Canadian Tax Form

Canadian Tax Form - Web forms and publications; Web a canadian tax return refers to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals or corporations earning an income in canada. The cra may call you between april 3, 2023 and may 29, 2023 using an automated telephone message to remind you to file your personal income tax return. Td1 forms for 2023 for pay received on january 1, 2023 or later Td1 personal tax credits returns; Web file income tax, get the income tax and benefit package, and check the status of your tax refund business or professional income calculate business or professional income, get industry codes, and report various income types Web automated reminder to file your personal income tax return. Web view and download forms. Income tax, gst/hst, payroll, business number, savings and pension plans, child and family benefits, excise taxes, duties, and levies, charities and giving. Web find all canadian federal and provincial 2022 tax forms.

Income tax, gst/hst, payroll, business number, savings and pension plans, child and family benefits, excise taxes, duties, and levies, charities and giving. Individuals can select the link for their place of residence as of december 31, 2022, to get the forms and information needed to. Web find all canadian federal and provincial 2022 tax forms. Td1 forms for 2023 for pay received on january 1, 2023 or later The return paperwork reports the sum of the previous year's (january to december) taxable income, tax credits, and other information relating to those two. The cra may call you between april 3, 2023 and may 29, 2023 using an automated telephone message to remind you to file your personal income tax return. Web get a paper or online version of 2022 income tax package for the province or territory where you reside, including specific tax return or form required for other tax situations. Go to what to expect when the canada revenue agency. Web file taxes, and get tax information for individuals, businesses, charities, and trusts. Td1 personal tax credits returns;

Td1 forms for 2023 for pay received on january 1, 2023 or later During this call, you will not be asked to give any personal information. The return paperwork reports the sum of the previous year's (january to december) taxable income, tax credits, and other information relating to those two. Web a canadian tax return refers to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals or corporations earning an income in canada. Web this is the main menu page for the t1 general income tax and benefit package for 2022. Income tax, gst/hst, payroll, business number, savings and pension plans, child and family benefits, excise taxes, duties, and levies, charities and giving. Web view and download forms. Web forms and publications; Web get a paper or online version of 2022 income tax package for the province or territory where you reside, including specific tax return or form required for other tax situations. Web automated reminder to file your personal income tax return.

Canadian tax form stock photo. Image of form, canada 18273962

Based on your tax situation, turbotax® provides the tax forms you need. The return paperwork reports the sum of the previous year's (january to december) taxable income, tax credits, and other information relating to those two. Td1 personal tax credits returns; All canada revenue agency forms listed by number and title. Web all individuals must fill out the federal form.

