Allowable Living Expenses Chapter 13

Allowable Living Expenses Chapter 13 - Married individuals must gather this information for their spouse regardless of whether they. It can also be used in chapter 7 and chapter 13. Irs has posted the 2021 ale standards, which are designed to reduce subjectivity when determining the basic living expenses a taxpayer can claim, in. The necessary expense test is defined as expenses that are necessary to provide for a taxpayer’s (and. [definition & classifications] although a favorite saying of irs revenue officers is that “the irs is not a bank” and takes collection of taxes owed seriously, the irs is prevented from collecting assets that a person needs to survive and meet their basic living. Web expense one person two persons three persons four persons; If you need to take on additional monthly expenses, you will have to clear it with your bankruptcy. Web allowable living expenses include those expenses that meet the necessary expense test. This is the category for child care costs, which are allowed. Web 2023 allowable living expenses national standards.

Web expense one person two persons three persons four persons; Web reasonable living expenses with chapter 13 i understand that the irs guidelines regarding reasonable expenses is used in calculating disposable income in a chapter 13 bankruptcy, which has me. Web allowable living expenses include those expenses that meet the necessary expense test. 14 “other necessary expenses” are expenses that meet the necessary expense test and are normally allowed. Web a detailed list of the debtor's monthly living expenses, i.e., food, clothing, shelter, utilities, taxes, transportation, medicine, etc. [definition & classifications] although a favorite saying of irs revenue officers is that “the irs is not a bank” and takes collection of taxes owed seriously, the irs is prevented from collecting assets that a person needs to survive and meet their basic living. Secured debts like your house or car payment must be paid but, in come cases, not all of your. The necessary expense test is defined as expenses that are necessary to provide for a taxpayer’s (and. Web chapter 13 what are irs allowable living expenses? Web 2023 allowable living expenses housing standards county state name 2023 published ale housing expense for a family of 1 2023 published ale housing expense for a family of 2 2023 published ale for a.

Web allowable living expenses include those expenses that meet the necessary expense test. 14 “other necessary expenses” are expenses that meet the necessary expense test and are normally allowed. Secured debts like your house or car payment must be paid but, in come cases, not all of your. If you need to take on additional monthly expenses, you will have to clear it with your bankruptcy. Web irs expenses refers to the allowable living expenses set by internal revenue services.it can also be called the “collection financial standards”. The necessary expense test is defined as expenses that are necessary to provide for a taxpayer's (and his or her family's). Web 2023 allowable living expenses housing standards county state name 2023 published ale housing expense for a family of 1 2023 published ale housing expense for a family of 2 2023 published ale for a. The necessary expense test is defined as expenses that are necessary to provide for a taxpayer’s (and. Web allowable living expenses include those expenses that meet the necessary expense test. Web allowable expenses in chapter 13 allowable expenses.

