Ca Form 3893

Ca Form 3893 - Web california form 3893 passthrough entity tax problems. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. Instructions, page 1, column 2, when and where to file. Due to an issue with some software providers, many passthrough entity tax payments made. To claim the withholding credit, report the sale or transfer as required and enter the amount from line 5 on the withholding line on your tax return,. Web california form 3893 (pte) taxable year 2021 6231216 detach here if no payment is due, do not mail this form detach here if paid. Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: We anticipate the revised form 3893 will be available march 7, 2022. Web we last updated the parents' election to report child's interest and dividends in february 2023, so this is the latest version of form 3803, fully updated for tax year 2022. Web how to claim the withholding.

Web go to california > passthrough entity tax worksheet. Web california form 3893 passthrough entity tax problems. Web we last updated the parents' election to report child's interest and dividends in february 2023, so this is the latest version of form 3803, fully updated for tax year 2022. Web how to claim the withholding. Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: Web california form 3893 (pte) taxable year 2021 6231216 detach here if no payment is due, do not mail this form detach here if paid. We anticipate the revised form 3893 will be available march 7, 2022. To claim the withholding credit, report the sale or transfer as required and enter the amount from line 5 on the withholding line on your tax return,. Due to an issue with some software providers, many passthrough entity tax payments made. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no.

Can i calculate late payment. Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: Instructions, page 1, column 2, when and where to file. We anticipate the revised form 3893 will be available march 7, 2022. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. Due to an issue with some software providers, many passthrough entity tax payments made. Web we last updated the parents' election to report child's interest and dividends in february 2023, so this is the latest version of form 3803, fully updated for tax year 2022. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. Web how to claim the withholding. Web california form 3893 passthrough entity tax problems.

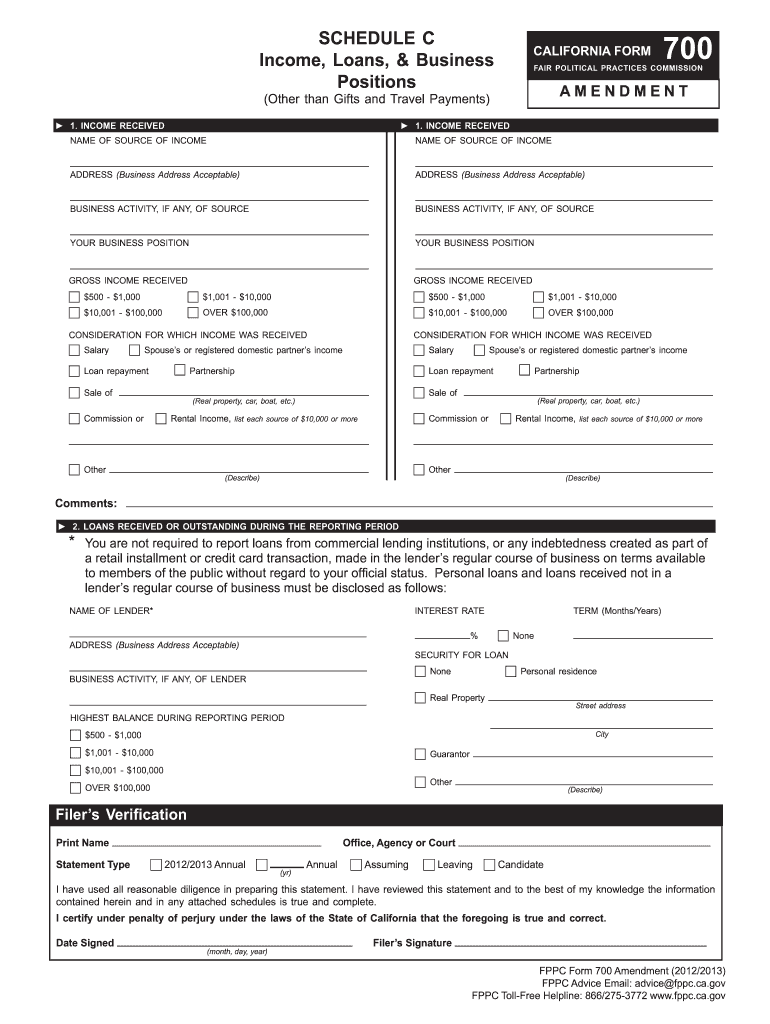

2013 Form CA FPPC 700 Fill Online, Printable, Fillable, Blank pdfFiller

To claim the withholding credit, report the sale or transfer as required and enter the amount from line 5 on the withholding line on your tax return,. Web california form 3893 passthrough entity tax problems. For this discussion, ignore the effect of income tax liability (llc or s corp). Web partnerships and s corporations may use ftb 3893 to make.

