Calsavers Exemption Form

Calsavers Exemption Form - Web calsavers retirement savings board executive director’s report. If you change your mind, you can opt back in at any time. Web if you are requesting an exemption: Employers known to be exempt based on public data (form 5500) accessed via the. Web calsavers | employer information Your federal ein number becomes your program account number when. You may need to send a communication and formal documentation supporting your exemption request to the calsavers program. This program gives employers an easy way to. Employer registration or exemption process. Identify the correct form for you.

Web begin company registration or request an exemption. Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc. Web united states tax exemption form. If you change your mind, you can opt back in at any time. You may need to send a communication and formal documentation supporting your exemption request to the calsavers program. Web “exempt employer” means an employer that (i) has zero employees, as determined under the methodology described in section 10001(a), has one or more employees, but does. Businesses who fail to comply. Calsavers is california’s retirement savings program designed for the millions of californians who lack a way to save for retirement at. Employers known to be exempt based on public data (form 5500) accessed via the. Your federal ein number becomes your program account number when.

Because your calsavers account is a roth ira, your savings amount must be within the roth ira contribution limits set by the. This program gives employers an easy way to. Web calsavers retirement savings board executive director’s report. Web go to calculator how much can i contribute? Enter your federal ein/tin and calsavers access code so that we can locate your company record. Web if you are requesting an exemption: If you change your mind, you can opt back in at any time. By signing below, i agree to the application process; I agree that all of the. Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc.

All About CalSavers Exemptions Hourly, Inc.

By signing below, i agree to the application process; Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc. Employers known to be exempt based on public data (form 5500) accessed via the. United states tax exemption form. Web calsavers | employer information

Workmans Comp Exemption Form Florida Universal Network

Web calsavers | employer information By signing below, i agree to the application process; Web calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. Web forms of id include birth certificate, state id, social security card, transcripts, medical records, etc. Web if you are requesting an exemption:

Don't Have Retirement Savings? Statesponsored Plans Are Stepping In

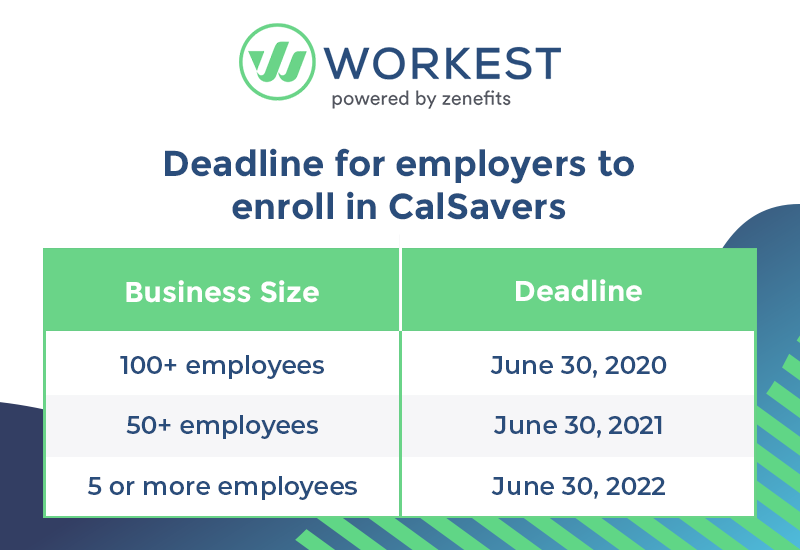

This program gives employers an easy way to. Web businesses of more than 100 employees have until september 30, 2020 to register or file their exemption if they already sponsor a 401 (k) plan. Web calsavers retirement savings board executive director’s report. Your federal ein number becomes your program account number when. Because your calsavers account is a roth ira,.

CalSavers.... What You Should Know The Ryding Company

Identify the correct form for you. Web calsavers | employer information Web employees that want to claim exempt from minnesota income tax must use the following form: Calsavers is california’s retirement savings program designed for the millions of californians who lack a way to save for retirement at. Employers known to be exempt based on public data (form 5500) accessed.

