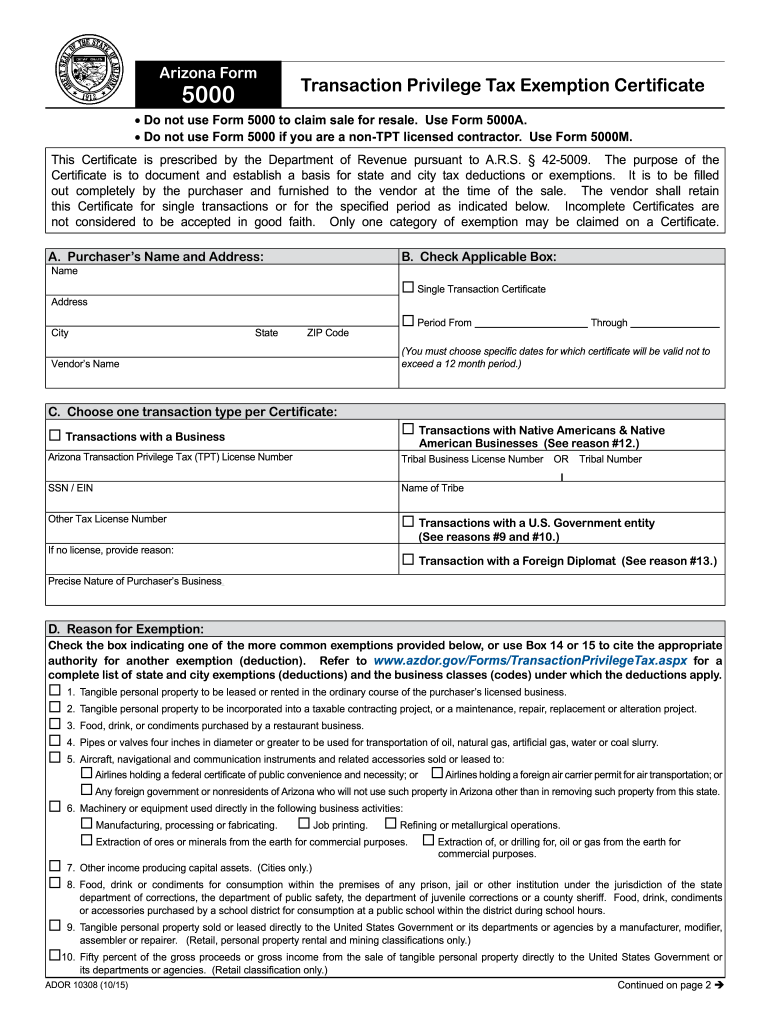

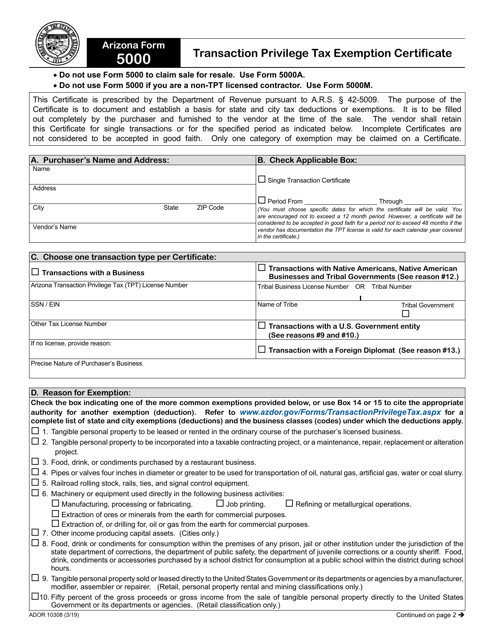

Arizona Form 5000

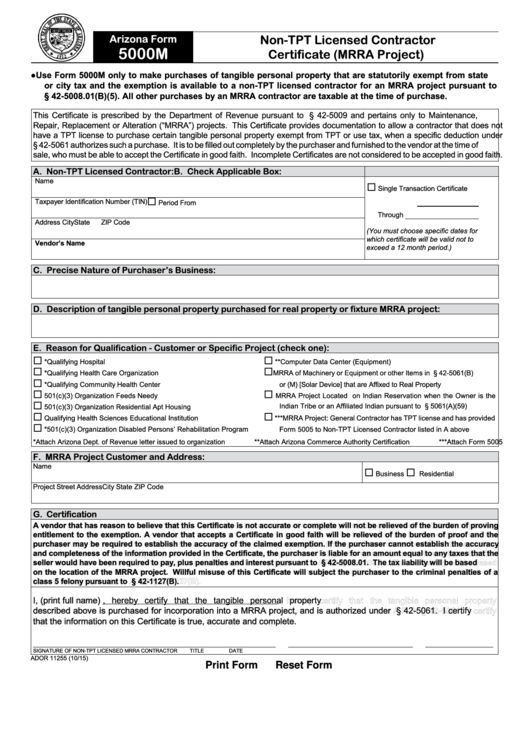

Arizona Form 5000 - Transaction privilege tax aircraft exemption certificate: Purchase exempt materials at retail for mrra projects when the materials are exempt by statute. This certificate is prescribed by the department of revenue pursuant to a.r.s. This certificate is prescribed by the department of revenue pursuant to a.r.s. This certificate is prescribed by the department of revenue pursuant to a.r.s. It is to be fi lled out completely by the purchaser and furnished to the vendor. Web 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Web arizona form 5000 this form replaces earlier forms: Web learn how to issue and use arizona resale certificates in 3 easy steps. The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales tax already collected.

The purpose of the certificate is to document and establish a basis for state and city tax deductions or exemptions. This certificate is prescribed by the department of revenue pursuant to a.r.s. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. Transaction privilege tax aircraft exemption certificate: Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Web learn how to issue and use arizona resale certificates in 3 easy steps. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Access an online guide in order to download a form az 5000 exemption license. Web 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. This certificate is prescribed by the department of revenue pursuant to a.r.s.

