Ca Form 100S

Ca Form 100S - Scroll down in the left column to the california forms. Solved • by intuit • 2 • updated march 21, 2023. Web to access available forms in turbotax business, click on the forms icon in the turbotax header. Each county has its own. Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: Web included in the form 100s, s corporation tax booklet. 2023 fourth quarter estimated tax payments due for corporations. All federal s corporations subject to california laws must file form 100s. Web included in the form 100s, s corporation tax booklet. A corporation with a valid federal s corporation election is considered an s corporation for california.

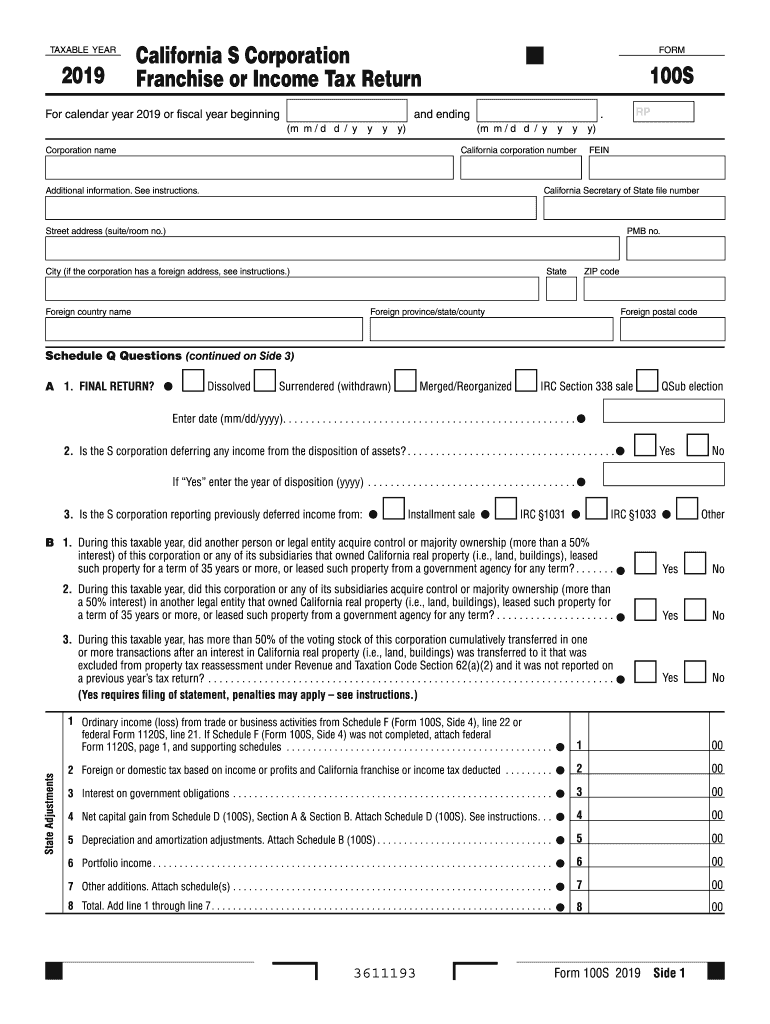

Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable. A corporation with a valid federal s corporation election is considered an s corporation for california. Web marking s corporate form 100s as an initial return in proconnect. Web included in the form 100s, s corporation tax booklet. Lifo recapture due to s corporation election, irc sec. Web all federal s corporations subject to california laws must file form 100s and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. Web a form 100s, franchise or income tax return is a document that california s corporations must file annually with the california franchise tax board. Web 100 booklet (instructions included) december 15, 2023. Solved • by intuit • 2 • updated march 21, 2023. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation.

Web all federal s corporations subject to california laws must file form 100s and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). Each county has its own. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable. Web included in the form 100s, s corporation tax booklet. A corporation with a valid federal s corporation election is considered an s corporation for california. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation. Solved • by intuit • 2 • updated march 21, 2023. Web 3611203 form 100s 2020 side 1 b 1. Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022.

