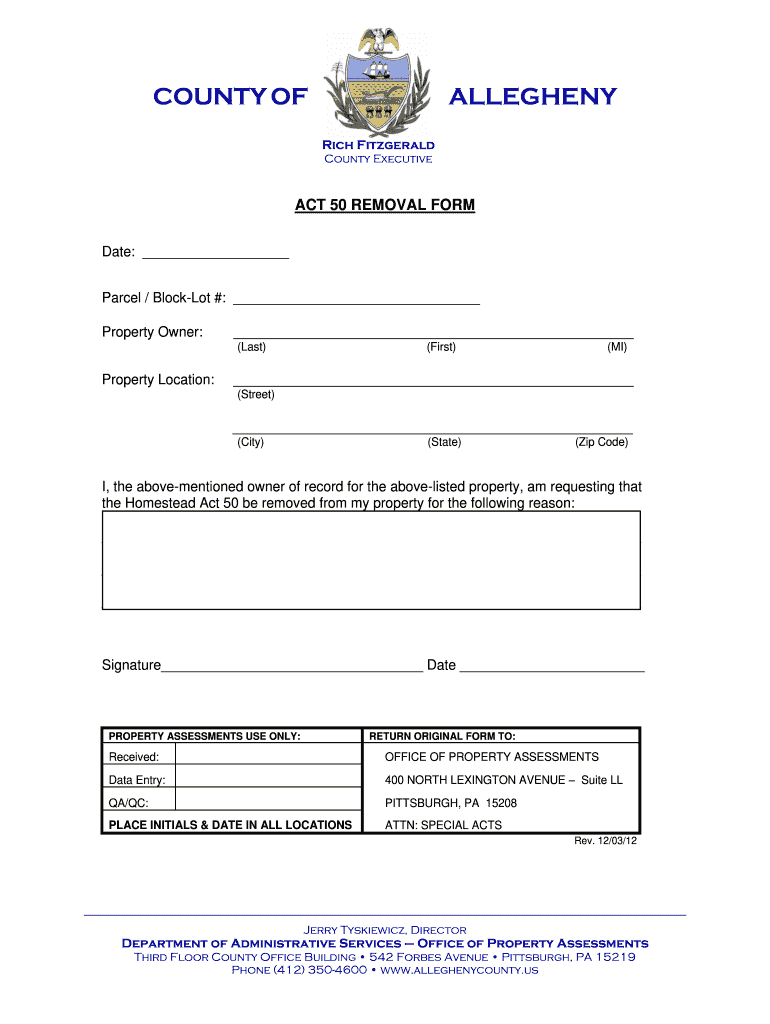

Allegheny County Homestead Exemption Form

Allegheny County Homestead Exemption Form - Web how do i apply for homestead exemption in allegheny county? Homeowners should contact their county assessment office (position 48) for a copy of their county’s homestead and farmstead application form. Do you use this property as your primary residence? The application deadline is march 1 of each year. Web the homestead act (act 50) is a program that reduces your market value by $18,000 for county taxes only. Signnow has paid close attention to ios users and developed an application just for them. Web allegheny county homestead exemptioneasily create electronic signatures for signing an allegheny county homestead exemption form in pdf format. To qualify, you must be the owner and occupy the dwelling as your primary residence. Web the treasurer’s office administrates act 77, senior citizen tax relief, which entitles qualified senior citizen homeowners to a flat 30% discount on the real estate tax on their primary residence. The exemptions apply only to property that you own and occupy as your principal place of residence.

The exemptions apply only to property that you own and occupy as your principal place of residence. Web the homestead act (act 50) is a program that reduces your market value by $15,000 for county taxes only. You do not have to reapply each year. Web to see the format for the homestead/farmstead application, please visit the application for homestead and farmstead exclusions. Signnow has paid close attention to ios users and developed an application just for them. To qualify for the allegheny county homestead act, you must be the owner of the property and occupy the dwelling as your primary residence. Web allegheny county homestead exemptioneasily create electronic signatures for signing an allegheny county homestead exemption form in pdf format. Web the homestead act (act 50) is a program that reduces your market value by $18,000 for county taxes only. Web the treasurer’s office administrates act 77, senior citizen tax relief, which entitles qualified senior citizen homeowners to a flat 30% discount on the real estate tax on their primary residence. Homeowners should contact their county assessment office (position 48) for a copy of their county’s homestead and farmstead application form.