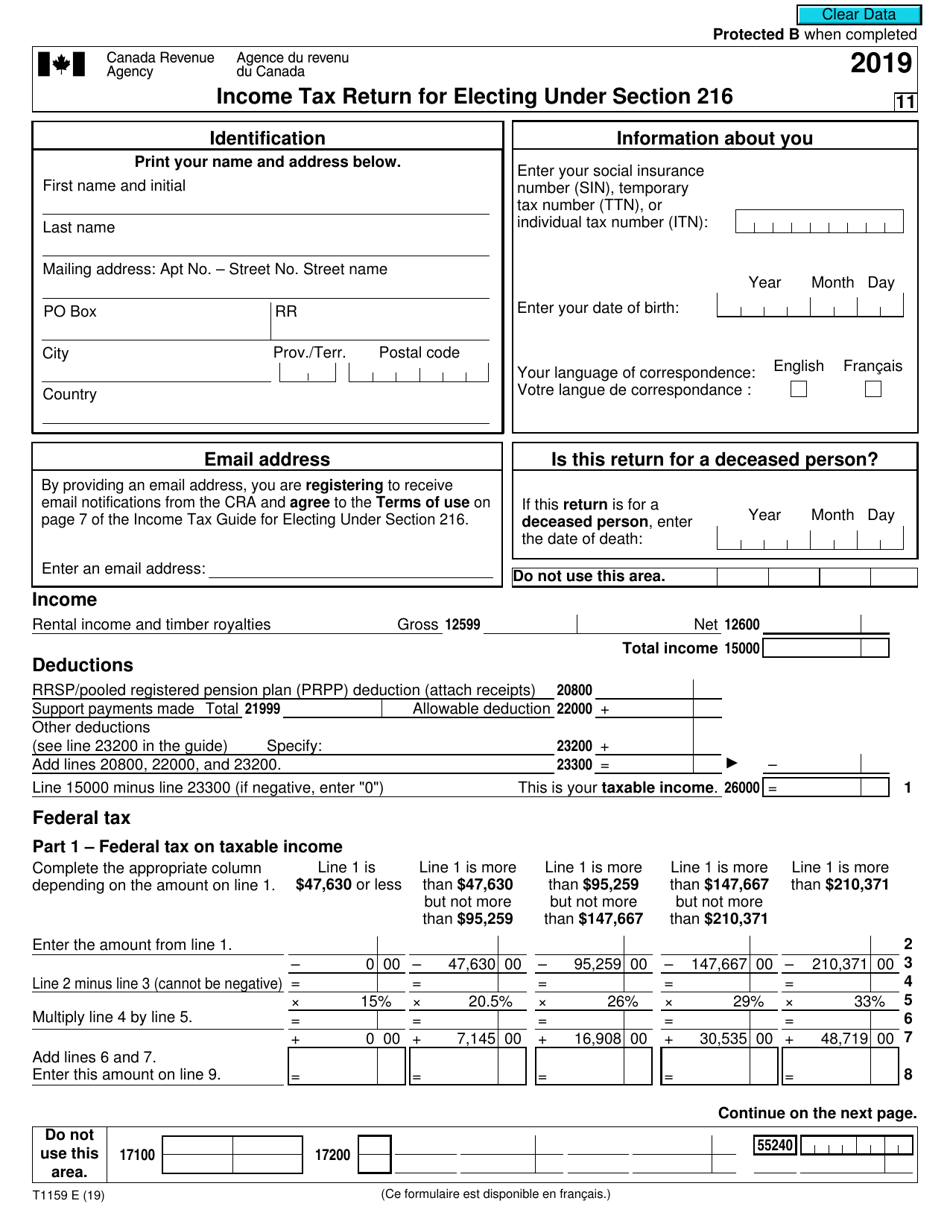

Form T1159 Download Fillable PDF or Fill Online Tax Return for

Go to what to expect when the canada revenue agency. Web a canadian tax return refers to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals or corporations earning an income in canada. Individuals in québec must use the federal td1. Web get a paper or online version of 2022 income.

