Amended 1099 Form

Amended 1099 Form - Web instructions for recipient recipient’s taxpayer identification number (tin). Individual income tax return use this revision to amend 2019 or later tax returns. Web you can file the amended form by following the steps below: If an organization is filing an amended return to claim a refund of tax paid under section 4940 or 4948, the irs requires the amended return filed within three years after the date the organization filed its original return, or within two years from. Web for tax year 2022, the filing deadline for brokers to submit 1099 files to the irs is march 31, but some brokers will file for an extension. The biggest mistake we see is that taxpayers make is neglecting to file an information return when one is required. Attach any necessary supporting documentation, such as: In others, the total dollar amount that is written on the form is incorrect. See fix missing contractors or wrong amounts on 1099s. Other forms or schedules that changed, such as schedule a if you updated your itemized deductions

In others, the total dollar amount that is written on the form is incorrect. If you make a mistake on a 1099 form, it’s important to get it corrected for both the internal revenue service (irs) and the payee. If an organization is filing an amended return to claim a refund of tax paid under section 4940 or 4948, the irs requires the amended return filed within three years after the date the organization filed its original return, or within two years from. The 1099 correction form is the same as the original form. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). See fix missing contractors or wrong amounts on 1099s. Record the correct information and other information like you did in the original return. Go to www.irs.gov/form1040x for instructions and the latest information. Prepare a new form 1096 as well with corrected information. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

The biggest mistake we see is that taxpayers make is neglecting to file an information return when one is required. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Irs publication 1220 details what, when, and how brokers report tax forms. Web instructions for recipient recipient’s taxpayer identification number (tin). Attach any necessary supporting documentation, such as: Depending on the additional amount and type of income, the following may be affected: Both the forms and instructions will be updated as needed. If you already mailed or efiled your form 1099's to the irs and now need to make a correction, you will need to file by paper copy a red copy a and 1096, fill out and mail to the irs, if you need further assistance preparing your corrected paper. Once done, mail the form to the irs. If you make a mistake on a 1099 form, it’s important to get it corrected for both the internal revenue service (irs) and the payee.