You do not have to reapply each year. The application deadline is march 1 of each year. Signnow has paid close attention to ios users and developed an application just for them. Do you use this property as your primary residence? Web the homestead act (act 50) is a program that reduces your market value by $15,000 for county taxes only. To qualify for the allegheny county homestead act, you must be the owner of the property and occupy the dwelling as your primary residence. Web the treasurer’s office administrates act 77, senior citizen tax relief, which entitles qualified senior citizen homeowners to a flat 30% discount on the real estate tax on their primary residence. Web to see the format for the homestead/farmstead application, please visit the application for homestead and farmstead exclusions. The application deadline is march 1 of each year. You do not have to reapply each year.

Allegheny County Homestead Exemption Fill Out and Sign Printable PDF

The application deadline is march 1 of each year. Web to see the format for the homestead/farmstead application, please visit the application for homestead and farmstead exclusions. Web how do i apply for homestead exemption in allegheny county? You do not have to reapply each year. To qualify, you must be the owner and occupy the dwelling as your primary.

2007 Form OH DTE 105A Fill Online, Printable, Fillable, Blank pdfFiller

Web the homestead act (act 50) is a program that reduces your market value by $15,000 for county taxes only. To qualify, you must be the owner and occupy the dwelling as your primary residence. Web how do i apply for homestead exemption in allegheny county? Web the homestead act (act 50) is a program that reduces your market value.