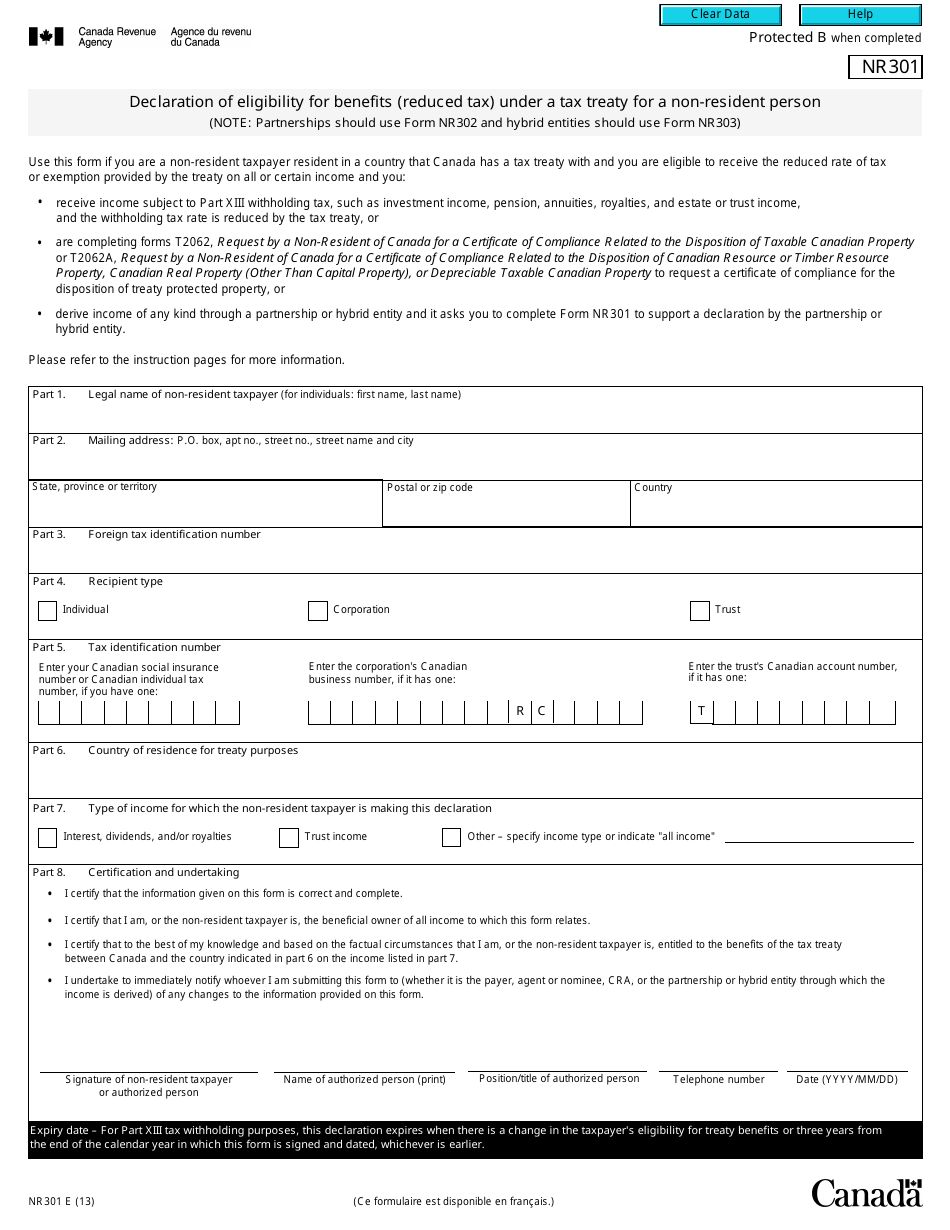

Form NR301 Download Fillable PDF or Fill Online Declaration of

Web file income tax, get the income tax and benefit package, and check the status of your tax refund business or professional income calculate business or professional income, get industry codes, and report various income types Go to what to expect when the canada revenue agency. Web forms and publications; Web all individuals must fill out the federal form td1,.

