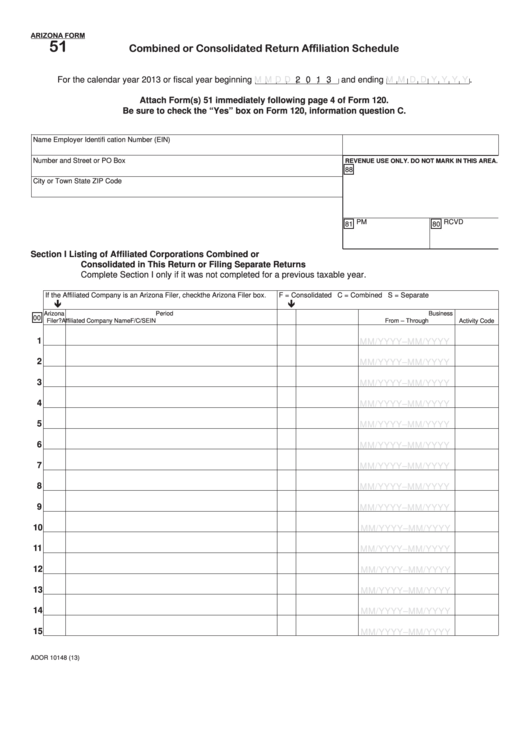

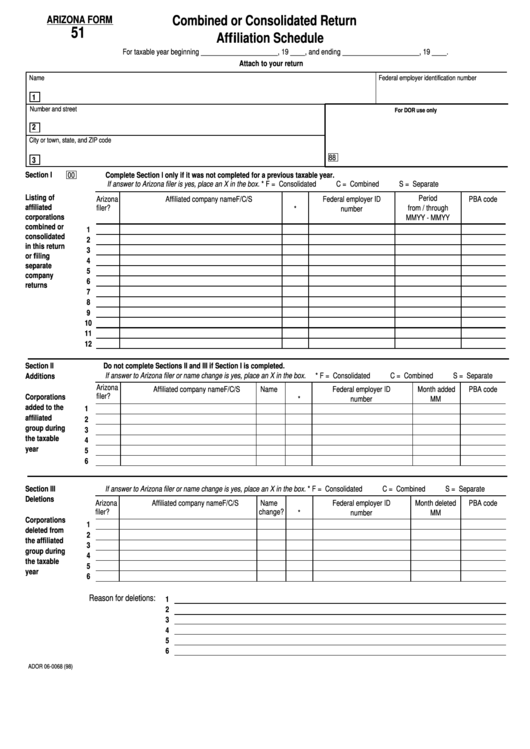

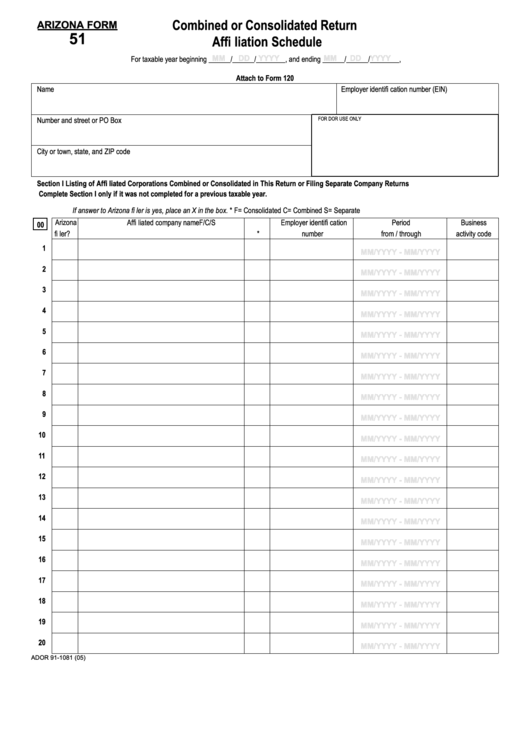

Arizona Form 51

Arizona Form 51 - Arizona department of revenue subject: Combined or consolidated in this return or filing separate. List the affiliated corporations that file to. Web 20 rows 120s. Web purpose and use of the form. Arizona form 51 name number and street. These changes include name changes, additions to the group filing the. Be sure to check the “yes” box on form. Web arizona form 51t author: Be sure to check the “yes” box on form 120, information question c.