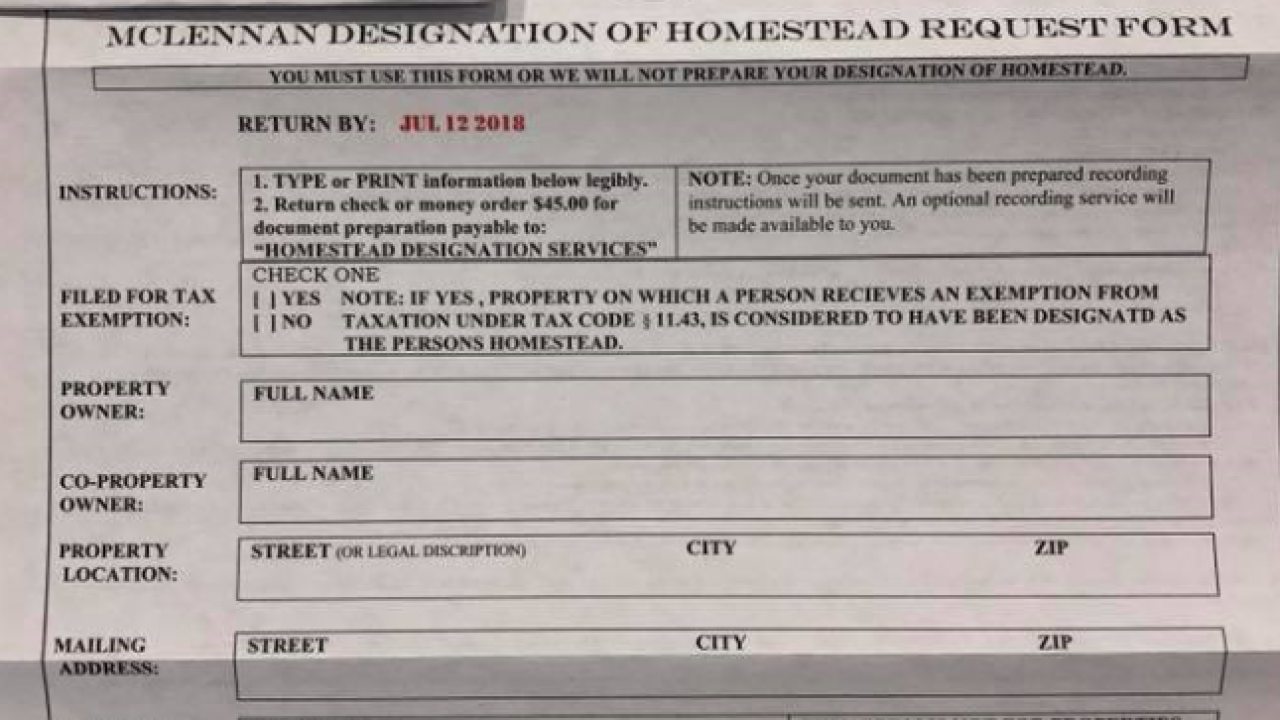

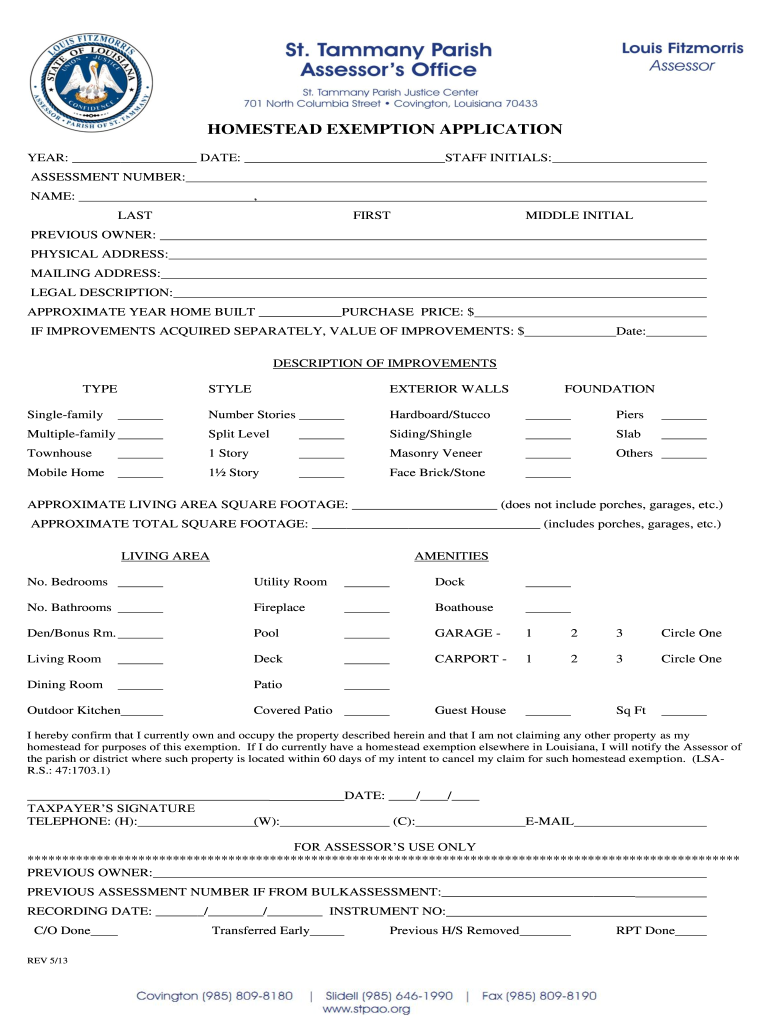

Hays County Homestead Exemption Form 2023

Web to see the format for the homestead/farmstead application, please visit the application for homestead and farmstead exclusions. Web the treasurer’s office administrates act 77, senior citizen tax relief, which entitles qualified senior citizen homeowners to a flat 30% discount on the real estate tax on their primary residence. Homeowners should contact their county assessment office (position 48) for a.