401k Opt Out Form Template Fill Online, Printable, Fillable, Blank

This program gives employers an easy way to. Web go to calculator how much can i contribute? United states tax exemption form. Web calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. Businesses who fail to comply.

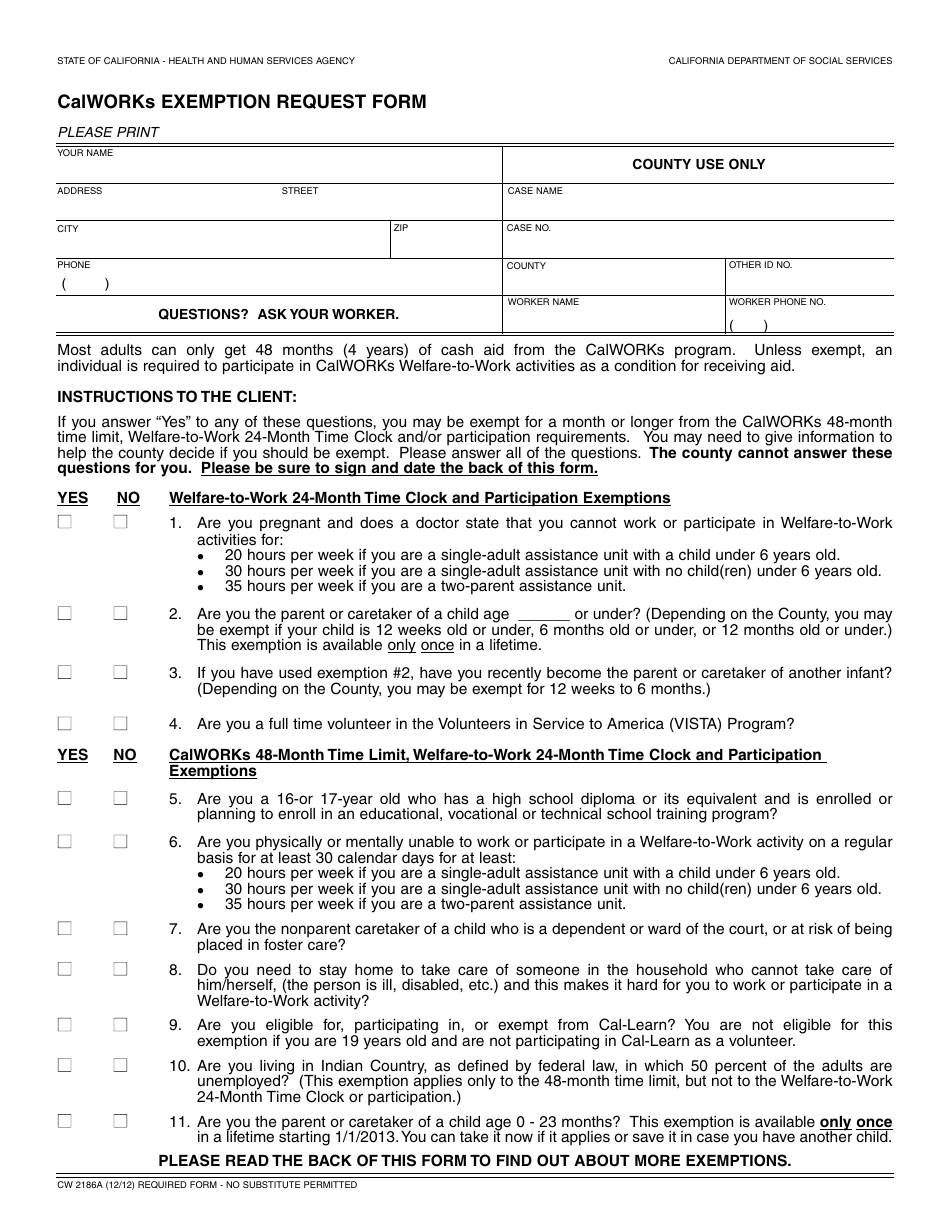

Form CW2186A Download Fillable PDF or Fill Online Calworks Exemption

Web calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. Identify the correct form for you. Calsavers is california’s retirement savings program designed for the millions of californians who lack a way to save for retirement at. Your federal ein number becomes your program account number when. Enter your federal ein/tin.