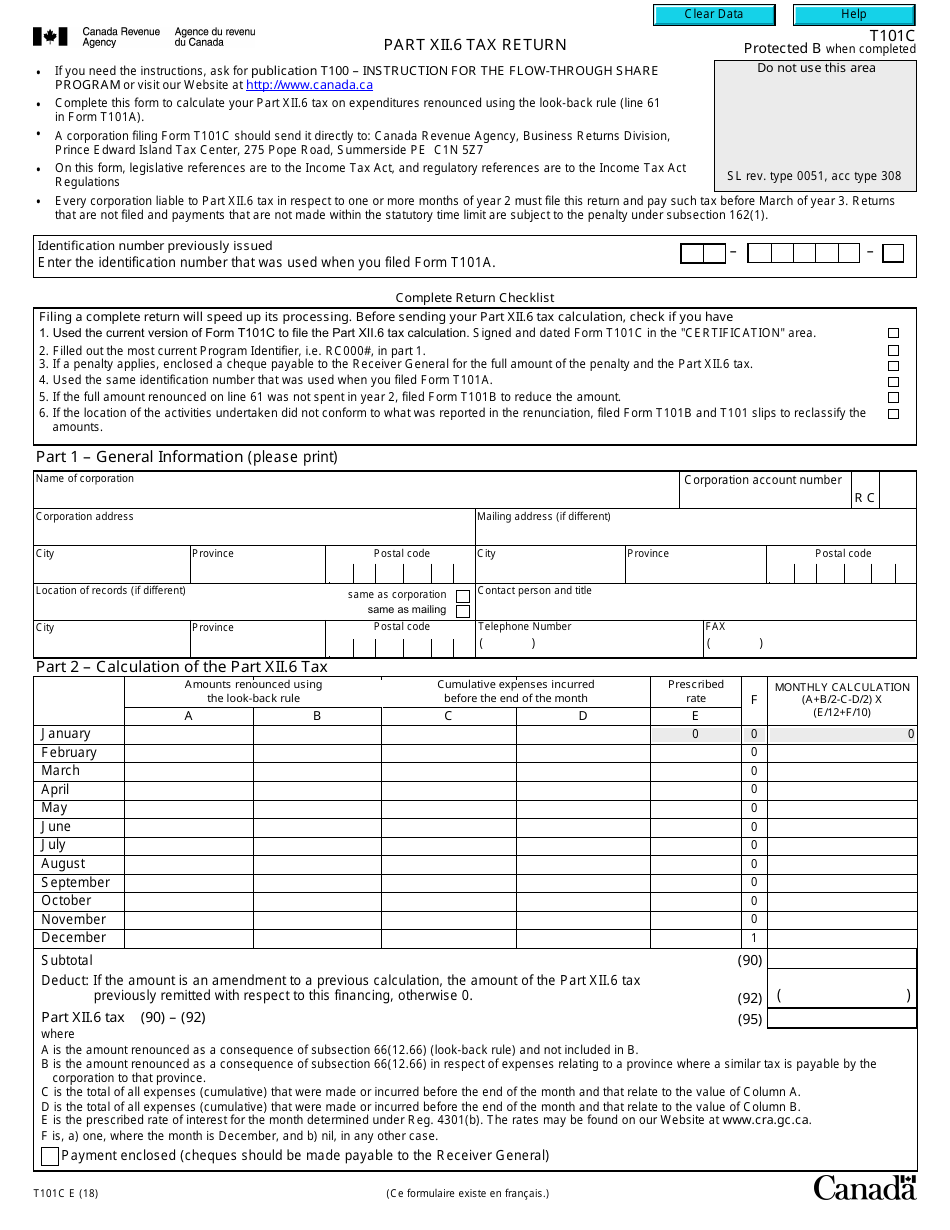

Form T101C Download Fillable PDF or Fill Online Part XII. 6 Tax Return

Web a canadian tax return refers to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals or corporations earning an income in canada. Web all individuals must fill out the federal form td1, personal tax credits return. Web this is the main menu page for the t1 general income tax and.