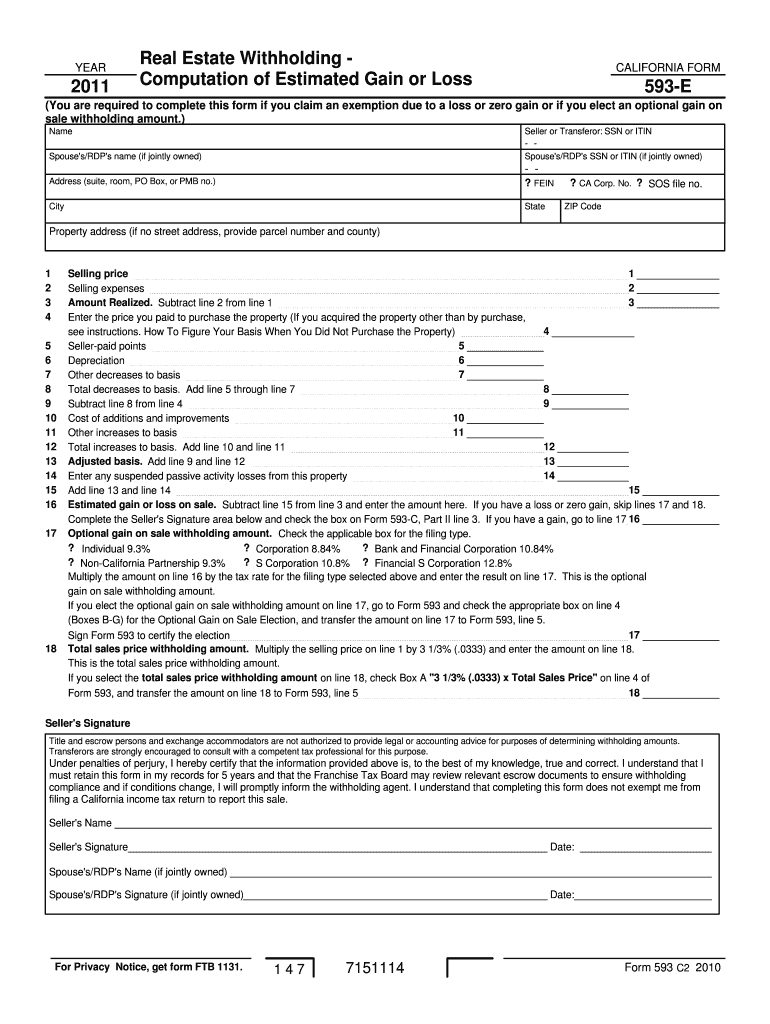

2011 Form CA FTB 593E Fill Online, Printable, Fillable, Blank pdfFiller

Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. Web go to california > passthrough entity tax worksheet. For this discussion, ignore the effect of income tax liability (llc or s corp). Web california form 3893 (pte) taxable year 2021 6231216 detach here if no payment is due, do.