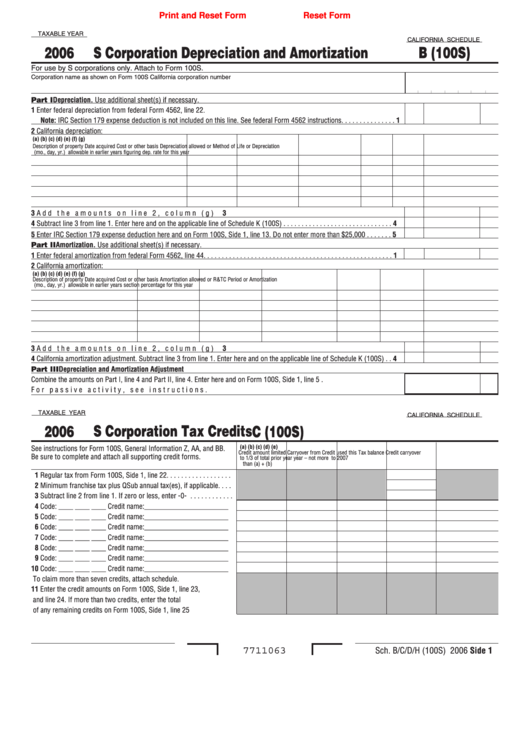

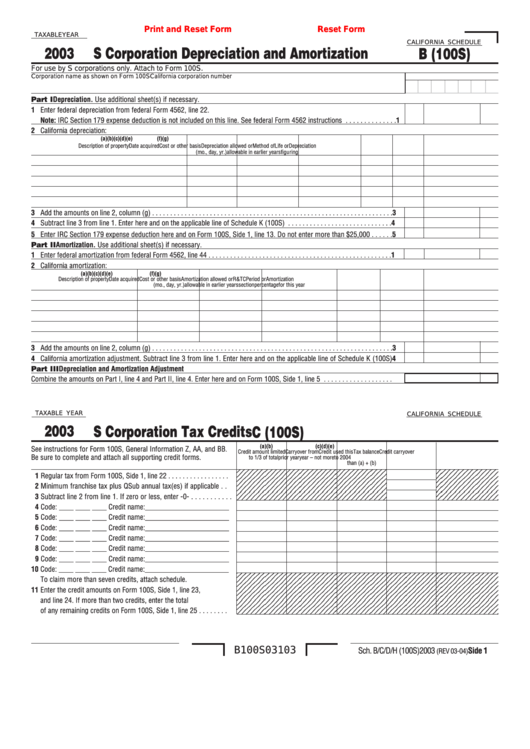

Fillable California Schedule B (100s) S Corporation Depreciation And

Corporations that incorporated or qualified. Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. Web a form 100s, franchise or income tax return is a document that california s corporations must file annually with the california franchise tax board..

2015 100s california Fill out & sign online DocHub

Web all federal s corporations subject to california laws must file form 100s and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: All federal s corporations subject to california laws must file form 100s. A.

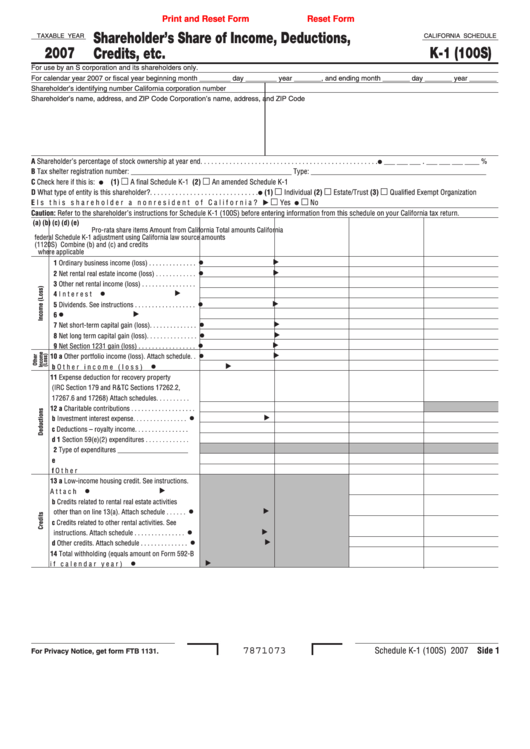

Fillable California Schedule K1 (Form 100s) Shareholder'S Share Of

During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation. Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: Web a form 100s, franchise or income tax return is a document that california s corporations must file annually.