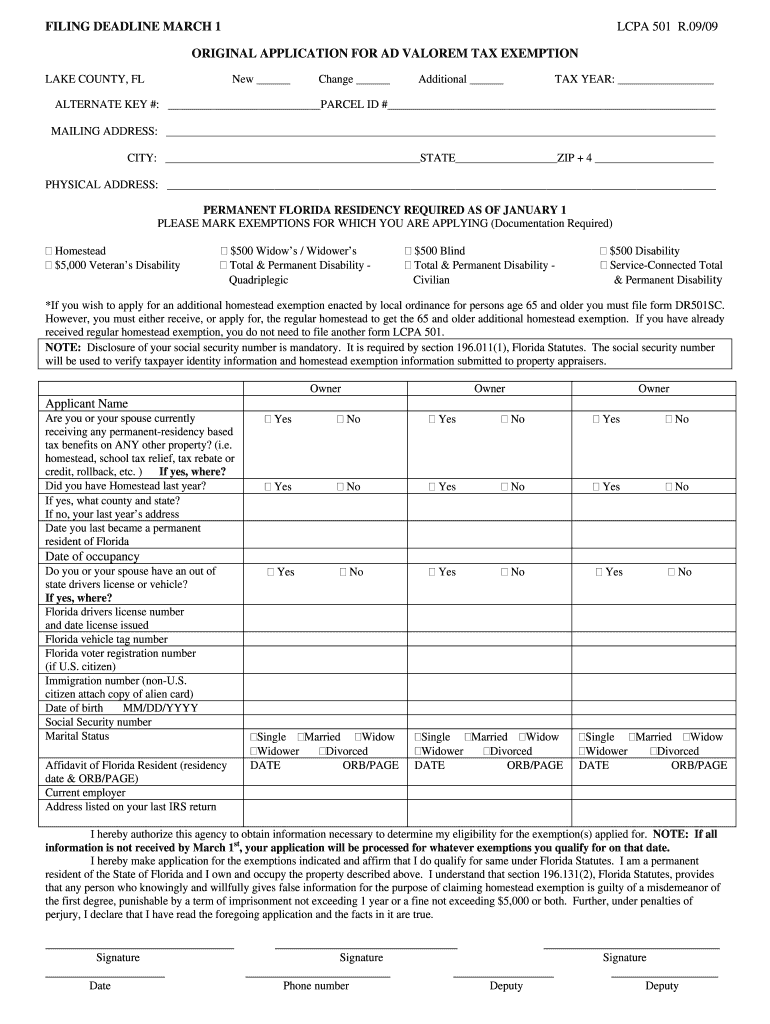

St Lucie County Homestead Exemption Form Fill Out and Sign Printable

Do you use this property as your primary residence? The application deadline is march 1st of each year. You do not have to reapply each year. The application deadline is march 1 of each year. Homeowners should contact their county assessment office (position 48) for a copy of their county’s homestead and farmstead application form.

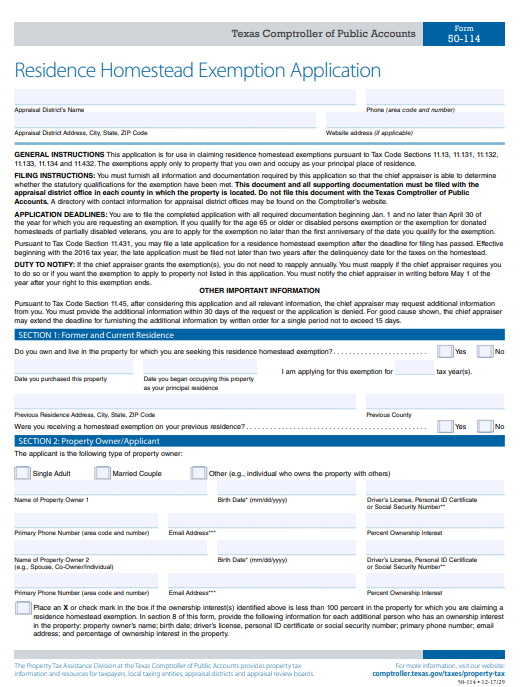

Homestead Exemption Form O'Connor Property Tax Reduction Experts

You do not have to reapply each year. The application deadline is march 1st of each year. Web to see the format for the homestead/farmstead application, please visit the application for homestead and farmstead exclusions. The application deadline is march 1 of each year. Yes no do you claim anywhere else as your primary residence?