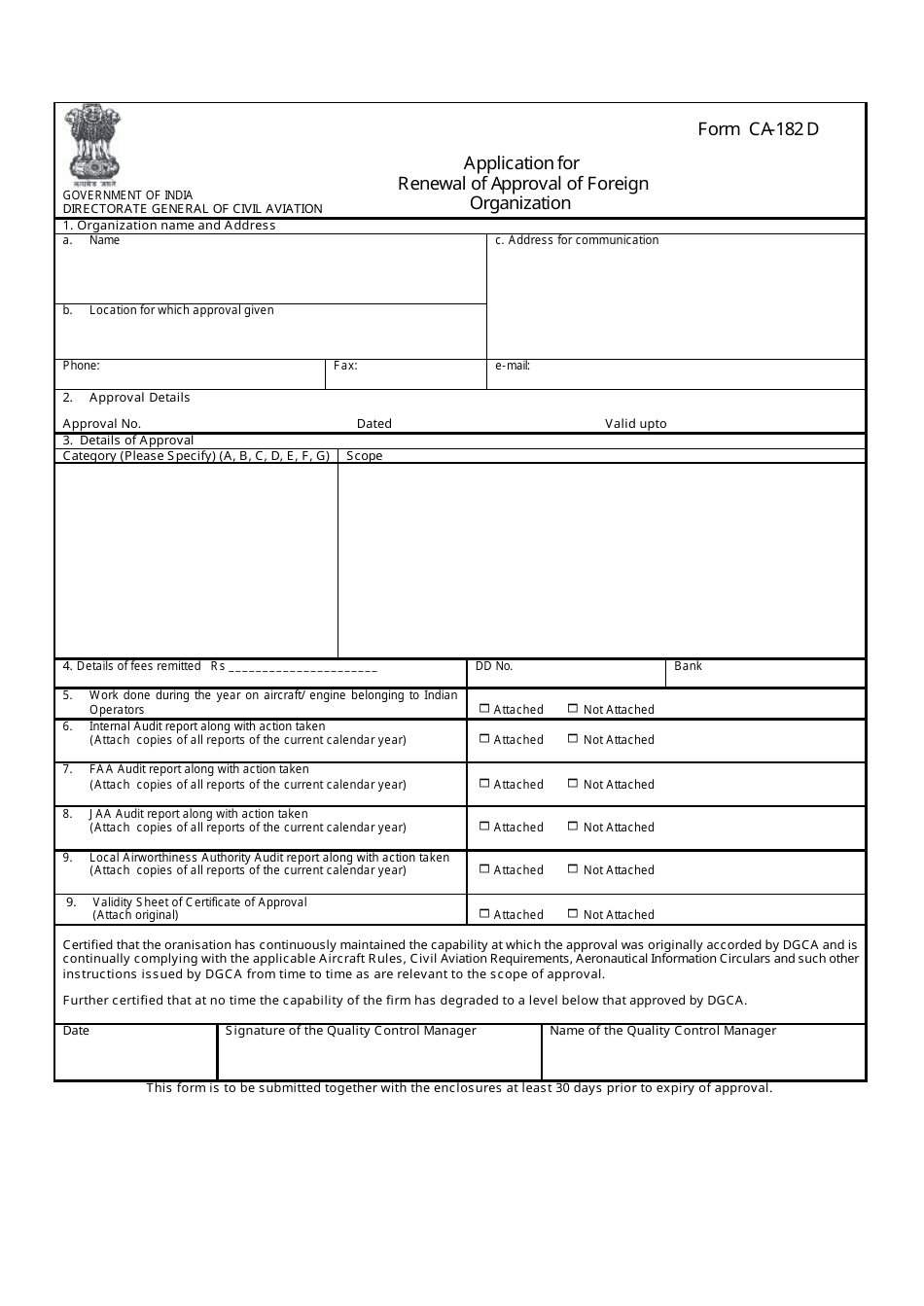

CA Form CA182 D Download Printable PDF or Fill Online Application for

We anticipate the revised form 3893 will be available march 7, 2022. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no..

Form 3853 Fill Out and Sign Printable PDF Template signNow

Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: For this discussion, ignore the effect of income tax liability (llc or s corp). Web california form 3893 (pte) taxable year 2021 6231216 detach here if no payment is due, do not mail this form detach here if paid. Web go to california > passthrough entity tax worksheet..

CA Form CA182 A Download Printable PDF or Fill Online Application for

Web answer additional information cch axcess™ tax and cch® prosystem fx® tax: We anticipate the revised form 3893 will be available march 7, 2022. Web california form 3893 passthrough entity tax problems. To claim the withholding credit, report the sale or transfer as required and enter the amount from line 5 on the withholding line on your tax return,. Can.