Ca form 100s instructions 2017

Scroll down in the left column to the california forms. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable. Web you must file california s corporation franchise or income tax return (form 100s).

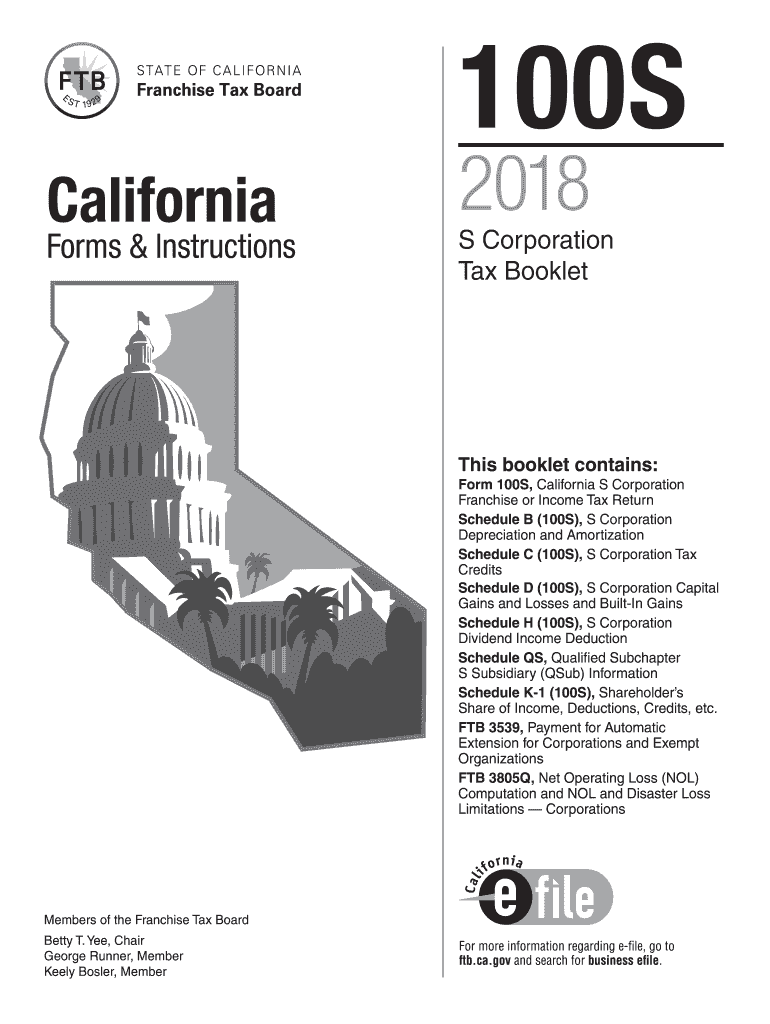

20182022 Form CA FTB 100S Tax Booklet Fill Online, Printable, Fillable

Web to access available forms in turbotax business, click on the forms icon in the turbotax header. Each county has its own. All federal s corporations subject to california laws must file form 100s. Web you must file california s corporation franchise or income tax return (form 100s) if the corporation is: Web form 100s is used if a corporation.

Top 9 Form 100s Templates free to download in PDF format

Web to access available forms in turbotax business, click on the forms icon in the turbotax header. Web included in the form 100s, s corporation tax booklet. Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. Lifo recapture due.

2012 Form 100S Franchise Tax Board Edit, Fill, Sign Online Handypdf

Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). Web a form 100s, franchise or income tax return is a document that california s corporations must file annually with the california franchise tax board. Corporations that incorporated or qualified. A corporation with a valid federal s corporation election is considered an.

