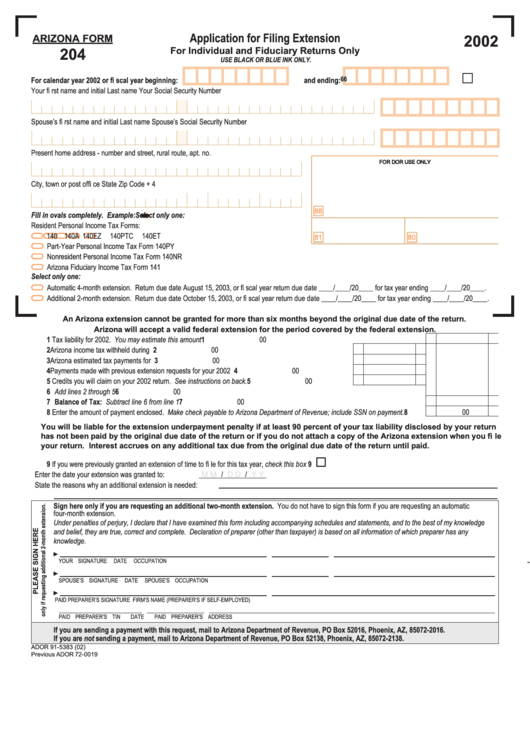

Arizona Form 204

Arizona Form 204 - You do not have to include a copy of the. If you defer your property taxes, you cannot claim the property tax credit for those taxes. The completed extension form must be filed by april 18, 2023. File your arizona return by. If you are filing under a federal extension but are making an arizona extension payment by credit card or electronic payment, do not mail form 204 to us. Web this form is being used to transmit the arizona extension payment. Cocodoc is the best place for you to go, offering you a great and easy to edit version. Web use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. Web we last updated arizona form 204 in february 2023 from the arizona department of revenue. Search by form number, name or organization.

If you are filing under a federal extension but are making an arizona extension payment by credit card or electronic payment, do not mail form 204 to us. Cocodoc is the best place for you to go, offering you a great and easy to edit version. See form 204 for details. Here are links to common. Web this form is being used to transmit the arizona extension payment. Web • apply for a state extension (arizona form 204). To apply for a state extension, file form 204 by april 15, 2022. Web arizona form 204 calendar year filers have until monday, may 17, 2021, to file the request for an extension. Web we last updated arizona form 204 in february 2023 from the arizona department of revenue. Web use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr.

Web we last updated arizona form 204 in february 2023 from the arizona department of revenue. The completed extension form must be filed by april 18, 2023. This will allow you to file your return by october 15, 2021. Web to file an extension on a return, individuals use arizona form 204 to apply for an automatic extension to file. Search by form number, name or organization. This form should be completed after filing your federal taxes, using form 1040. Web arizona form 204 calendar year filers have until monday, may 17, 2021, to file the request for an extension. If you are filing under a federal extension but are making an arizona extension payment by credit card or electronic payment, do not mail form 204 to us. You do not have to include a copy of the. You do not have to include a copy of the extension with your return.

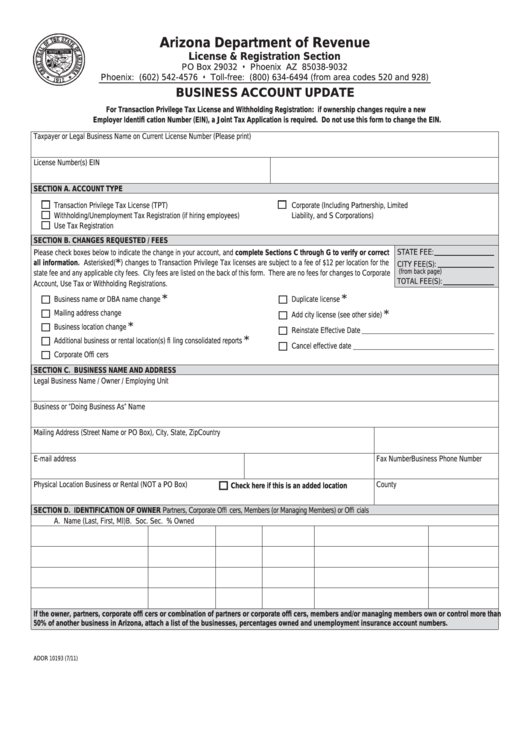

Fillable Arizona Form 10193 Business Account Update printable pdf

If you defer your property taxes, you cannot claim the property tax credit for those taxes. Web use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. If you are filing under a federal extension but are making an. To apply for a state extension, file form.