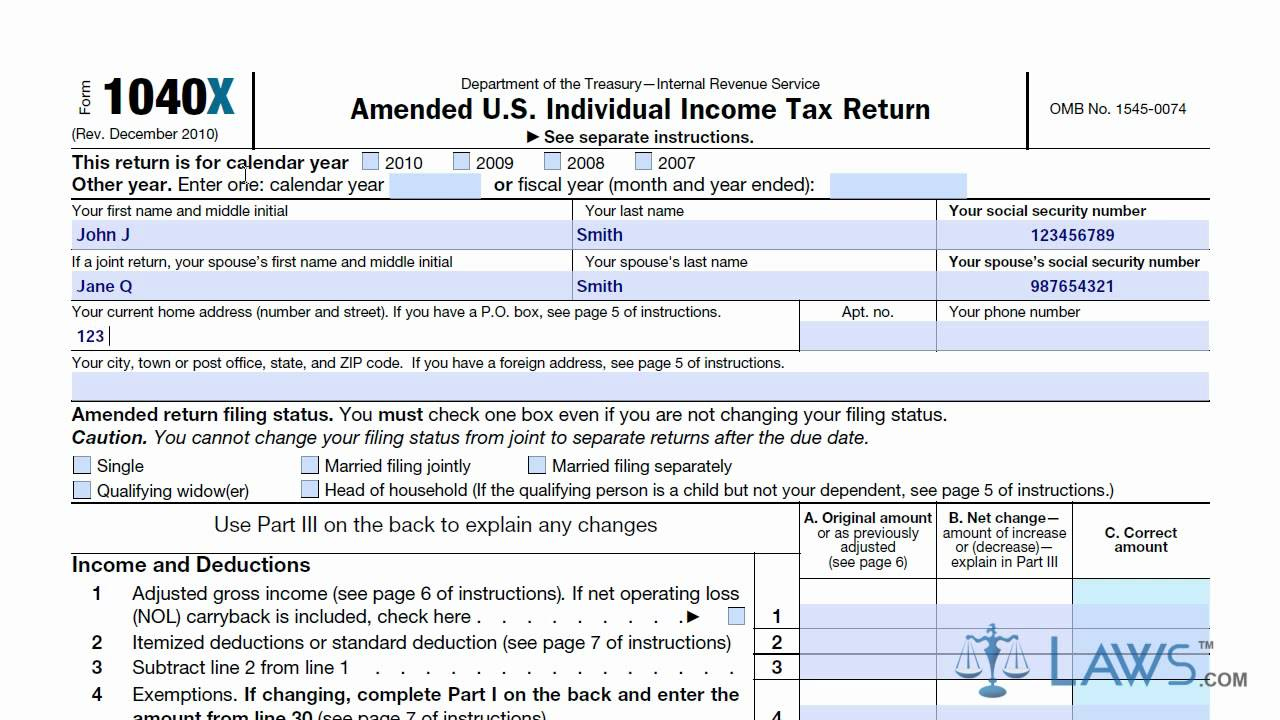

Form 1040X lets you fix a wrong tax return Don't Mess With Taxes

In others, the total dollar amount that is written on the form is incorrect. If you received a form 1099 after submitting your return, you might need to amend it. Web you can file the amended form by following the steps below: Web there are many reasons to amend a 1099 form. Individual income tax return use this revision to.

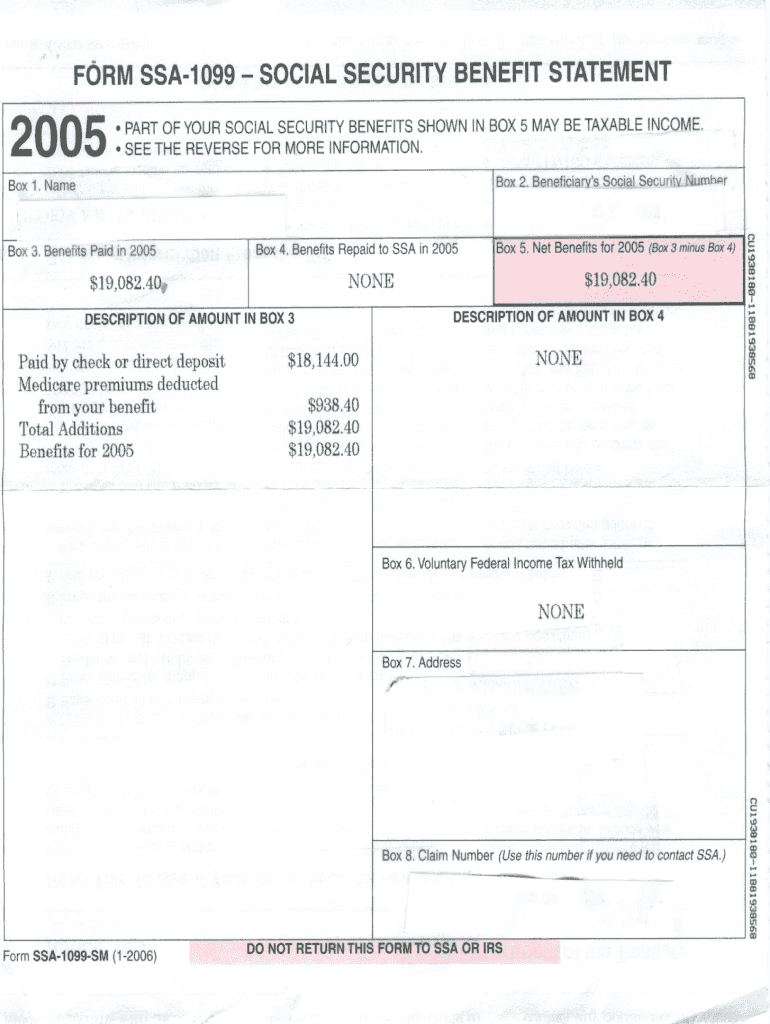

What is a 1099Misc Form? Financial Strategy Center

In others, the total dollar amount that is written on the form is incorrect. If you already mailed or efiled your form 1099's to the irs and now need to make a correction, you will need to file by paper copy a red copy a and 1096, fill out and mail to the irs, if you need further assistance preparing.