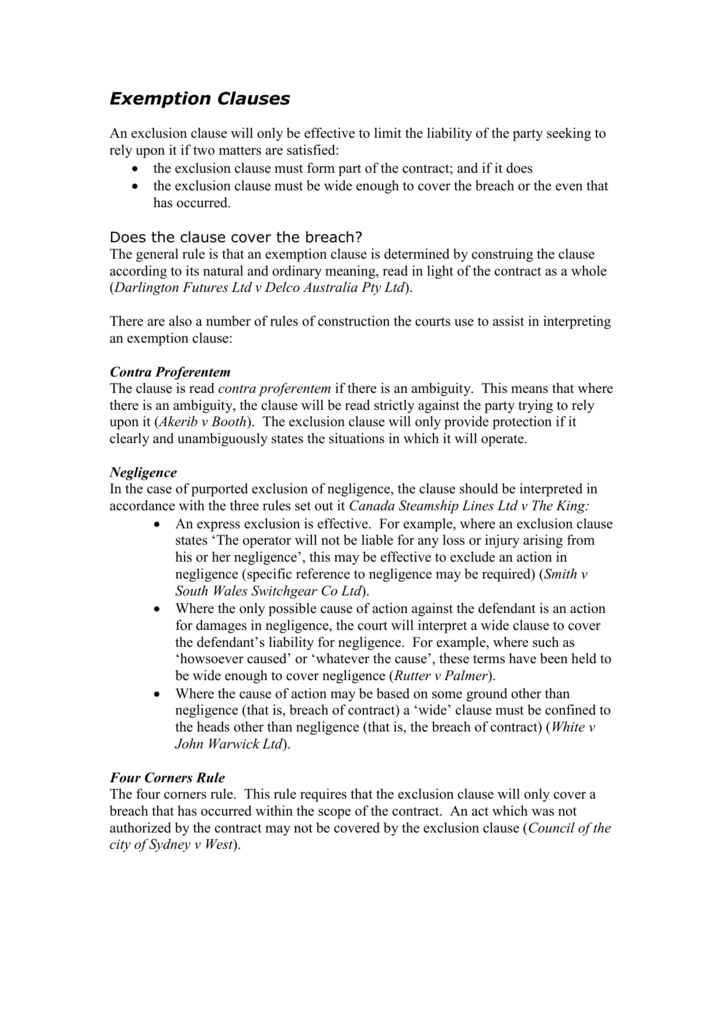

Exemption Clauses

Web “exempt employer” means an employer that (i) has zero employees, as determined under the methodology described in section 10001(a), has one or more employees, but does. Employer registration or exemption process. Web calsavers | employer information Calsavers is california’s retirement savings program designed for the millions of californians who lack a way to save for retirement at. Because your.