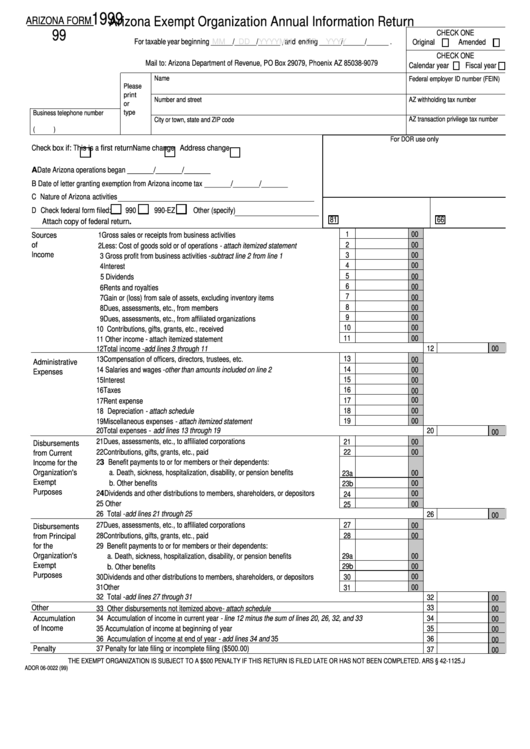

Form 99 Arizona Exempt Organization Annual Information Return 1999

You do not have to include a copy of the. Application for electronic filing of extension request to fill? This form is for income earned in tax year 2022, with tax returns due in april. Web search irs and state income tax forms to efile or complete, download online and back taxes. Cocodoc is the best place for you to.

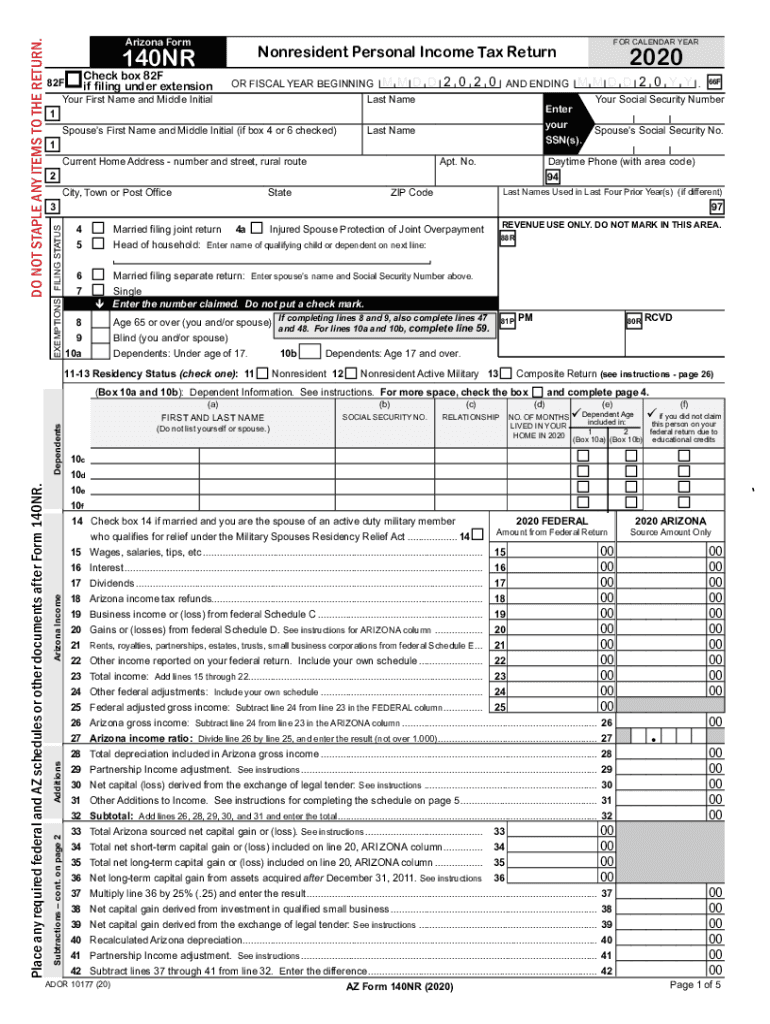

PDF Arizona Form 140NR Arizona Department of Revenue Fill Out and

Web arizona form 204 application for filing extension for individual returns only for calendar year 2021 check one box: If you are filing under a federal extension but are making an. Web we last updated arizona form 204 in february 2023 from the arizona department of revenue. M m d d y y y y m m d d y.