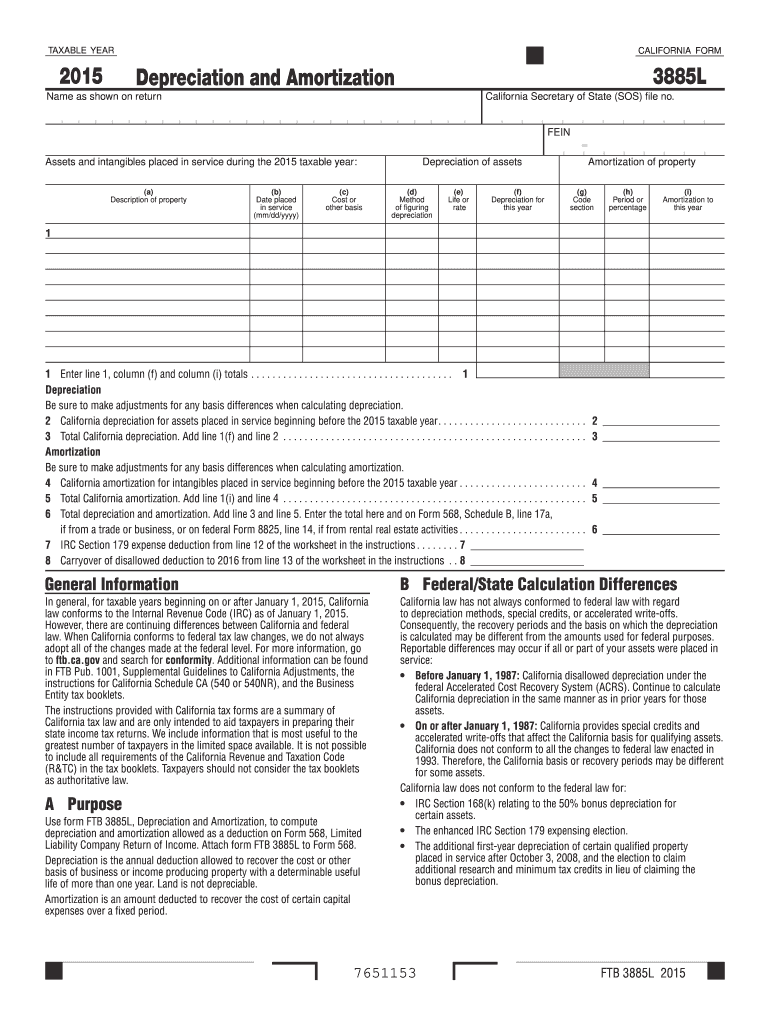

2015 CA Form 3885L Fill Online, Printable, Fillable, Blank pdfFiller

Web go to california > passthrough entity tax worksheet. Web california form 3893 (pte) taxable year 2021 6231216 detach here if no payment is due, do not mail this form detach here if paid. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it.

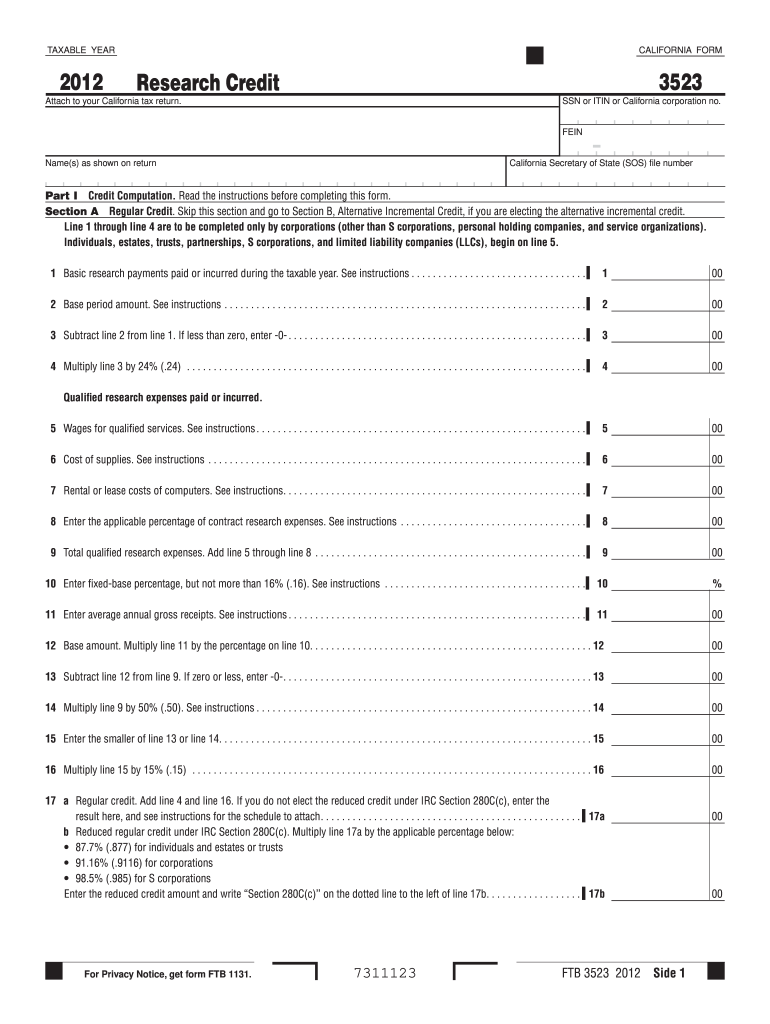

Ca Form 3523 Fill Out and Sign Printable PDF Template signNow

Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. We anticipate the revised form 3893 will be available march 7, 2022. Can i calculate late payment. Web go to california > passthrough entity tax worksheet. Due to an issue with some software providers, many passthrough entity tax payments made.