Be sure to check the “yes” box on form 120, information question c. These changes include name changes, additions to the group filing the. Web we last updated the election for accounting and reporting expenses credit in march 2023, so this is the latest version of form 51t, fully updated for tax year 2022. Web attach form(s) 51 immediately following page 4 of form 120. Arizona form 51 name number and street. Web az form 51 (2021) page 2 of 2 section 2 corporations added to the affiliated group during the taxable year do not complete section 2 if section 1 is completed. Ador 10148 (16) name (as shown on page 1) ein az form 51 (2016) page 2 of 2 section 2. Web you may be offline or with limited connectivity. Web 12 rows forms corporate tax forms combined or consolidated return affiliation schedules combined or consolidated return affiliation schedules. Arizona s corporation income tax return.

Web arizona form 51t author: Be sure to check the “yes” box on form 120, information question c. Arizona department of revenue subject: Arizona form 51 name number and street. Web arizona form 51 consolidated or combined return affiliation schedule 2022 include form(s) 51 immediately following form 120. These changes include name changes, additions to the group filing the. Web form 51 identifies changes to the federal consolidated group and related companies during the taxable year. Combined or consolidated in this return or filing separate. Web you may be offline or with limited connectivity. Web 51 nonrefundable credits from arizona form 301, part 2, line 61.

Fillable Arizona Form 51 Combined Or Consolidated Return Affiliation

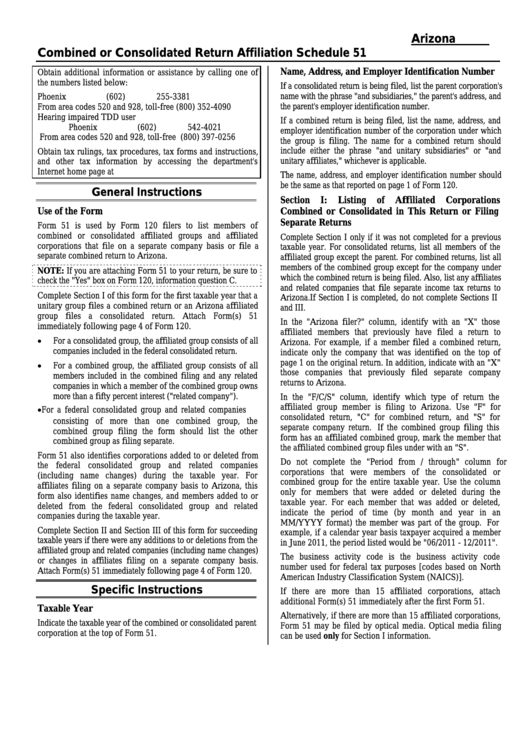

Web general instructions use of the form form 51 is used by form 120 filers to list members of combined or consolidated affiliated groups and affiliated corporations that file on a. Web form 51 is used by form 120 filers to list members of combined or consolidated affiliated groups and affiliated corporations that file on a separate company basis, or.

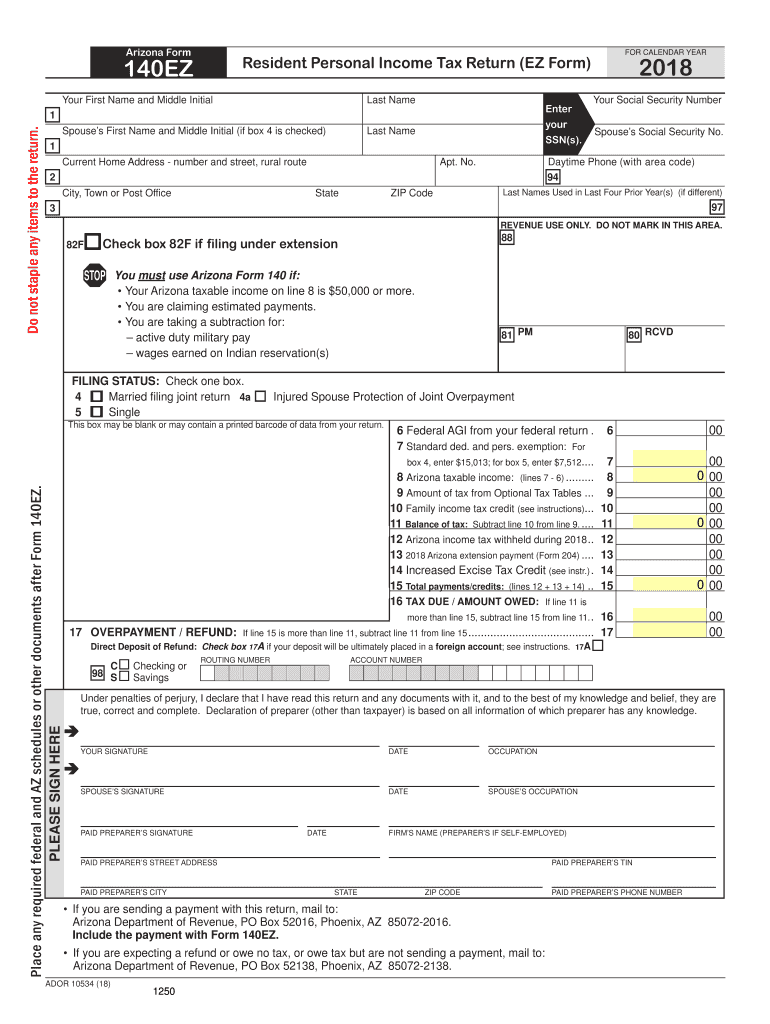

Arizona Form 140ez Fill Out and Sign Printable PDF Template signNow

Web purpose and use of the form. 51 00 52 balance of tax: Web arizona form 51 combined or consolidated return affiliation schedule 2016. Be sure to check the “yes” box on form. Web arizona form 51t author:

Fillable Arizona Form 51 Combined Or Consolidated Return Affiliation

Arizona form 51 name number and street. Web 20 rows 120s. Web 26 rows resident shareholder's information schedule form with instructions: Web arizona form 51 combined or consolidated return affiliation schedule 2016. List the affiliated corporations that file to.

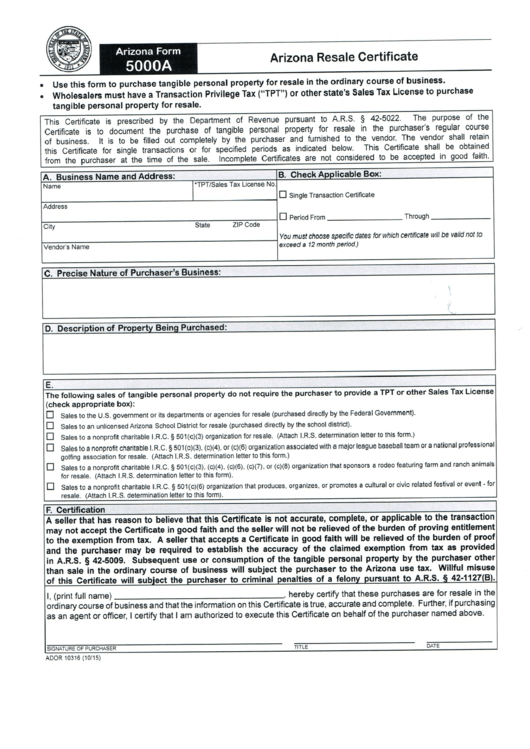

6 Arizona 5000 Forms And Templates free to download in PDF

Web arizona form 51t author: Web arizona form 51 consolidated or combined return affiliation schedule 2022 include form(s) 51 immediately following form 120. Web 51 nonrefundable credits from arizona form 301, part 2, line 61. 51 00 52 balance of tax: Web general instructions use of the form form 51 is used by form 120 filers to list members of.

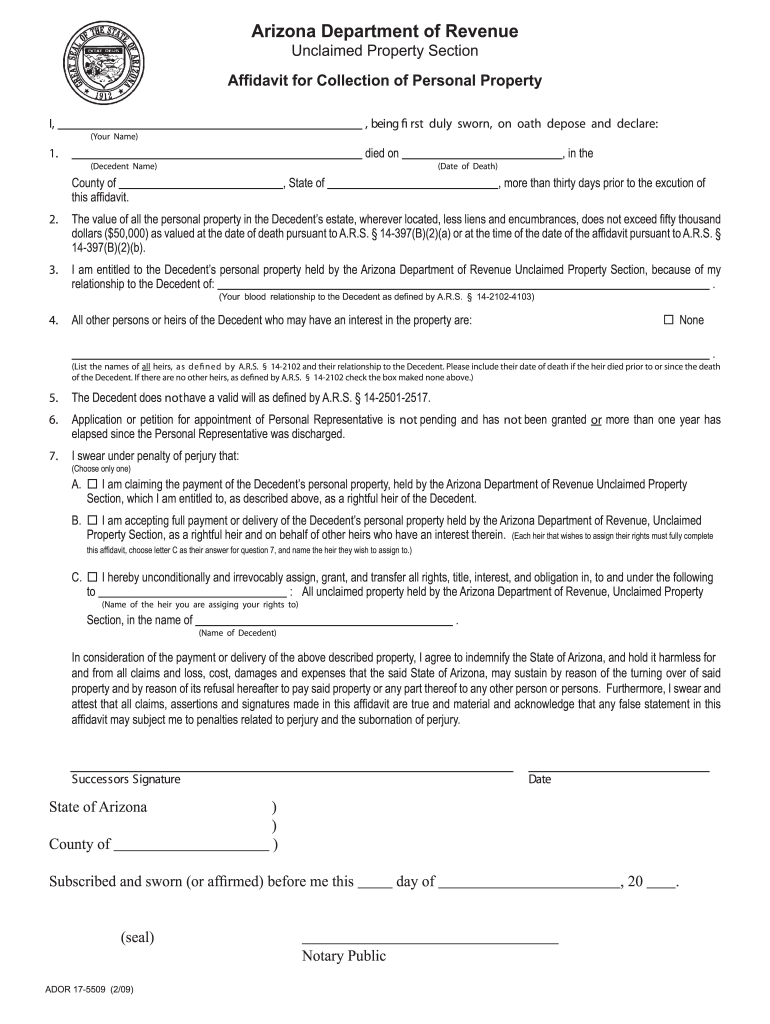

Arizona Form 17 5509 Fill Out and Sign Printable PDF Template signNow

Web general instructions use of the form form 51 is used by form 120 filers to list members of combined or consolidated affiliated groups and affiliated corporations that file on a. Web arizona form 51t author: Web we last updated the election for accounting and reporting expenses credit in march 2023, so this is the latest version of form 51t,.

Download Arizona Form A4 (2013) for Free FormTemplate

Web attach form(s) 51 immediately following page 4 of form 120. Web general instructions use of the form arizona form 120 filers complete form 51 to: Ador 10148 (16) name (as shown on page 1) ein az form 51 (2016) page 2 of 2 section 2. Arizona s corporation income tax return. Web 12 rows forms corporate tax forms combined.

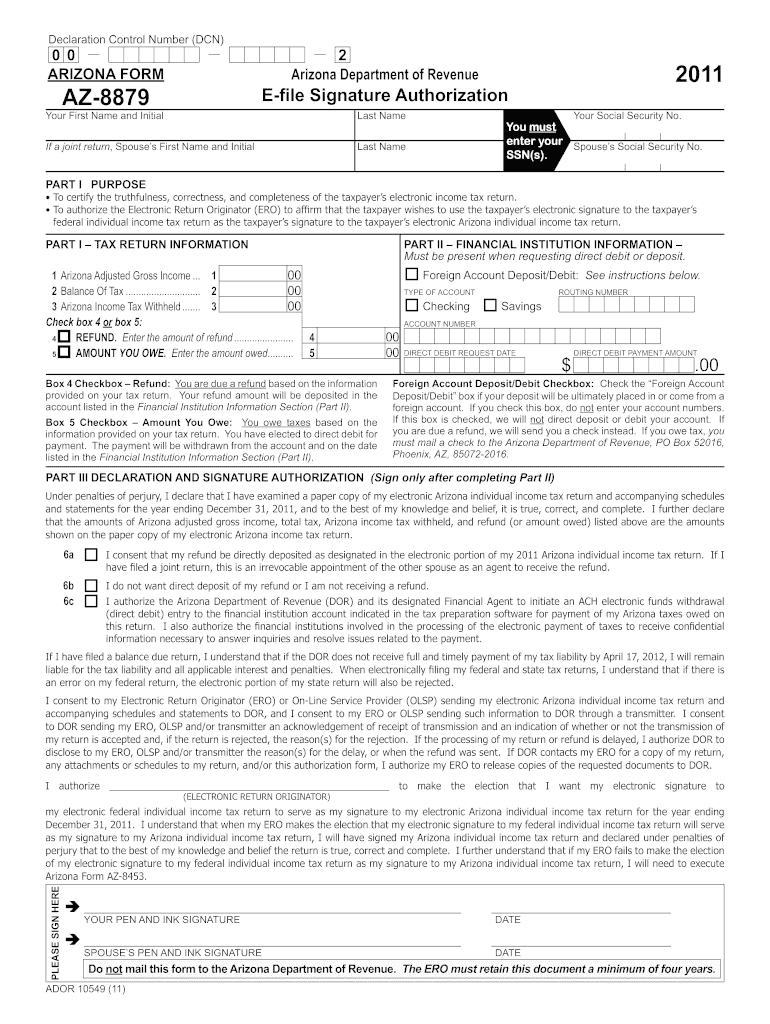

Az8879 Fill Out and Sign Printable PDF Template signNow

Web arizona form 51 consolidated or combined return affiliation schedule 2022 include form(s) 51 immediately following form 120. Arizona form 51 name number and street. Subtract lines 49, 50 and 51 from line 48. Transaction privilege tax election for accounting and reporting expenses credit keywords: Web attach form(s) 51 immediately following page 4 of form 120.

Instructions For Arizona Form 51 Combined Or Consolidated Return

Arizona department of revenue subject: Web form 51 identifies changes to the federal consolidated group and related companies during the taxable year. Corporations filing arizona form 120, complete form 51 as instructed below: 51 00 52 balance of tax: Transaction privilege tax election for accounting and reporting expenses credit keywords:

Arizona Form 140IA Arizona Department Of Revenue Fill and Sign

List the members of combined or consolidated groups. These changes include name changes, additions to the group filing the. Be sure to check the “yes” box on form 120, information question c. Web purpose and use of the form. Combined or consolidated in this return or filing separate.

Arizona Form 51 Combined Or Consolidated Return Affiliation Schedule

Ador 10148 (16) name (as shown on page 1) ein az form 51 (2016) page 2 of 2 section 2. Web arizona form 51 combined or consolidated return affiliation schedule 2016. Web attach form(s) 51 immediately following page 4 of form 120. Web form 51 is used by form 120 filers to list members of combined or consolidated affiliated groups.

Web Az Form 51 (2021) Page 2 Of 2 Section 2 Corporations Added To The Affiliated Group During The Taxable Year Do Not Complete Section 2 If Section 1 Is Completed.

Arizona form 51 name number and street. Web you may be offline or with limited connectivity. Ador 10148 (16) name (as shown on page 1) ein az form 51 (2016) page 2 of 2 section 2. Corporations filing arizona form 120, complete form 51 as instructed below:

Web Form 51 Is Used By Form 120 Filers To List Members Of Combined Or Consolidated Affiliated Groups And Affiliated Corporations That File On A Separate Company Basis, Or File A.

Web 26 rows resident shareholder's information schedule form with instructions: Subtract lines 49, 50 and 51 from line 48. Transaction privilege tax election for accounting and reporting expenses credit keywords: Web arizona form 51 consolidated or combined return affiliation schedule 2022 include form(s) 51 immediately following form 120.

Arizona Form 51 Name Number And Street.

Web purpose and use of the form. Combined or consolidated in this return or filing separate. List the affiliated corporations that file to. Be sure to check the “yes” box on form 120, information question c.

Web Arizona Form 51T Author:

51 00 52 balance of tax: Web 20 rows 120s. Arizona s corporation income tax return. Web arizona form 51 consolidated or combined return affiliation schedule 2020 (section 1):