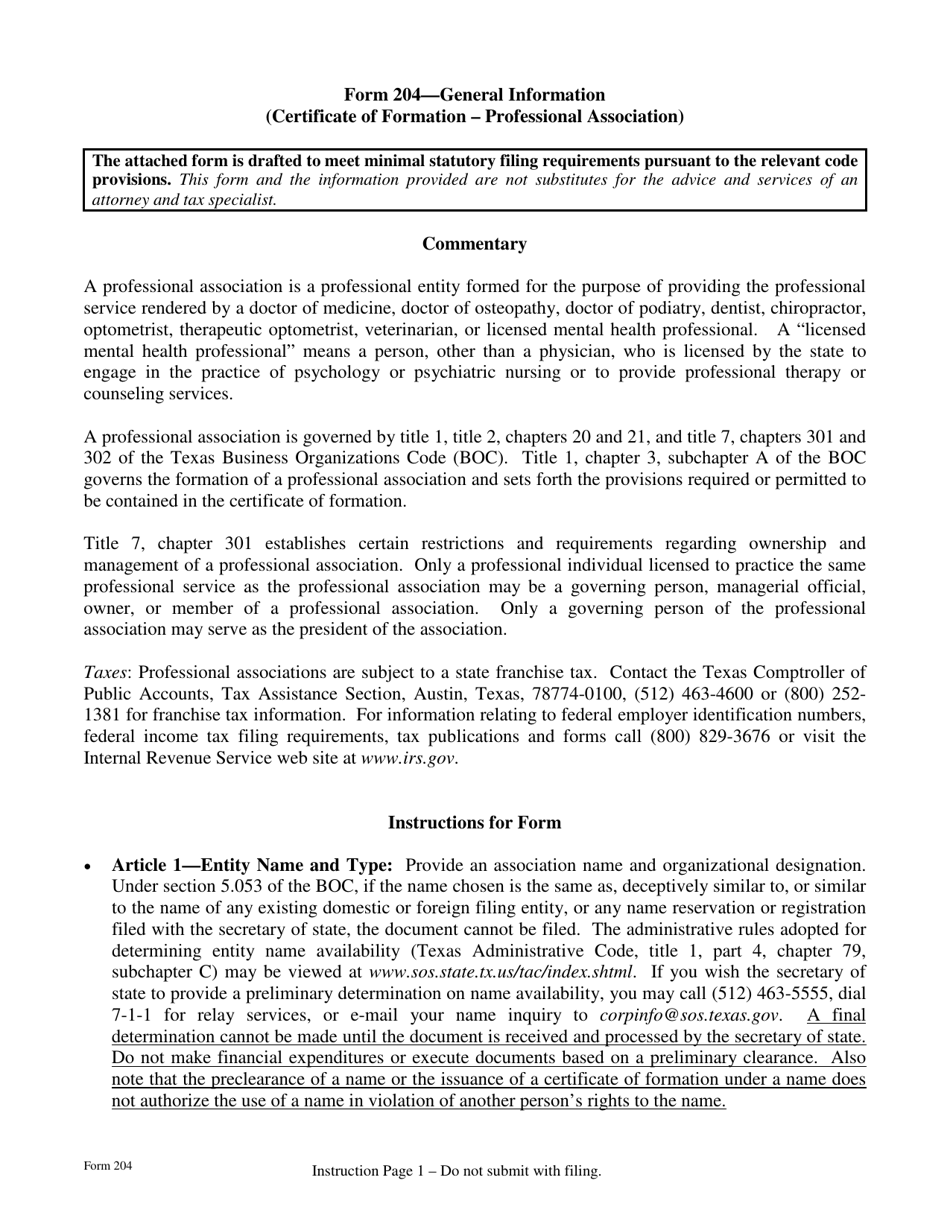

Form 204 Download Fillable PDF or Fill Online Certificate of Formation

This form is for income earned in tax year 2022, with tax returns due in april. You do not have to include a copy of the extension with your return. Here are links to common. For information or help, call one of the numbers listed: See form 204 for details.