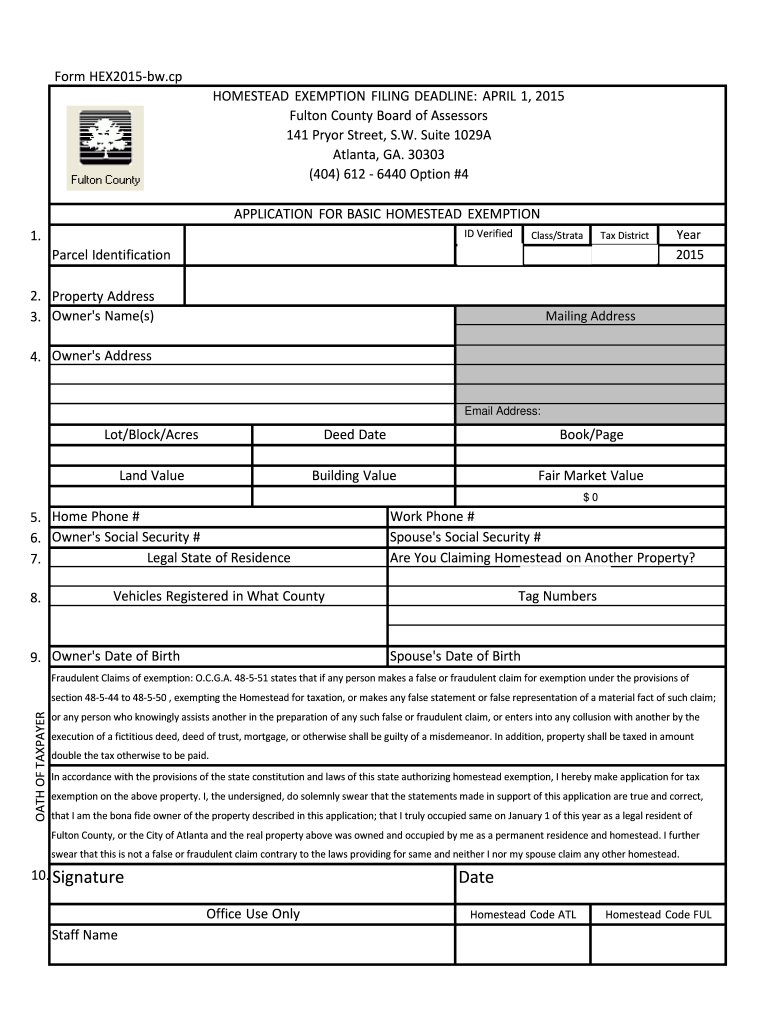

Fulton County Homestead Exemption Form Fill Out and Sign Printable

To qualify, you must be the owner and occupy the dwelling as your primary residence. You do not have to reapply each year. 2024 application will be available in the spring. To qualify for the allegheny county homestead act, you must be the owner of the property and occupy the dwelling as your primary residence. Do you use this property.