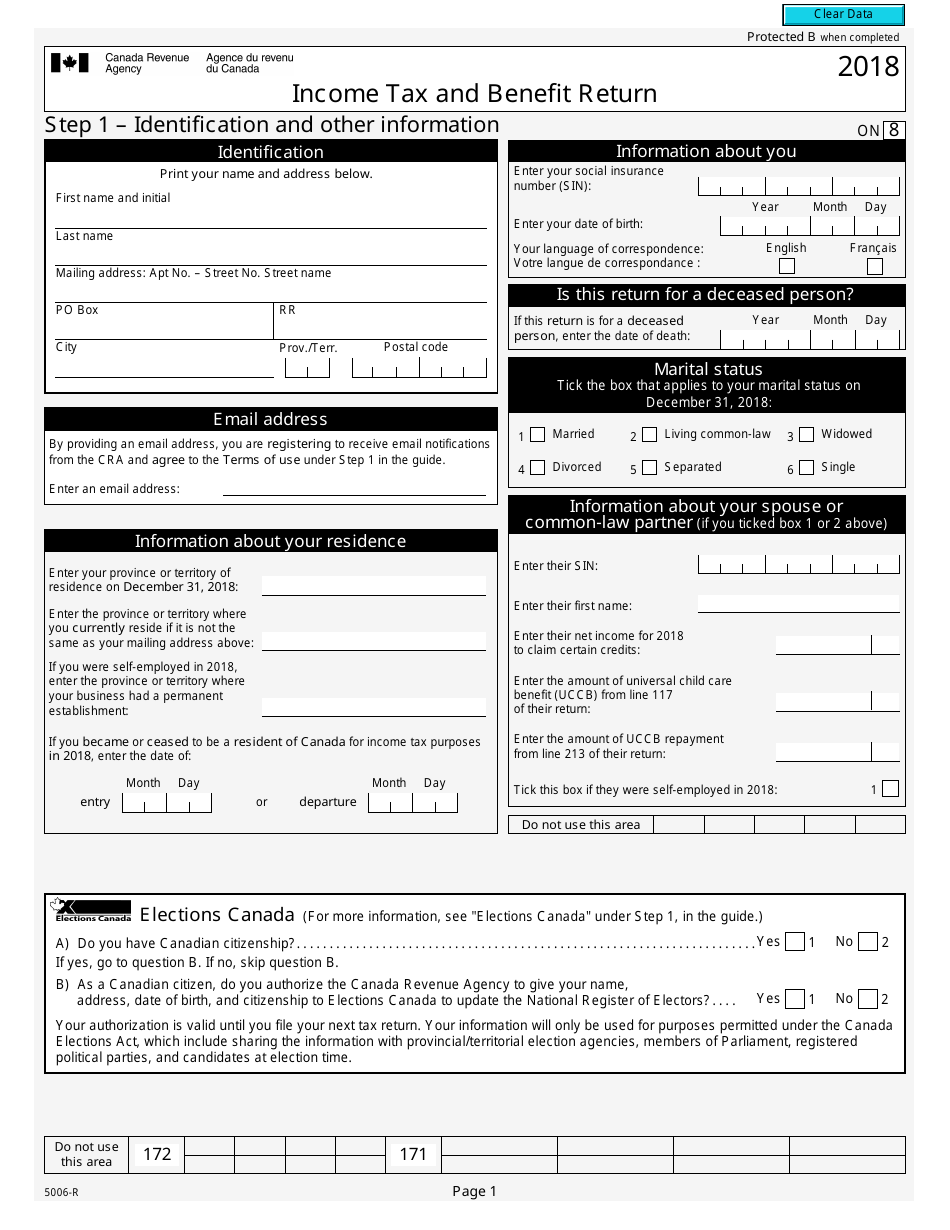

Form 5006R Download Fillable PDF or Fill Online Tax and Benefit

All canada revenue agency forms listed by number and title. Web forms and publications; Go to what to expect when the canada revenue agency. During this call, you will not be asked to give any personal information. The return paperwork reports the sum of the previous year's (january to december) taxable income, tax credits, and other information relating to those.