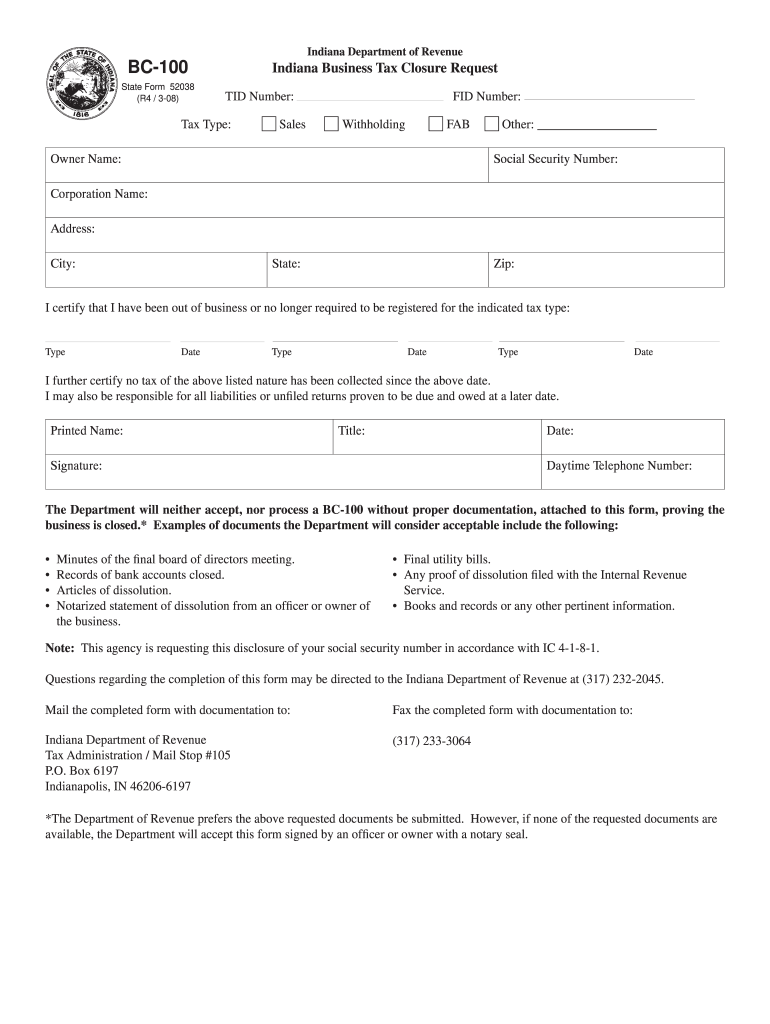

2008 Form IN BC100 Fill Online, Printable, Fillable, Blank pdfFiller

Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable. Web form 100s is used if a corporation has elected to be a small business corporation (s corporation). Each county has its own. All.

Ca form 100s instructions 2017

Web included in the form 100s, s corporation tax booklet. Web we last updated the california corporation franchise or income tax return in january 2023, so this is the latest version of form 100, fully updated for tax year 2022. Web marking s corporate form 100s as an initial return in proconnect. All federal s corporations subject to california laws.