Form Ca 10 Fill Online, Printable, Fillable, Blank pdfFiller

Due to an issue with some software providers, many passthrough entity tax payments made. Web california form 3893 (pte) taxable year 2021 6231216 detach here if no payment is due, do not mail this form detach here if paid. For this discussion, ignore the effect of income tax liability (llc or s corp). Web go to california > passthrough entity.

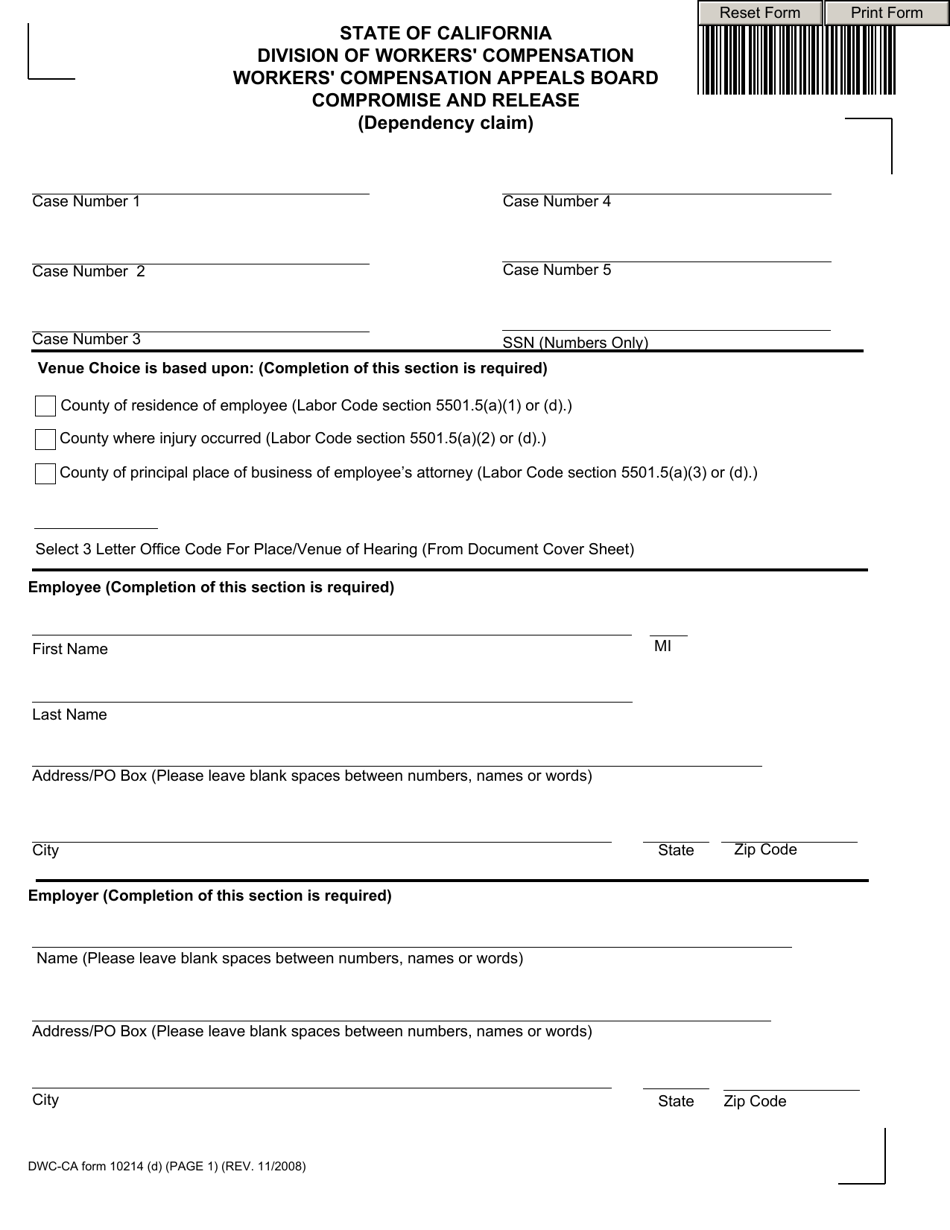

DWCCA Form 10214(D) Download Fillable PDF or Fill Online Compromise

We anticipate the revised form 3893 will be available march 7, 2022. To claim the withholding credit, report the sale or transfer as required and enter the amount from line 5 on the withholding line on your tax return,. Web california form 3893 passthrough entity tax problems. Web how to claim the withholding. Instructions, page 1, column 2, when and.