Instructions and Download of Arizona Form 140 Unemployment Gov

Web this form is used by residents who file an individual income tax return. The completed extension form must be filed by april 18, 2023. Web you must make a payment, use form 204, or visit www.aztaxes.gov to make an electronic payment. Web arizona form 204 application for filing extension for individual returns only for calendar year 2021 check one.

12052019 SBD Arizona204 US Department of Education Flickr

Web we last updated arizona form 204 in february 2023 from the arizona department of revenue. File your arizona return by. Web • apply for a state extension (arizona form 204). You do not have to include a copy of the extension with your return. This form should be completed after filing your federal taxes, using form 1040.

Fillable Arizona Form 204 Application For Filing Extension 2002

This will allow you to file your return by october 15, 2021. Web you must make a payment, use form 204, or visit www.aztaxes.gov to make an electronic payment. You do not have to include a copy of the. • use your federal extension (federal form 4868). Web 26 rows home forms individual income tax forms individual income tax forms.

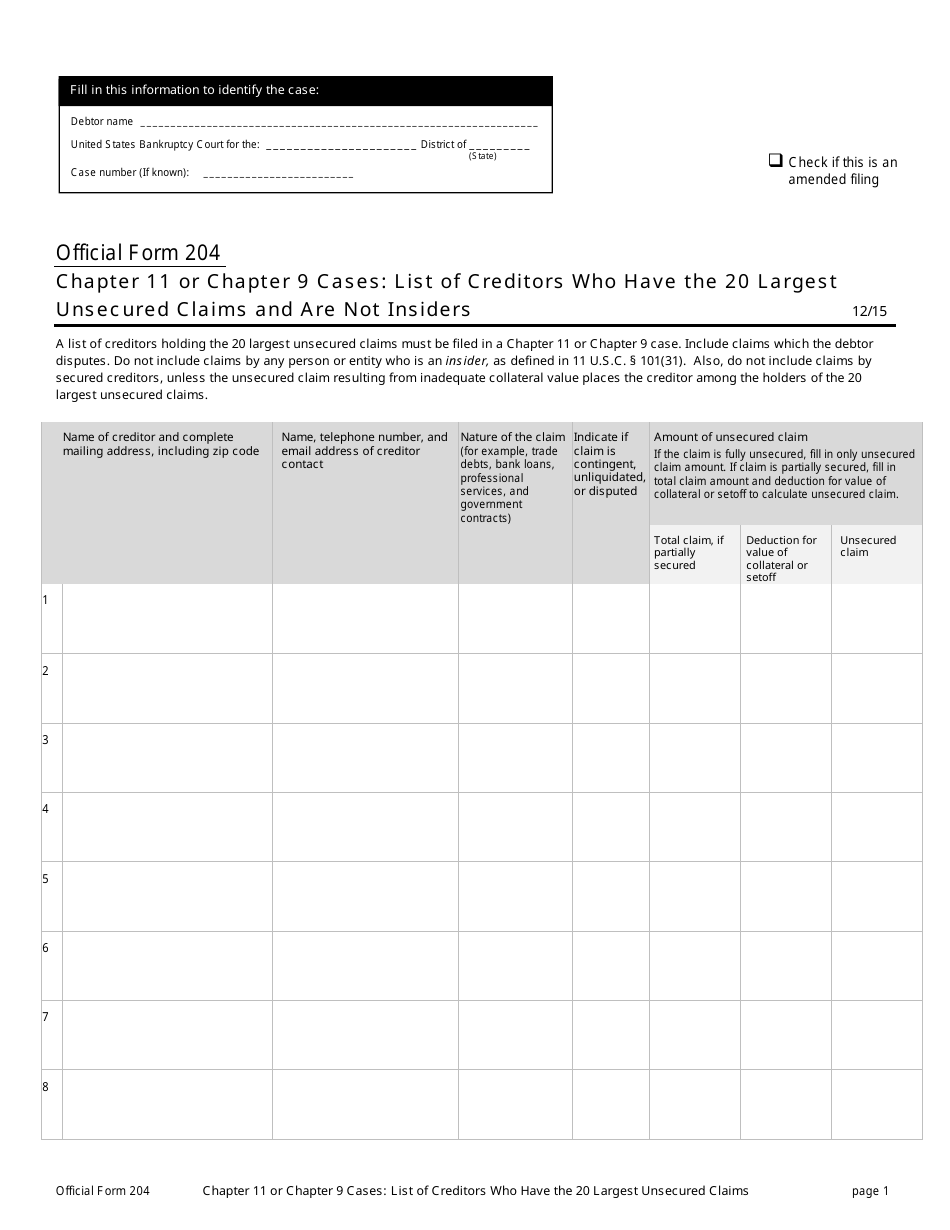

Official Form 204 Download Printable PDF or Fill Online Chapter 11 or

Web arizona form 204 calendar year filers have until monday, may 17, 2021, to file the request for an extension. Application for electronic filing of extension request to fill? You do not have to include a copy of the. Web 26 rows resident shareholder's information schedule form with instructions: The completed extension form must be filed by april 18, 2023.

204 Form YouTube

If you are filing under a federal extension but are making an. This will allow you to file your return by october 15, 2021. If you defer your property taxes, you cannot claim the property tax credit for those taxes. Web this form is used by residents who file an individual income tax return. M m d d y y.

