Amended 1120S Form

Amended 1120S Form - Go to www.irs.gov/form1120s for instructions and the latest information. Say you omitted revenue or deductions when you. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Make an additional tax payment. Information about form 1120x and its instructions is at. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Attach a statement that identifies the line number of each amended item, the corrected amount or treatment of the item, and an explanation of. Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1. Web amended and superseding corporate returns. This is why you need to save the previous version as a different file, so that you may keep a data copy of the originally filed return.

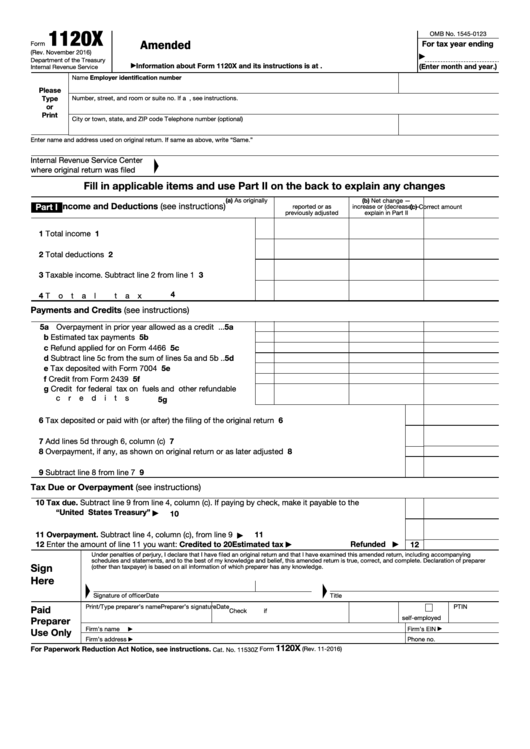

Information about form 1120x and its instructions is at. Amended returns can be amended additional times. November 2016) department of the treasury internal revenue service. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Make an additional tax payment. Attach a statement that identifies the line number of each amended item, the corrected amount or treatment of the item, and an explanation of. Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1. (enter month and year.) please type or print. To access this checkbox through the q&a: Web amended and superseding corporate returns.

Corporation income tax return, including recent updates, related forms, and instructions on how to file. (enter month and year.) please type or print. Make an additional tax payment. Say you omitted revenue or deductions when you. Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Web amended and superseding corporate returns. Go to www.irs.gov/form1120s for instructions and the latest information. Web consolidated returns being amended for a specific tax authority (federal or state (s)) require that same tax authority to be amended in each separate client return in the return group for electronic filing. Information about form 1120x and its instructions is at. Attach a statement that identifies the line number of each amended item, the corrected amount or treatment of the item, and an explanation of.

Federal Gift Tax Form 709 Gift Ftempo ED4

Make an additional tax payment. Corporation income tax return, including recent updates, related forms, and instructions on how to file. (enter month and year.) please type or print. Attach a statement that identifies the line number of each amended item, the corrected amount or treatment of the item, and an explanation of. Income tax return for an s corporation is.

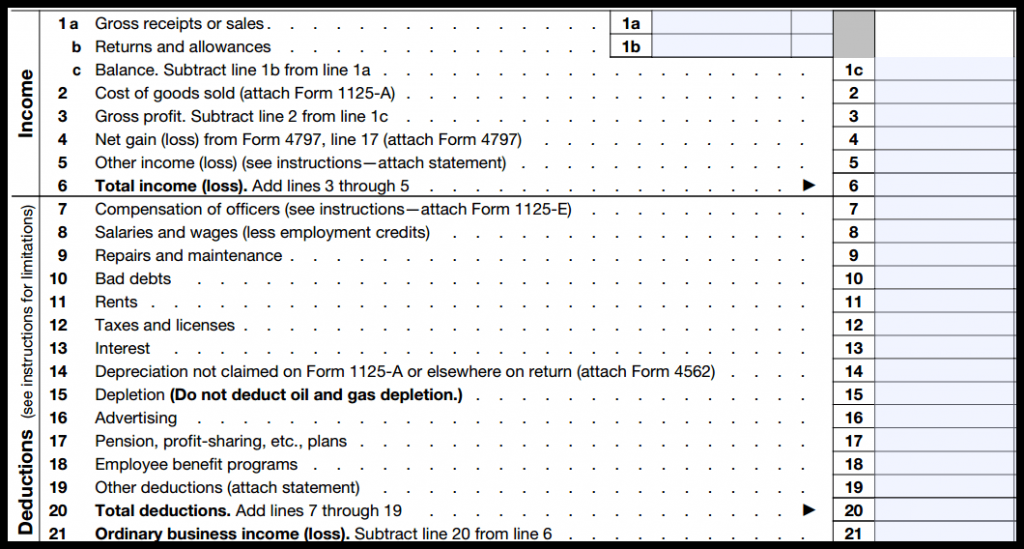

IRS Form 1120S Definition, Download, & 1120S Instructions

Information about form 1120x and its instructions is at. Make an additional tax payment. To access this checkbox through the q&a: Web amended and superseding corporate returns. Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1.

