Backdoor Roth Tax Form

Backdoor Roth Tax Form - If you have any questions. You should have completed the 8606 on your 2018 return, it would then have your basis set at $5,500. Web for more information about estate planning in overland park, ks (and throughout the rest of kansas and missouri) and to download free tools to help you organize your estate, visit. Web after going through all these, let’s confirm how you’re taxed on the backdoor roth. Report the strategy on form 8606. You cannot deduct contributions to a roth ira. Web a backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Learn from bankrate about the benefits of using a. Web transfer of ownership form.

Web a backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Contributing directly to a roth ira is restricted if your. Web go back to federal q&a. Look for line 4 in form 1040. Web for more information about estate planning in overland park, ks (and throughout the rest of kansas and missouri) and to download free tools to help you organize your estate, visit. For this strategy to work, you should. You should have completed the 8606 on your 2018 return, it would then have your basis set at $5,500. You cannot deduct contributions to a roth ira. Web transfer of ownership form. Web we recommend keeping form 5498 for your records, but you don’t need to report form 5498 in your tax filing.

Web a backdoor roth ira strategy could be useful to high earners as they may not be able to fully deduct ira contributions, and they may not be able to contribute directly to a roth. Contributing directly to a roth ira is restricted if your. Web a backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Web backdoor roths are an option if your income is too high for a roth ira. Web go back to federal q&a. Schwab offers multiple types of iras. A backdoor roth ira lets you convert a traditional ira into a roth ira, which could save. Contribute money to an ira, and then roll over the money to a roth ira. Web a backdoor roth ira is a strategy rather than an official type of individual retirement account. Web transfer of ownership form.

Make Backdoor Roth Easy On Your Tax Return

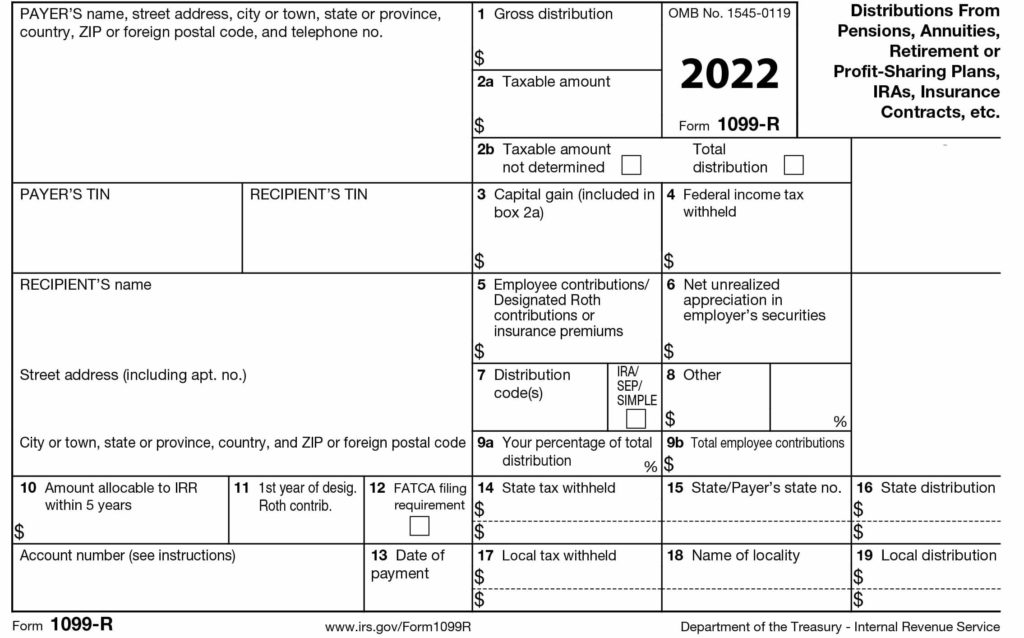

Web in order to accomplish a backdoor roth or nondeductible contribution, there are a few tax forms you need to report correctly. You cannot deduct contributions to a roth ira. Taxation will be deferred until you receive a distribution of these amounts plus earnings. Web each spouse reports their backdoor roth ira on their own separate 8606, so the tax.

Backdoor IRA Gillingham CPA

Report the strategy on form 8606. Web there are 2 ways to set up a backdoor roth ira: Contributing directly to a roth ira is restricted if your. Web for now, though, getting familiar with the backdoor roth strategy and the role that irs form 8606 plays in implementing it could be a great way to give you. Web backdoor.

Fixing Backdoor Roth IRAs The FI Tax Guy

Web a roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. Use this form to transfer shares to a new owner or change your account ownership. Web a backdoor roth ira strategy could be useful to high earners as they may not be able to fully deduct ira.

Fixing Backdoor Roth IRAs The FI Tax Guy

Web transfer of ownership form. Web a backdoor roth ira strategy could be useful to high earners as they may not be able to fully deduct ira contributions, and they may not be able to contribute directly to a roth. Learn from bankrate about the benefits of using a. Web in order to accomplish a backdoor roth or nondeductible contribution,.