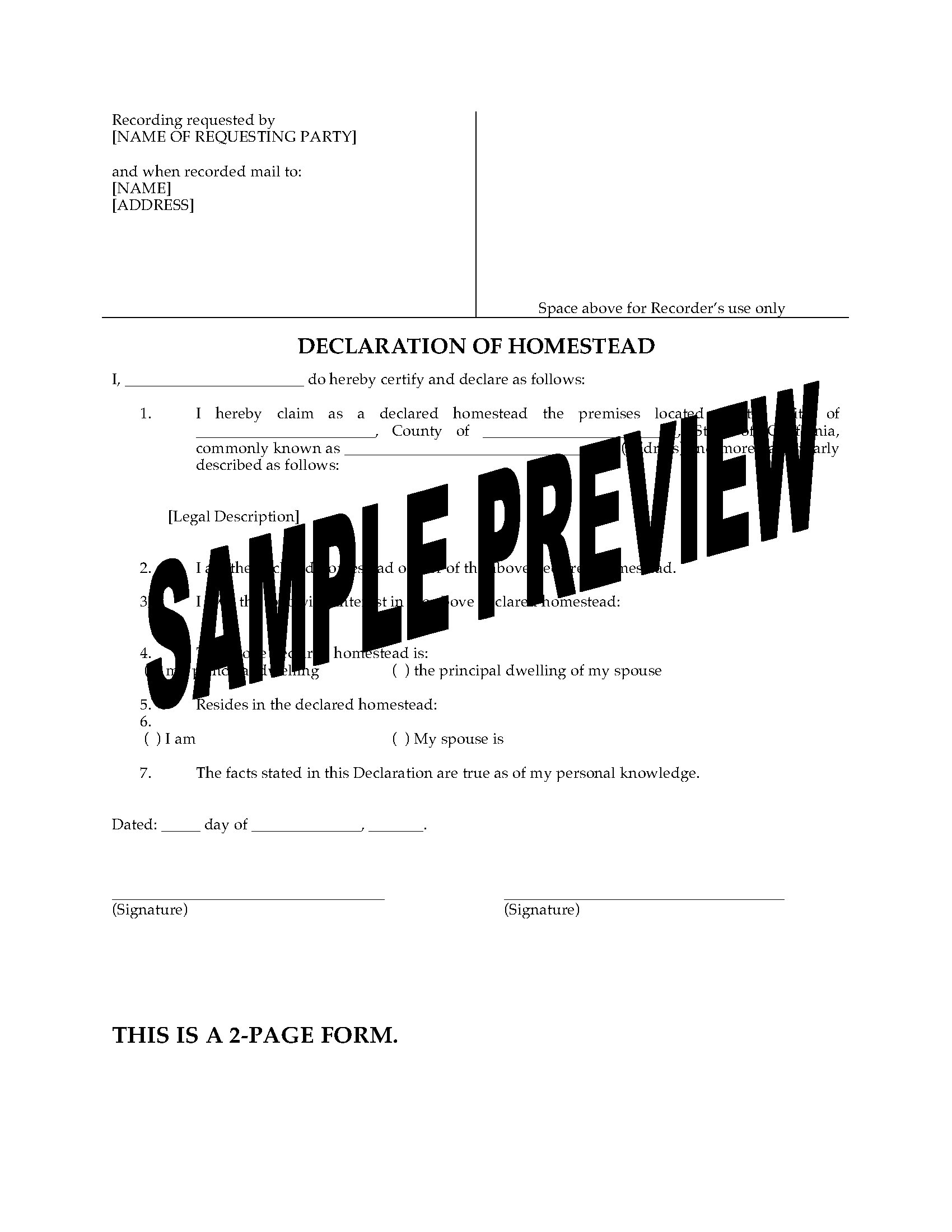

California Homestead Exemption Form Riverside County

Web the homestead act (act 50) is a program that reduces your market value by $15,000 for county taxes only. Web to see the format for the homestead/farmstead application, please visit the application for homestead and farmstead exclusions. Do you use this property as your primary residence? To qualify for the allegheny county homestead act, you must be the owner.

Fill Free fillable County of Allegheny ACT 50 Application for

The application deadline is march 1st of each year. Web the treasurer’s office administrates act 77, senior citizen tax relief, which entitles qualified senior citizen homeowners to a flat 30% discount on the real estate tax on their primary residence. To qualify, you must be the owner and occupy the dwelling as your primary residence. Web how do i apply.

Fillable Form T 1058 Homestead Exemption Update 1996 Printable Pdf

The application deadline is march 1 of each year. The exemptions apply only to property that you own and occupy as your principal place of residence. Yes no do you claim anywhere else as your primary residence? To qualify, you must be the owner and occupy the dwelling as your primary residence. You do not have to reapply each year.