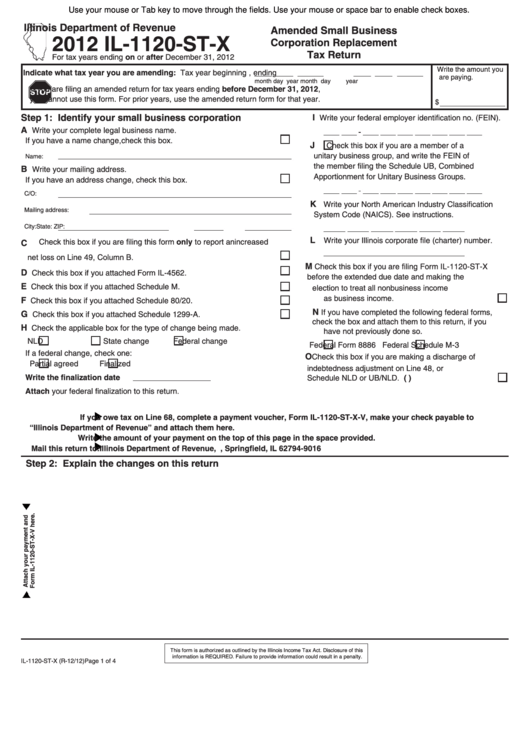

Fillable Form Il1120StX Amended Small Business Corporation

Corporation income tax return, including recent updates, related forms, and instructions on how to file. Make an additional tax payment. Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. (enter month and year.).

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

Go to www.irs.gov/form1120s for instructions and the latest information. Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Say you omitted revenue or deductions when you. Web consolidated returns being amended for a specific tax authority (federal or state (s)) require that same tax.

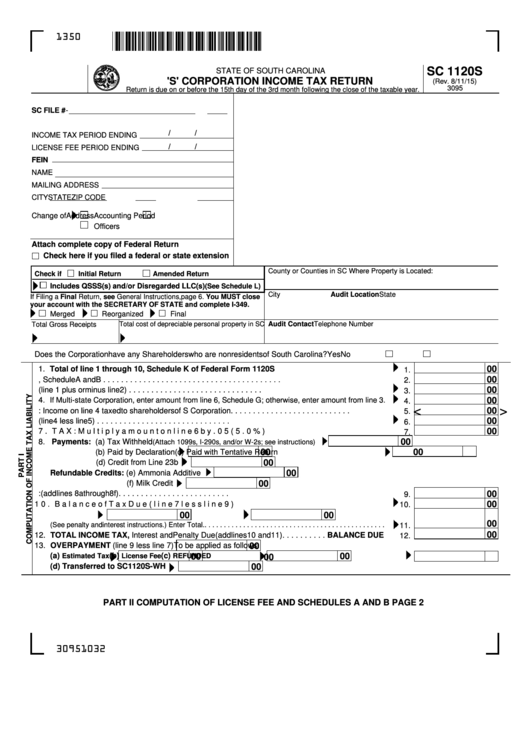

Form Sc 1120s 'S' Corporation Tax Return printable pdf download

Make an additional tax payment. (enter month and year.) please type or print. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Attach a statement that identifies the line number of each amended item, the corrected amount or treatment of the item, and an explanation of. This is why you need to save the.

Fillable Form 1120X Amended U.s. Corporation Tax Return

Web an amended 1120s is not filed using form 1120x, but is done through superseding (or supplanting) the original 1120s return with the revised version. Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s.

Form 1120X Amended U.S. Corporation Tax Return (2012) Free

Go to www.irs.gov/form1120s for instructions and the latest information. (enter month and year.) please type or print. Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1. Make an additional tax payment. To access this checkbox through the q&a:

Download Instructions for Form IL1120 Schedule INS Tax for Foreign

Corporation income tax return, including recent updates, related forms, and instructions on how to file. Web consolidated returns being amended for a specific tax authority (federal or state (s)) require that same tax authority to be amended in each separate client return in the return group for electronic filing. To access this checkbox through the q&a: Information about form 1120x.

How to Complete Form 1120S Tax Return for an S Corp

Say you omitted revenue or deductions when you. Web amended and superseding corporate returns. Income tax return for an s corporation is amended by checking the amended return box located at the top of page 1. Web consolidated returns being amended for a specific tax authority (federal or state (s)) require that same tax authority to be amended in each.

Form 1120 Amended Return Overview & Instructions

(enter month and year.) please type or print. Make an additional tax payment. Amended returns can be amended additional times. Web amended and superseding corporate returns. Corporation income tax return, including recent updates, related forms, and instructions on how to file.

Web An Amended 1120S Is Not Filed Using Form 1120X, But Is Done Through Superseding (Or Supplanting) The Original 1120S Return With The Revised Version.

To access this checkbox through the q&a: Say you omitted revenue or deductions when you. Make an additional tax payment. Information about form 1120x and its instructions is at.

Web Consolidated Returns Being Amended For A Specific Tax Authority (Federal Or State (S)) Require That Same Tax Authority To Be Amended In Each Separate Client Return In The Return Group For Electronic Filing.

Web amended and superseding corporate returns. This is why you need to save the previous version as a different file, so that you may keep a data copy of the originally filed return. Income tax return for an s corporation department of the treasury internal revenue service do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Amended returns can be amended additional times.

November 2016) Department Of The Treasury Internal Revenue Service.

(enter month and year.) please type or print. Go to www.irs.gov/form1120s for instructions and the latest information. Corporation income tax return, including recent updates, related forms, and instructions on how to file. Attach a statement that identifies the line number of each amended item, the corrected amount or treatment of the item, and an explanation of.