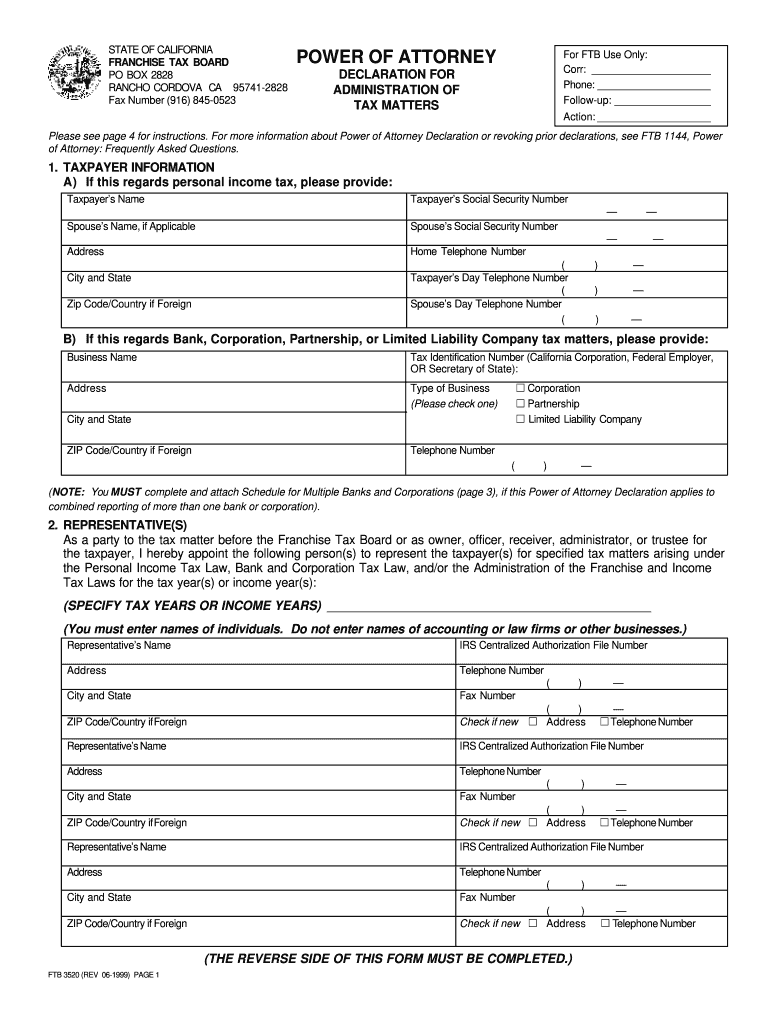

Ftb fax number Fill out & sign online DocHub

Due to an issue with some software providers, many passthrough entity tax payments made. Web go to california > passthrough entity tax worksheet. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. Web we last updated the parents' election to report child's interest and dividends in february 2023, so.

Web Answer Additional Information Cch Axcess™ Tax And Cch® Prosystem Fx® Tax:

Web go to california > passthrough entity tax worksheet. We anticipate the revised form 3893 will be available march 7, 2022. Taxable year 2018 real estate withholding tax statement california form 593 business name ssn or itin fein ca corp no. Web partnerships and s corporations may use ftb 3893 to make a pte elective tax payment by printing the voucher from ftb’s website and mailing it to us.

Web California Form 3893 (Pte) Taxable Year 2021 6231216 Detach Here If No Payment Is Due, Do Not Mail This Form Detach Here If Paid.

Web how to claim the withholding. Can i calculate late payment. Web california form 3893 passthrough entity tax problems. Web we last updated the parents' election to report child's interest and dividends in february 2023, so this is the latest version of form 3803, fully updated for tax year 2022.

Due To An Issue With Some Software Providers, Many Passthrough Entity Tax Payments Made.

To claim the withholding credit, report the sale or transfer as required and enter the amount from line 5 on the withholding line on your tax return,. Instructions, page 1, column 2, when and where to file. For this discussion, ignore the effect of income tax liability (llc or s corp).