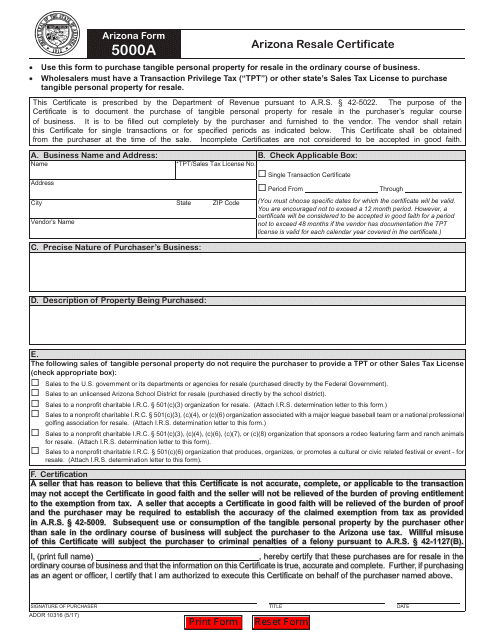

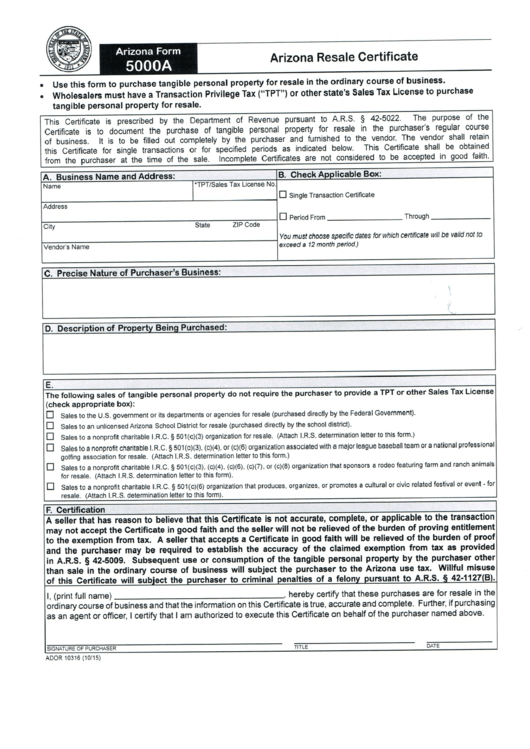

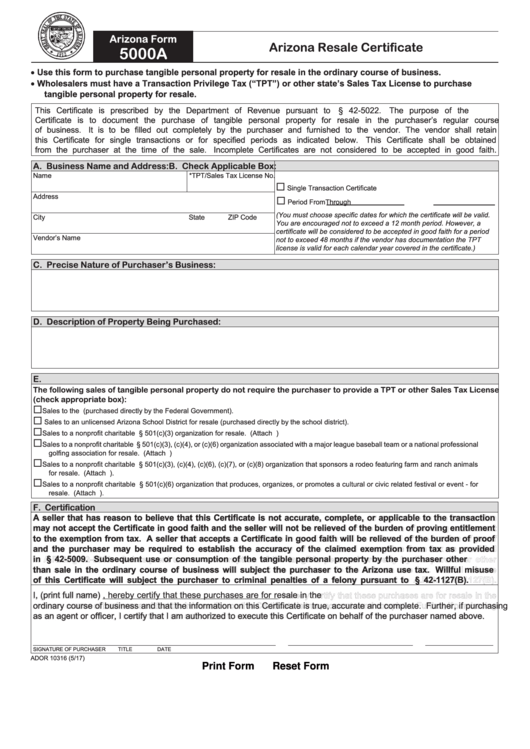

Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. The purpose of the certificate is to document and establish a basis for state and city tax deductions or exemptions. This certificate is prescribed by the department of revenue pursuant to a.r.s. This certificate is prescribed by the department of revenue pursuant to a.r.s. It is to be fi lled out completely by the purchaser and furnished to the vendor. Web learn how to issue and use arizona resale certificates in 3 easy steps. Purchase exempt materials at retail for mrra projects when the materials are exempt by statute. The certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the university in these cases, or for the vendor to refund the sales tax already billed to the university.

2015 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank pdfFiller

Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. This certificate is prescribed by the department of revenue pursuant to a.r.s. Web 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Web arizona form 5000 this form replaces earlier forms: The certificate must be provided to the.

Arizona Form 5000A (ADOR10316) Download Fillable PDF or Fill Online

Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. The certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the university in these cases, or for the vendor to refund the sales tax already billed to the university. Web arizona form.

Free Arizona Boat Bill of Sale Form 678 Form PDF Word (.doc)

The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales tax already collected. The certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the university in these cases, or for the.