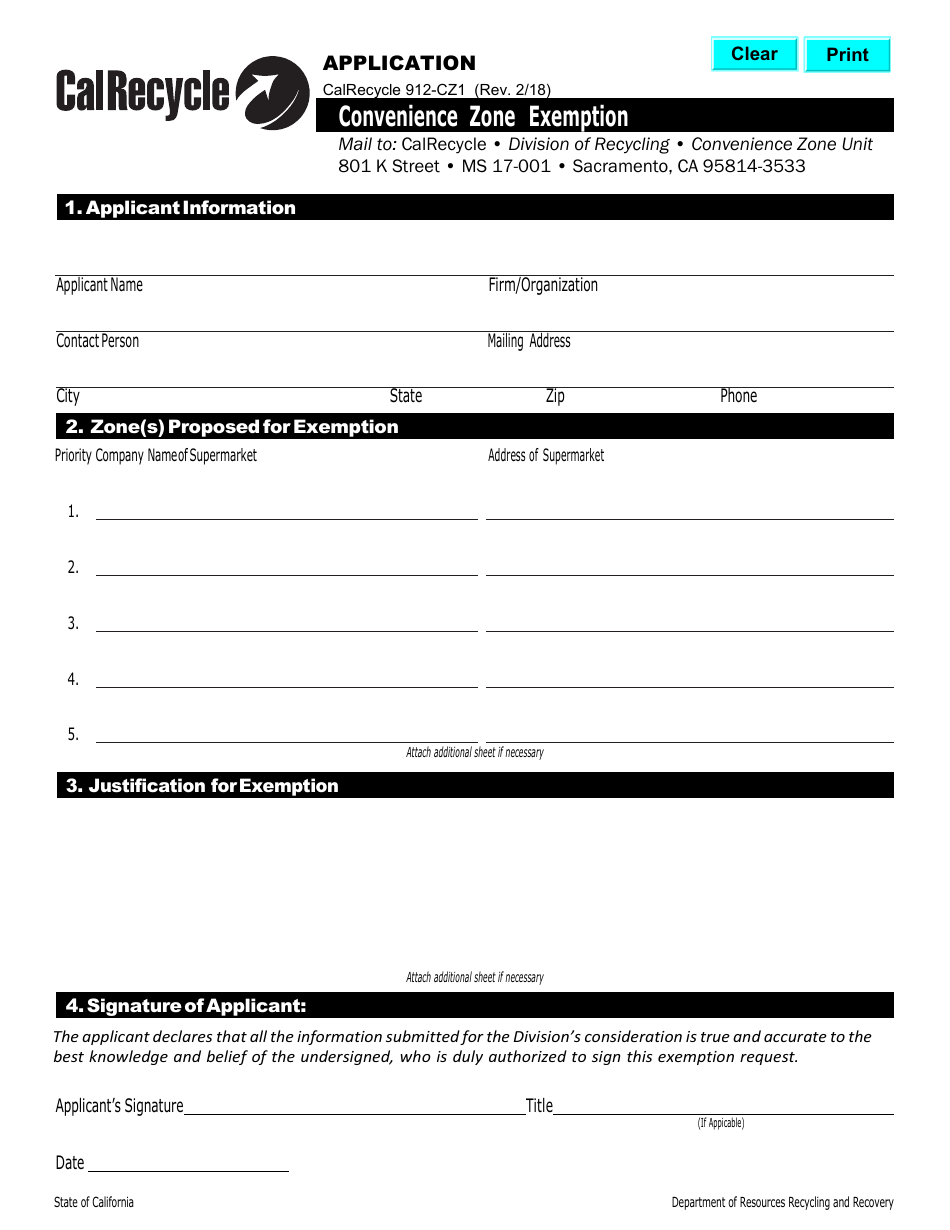

Form CalRecycle912CZ1 Download Printable PDF or Fill Online

This program gives employers an easy way to. You may need to send a communication and formal documentation supporting your exemption request to the calsavers program. Your federal ein number becomes your program account number when. Web if you are requesting an exemption: Enter your federal ein/tin and calsavers access code so that we can locate your company record.

CalSavers Additional Information Bandy and Associates

Web if you are requesting an exemption: Web calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. Web go to calculator how much can i contribute? Employers known to be exempt based on public data (form 5500) accessed via the. This program gives employers an easy way to.

Medical Exemption Form Arizona Free Download

Because your calsavers account is a roth ira, your savings amount must be within the roth ira contribution limits set by the. Web calsavers | employer information If you change your mind, you can opt back in at any time. Web if you are requesting an exemption: Web calsavers retirement savings board executive director’s report.

Enter Your Federal Ein/Tin And Calsavers Access Code So That We Can Locate Your Company Record.

Identify the correct form for you. Employer registration or exemption process. Calsavers is california’s retirement savings program designed for the millions of californians who lack a way to save for retirement at. I agree that all of the.

