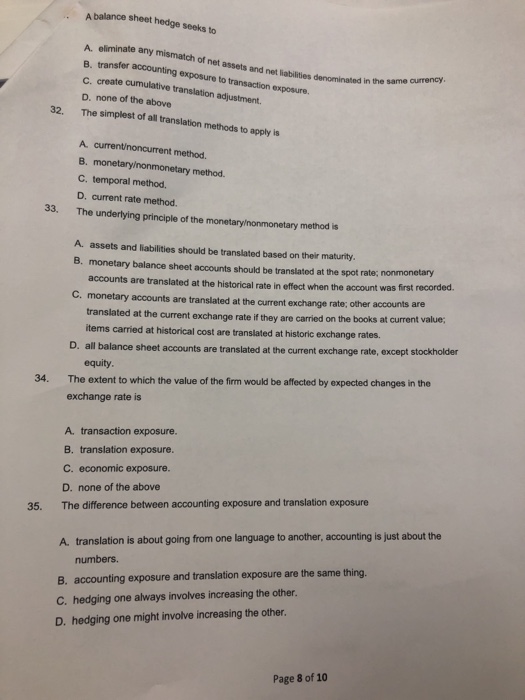

Balance Sheet Hedge

Balance Sheet Hedge - Web hedge accounting is useful for companies with a significant market risk on their balance sheet; Web two kinds of indirect costs are worth discussing: The opportunity cost of holding margin capital and lost upside. It can be an interest rate.

Web two kinds of indirect costs are worth discussing: Web hedge accounting is useful for companies with a significant market risk on their balance sheet; The opportunity cost of holding margin capital and lost upside. It can be an interest rate.

Web two kinds of indirect costs are worth discussing: The opportunity cost of holding margin capital and lost upside. It can be an interest rate. Web hedge accounting is useful for companies with a significant market risk on their balance sheet;

Balance Sheet for Cash Flow Hedge Example PayFixed/ReceiveLIBOR Swap

It can be an interest rate. The opportunity cost of holding margin capital and lost upside. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; Web two kinds of indirect costs are worth discussing:

Technical Balance sheet Hedge Fund Telemetry

The opportunity cost of holding margin capital and lost upside. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; Web two kinds of indirect costs are worth discussing: It can be an interest rate.

How to Show Cash Flow Hedge in Financial Statements Accounting Education

Web two kinds of indirect costs are worth discussing: Web hedge accounting is useful for companies with a significant market risk on their balance sheet; It can be an interest rate. The opportunity cost of holding margin capital and lost upside.

Balance Sheet for Fair Value Hedge Example ReceiveFixed/PayLIBOR

Web two kinds of indirect costs are worth discussing: It can be an interest rate. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; The opportunity cost of holding margin capital and lost upside.

Here's What a Hedge Fund ProfitAndLoss Statement Looks Like

Web hedge accounting is useful for companies with a significant market risk on their balance sheet; It can be an interest rate. The opportunity cost of holding margin capital and lost upside. Web two kinds of indirect costs are worth discussing:

PPT Module III AssetLiability Management PowerPoint Presentation

The opportunity cost of holding margin capital and lost upside. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; It can be an interest rate. Web two kinds of indirect costs are worth discussing:

Mutual Funds Accounting ( Simplified ) Accounting Education

Web two kinds of indirect costs are worth discussing: The opportunity cost of holding margin capital and lost upside. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; It can be an interest rate.

4 Steps to Analyse a Balance Sheet Like a Hedge Fund Manager YouTube

The opportunity cost of holding margin capital and lost upside. Web two kinds of indirect costs are worth discussing: Web hedge accounting is useful for companies with a significant market risk on their balance sheet; It can be an interest rate.

Foreign exchange risk online presentation

It can be an interest rate. Web hedge accounting is useful for companies with a significant market risk on their balance sheet; Web two kinds of indirect costs are worth discussing: The opportunity cost of holding margin capital and lost upside.

Solved A balance sheet hedge seeks to nate any mismatch of

It can be an interest rate. Web two kinds of indirect costs are worth discussing: The opportunity cost of holding margin capital and lost upside. Web hedge accounting is useful for companies with a significant market risk on their balance sheet;

The Opportunity Cost Of Holding Margin Capital And Lost Upside.

It can be an interest rate. Web two kinds of indirect costs are worth discussing: Web hedge accounting is useful for companies with a significant market risk on their balance sheet;