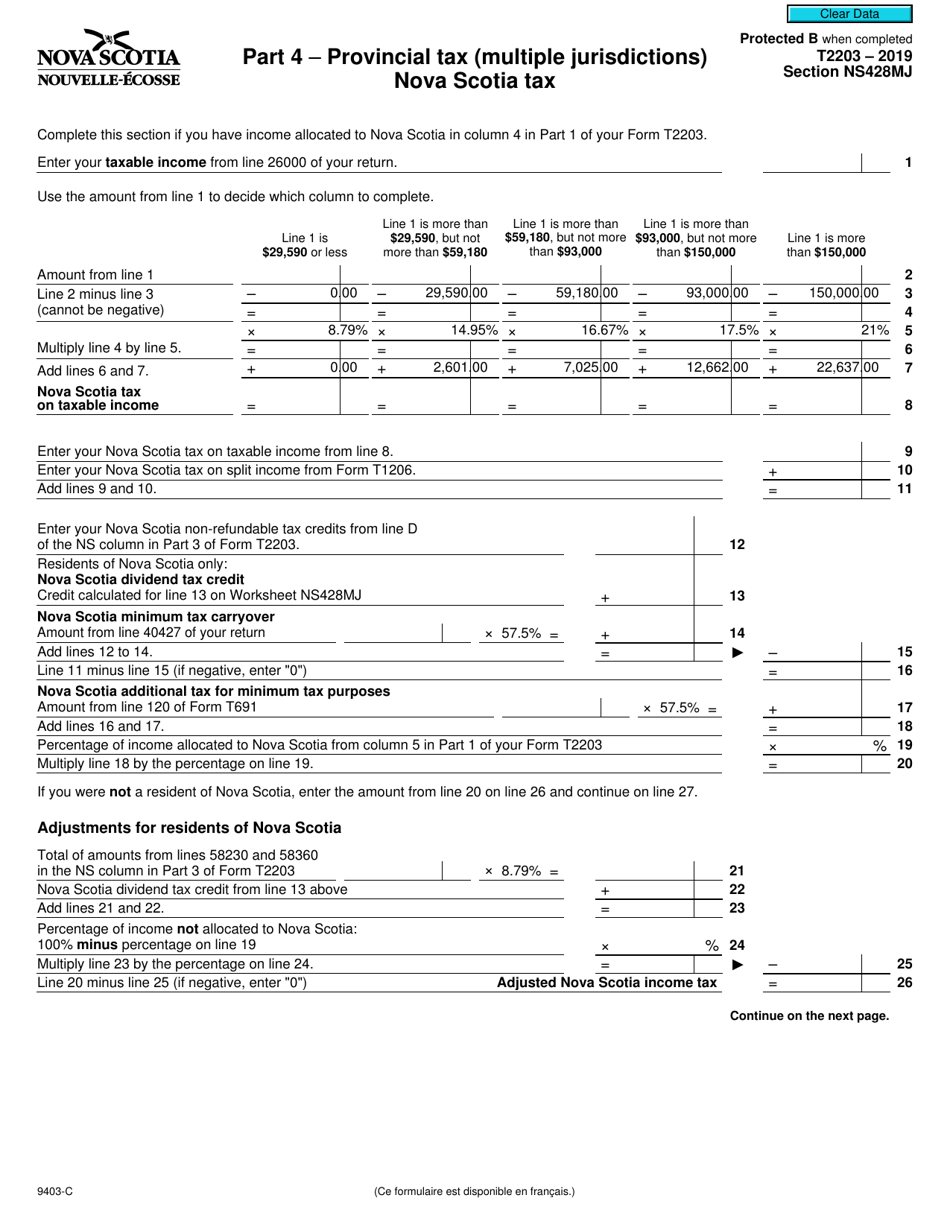

Form T2203 (9403C) Section NS428MJ Download Fillable PDF or Fill

Td1 personal tax credits returns; All canada revenue agency forms listed by number and title. Go to what to expect when the canada revenue agency. During this call, you will not be asked to give any personal information. Web get a paper or online version of 2022 income tax package for the province or territory where you reside, including specific.

Canadian Tax Return Stock Photo Download Image Now iStock

Td1 personal tax credits returns; Based on your tax situation, turbotax® provides the tax forms you need. Web view and download forms. Web automated reminder to file your personal income tax return. Web all individuals must fill out the federal form td1, personal tax credits return.

Canadian tax form stock photo. Image of form, document 18273838

Web automated reminder to file your personal income tax return. Td1 personal tax credits returns; Web a canadian tax return refers to the obligatory forms that must be submitted to the canada revenue agency (cra) each financial year for individuals or corporations earning an income in canada. Web all individuals must fill out the federal form td1, personal tax credits.