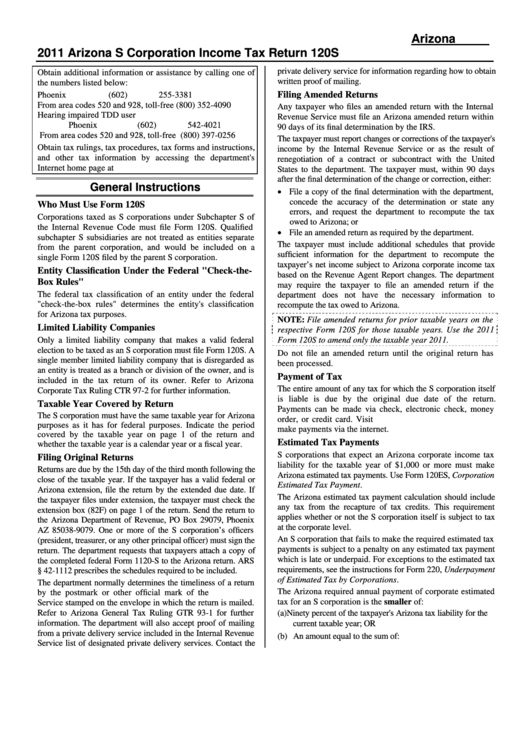

Instructions For Arizona Form 120s Arizona S Corporation Tax

This form is for income earned in tax year 2022, with tax returns due in april. Web we last updated arizona form 204 in february 2023 from the arizona department of revenue. Web arizona form 204 calendar year filers have until monday, may 17, 2021, to file the request for an extension. Individuals use this form to apply for an..

The Completed Extension Form Must Be Filed By April 18, 2023.

M m d d y y y y m m d d y y y y • important: Web we last updated arizona form 204 in february 2023 from the arizona department of revenue. Web purpose of form 204 use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. Application for electronic filing of extension request to fill?

See Form 204 For Details.

Cocodoc is the best place for you to go, offering you a great and easy to edit version. Web arizona form 204 calendar year filers have until monday, may 17, 2021, to file the request for an extension. If you are filing under a federal extension but are making an. See form 204 for details.

M M D D Y Y Y Y M M D D Y Y Y Y • Important:

File your arizona return by. This will allow you to file your return by october 15, 2021. Web use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. To apply for a state extension, file form 204 by april 15, 2021.

This Form Should Be Completed After Filing Your Federal Taxes, Using Form 1040.

Web 26 rows resident shareholder's information schedule form with instructions: Web 26 rows home forms individual income tax forms individual income tax forms the arizona department of revenue will follow the internal revenue service (irs). Web • apply for a state extension (arizona form 204). If you defer your property taxes, you cannot claim the property tax credit for those taxes.