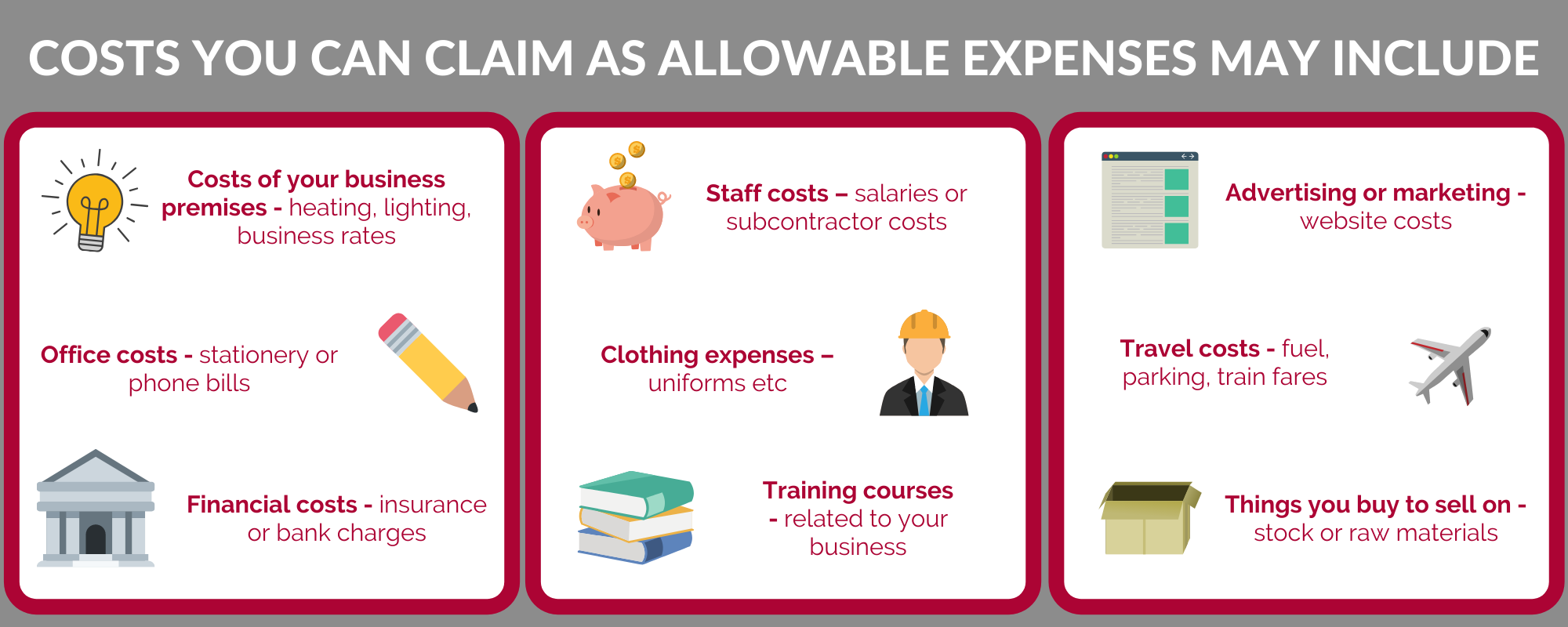

Allowable Expenses Performance Accountancy

It can also be used in chapter 7 and chapter 13. Web expense one person two persons three persons four persons; Web 2021 allowable living expense (ale) standards. The necessary expense test is defined as expenses that are necessary to provide for a taxpayer's (and his or her family's). Web allowable living expenses include those expenses that meet the necessary.

The Challenge of Allowable Living Expenses for Dallas Taxpayers Who Owe

Web reasonable living expenses with chapter 13 i understand that the irs guidelines regarding reasonable expenses is used in calculating disposable income in a chapter 13 bankruptcy, which has me. This is the category for child care costs, which are allowed. At the beginning of the chapter 13 bankruptcy process, the bankruptcy trustee will look at. The key factors in.

Types of NonTax Allowable Expenses In A Company Corporate BackOffice

The necessary expense test is defined as expenses that are necessary to provide for a taxpayer's (and his or her family's). In devising a repayment plan under chapter 13, a debtor will need to calculate their income, property, debts, and expenses. Web 2023 allowable living expenses national standards. Web if the amount claimed is more than the total allowed by.

Allowable Expenses For Rental The Basics Hive Business

Secured debts like your house or car payment must be paid but, in come cases, not all of your. Web 2021 allowable living expense (ale) standards. Married individuals must gather this information for their spouse regardless of whether they. It can also be used in chapter 7 and chapter 13. 14 “other necessary expenses” are expenses that meet the necessary.

What are allowable expenses when renting property? PropertyLab

The key factors in this situation are the. [definition & classifications] although a favorite saying of irs revenue officers is that “the irs is not a bank” and takes collection of taxes owed seriously, the irs is prevented from collecting assets that a person needs to survive and meet their basic living. Web reasonable living expenses with chapter 13 i.

Allowable Living Expenses in an IVA Beat My Debt

14 “other necessary expenses” are expenses that meet the necessary expense test and are normally allowed. Irs has posted the 2021 ale standards, which are designed to reduce subjectivity when determining the basic living expenses a taxpayer can claim, in. The key factors in this situation are the. In devising a repayment plan under chapter 13, a debtor will need.

Allowable expenses Simplified for Business Owners Stonehouse

The necessary expense test is defined as expenses that are necessary to provide for a taxpayer's (and his or her family's). Web expense one person two persons three persons four persons; Web allowable living expenses include those expenses that meet the necessary expense test. Married individuals must gather this information for their spouse regardless of whether they. The necessary expense.

Personal Tax Planning How to get it Right Accountants Price Davis

Married individuals must gather this information for their spouse regardless of whether they. Web 2023 allowable living expenses housing standards county state name 2023 published ale housing expense for a family of 1 2023 published ale housing expense for a family of 2 2023 published ale for a. Secured debts like your house or car payment must be paid but,.