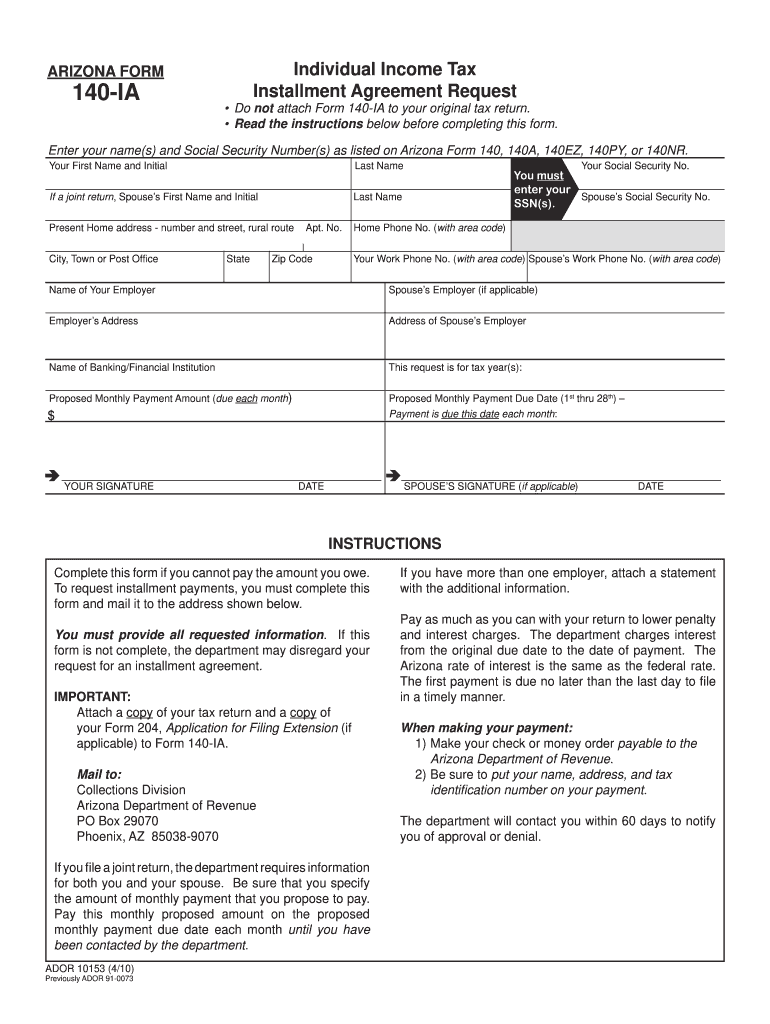

Arizona Form 140IA Arizona Department Of Revenue Fill and Sign

Web arizona form 5000 this form replaces earlier forms: The purpose of the certificate is to document and establish a basis for state and city tax deductions or exemptions. The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales tax already collected. Purchase.

Fill Free fillable forms Arizona Department of Real Estate

Web learn how to issue and use arizona resale certificates in 3 easy steps. Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. This certificate is prescribed by the department of revenue pursuant to a.r.s. Web arizona form 5000 this form replaces earlier forms: Purchase exempt materials at retail.

Arizona Form 5000 (ADOR10308) Fill Out, Sign Online and Download

The purpose of the certificate is to document and establish a basis for state and city tax deductions or exemptions. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to. Web arizona form 5000 this form replaces earlier forms: Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim.

6 Arizona 5000 Forms And Templates free to download in PDF

Access an online guide in order to download a form az 5000 exemption license. The purpose of the certificate is to document and establish a basis for state and city tax deductions or exemptions. This certificate is prescribed by the department of revenue pursuant to a.r.s. Purchase exempt materials at retail for mrra projects when the materials are exempt by.

Fillable Form 5000a Arizona Resale Certificate printable pdf download

The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales tax already collected. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Web learn how to issue and use arizona resale certificates in.

Arizona Form 111 Fill Online, Printable, Fillable, Blank pdfFiller

Web 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. This certificate is prescribed by the department of revenue pursuant to a.r.s. The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales tax already collected. Web.

6 Arizona 5000 Forms And Templates free to download in PDF

Web learn how to issue and use arizona resale certificates in 3 easy steps. Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. The certificate is provided to vendors so they can document why sales tax was not charged to the university in these cases, or why they refunded sales.

It Is To Be Fi Lled Out Completely By The Purchaser And Furnished To The Vendor.

Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Transaction privilege tax aircraft exemption certificate: Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Access an online guide in order to download a form az 5000 exemption license.

Web Arizona Form 5000 Is Used To Claim Arizona Tpt (Sales Tax) Exemptions From A Vendor.

Web arizona form 5000 this form replaces earlier forms: Web arizona form 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Purchase exempt materials at retail for mrra projects when the materials are exempt by statute. Web learn how to issue and use arizona resale certificates in 3 easy steps.

The Certificate Is Provided To Vendors So They Can Document Why Sales Tax Was Not Charged To The University In These Cases, Or Why They Refunded Sales Tax Already Collected.

This certificate is prescribed by the department of revenue pursuant to a.r.s. The certificate must be provided to the vendor in order for the vendor to document why sales tax is not charged to the university in these cases, or for the vendor to refund the sales tax already billed to the university. Web 5000 transaction privilege tax exemption certificate do not use form 5000 to claim sale for resale. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s sales tax license to.

This Certificate Is Prescribed By The Department Of Revenue Pursuant To A.r.s.

The purpose of the certificate is to document and establish a basis for state and city tax deductions or exemptions. This certificate is prescribed by the department of revenue pursuant to a.r.s.