How to report a backdoor Roth IRA contribution on your taxes Merriman

Contribute money to an ira, and then roll over the money to a roth ira. Web a backdoor roth ira strategy could be useful to high earners as they may not be able to fully deduct ira contributions, and they may not be able to contribute directly to a roth. Web after going through all these, let’s confirm how you’re.

Fixing Backdoor Roth IRAs The FI Tax Guy

Contribute money to an ira, and then roll over the money to a roth ira. Web after going through all these, let’s confirm how you’re taxed on the backdoor roth. Contributing directly to a roth ira is restricted if your. Web in order to accomplish a backdoor roth or nondeductible contribution, there are a few tax forms you need to.

Considering a Backdoor Roth Contribution? Don’t Form 8606!

Web we recommend keeping form 5498 for your records, but you don’t need to report form 5498 in your tax filing. If you have any questions. Web salary deferral contributions are taken from your pay on a pre tax basis. Now that we have walked through the steps, let’s look. Web backdoor roths are an option if your income is.

Make Backdoor Roth Easy On Your Tax Return

Web a backdoor roth ira is a strategy rather than an official type of individual retirement account. Look for line 4 in form 1040. Contributing directly to a roth ira is restricted if your. Use this form to transfer shares to a new owner or change your account ownership. If you have any questions.

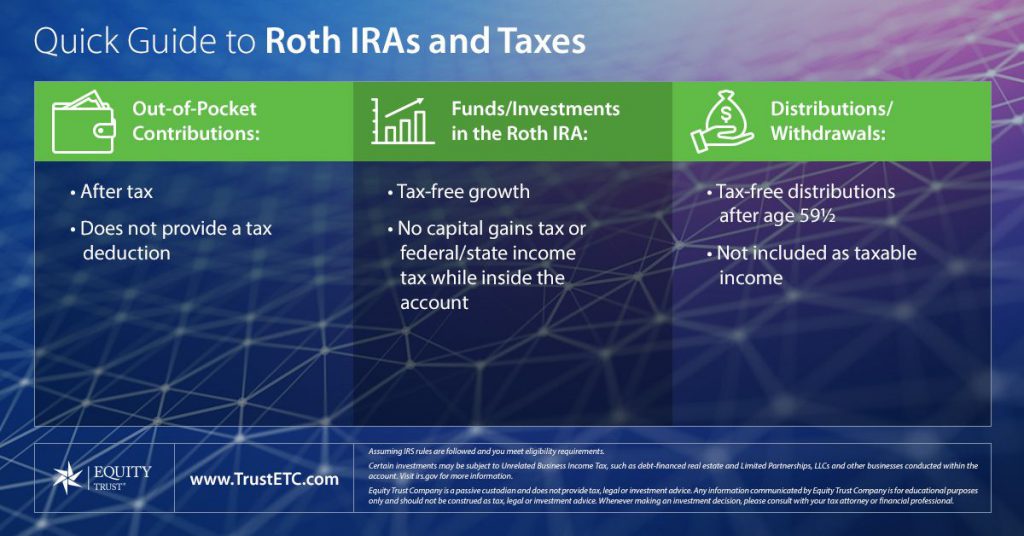

What is a Backdoor Roth IRA Conversion? Equity Trust

Learn from bankrate about the benefits of using a. Web there are 2 ways to set up a backdoor roth ira: Look for line 4 in form 1040. You should have completed the 8606 on your 2018 return, it would then have your basis set at $5,500. A backdoor roth ira lets you convert a traditional ira into a roth.

SplitYear Backdoor Roth IRAs The FI Tax Guy

Web there are 2 ways to set up a backdoor roth ira: For this strategy to work, you should. Web a backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Use this form to transfer shares to a new owner or change your account ownership. Look for line 4 in.

Report The Strategy On Form 8606.

Web transfer of ownership form. Look for line 4 in form 1040. Learn from bankrate about the benefits of using a. You can file an amended return to report that.

Web A Backdoor Roth Ira Strategy Could Be Useful To High Earners As They May Not Be Able To Fully Deduct Ira Contributions, And They May Not Be Able To Contribute Directly To A Roth.

Web go back to federal q&a. Web a backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira (to avoid paying taxes on any earnings or. Web a backdoor roth ira allows you to get around income limits by converting a traditional ira into a roth ira. Web we recommend keeping form 5498 for your records, but you don’t need to report form 5498 in your tax filing.

Web Salary Deferral Contributions Are Taken From Your Pay On A Pre Tax Basis.

Web after going through all these, let’s confirm how you’re taxed on the backdoor roth. You cannot deduct contributions to a roth ira. Web a roth ira is an ira that, except as explained below, is subject to the rules that apply to a traditional ira. Web for more information about estate planning in overland park, ks (and throughout the rest of kansas and missouri) and to download free tools to help you organize your estate, visit.

For This Strategy To Work, You Should.

Contribute money to an ira, and then roll over the money to a roth ira. Contributing directly to a roth ira is restricted if your. Web in order to accomplish a backdoor roth or nondeductible contribution, there are a few tax forms you need to report correctly. Use this form to transfer shares to a new owner or change your account ownership.