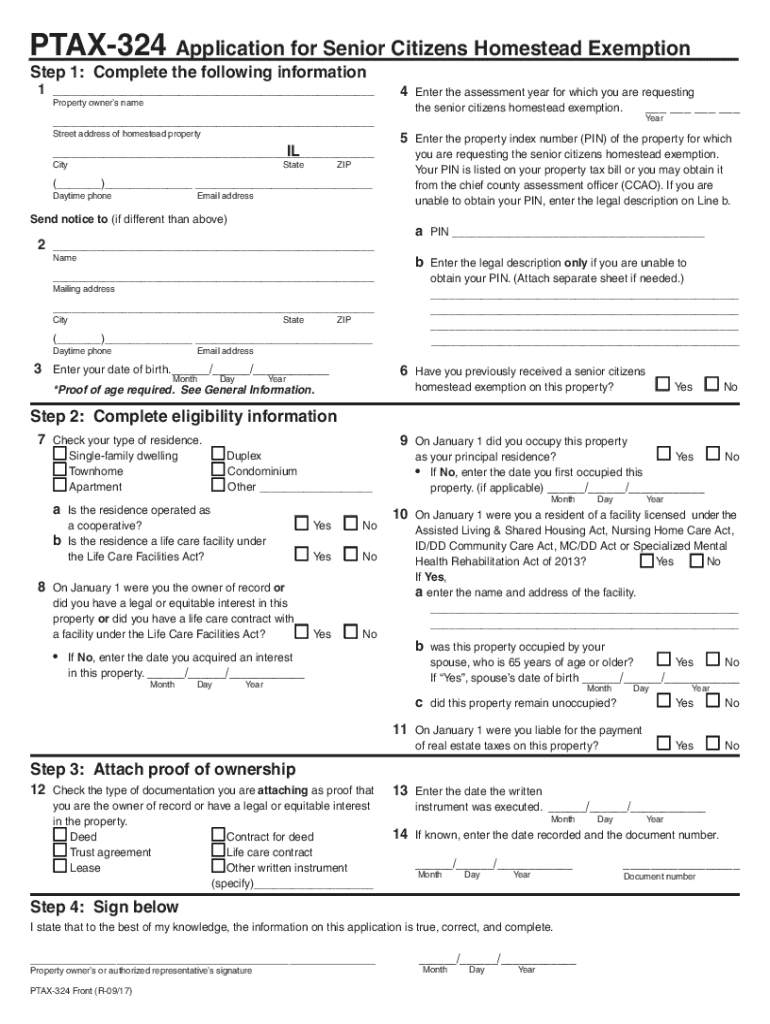

Ptax 324 Fill Out and Sign Printable PDF Template signNow

Web the homestead act (act 50) is a program that reduces your market value by $15,000 for county taxes only. Web allegheny county homestead exemptioneasily create electronic signatures for signing an allegheny county homestead exemption form in pdf format. You do not have to reapply each year. Do you use this property as your primary residence? The exemptions apply only.

Yes No Do You Claim Anywhere Else As Your Primary Residence?

To qualify, you must be the owner and occupy the dwelling as your primary residence. Web notification letter request to include tax delinquent properties in treasurer’s sale form discount extension form if you did not meet the 2% discount deadline (february 10th) of the current tax year, you can complete discount. To qualify for the allegheny county homestead act, you must be the owner of the property and occupy the dwelling as your primary residence. Web the homestead act (act 50) is a program that reduces your market value by $15,000 for county taxes only.

Do You Use This Property As Your Primary Residence?

Signnow has paid close attention to ios users and developed an application just for them. Web how do i apply for homestead exemption in allegheny county? 2024 application will be available in the spring. Web allegheny county homestead exemptioneasily create electronic signatures for signing an allegheny county homestead exemption form in pdf format.

The Application Deadline Is March 1 Of Each Year.

Web the homestead act (act 50) is a program that reduces your market value by $18,000 for county taxes only. Web the treasurer’s office administrates act 77, senior citizen tax relief, which entitles qualified senior citizen homeowners to a flat 30% discount on the real estate tax on their primary residence. The exemptions apply only to property that you own and occupy as your principal place of residence. The application deadline is march 1st of each year.

You Do Not Have To Reapply Each Year.

Web to see the format for the homestead/farmstead application, please visit the application for homestead and farmstead exclusions. To qualify, you must be the owner and occupy the dwelling as your primary residence. Web this application is for claiming residence homestead exemptions pursuant to tax code sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. You do not have to reapply each year.