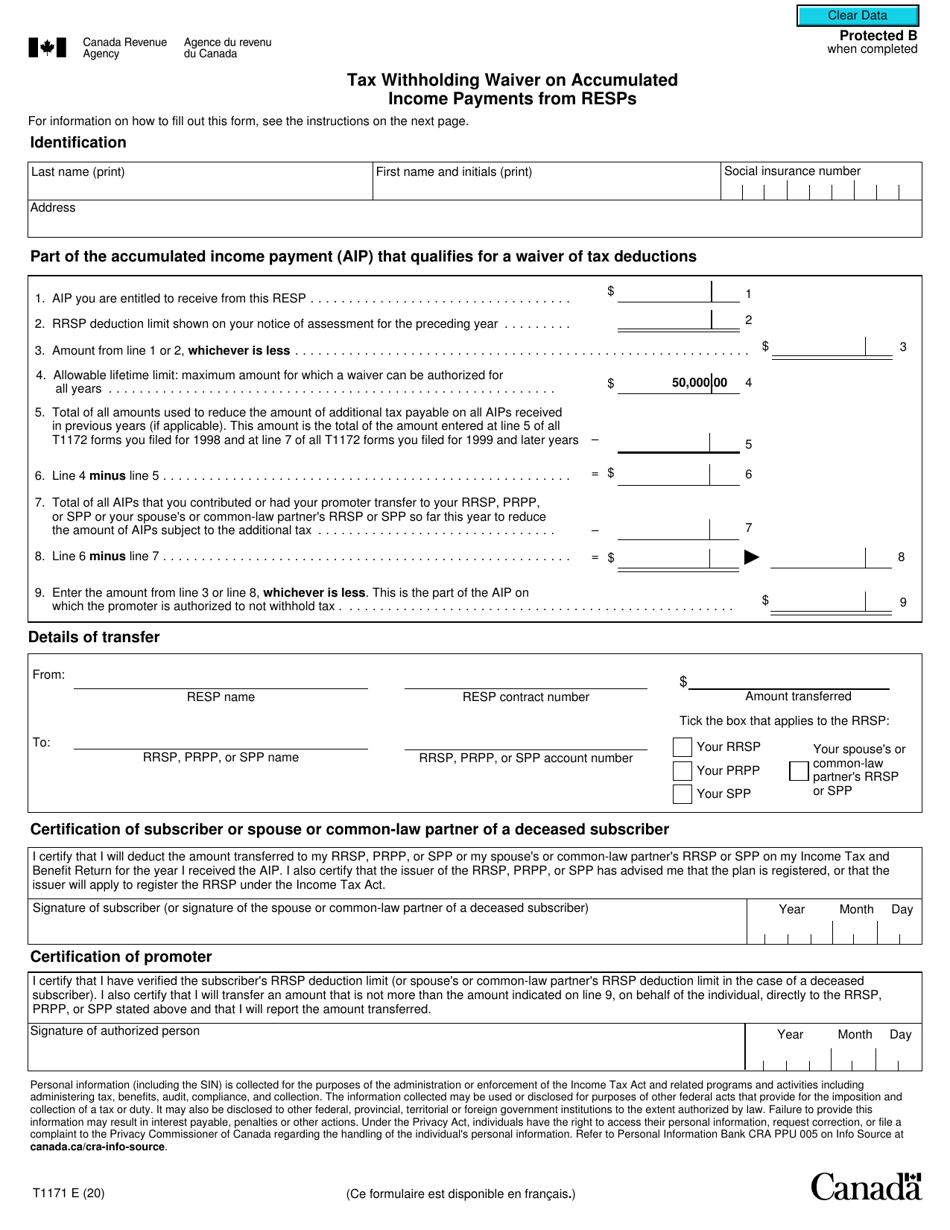

Form T1171 Download Fillable PDF or Fill Online Tax Withholding Waiver

During this call, you will not be asked to give any personal information. Web get a paper or online version of 2022 income tax package for the province or territory where you reside, including specific tax return or form required for other tax situations. Web all individuals must fill out the federal form td1, personal tax credits return. Web automated.

