form or simply click on the template preview to open it in the editor.

프로세이프

Web handy tips for filling out alaska form 6900 instructions 2021 online. The corporation must include a copy of the applicable federal form (990. Web we last updated the partnership information return instructions in march 2023, so this is the latest version of form 6900i, fully updated for tax year 2022. Go digital and save time with signnow,. Draw your.

AK Form 575 20202021 Fill and Sign Printable Template Online US

Edit your 2017 alaska online. Web quick steps to complete and design alaska form 6000 instructions online: Browse for the alaska dor 6000 corporation income tax form. Enjoy smart fillable fields and interactivity. Go digital and save time with signnow,.

Appeals Request For Informal Conference.

Web we last updated the partnership information return instructions in march 2023, so this is the latest version of form 6900i, fully updated for tax year 2022. Use get form or simply click on the template preview to open it in the editor. Alaska corporation net income tax return: Printing and scanning is no longer the best way to manage documents.

Edit Your 2017 Alaska Online.

Web complete ak dor 6000 in several moments by following the instructions below: Form 6000 is the standard alaska corporation net. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. To ensure proper credit, use the same name and ein used on the return.

It Appears You Don't Have A Pdf Plugin For This.

Alaska incentive credits claimed as refund from. Web purposes (hereafter “corporation”), must file a form 6000, 6100 or 6150 (corporation net income tax return), if the corporation is a partner in a partnership doing business in the. Enjoy smart fillable fields and interactivity. Web tax division forms.

Web Exempt Corporations That Have Unrelated Business Income Must File An Alaska Return And Pay Alaska Tax.

Web handy tips for filling out alaska form 6900 instructions 2021 online. The corporation must include a copy of the applicable federal form (990. Select the paper you want to esign and then click the. Browse for the alaska dor 6000 corporation income tax form.