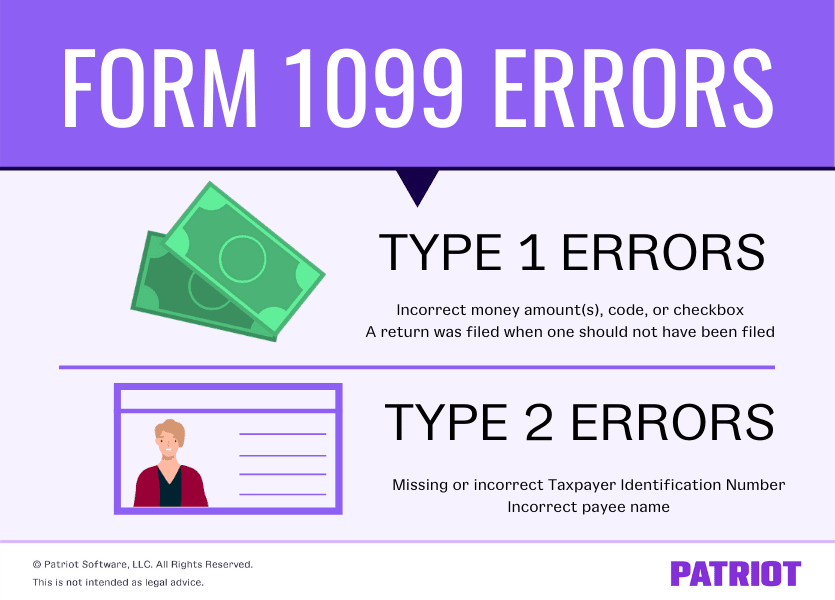

Corrected 1099 Issuing Corrected Forms 1099MISC and 1099NEC

For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Gather all new tax documents. Web there are many reasons to amend a 1099 form. The biggest mistake we see is that taxpayers make is neglecting to file an information return when one is required. If you already mailed or efiled your form 1099's to the irs and now need.

Irs Form 1099 R Corrected Universal Network

If you are claiming a new deduction or credit, any document that supports your eligibility to claim it such as a receipt will be helpful. Go to www.irs.gov/form1040x for instructions and the latest information. The biggest mistake we see is that taxpayers make is neglecting to file an information return when one is required. There are several situations that require.

10 Form Real Estate Five Mind Numbing Facts About 10 Form Real Estate

If you already mailed or efiled your form 1099's to the irs and now need to make a correction, you will need to file by paper copy a red copy a and 1096, fill out and mail to the irs, if you need further assistance preparing your corrected paper. If you are claiming a new deduction or credit, any document.

Learn How To Fill The Form 1040X Amended U S Individual 1040 Form

Web for tax year 2022, the filing deadline for brokers to submit 1099 files to the irs is march 31, but some brokers will file for an extension. Once done, mail the form to the irs. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption.

Form 1040X Amended Tax Return Legacy Tax & Resolution Services

Gather all new tax documents. Not filing a form when a form is needed. Prepare a new form 1096 as well with corrected information. Web to indicate that a form is amended, check “amended return” in item g at the top of page 1. If you already mailed or efiled your form 1099's to the irs and now need to.

Free Printable 1099 Misc Forms Free Printable

Irs publication 1220 details what, when, and how brokers report tax forms. Web for tax year 2022, the filing deadline for brokers to submit 1099 files to the irs is march 31, but some brokers will file for an extension. The 1099 correction form is the same as the original form. Once done, mail the form to the irs. Still.

Ssa 1099 Form 2019 Pdf Fill Online, Printable, Fillable, Blank

Web to indicate that a form is amended, check “amended return” in item g at the top of page 1. Other forms or schedules that changed, such as schedule a if you updated your itemized deductions For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. If you are claiming a new deduction or credit, any document that supports your.

Tax Refund Schedule for July 2021 How to Use 'Where's My Amended

Go to www.irs.gov/form1040x for instructions and the latest information. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web you can file the amended form by following the steps below: Prepare a new form 1096 as.

If You Already Mailed Or Efiled Your Form 1099'S To The Irs And Now Need To Make A Correction, You Will Need To File By Paper Copy A Red Copy A And 1096, Fill Out And Mail To The Irs, If You Need Further Assistance Preparing Your Corrected Paper.

Individual income tax return use this revision to amend 2019 or later tax returns. See fix missing contractors or wrong amounts on 1099s. Depending on the additional amount and type of income, the following may be affected: You must use a regular copy of form 1099 (either nec or misc) and mark the box next to “corrected” at the top.

In Others, The Total Dollar Amount That Is Written On The Form Is Incorrect.

Attach any necessary supporting documentation, such as: Web you can submit a 1099 amendment or corrected form to the irs. If you make a mistake on a 1099 form, it’s important to get it corrected for both the internal revenue service (irs) and the payee. The biggest mistake we see is that taxpayers make is neglecting to file an information return when one is required.

Web Instructions For Recipient Recipient’s Taxpayer Identification Number (Tin).

If you are claiming a new deduction or credit, any document that supports your eligibility to claim it such as a receipt will be helpful. Gather all new tax documents. Not filing a form when a form is needed. Other forms or schedules that changed, such as schedule a if you updated your itemized deductions

Both The Forms And Instructions Will Be Updated As Needed.

Go to www.irs.gov/form1040x for instructions and the latest information. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Whatever the reason may be, the most critical thing is to amend the form promptly. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein).