Az Non Resident Tax Form

Az Non Resident Tax Form - Web 26 rows arizona corporation income tax return (short form) corporate tax forms : Web taxpayers can contact their state of residency for more information about tax credits allowed. Web more about the arizona form 140nr nonresident efile your arizona tax return now efiling is easier, faster, and safer than filling out paper tax forms. Nonresident shareholder's share of income and. Web itemized deductions for nonresidents form. Arizona corporate or partnership income tax payment voucher: Web the most common arizona income tax form is the arizona form 140. Web nonresidents are subject to arizona tax on any income earned from arizona sources. Web when the nonresident service member is assigned overseas and the spouse or dependent must remain in arizona, the exemption still applies if the nonresident service person was. Web nonresident alien (nra) tax most income received in the united states (u.s.) is subject to federal and state taxation, and in most cases, the university is required to withhold.

Arizona s corporation income tax return: Web nonresidents are subject to arizona tax on any income earned from arizona sources. Web when the nonresident service member is assigned overseas and the spouse or dependent must remain in arizona, the exemption still applies if the nonresident service person was. Arizona corporate or partnership income tax payment voucher: This form should be completed after. Web 26 rows arizona corporation income tax return (short form) corporate tax forms : Web the most common arizona income tax form is the arizona form 140. Nonresidents may also exclude income arizona law does not tax. Web itemized deductions for nonresidents form. Web nonresident alien (nra) tax most income received in the united states (u.s.) is subject to federal and state taxation, and in most cases, the university is required to withhold.

Arizona corporate or partnership income tax payment voucher: Web 26 rows arizona corporation income tax return (short form) corporate tax forms : Web the most common arizona income tax form is the arizona form 140. Arizona s corporation income tax return: Web nonresidents are subject to arizona tax on any income earned from arizona sources. Web itemized deductions for nonresidents form. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Web nonresident alien (nra) tax most income received in the united states (u.s.) is subject to federal and state taxation, and in most cases, the university is required to withhold. Web taxpayers can contact their state of residency for more information about tax credits allowed. Web payment vouchers, corporate tax forms, partnership forms :

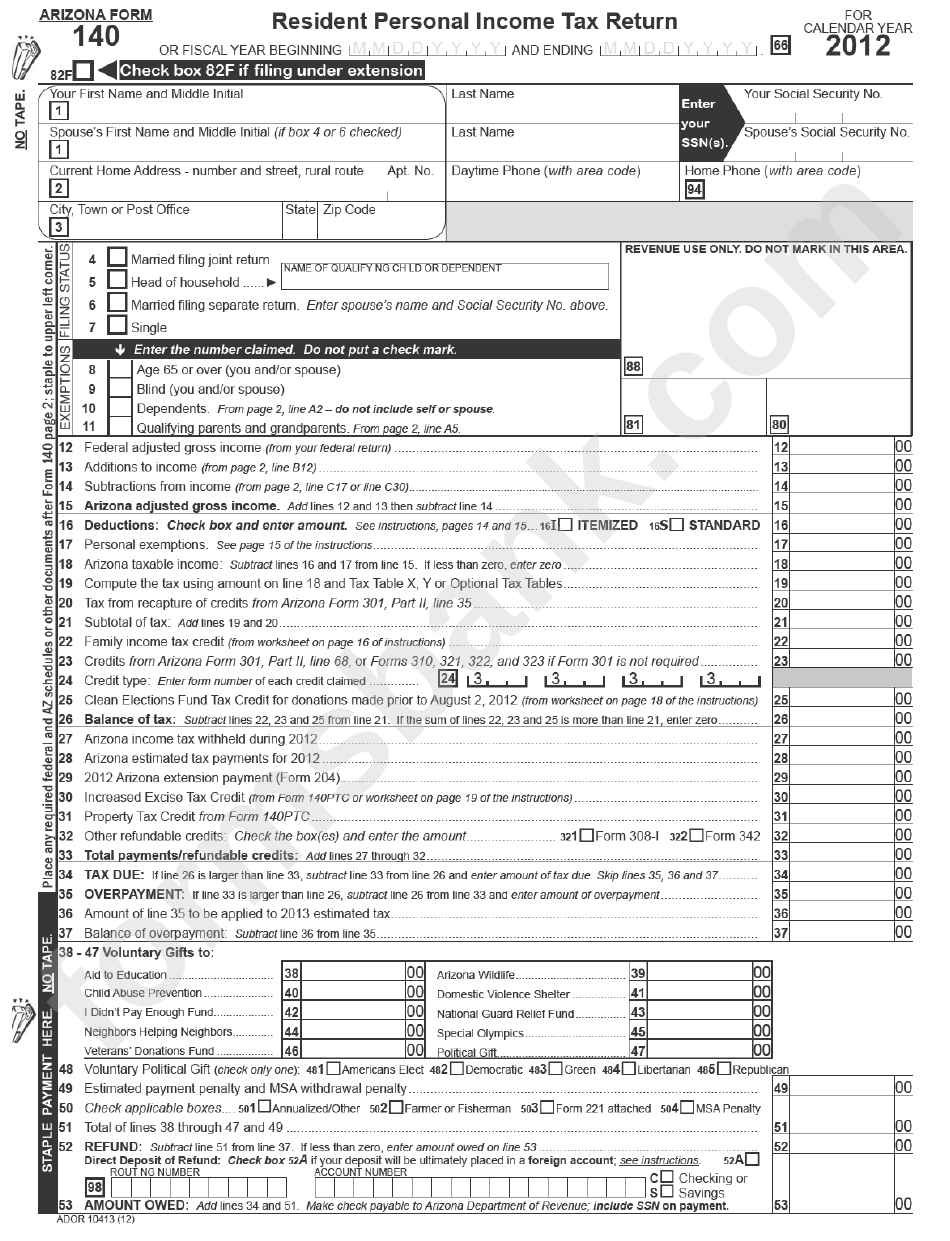

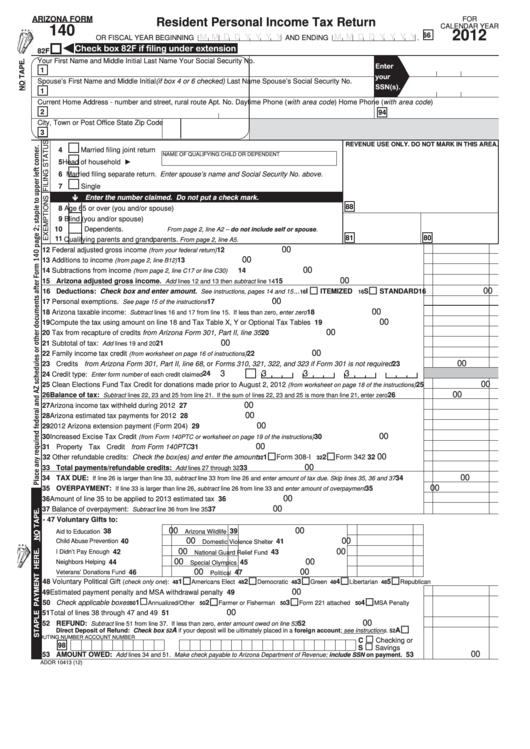

Arizona Form 140 Resident Personal Tax Return printable pdf

Web itemized deductions for nonresidents form. Web nonresident alien (nra) tax most income received in the united states (u.s.) is subject to federal and state taxation, and in most cases, the university is required to withhold. Web more about the arizona form 140nr nonresident efile your arizona tax return now efiling is easier, faster, and safer than filling out paper.

FORM 210 NON RESIDENT TAX DECLARATION AF Consulting

This form should be completed after. Web taxpayers can contact their state of residency for more information about tax credits allowed. Web the most common arizona income tax form is the arizona form 140. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Web arizona nonresident personal.

US NonResident Tax Return 2019 Delaware Company Formation LLC

Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. This form is used by residents who file an individual income tax return. This form should be completed after. Web arizona nonresident personal income tax booklet update to the 2020 increase standard deduction worksheet for taxpayers electing to.

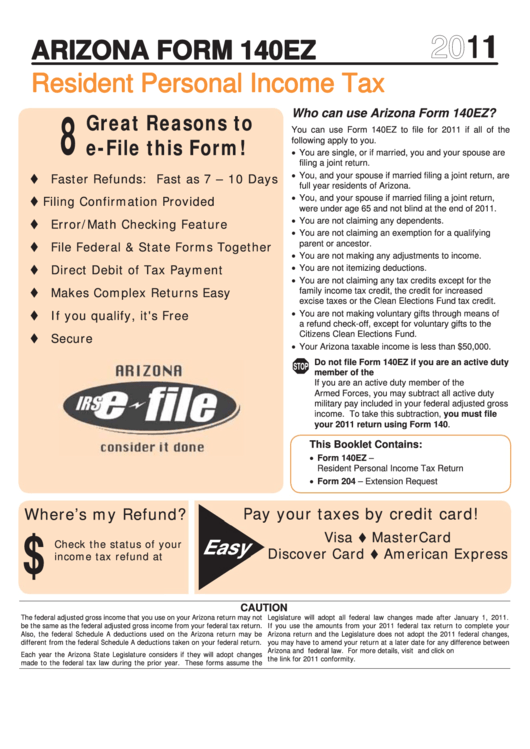

Arizona Form 140ez Resident Personal Tax Return (Ez Form

Web 26 rows arizona corporation income tax return (short form) corporate tax forms : Web more about the arizona form 140nr nonresident efile your arizona tax return now efiling is easier, faster, and safer than filling out paper tax forms. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department.

Az Ez Tax Form Form Resume Examples

Web nonresident alien (nra) tax most income received in the united states (u.s.) is subject to federal and state taxation, and in most cases, the university is required to withhold. Web arizona form 140nrnonresident personal income tax return for calendar year 2021 82f check box 82f if filing under extension place any required federal and az. Web arizona nonresident personal.

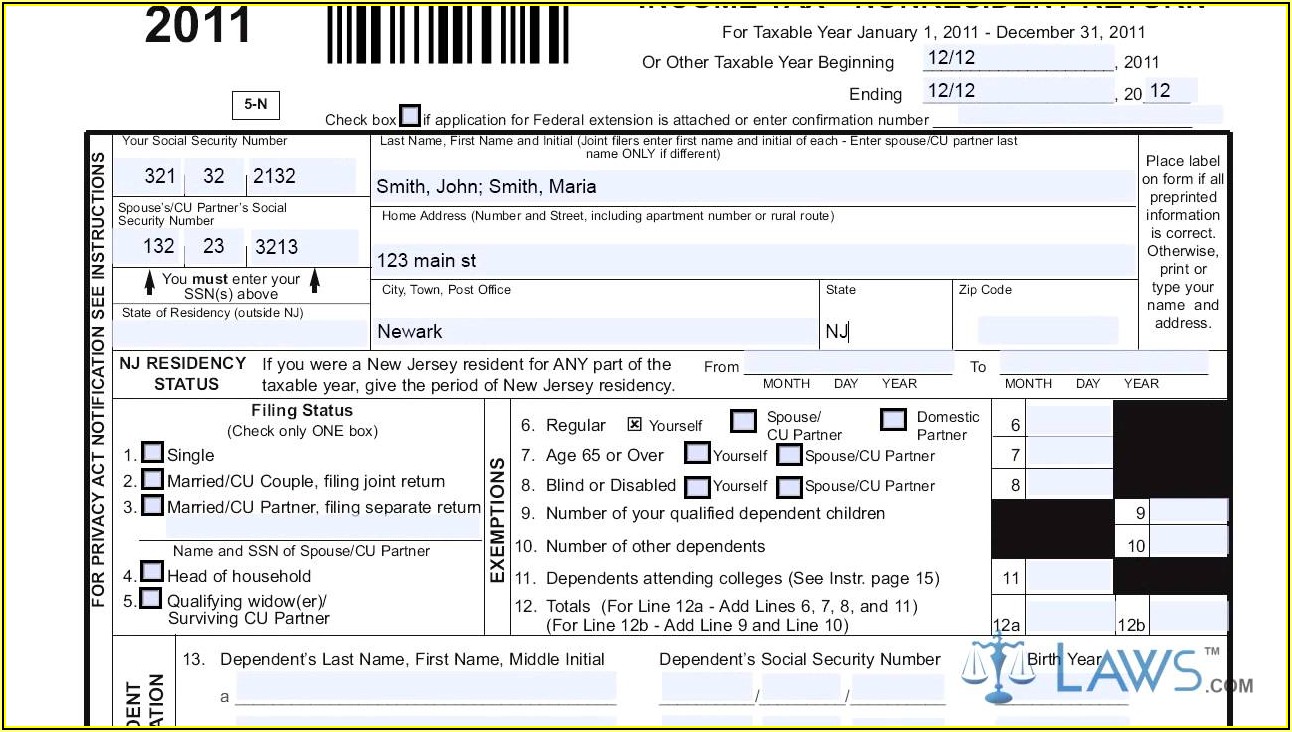

Nj Tax Form 1040 Non Resident Form Resume Examples xz20doG2ql

Web nonresident alien (nra) tax most income received in the united states (u.s.) is subject to federal and state taxation, and in most cases, the university is required to withhold. Web itemized deductions for nonresidents form. Web 26 rows arizona corporation income tax return (short form) corporate tax forms : Arizona corporate or partnership income tax payment voucher: This form.