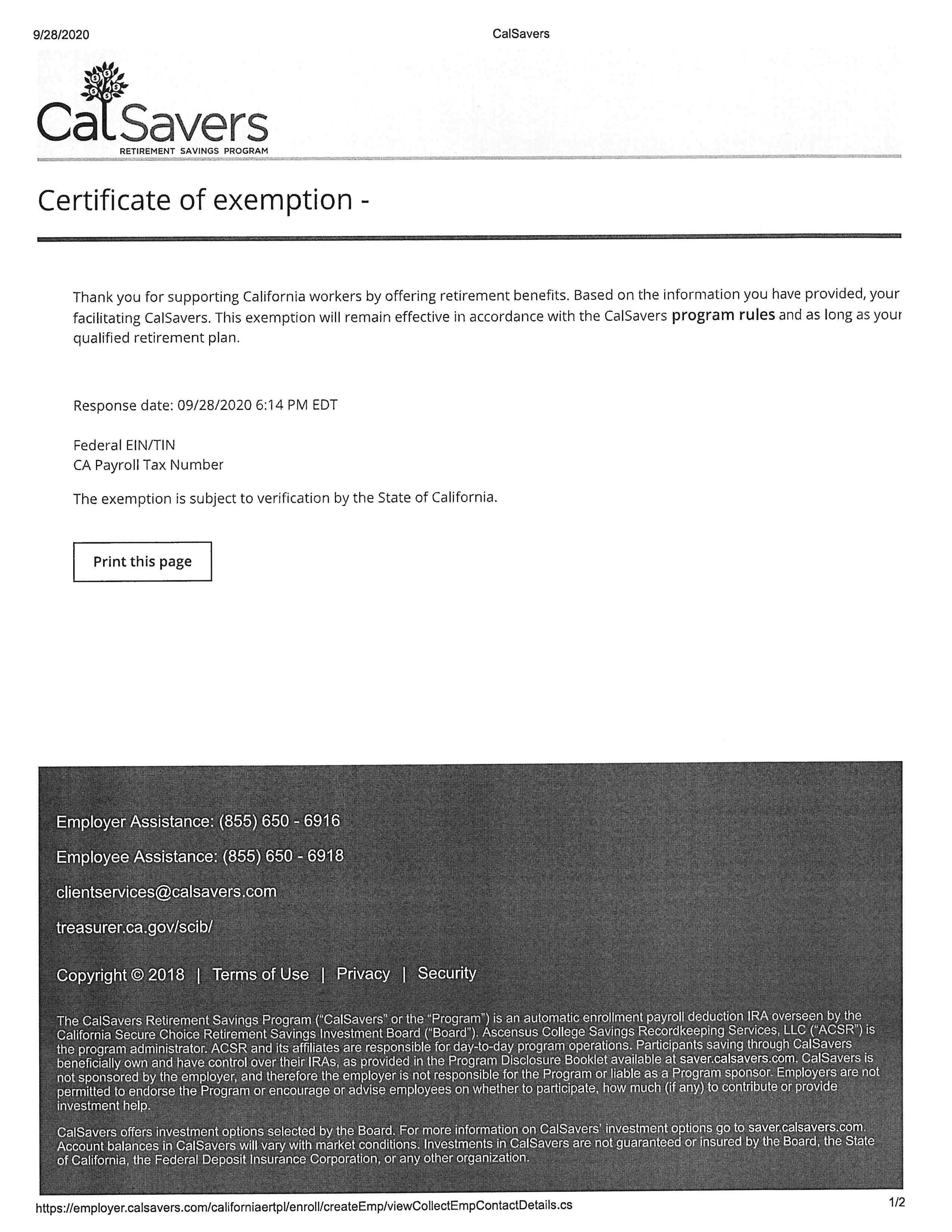

If You Believe Your Company Is Exempt From The Mandate, Submit An.

Web calsavers is a retirement savings program for private sector workers whose employers do not offer a retirement plan. Web employees that want to claim exempt from minnesota income tax must use the following form: Web calsavers retirement savings board executive director’s report. By signing below, i agree to the application process;

Web United States Tax Exemption Form.

Web calsavers | employer information Web businesses of more than 100 employees have until september 30, 2020 to register or file their exemption if they already sponsor a 401 (k) plan. Web “exempt employer” means an employer that (i) has zero employees, as determined under the methodology described in section 10001(a), has one or more employees, but does. Web if you are requesting an exemption:

Employers Known To Be Exempt Based On Public Data (Form 5500) Accessed Via The.

You may need to send a communication and formal documentation supporting your exemption request to the calsavers program. Web begin company registration or request an exemption. If you change your mind, you can opt back in at any time. United states tax exemption form.