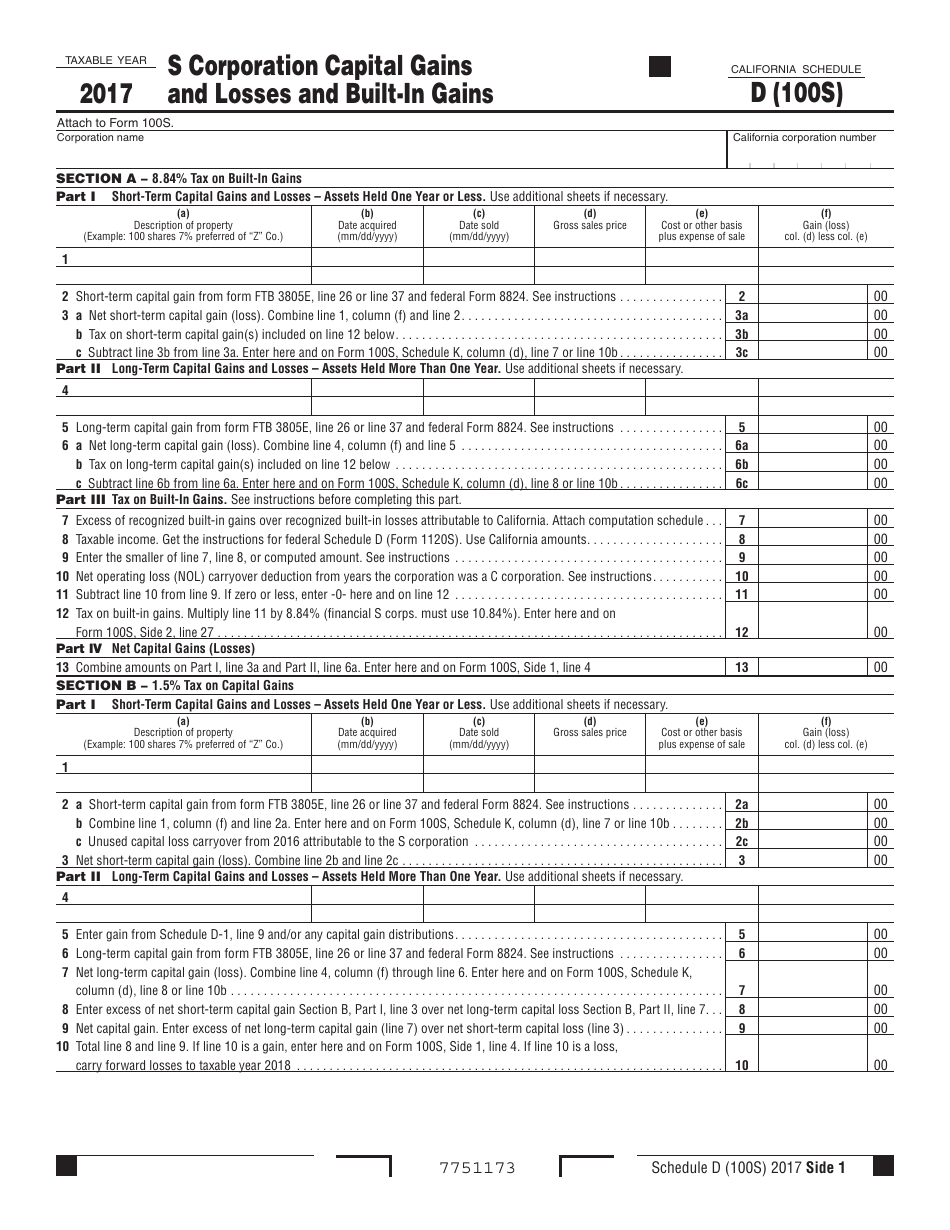

Form 100S Schedule D Download Printable PDF or Fill Online S

Web all federal s corporations subject to california laws must file form 100s and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. Web to access available forms in turbotax business, click on the forms icon in the turbotax header. Web included in the form 100s, s corporation tax booklet. Web form 100s is.

Web We Last Updated The California Corporation Franchise Or Income Tax Return In January 2023, So This Is The Latest Version Of Form 100, Fully Updated For Tax Year 2022.

Solved • by intuit • 2 • updated march 21, 2023. Web a form 100s, franchise or income tax return is a document that california s corporations must file annually with the california franchise tax board. Web to access available forms in turbotax business, click on the forms icon in the turbotax header. During this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this corporation.

Lifo Recapture Due To S Corporation Election, Irc Sec.

Web 100 booklet (instructions included) december 15, 2023. Original due date is the 15th day of the 3rd month after the close of the taxable year and extended due date is the 15th day of the 9th month after the close of the taxable. Corporations that incorporated or qualified. Web included in the form 100s, s corporation tax booklet.

2023 Fourth Quarter Estimated Tax Payments Due For Corporations.

Web marking s corporate form 100s as an initial return in proconnect. Scroll down in the left column to the california forms. This is a reminder for you and your clients to make sure to file form 100s, california s. Web 3611203 form 100s 2020 side 1 b 1.

All Federal S Corporations Subject To California Laws Must File Form 100S.

Each county has its own. A corporation with a valid federal s corporation election is considered an s corporation for california. A corporation with a valid federal s corporation election is considered an s corporation for california. Web since the s corporation is doing business in both nevada and california, it must file form 100s (california s corporation franchise or income tax return) and use schedule r to.