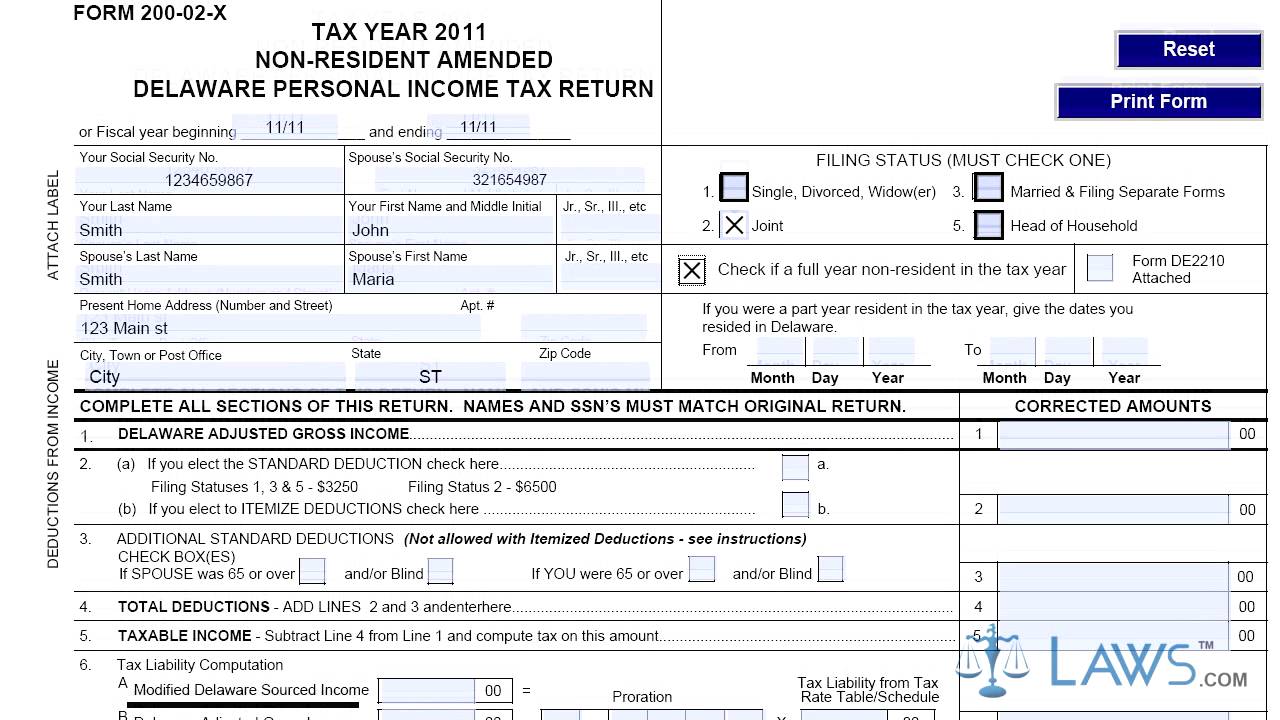

Form 200 02 X Non Resident Amended Delaware Personal Tax Return

Web 26 rows arizona corporation income tax return (short form) corporate tax forms : Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Nonresidents may also exclude income arizona law does not tax. Web nonresident alien (nra) tax most income received in the united states (u.s.) is.

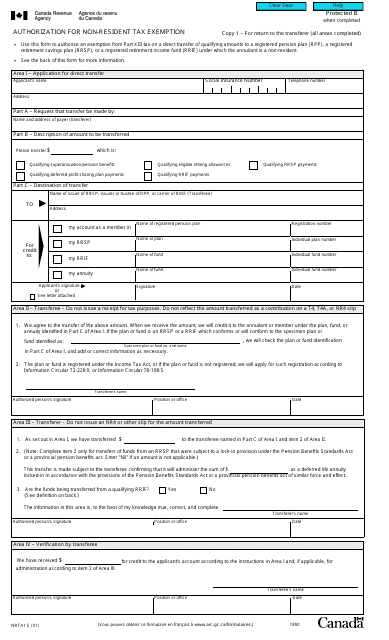

Form NRTA1 Download Fillable PDF or Fill Online Authorization for Non

This form is used by residents who file an individual income tax return. Nonresidents may also exclude income arizona law does not tax. Arizona corporate or partnership income tax payment voucher: Web when the nonresident service member is assigned overseas and the spouse or dependent must remain in arizona, the exemption still applies if the nonresident service person was. Web.

Fillable Arizona Form 140 Resident Personal Tax Return 2012

Web payment vouchers, corporate tax forms, partnership forms : Arizona s corporation income tax return: Nonresident shareholder's share of income and. This form is used by residents who file an individual income tax return. Web itemized deductions for nonresidents form.

Which nonresident US tax forms you should file YouTube

Nonresident shareholder's share of income and. Arizona s corporation income tax return: This form is used by residents who file an individual income tax return. Web taxpayers can contact their state of residency for more information about tax credits allowed. Web nonresidents are subject to arizona tax on any income earned from arizona sources.

Nonresident Shareholder's Share Of Income And.

Web 26 rows arizona corporation income tax return (short form) corporate tax forms : Web taxpayers can contact their state of residency for more information about tax credits allowed. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. This form should be completed after.

Web Arizona Form 140Nrnonresident Personal Income Tax Return For Calendar Year 2021 82F Check Box 82F If Filing Under Extension Place Any Required Federal And Az.

Arizona s corporation income tax return: Web arizona nonresident personal income tax booklet update to the 2020 increase standard deduction worksheet for taxpayers electing to take the standard. Web nonresident alien (nra) tax most income received in the united states (u.s.) is subject to federal and state taxation, and in most cases, the university is required to withhold. Web more about the arizona form 140nr nonresident efile your arizona tax return now efiling is easier, faster, and safer than filling out paper tax forms.

Web Payment Vouchers, Corporate Tax Forms, Partnership Forms :

Web itemized deductions for nonresidents form. Web nonresidents are subject to arizona tax on any income earned from arizona sources. You may file form 140 only if you (and your spouse, if. Web the most common arizona income tax form is the arizona form 140.

Web When The Nonresident Service Member Is Assigned Overseas And The Spouse Or Dependent Must Remain In Arizona, The Exemption Still Applies If The Nonresident Service Person Was.

This form is used by residents who file an individual income tax return. Arizona corporate or partnership income tax payment voucher: Nonresidents may also exclude income arizona law does not tax.