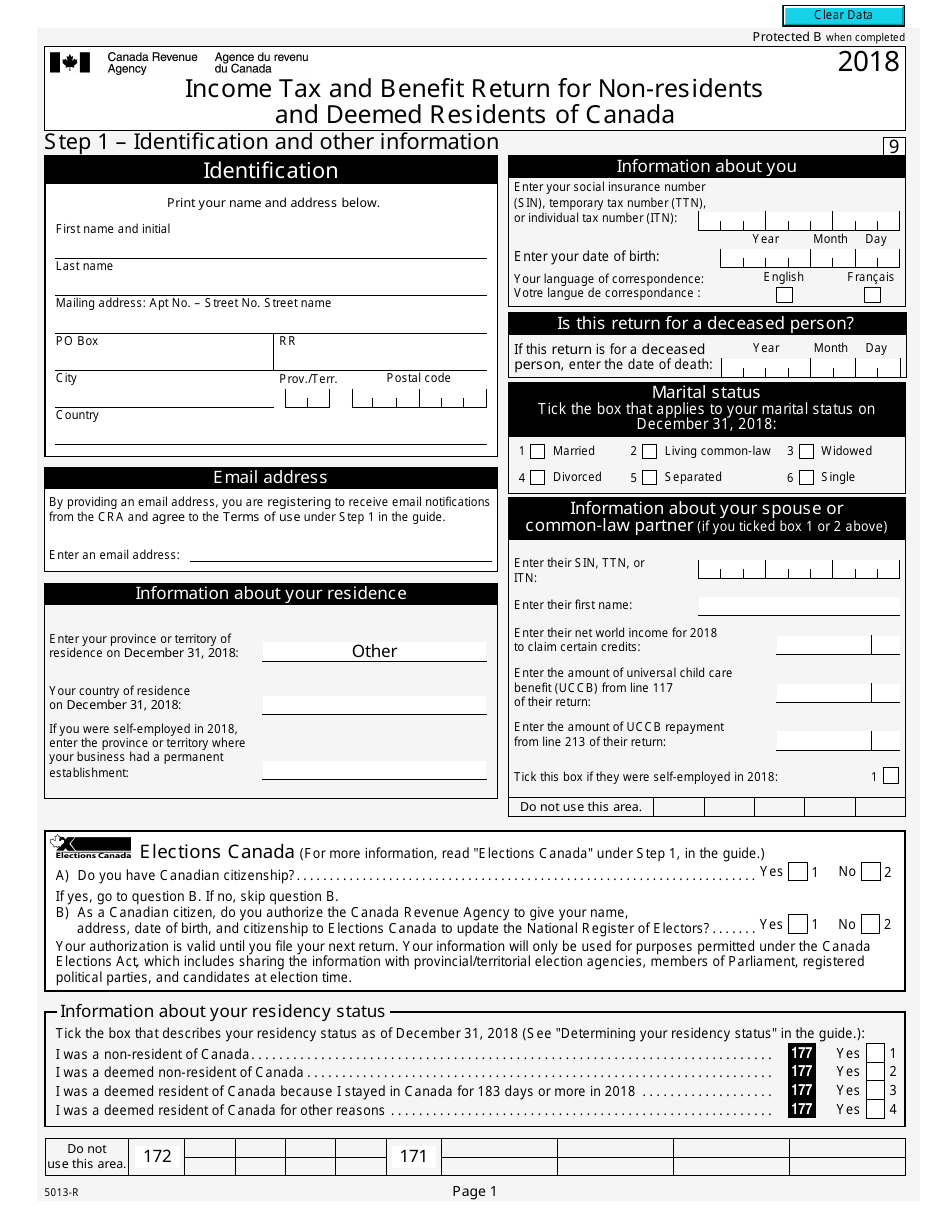

Form 5013R Download Fillable PDF or Fill Online Tax and Benefit

Td1 personal tax credits returns; Web get a paper or online version of 2022 income tax package for the province or territory where you reside, including specific tax return or form required for other tax situations. Td1 forms for 2023 for pay received on january 1, 2023 or later Individuals in québec must use the federal td1. Individuals can select.

Web A Canadian Tax Return Refers To The Obligatory Forms That Must Be Submitted To The Canada Revenue Agency (Cra) Each Financial Year For Individuals Or Corporations Earning An Income In Canada.

Web this is the main menu page for the t1 general income tax and benefit package for 2022. All canada revenue agency forms listed by number and title. Individuals in québec must use the federal td1. Web all individuals must fill out the federal form td1, personal tax credits return.

During This Call, You Will Not Be Asked To Give Any Personal Information.

The cra may call you between april 3, 2023 and may 29, 2023 using an automated telephone message to remind you to file your personal income tax return. Web file income tax, get the income tax and benefit package, and check the status of your tax refund business or professional income calculate business or professional income, get industry codes, and report various income types Go to what to expect when the canada revenue agency. Individuals can select the link for their place of residence as of december 31, 2022, to get the forms and information needed to.

Web File Taxes, And Get Tax Information For Individuals, Businesses, Charities, And Trusts.

Web automated reminder to file your personal income tax return. Td1 forms for 2023 for pay received on january 1, 2023 or later Web view and download forms. The return paperwork reports the sum of the previous year's (january to december) taxable income, tax credits, and other information relating to those two.

Td1 Personal Tax Credits Returns;

Web find all canadian federal and provincial 2022 tax forms. Income tax, gst/hst, payroll, business number, savings and pension plans, child and family benefits, excise taxes, duties, and levies, charities and giving. Web get a paper or online version of 2022 income tax package for the province or territory where you reside, including specific tax return or form required for other tax situations. Web forms and publications;