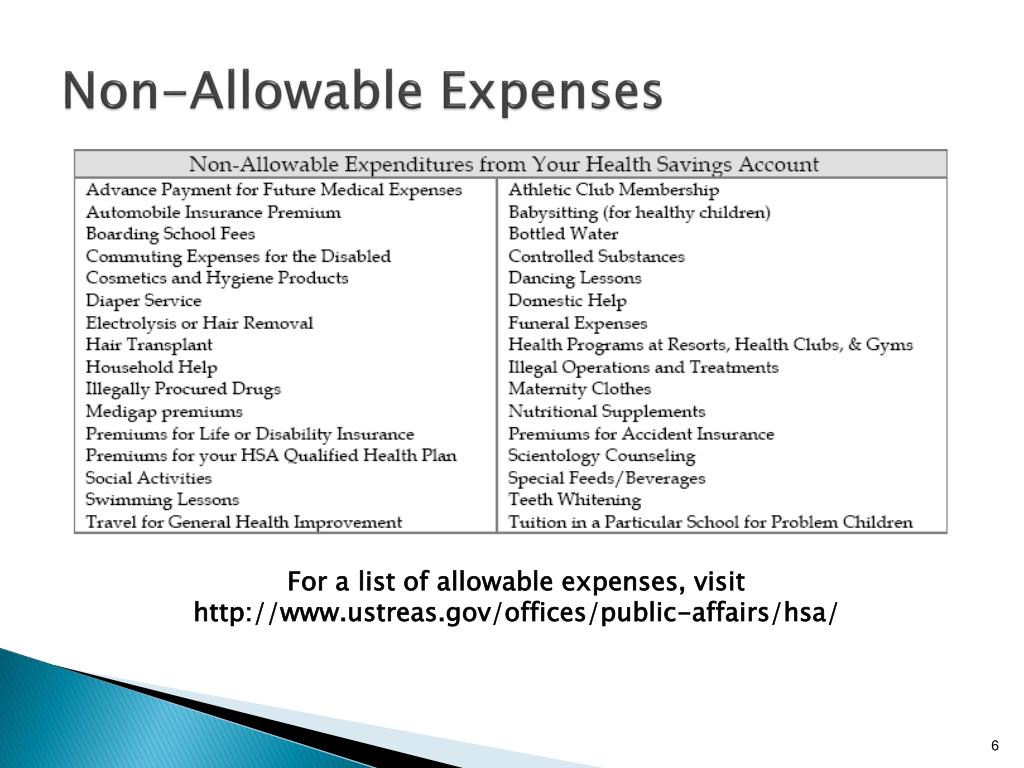

PPT Stratfor Medical Plan Review Plan Year 20082009 PowerPoint

Web allowable living expenses include those expenses that meet the necessary expense test. Web 13 irm 5.15.1.7(1), allowable expense overview (oct. Web if the amount claimed is more than the total allowed by the national standards for food, housekeeping supplies, apparel and services, and personal care products and services, the taxpayer must provide documentation to. The key factors in this.

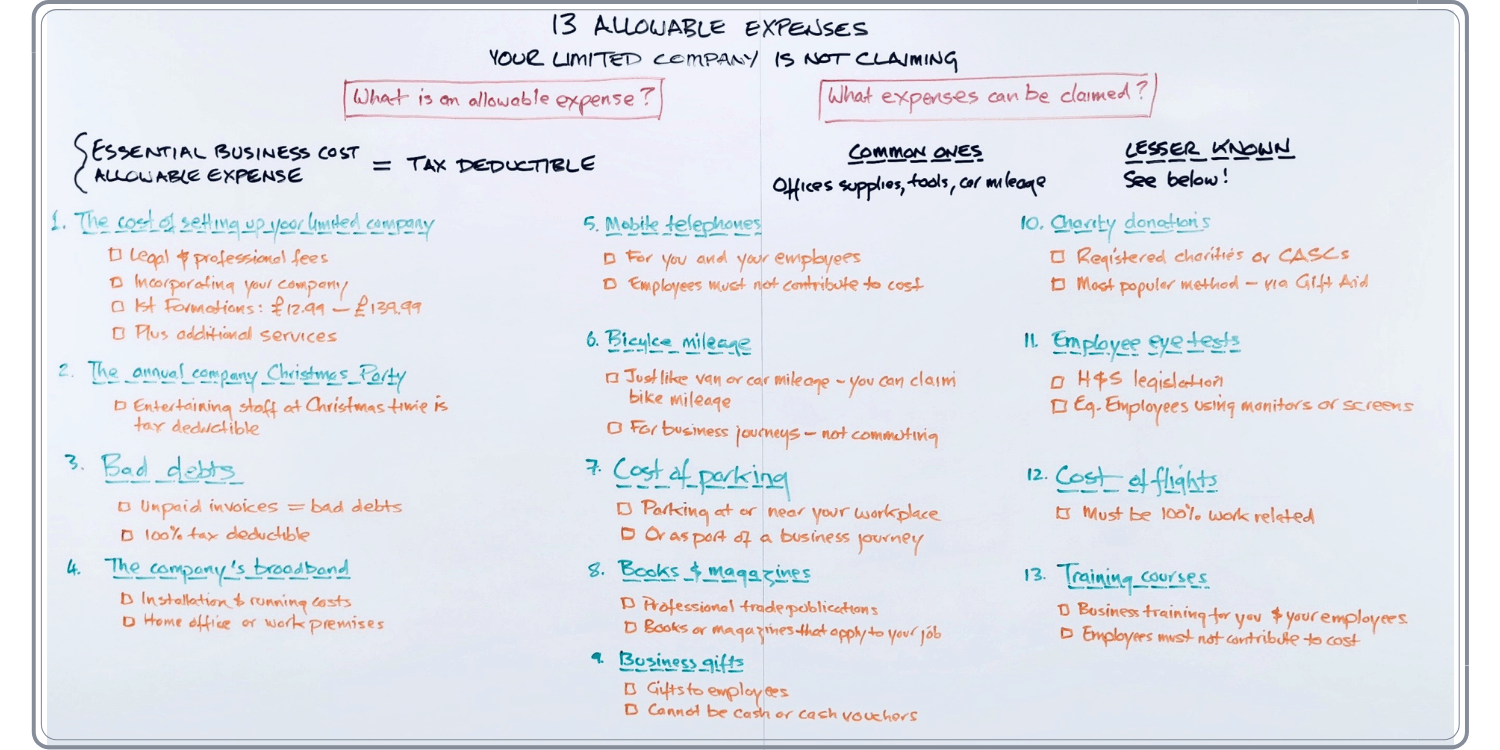

13 allowable expenses your limited company isn’t claiming Whiteboard

Web 2023 allowable living expenses national standards. Married individuals must gather this information for their spouse regardless of whether they. Web 2023 allowable living expenses housing standards county state name 2023 published ale housing expense for a family of 1 2023 published ale housing expense for a family of 2 2023 published ale for a. The necessary expense test is.

Web 2023 Allowable Living Expenses Housing Standards County State Name 2023 Published Ale Housing Expense For A Family Of 1 2023 Published Ale Housing Expense For A Family Of 2 2023 Published Ale For A.

The necessary expense test is defined as expenses that are necessary to provide for a taxpayer's (and his or her family's). Secured debts like your house or car payment must be paid but, in come cases, not all of your. Web the impact of exemptions under chapter 13. The key factors in this situation are the.

Irs Has Posted The 2021 Ale Standards, Which Are Designed To Reduce Subjectivity When Determining The Basic Living Expenses A Taxpayer Can Claim, In.

The necessary expense test is defined as expenses that are necessary to provide for a taxpayer’s (and. Web a detailed list of the debtor's monthly living expenses, i.e., food, clothing, shelter, utilities, taxes, transportation, medicine, etc. The standards are intended to assist determining a taxpayer’s ability to pay a delinquent tax liability. Web allowable living expenses include those expenses that meet the necessary expense test.

If You Need To Take On Additional Monthly Expenses, You Will Have To Clear It With Your Bankruptcy.

Web 13 irm 5.15.1.7(1), allowable expense overview (oct. Married individuals must gather this information for their spouse regardless of whether they. Web allowable living expenses include those expenses that meet the necessary expense test. In devising a repayment plan under chapter 13, a debtor will need to calculate their income, property, debts, and expenses.

Web If The Amount Claimed Is More Than The Total Allowed By The National Standards For Food, Housekeeping Supplies, Apparel And Services, And Personal Care Products And Services, The Taxpayer Must Provide Documentation To.

Web reasonable living expenses with chapter 13 i understand that the irs guidelines regarding reasonable expenses is used in calculating disposable income in a chapter 13 bankruptcy, which has me. [definition & classifications] although a favorite saying of irs revenue officers is that “the irs is not a bank” and takes collection of taxes owed seriously, the irs is prevented from collecting assets that a person needs to survive and meet their basic living. It can also be used in chapter 7 and chapter 13. At the beginning of the chapter 13 bankruptcy process, the bankruptcy trustee will look at.